Example Business Plan Presentation (Power Point File)

advertisement

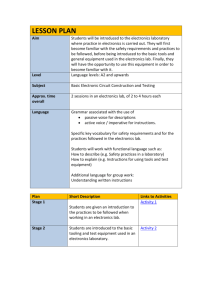

Global Business Review 2001 1 Electronics SBG - January 26, 2001 Agenda Organization President Global Overview President Applications & Market Drivers Ind. Mktg. Dir. Segment Overview Mktg. VP Strategies & Challenges President Fiber Optics Review Business VP Operations Direction Operations VP Financial Plan Controler 2 Electronics SBG - January 26, 2001 Global Overview 3 Electronics SBG - January 26, 2001 Company - Global Sales Cons 11% 1999 Sales Comm 50% 1,190 M € Cons 10% Indust 12% Data 27% Indust 10% 2000 YEF 1,536 M € Comm 57% Data 23% Cons 11% 2001 Budget 1,709 M € Data 21% 4 Indust 9% Comm 59% Electronics SBG - January 26, 2001 Company vs Market GLOBAL - 2000 SAM = $23.9B Asia 36% GLOBAL - 2001 SAM = $26.1B Asia 37% Americas 41% Americas 40% MARKET Europe 23% CAGR = 9.2% Europe 23% Source: Bishop Global- 2000 Total Sales = 1536M Asia 27% Global - 2001 Total Sales = 1709M Asia 28% Americas 42% Europe 31% 6.4% share Americas 41% Europe 31% Company CAGR = 11.3% 6 6.5% share Electronics SBG - January 26, 2001 Company - Sales by Channel DIST 13% 1999 Sales CEM 19% 1190 M € OEM 68% DIST 13% 2000 YEF CEM 26% 1536 M € OEM 61% DIST 14% 2001 Budget 1709 M € CEM 33% 7 OEM 53% Electronics SBG - January 26, 2001 Global Top 15 Key Customers (includes CEM derived demand) 2000 300 2001 Top 15 = 64% Std Margin% 34% 200 29% 38% 150 34% 100 31% 32% 39% 50 45% 45% 29% 34% 15% 10% 26% 25% 8 H S C N I S D P ot or ol a M Q C N S C N A E 0 L Sales KK Euros 250 All values in M EUROS Electronics SBG - January 26, 2001 Global Top 15 Key Customers 2000 160 2001 Top 15 = 52% 140 Sales KK Euros 120 100 80 60 40 CEM 20 DIST 0 Sl L A Sn Ar C Nk Nt E 9 V Sc J P in MM EUROS AllT values Electronics SBG - January 26, 2001 Product Groupings Product Groupings - 2001 FO 2% CPCB Cable Assy BP Assy BusBar D-Sub USB/1394 Combo Serpent PCMCIA Mod Jack VHDCI Metagig SIMM/DIMM Smart Card Other 2% Mobile 4% VA 18% BP 44% Metral Millipacs DIN Fastech PwrBlade Micropax Norcon HPC SCA-2 IO 13% BTB 17% Basics Sockets Minitek CEE Mini BTB MegArray FFC/FPC 10 Electronics SBG - January 26, 2001 Electronic Cabinet Packaging - Chassis LEVEL 3 LEVEL 4 LEVEL 5 LEVEL 1 & 2 INTERCONNECT LEVELS 11 Electronics SBG - January 26, 2001 Global Sales by Product Groupings Series1 2000 Series2 2001 800 40% Std Margin% 700 Sales KK Euros 600 500 400 27% 25% 300 25% 200 24% 16% 14% FO O 100 0 BP BtB VA MP IO All values in M EUROS 12 Electronics SBG - January 26, 2001 Global Sales - Top Products 2000 450 2001 400 Top 15 = 76% Std Margin% 39% Sales KK Euros 350 300 250 200 13% 37% 18% 150 33% 23% 44% 24% 32% 7% 19% 39% 100 26% 26% 50 0 M CA BC PC SSAC FP MP CAS F D MP N HC MJ All values in M EUROS 13 Electronics SBG - January 26, 2001 Segment Summary - Global Market 10B Market Size Instrumentation Process Control Embedded Comp Medical Office Equip DATA I&I COMM Mobile Phone Mobile Equip Set Top Boxes Modems DSC Mobile Comp PC Servers Storage Peripherals Telecom Datacom Wireless Infrastructure CONS 1B 5% 10% Growth Rate Source: Bishop, except Mobile Phone in Consumer, not Communications 14 Electronics SBG - January 26, 2001 Applications & Market Drivers 15 Electronics SBG - January 26, 2001 Market Drivers e-Infrastructure for e-Commerce Network Traffic Global Internet Users millions Data Voice Time 1998 2000 500 450 400 350 300 250 200 150 100 50 0 1996 1997 1998 1999 2000 2003 2001 2002 2003 IDC 1998 - 2003 1998 - 2003 Internet users 4X Data traffic 20X PERFORMANCE REQUIREMENTS DOUBLE EVERY YEAR! 16 Electronics SBG - January 26, 2001 End User Applications 17 Electronics SBG - January 26, 2001 Bandwidth to the Users 18 Electronics SBG - January 26, 2001 Communications Network 19 Electronics SBG - January 26, 2001 Market Trends CONSUMER Set Top Box/Games Cell Phones DSC/Video/MP3 Modems Residential Gateway PCs Servers Network appliance DATA INTERNET RAID Laptops WIRELESS CONNECTIONLESS USER INTERFACES PDA LIMITLESS BANDWIDTH DEREGULATION Mobile Commerce Datacom