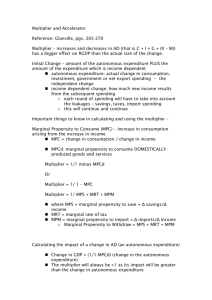

Aggregate Expenditure

advertisement

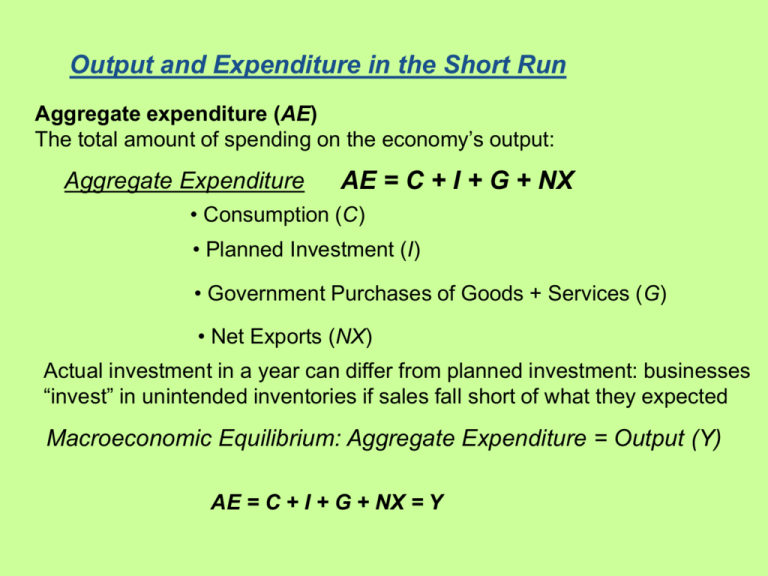

Output and Expenditure in the Short Run Aggregate expenditure (AE) The total amount of spending on the economy’s output: Aggregate Expenditure AE = C + I + G + NX • Consumption (C) • Planned Investment (I) • Government Purchases of Goods + Services (G) • Net Exports (NX) Actual investment in a year can differ from planned investment: businesses “invest” in unintended inventories if sales fall short of what they expected Macroeconomic Equilibrium: Aggregate Expenditure = Output (Y) AE = C + I + G + NX = Y Components of Real Aggregate Expenditure, 2008 The Aggregate Expenditure Model Adjustments to Macroeconomic Equilibrium Actual investment in a year can differ from planned investment: businesses “invest” in unintended inventories if sales fall short of what they expected IF … Aggregate expenditure is equal to GDP Aggregate expenditure is less than GDP THEN … AND … inventories are unchanged the economy is in macroeconomic equilibrium. inventories rise GDP and employment decrease. Aggregate Expenditure is greater than GDP inventories fall GDP and employment increase. Real Consumption Expenditure, 1979 - 2009 Consumption follows a smooth, upward trend, interrupted only infrequently by recessions. The most important variables that determine the level of C: • Current disposable income • Household wealth: Assets minus liabilities Including equity in owner occupied houses? Making Do Changes in Housing Wealth the Connection Affect Consumption Spending? Many macroeconomic variables, such as GDP, housing prices, consumption spending, and investment spending, rise and fall at about the same time during the business cycle The most important variables that determine the level of C: • Current disposable income • Household wealth: Assets minus liabilities Including equity in owner occupied houses? • Expected future income People try to keep their consumption fairly steady from year-to-year save for a rainy day • The price level Higher price level reduces real value of monetary wealth • The interest rate High interest rate discourages spending on credit/encourages saving • New, gotta-have styles and products The Consumption Function The Relationship between Consumption and Income, 1960– 2008 The Consumption Function Marginal propensity to consume (MPC) The slope of the consumption function: The amount by which consumption spending changes when disposable income changes. Change in consumptio n C MPC Change in disposable income YD When disposable income changes: Change in consumption = ΔYD× MPC For a textbook economy: The Relationship between Consumption and National Income when net taxes are constant ΔYD = ΔNI Income, Consumption, and Saving National income = Consumption + Saving + Taxes Y=C+S+T Change in national income = Change in consumption + Change in saving + Change in taxes Y C S T If taxes are always a constant amount, ΔT = 0 ΔY = ΔC + ΔS 1 = MPC + MPS Calculating the Marginal Propensity to Consume and the Marginal Propensity to Save C MPC Y NATIONAL INCOME AND REAL GDP (Y) S MPS Y CONSUMPT ION SAVING (C) (S) $9,000 $8,000 1,000 10,000 8,600 1,400 11,000 9,200 1,800 12,000 9,800 2,200 13,000 10,400 2,600 MARGINAL PROPENSITY TO CONSUME (MPC) MARGINAL PROPENSITY TO SAVE (MPS) — — 0.6 0.4 0.6 0.4 0.6 0.4 0.6 0.4 Planned Investment = I Real Investment, 1979 - 2009 Investment is subject to larger changes than is consumption. Investment declined significantly during the recessions of 1980, 1981–1982, 1990–1991, 2001, and 2007–2009. The most important variables that determine the level of investment: • Expectations of future profitability Waves of optimism and pessimism • Major technology changes: new products & processes • The interest rate • Taxes • Cash flow Retained earnings for financing investment • Current capacity utilization Government Purchases = G Real Government Purchases, 1979 – 2009 Government purchases grew steadily for most of the 1979–2009 period, with the exception of the early 1990s, when concern about the federal budget deficit caused real government purchases to fall for three years, beginning in 1992. Net Exports (NX) Real Net Exports, 1979–2006 Net Exports = NX Real Net Exports, 1979 – 2009 Net exports were negative in most years between 1979 and 2009. Net exports have usually increased when the U.S. economy is in recession and decreased when the U.S. economy is expanding, although they fell during most of the 2001 recession. Net Exports (NX) The most important variables that determine the level of net exports: • The price