Purchasing Performing Accounts

The Purchase and Sale of Performing Accounts Receivables

November 17, 2015

Scott Coffin, President

Canaccede Financial Group

170 University Avenue, Suite 901

Toronto, ON

M5H 3B3

Phone: 905.466.6655 scott.coffin@canaccede.com

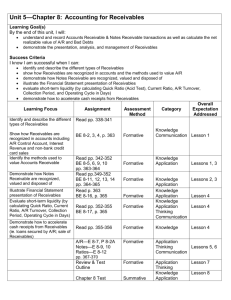

Agenda

1. Canaccede Financial Group - Corporate Profile

2. Varde Partners – Corporate Profile

3. What is a Performing Receivable?

4. Performing Assets - Trade Market

5. Performing versus Non-Performing Receivables

6. Why sell Performing Receivables?

7. Customer Experience – The Nurse

Corporate Profile

Canaccede Financial Group (CFG)

CFG operates two separate businesses. Canaccede

Investments, founded in 2008, specializes in the acquisition of consumer receivables portfolios from Canadian financial institutions. Canaccede Investments acquires consumer accounts across the credit spectrum, ranging from insolvency and distressed debt portfolios through performing loan and credit card accounts.

Affirm Financial, founded in 2010, is a consumer finance company providing term loan and credit card solutions to

Canadian consumers who do not qualify for prime sources of credit.

Varde Partners acquired a majority interest in CFG in the first quarter of 2015

Corporate Profile

Värde Partners is a global investment adviser focused on credit and value investing strategies

February 2015 - Värde Partners and Canaccede Financial Group Ltd.

(“Canaccede”) announced that Värde has entered into a purchase agreement to acquire a 51% majority equity stake in Canaccede. As part of the transaction, Värde has also committed up to an additional C$275 million of financing to grow Affirm Financial Services, Inc., Canaccede’s non-prime consumer lending business in Canada.

March 2015 - Värde Partners a global alternative investment firm, KKR, a leading global investment firm, and Deutsche Bank have signed an agreement for the purchase of GE Capital’s Australia and New Zealand Consumer Lending

Business at an enterprise value of A$8.2 billion.

What is a Performing Receivable?

• Performing Receivables are loans or credit cards where the consumer is either making all of their payments as agreed or in a delinquent condition, prior to charge off.

• Various products:

• Active Credit Card

• Liquidating Credit Card

• Line of Credit

• Term Loan

• Auto Loan

• 1 st and 2 nd mortgages

• Retail Credit Revolvers

• Retail Special Plan Programs

• Student Credit Portfolios

• They can be transacted in various ways:

• Entire portfolio sales

• Specific customer type or delinquency cycle

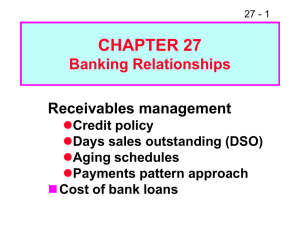

Performing Assets - Trade Market

Two distinct markets that drive performing asset trade activity in Canada.

1. Prime Bank Consolidation Market – e.g. October announcement by

Scotiabank of its agreement to buy the Canadian credit card business of JPMorgan & Chase.

• Provide effective solution for Customers within these portfolios that do not meet the minimum credit standards of the acquirer

- providing either buy side or sell side support.

2. Non-prime Market – market is predominantly driven by Financial

Buyers and Strategic Buyers.

• CFG is an active participant in this segment of the market having acquired in excess of 50,000 performing credit accounts in the private label, bank card and term loan product types.

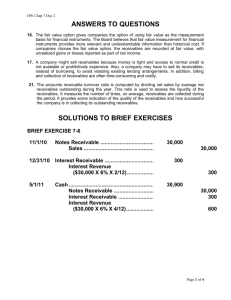

Performing vs Non-Performing Receivables

Operating

Requirements

Regulatory and

Compliance

Non-Performing Receivable

• Collections and Recovery Strategy

• Multiple outsourcing options available

• No requirement for monthly statements

• PAP’s not necessary

• Small percentage of RPC’s established

• High payment / PIF objective

• Limited to provincial specific collections regulatory requirements

Resolution

Objective

• PIF to SIF

• Liquidating Objective

Return Profile • High hurdle rate requirements due to high

COF from financing sources

Performing Receivable

• Account Management and Delinquency

Curing Strategy

• Outsourcing – few options

• Monthly statements required

• PAP required

• Harmonization to originator terms and conditions dates required

• Interest rate accrual precision required

• High RPC’s established

• Low / pre-set payments necessary

• OSFI, PIPEDA & PCI Certification Required for Credit Card Product

• Complex regulatory, compliance and audit procedures required

• Create a Customer relationship

• Fast liquidation is not the objective

• Lower hurdle rate expectations necessitating lower COF sources

Why sell Performing Receivables?

• Maximizing Return

Selling receivables earlier in their delinquency when charge-off probability is high yields a better price than selling the same receivable post charge-off.

Selling higher risk assets (generally, Customers who have a FICO

Score <675) from portfolios enables FI’s to de-risk remaining portfolios and allow for lower provision of capital against the core assets. This yields an enhancement of ROI and ROC for the most profitable segment of a portfolio.

• Exiting non-strategic business lines or non-strategic customer relationships:

Specific non-core products or industries that are no longer deemed core for growth strategy.

Undesirable geographies or regions where resources are thin and account management is difficult.

Customer Experience

• Enhancing the Customer Experience

Customers for whom the bank has made a strategic decision to liquidate will be able to work with a long-term strategic partner who will not take a “liquidate first” approach to their account.

Partnering with a non-bank financial services company, who are not constrained by strict OSFI or OCC directives, can yield improved experience for the Customer.

Customer Experience Example

A senior executive of a major credit card issuer shared the experience of a long term customer who injured herself at work. Recognizing she would be living on reduced income during the period of medical leave she contacted the issuer and made alternative arrangements during the period of her convalescence.

Upon being cleared to return to work, she needed relief from one month’s payment before resuming work to pay professional fees. This resulted in a break of revised terms and necessitated charge off – despite being able to resume her full monthly payments the following month.