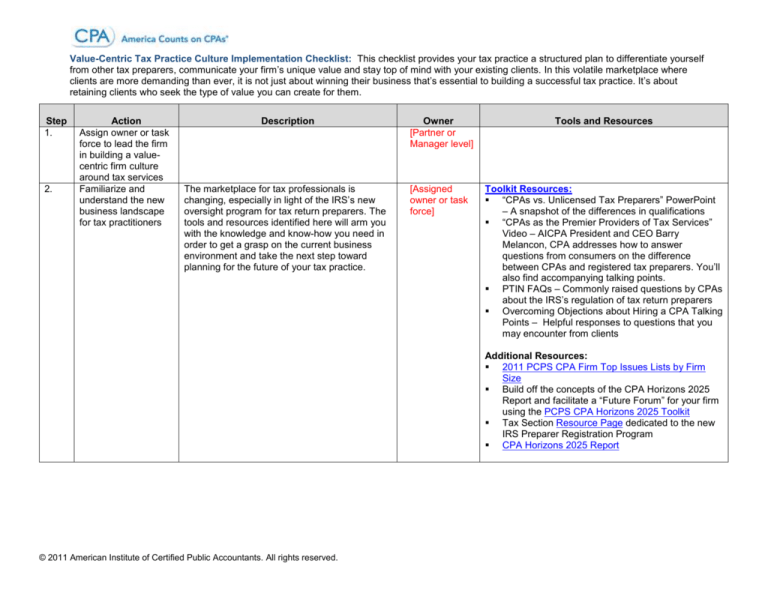

Value-Centric Tax Practice Culture Implementation Checklist: This checklist provides your tax practice a structured plan to differentiate yourself

from other tax preparers, communicate your firm’s unique value and stay top of mind with your existing clients. In this volatile marketplace where

clients are more demanding than ever, it is not just about winning their business that’s essential to building a successful tax practice. It’s about

retaining clients who seek the type of value you can create for them.

Step

1.

2.

Action

Assign owner or task

force to lead the firm

in building a valuecentric firm culture

around tax services

Familiarize and

understand the new

business landscape

for tax practitioners

Description

Owner

[Partner or

Manager level]

Tools and Resources

The marketplace for tax professionals is

changing, especially in light of the IRS’s new

oversight program for tax return preparers. The

tools and resources identified here will arm you

with the knowledge and know-how you need in

order to get a grasp on the current business

environment and take the next step toward

planning for the future of your tax practice.

[Assigned

owner or task

force]

Toolkit Resources:

“CPAs vs. Unlicensed Tax Preparers” PowerPoint

– A snapshot of the differences in qualifications

“CPAs as the Premier Providers of Tax Services”

Video – AICPA President and CEO Barry

Melancon, CPA addresses how to answer

questions from consumers on the difference

between CPAs and registered tax preparers. You’ll

also find accompanying talking points.

PTIN FAQs – Commonly raised questions by CPAs

about the IRS’s regulation of tax return preparers

Overcoming Objections about Hiring a CPA Talking

Points – Helpful responses to questions that you

may encounter from clients

Additional Resources:

2011 PCPS CPA Firm Top Issues Lists by Firm

Size

Build off the concepts of the CPA Horizons 2025

Report and facilitate a “Future Forum” for your firm

using the PCPS CPA Horizons 2025 Toolkit

Tax Section Resource Page dedicated to the new

IRS Preparer Registration Program

CPA Horizons 2025 Report

© 2011 American Institute of Certified Public Accountants. All rights reserved.

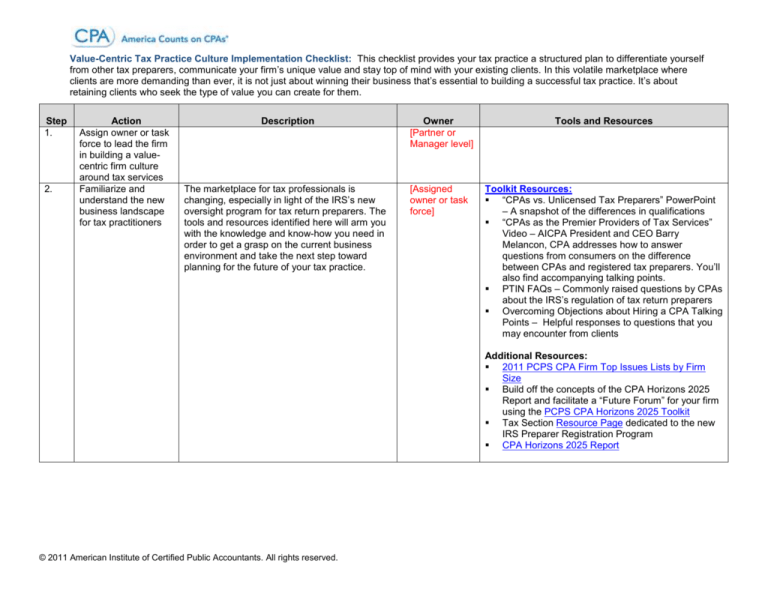

Step

3.

4.

Action

Build a plan that

identifies and

establishes your

firm’s value with an

actionable strategy to

articulate that value

to clients and

prospects

Educate your

professional team on

how to respond to

questions about the

differences between

CPAs and other tax

preparers

Description

Build meaningful and lasting relationships with

your clients. For some, these resources will help

you begin a process to discover what makes

you valuable and different from other CPAs. For

others, these resources will help you develop a

plan to memorialize and communicate your

value. The end result should be a firm-wide

strategy to knowledgably and confidently

present yourself to clients in a unique way and

infuse your value into each and every client

contact.