level in the United States relative to the price levels in other countries • The growth rate of GDP in the United States relative to the growth rates of GDP in other countries • The exchange rate between the dollar and other currencies Graphing Macroeconomic Equilibrium The Relationship between Planned Aggregate Expenditure and GDP on a 45°-Line Diagram Graphing Macroeconomic Equilibrium Graphing Macroeconomic Equilibrium Showing a Recession on the 45°-Line Diagram Macroeconomic Equilibrium Planned Unplan Planned Govern Aggregate ned Invest ment Net Expenditur Change ment Purchases Export e in Invent (I) (G) (NX) (AE) ories Real GDP (Y) Consump tion (C) Real GDP Will … $8,000 $6,200 $1,500 $1,500 – $500 $8,700 –$700 increase 9,000 6,850 1,500 1,500 –500 9,350 –350 increase be in equili brium 10000 7,500 1,500 1,500 –500 10,000 0 11000 8,150 1,500 1,500 –500 10,650 +350 decrease 12000 8,800 1,500 1,500 –500 11,300 +700 decrease The Multiplier Effect Learning Objective 11.4 The Multiplier Effect Autonomous expenditure An expenditure that does not depend on the level of GDP. Multiplier The increase in equilibrium real GDP in response to increase in autonomous expenditure, e.g. Expenditure multiplier = ΔY/ΔI Multiplier effect The process by which an increase in autonomous expenditure leads to a larger increase in real GDP: ΔY = ΔI + ΔC = Change in autonomous spending that sparks an expansion + Change in consumption spending induced by increasing output and income. The Multiplier Effect in Action ADDITIONAL AUTONOMOUS EXPENDITURE (INVESTMENT) ROUND 1 $100 billion ADDITIONAL INDUCED EXPENDITURE (CONSUMPTION) $0 TOTAL ADDITIONAL EXPENDITURE = TOTAL ADDITIONAL GDP $100 billion ROUND 2 0 75 billion 175 billion ROUND 3 0 56 billion 231 billion ROUND 4 ROUND 5 . . . ROUND 10 . . . ROUND 15 . . . 0 0 . . . 0 . . . 0 . . . 42 billion 32 billion . . . 8 billion . . . 2 billion . . . 273 billion 305 billion . . . 377 billion . . . 395 billion . . . ROUND 19 0 1 billion 398 billion n 0 0 $400 billion Making the Connection The Multiplier in Reverse: The Great Depression of the 1930s The multiplier effect contributed to the very high levels of unemployment during the Great Depression. Year Consumption Investment Net Exports Real GDP Unemployment Rate 1929 $661 billion $91.3 billion -$9.4illion $865 billion 3.2% 1933 $541 billion $17.0 billion -$10.2 billion $636 billion 24.9% The Multiplier Effect A Formula for the Multiplier 1 1 MPC Y = C + I + G + NX C depends on YD: C = c0 + MPC x YD = c0 + MPC x (Y – T) c0, I, G, T, and NX are autonomous—they do not depend on Y Y = c0 + MPC x Y – MPC x T + I + G + NX (1 – MPC) x Y = c0 + I + G – MPC x T + NX Y = [1/(1 – MPC)] x [c0 + I + G – MPC x T + NX] Change in equilibriu m real GDP 1 Multiplier Change in autonomous expenditur e 1 MPC Summarizing the Multiplier Effect 1 The multiplier effect occurs both when autonomous expenditure increases and when it decreases. 2 The multiplier effect makes the economy more sensitive to changes in autonomous expenditure than it would otherwise be. 3 The larger the MPC, the larger the value of the multiplier. 4 The formula for the multiplier, 1/(1 − MPC), is oversimplified because it ignores some real-world complications, such as the effect that an increasing GDP can have on taxes, imports, prices and interest rates. The Aggregate Demand Curve The Effect of a Change in the Price Level on Real GDP Aggregate demand curve A curve that shows the relationship between the price level and the level of planned aggregate expenditure, holding constant all other factors that affect aggregate expenditure. Key Terms Aggregate demand curve Aggregate expenditure (AE) Marginal propensity to consume (MPC) Autonomous expenditure Marginal propensity to save (MPS) Cash flow Multiplier Consumption function Multiplier effect Aggregate expenditure model Inventories Appendix The Algebra of Macroeconomic Equilibrium 1 C C MPC (Y ) Consumption function 2 I 1 Planned investment function 3 G G Government spending function 4 NX NX Net export function 5 Y C I G NX Equilibrium condition Appendix The Algebra of Macroeconomic Equilibrium The letters with bars over them represent fixed, or autonomous, values. So, C represents autonomous consumption, which had a value of 1,000 in our original example. Now, solving for equilibrium, we get: Y C MPC(Y) I G NX Or, Y - MPC(Y) C I G NX Or, Y (1 MPC ) C I G NX Or, C I G NX Y 1 MPC Appendix The Algebra of Macroeconomic Equilibrium 1 is the multiplier. Therefore an alternative 1 MPC expression for equilibrium GDP is: Remember that Equilibrium GDP = Autonomous expenditure x Multiplier