Owner

[Assigned

owner or task

force]

Prepare your professional team for the changes

resulting from the IRS registered tax preparer

program. Help them understand how it impacts

the firm and the importance of communicating

the firm’s value with clients. The PowerPoint

template can help facilitate a firm-wide training

session (e.g., lunch-n-learn session) and can be

tailored or expanded upon based on your firm’s

need.

[Assigned

owner or task

force]

Further, consider discussing the resulting

strategies and tactics from #2 and #3 above

with the entire team.

Tools and Resources

Toolkit Resources:

“CPA: The Value of Articulating Your Value”

Webinar – Practical tips and insights from tax

practitioners on the importance of communicating

your value to clients

Sample Client Satisfaction Survey – An easy way to

gauge how you are doing from clients and identify

areas for improvement so you retain the clients you

have worked so hard to attract

Additional Resources:

Facilitate an in-house workshop walking through

these concepts using the PCPS You Are the Value

Workshop

Toolkit Resources:

“CPAs vs. Unlicensed Tax Preparers” PowerPoint –

A snapshot of the differences in qualifications

“CPAs as the Premier Providers of Tax Services” –

AICPA President and CEO Barry Melancon, CPA

addresses how to answer questions from

consumers on the difference between CPAs and

registered tax preparers. You’ll also find

accompanying talking points.

PTIN FAQs – Commonly raised questions by CPAs

about the IRS’s regulation of tax return preparers

Overcoming Objections about Hiring a CPA Talking

Points – Helpful responses to questions that you

may encounter from clients

Additional Resources:

Tax Section Resource Page dedicated to the new IRS

Preparer Registration Program

© 2011 American Institute of Certified Public Accountants. All rights reserved.

2 of 4

Step

5.

Action

Identify resources

and strategies to help

you stay top of mind

with your tax clients,

reach out to them

throughout the year

to and enhance your

client development

and retention efforts

Description

These resources are available for your use

during tax season and year round. Regularly

communicate with clients on a variety of tax

related subjects using different media (blurbs for

newsletters or websites, tweets for Twitter or as

inspiration for Facebook posts) to maintain and

deepen the relationships you have worked so

hard to establish.

Owner

[Assigned

owner or task

force]

Tools and Resources

Toolkit Resources:

“Making Your Voice Heard, Tax Season and

Beyond” Guide – Practical tips to get you started

using these resources and complement your current

client retention and acquisition strategies

Series of Tax and CPA Value Blurbs for Your Client

Newsletter, Website or Blog – An assortment of

newsworthy topics to reinforce the CPA/client

relationship and encourage clients and prospective

clients to contact you

“Tax Saving Strategies for the 2012 Filing Season”

Brochure – A highlight of key tax law provisions that

may impact individuals

“Small Business Tax Saving Strategies for the 2012

Filing Season” Brochure – A highlight of key tax law

provisions that may impact small businesses

“Preparing for Life’s Most Important Moments”

Brochure – A detailed overview of the advantages of

working with a CPA

Social Media Tweets – A selection of holidaythemed, technical and general tweets to connect

with all your important audiences

Additional Resources:

Issue-specific client letters (with tips on how to

repurpose for different size firms or clients) for

clients year-round

Tax Section E-Alerts (for news of tax laws changes

and advocacy initiatives that may be worth

mentioning to clients and prospects)

© 2011 American Institute of Certified Public Accountants. All rights reserved.

3 of 4

Step

6.

Action

Incorporate toolkit

resources into your

overall client

acquisition efforts

Description

For many small firms, new clients come through

referrals from existing clients. These resources

offer additional ideas for outreach to both

existing and prospective clients. By regularly

connecting with clients, it will cement your

relationship with those clients, the notion that

prospective clients should be seeking a CPA

and that they should refer those prospects to

your firm.

Owner

[Assigned

owner or task

force]

Tools and Resources

Toolkit Resources:

“Making Your Voice Heard, Tax Season and

Beyond” Guide – Practical tips to get you started

using these resources and complement your current

client retention and acquisition strategies

Print Advertisements – Full page or half page ads to

promote your tax services to individual and small

business clients

“Tax Saving Strategies for the 2012 Filing Season”

PowerPoint and Speech – A summary of the key tax

law provisions that may impact individuals and small

businesses – excellent tools for presenting to civic

groups, client lunch-n-learns and volunteer boards

“Preparing for Life’s Most Important Moments”

Brochure – A detailed overview of the advantages of

working with a CPA – an excellent resource for

potential clients

“Preparing for Life’s Important Moments”

PowerPoint – Overview of the CPA’s value and the

new competitive landscape

Social Media Tweets – A selection of holidaythemed, technical and general tweets to connect

with all your important audiences

Google AdWords – Sample ad copy to get you

started with this pay per click advertising program

on Google’s flagship search engine

Media Advisory Template – A template with possible

tax topics that can be tailored to your area(s) of

expertise to help you begin the process of becoming

a trusted resource for reporters

Additional Resources:

CPA Marketing Toolkit Resources

© 2011 American Institute of Certified Public Accountants. All rights reserved.

4 of 4