Optical Networking Broadband Access COMMUNICATIONS 20 FIBER Electronics SBG - January 26, 2001 Network Revolution = Optical BANDWIDTH 21 Electronics SBG - January 26, 2001 Product Trend BANDWIDTH DEMAND INSTALLATION POPULATION DEREGULATION IP Networks (packet switched) Fiber Optics HS Mezz Internet Metral 3000 InfiniBand Fastech DIN 1975 VOICE Metral 2000 MicroCN Metral 1000 HSSDC2 Millipacs Metral Cat 5e Cat 5 Cat 3 PSTN Networks Norcon (circuit switched) 1985 1995 E-MAIL FILE TRANSFER TIME 2000 GRAPHICS 22 2003 MUSIC VIDEO Electronics SBG - January 26, 2001 System Design Challenges Bandwidth Density Cost Time to Market/Volume Modularity/Scalability EMI Power/Cooling Inter/Intra Cabinet Connection Design re-use / Standardization 23 Electronics SBG - January 26, 2001 Communications 31 Electronics SBG - January 26, 2001 Product Portfolio Communications - FCI Market Position 1999 SAM = $4.70B TOP SUPPLIERS (1999 - Bishop) 1) Tyco 887.5 18.9% 2) FCI 598.7 12.7% 3) Molex 438.6 9.3% 4) FoxConn 226.6 4.8% 5) 3M+RN 187.3 4.0% 6) Amphenol 157.3 3.3% 7) Elco 150.0 3.2% 8) ITT Cannon 146.8 3.1% 9) JAE 140.1 3.0% 10) Radiall 122.6 2.6% 11) Hirose 99.6 2.1% 12) Gilbert 95.0 2.0% 13) ERNI 76.3 1.6% 14) Teradyne 73.1 1.6% 15) T&B 72.0 1.5% Tyco FCI Molex FoxConn ITT Amph Teradyne 3M Elco Radiall Technology 32 Electronics SBG - January 26, 2001 Communications - FCI Electronics vs Market Communications - 2000 SAM = $6.0B Asia 32% Communications - 2001 SAM = $6.6B Asia 37% Americas 44% Americas 39% MARKET Europe 24% CAGR = 10.8% Europe 24% Source: Bishop Comm- 2000 Total Sales = 864M Comm - 2001 Total Sales = 968M Asia 12% Asia 14% Americas 47% Americas 48% Europe 41% Europe 38% Company 14.4% share CAGR = 12.0% 33 14.7% share Electronics SBG - January 26, 2001 Communications - Key Market Trends Bandwidth expansion in network infrastructure to support Internet growth and data communications. IP standard implementation to support voice over data. Telecom and Datacom convergence. High growth areas in new equipment to support bandwidth expansion. SONET/SDH, DWDM, xDSL, Base Stations Fiber optics moves closer to the home/desk High performance connector and I/O cable assembly needs. Outsourcing trend to CEM to accelerate. Maximum growth rate in 2000 Slowing through rest of forecast due to build-out saturation 34 Electronics SBG - January 26, 2001 Communications - Sub-Segments Market Size Ericsson Nokia Motorola Nortel Lucent 1B SONET SDH Base Station Nortel Lucent Fujitsu Alcatel NEC Cisco SWITCHING TRANSPORT RAC IPR DCS Tellabs ACCESS Lucent Cisco 3Com Nortel Cisco Nortel Lucent Juniper Alcatel Lucent 10% Lucent Nortel Alcatel Marconi Cisco ATM DLC Alcatel Lucent Nortel Marconi AFC 20% 35 DSL Alcatel Cisco Nokia Cu Mtn Nortel Lucent Nortel Lucent Ciena DWDM Cisco NEC 30% Growth Rate Electronics SBG - January 26, 2001 SDH Market Share - EU Global SONET/SDH Europe SDH Market Share - 2000 Metral HM Tyco Metral FCI Asia Pacific 20% Siemens 9% FCI ECI 4% Others 4% Nortel 17% Europe 22% Americas 58% Marconi 29% Metral ITT / FCI Metral Lucent 13% FCI Metral Alcatel 24% FCI Alcatel Marconi Nortel A1660, A1670 SMA, MSH TN4X, TN6X Marconi includes GPT, Bosch & Nokia RHK 36 Electronics SBG - January 26, 2001 Base Station Market Share - Global Base Station Market Share - 1999 Global BTS Shipped FCI Metral FCI Metral HM Tyco Metral & HM Metral Alcatel 3% Samsung 1% Others 1% NEC Panasonic HM FCI Lucent 7% Metral Siemens 10% Ericsson 33% Nortel 10% FCI & Tyco Motorola 13% HM Nokia 22% ERNI & Tyco Metral & HM VHDM Teradyne Ericsson Pluto, HiCap Nokia UltraSite, Talk, S8000 Nortel Metrocell, S8000 Lucent Flexent, DoCoMo Alcatel BTS 3.5G, A9900 LMDS Samsung, LGIC, ZhongXing 37 FCI & Perlos Dataquest Electronics SBG - January 26, 2001 xDSL Market Share - Global xDSL Market Share - 1999 Global Ports Shipped ERNI cPCI Metral Newbridge 4% FCI Others 11% Lucent Metral FCI + Tyco RN Paradyne 4% Metral Alcatel 34% Nortel 5% Metral FCI/Tyco Metral Orckit 6% FCI Copper Mtn 8% cPCI ERNI Cisco 18% Nokia 10% Metral Marconi partner FCI & Tyco Press fit CEE Alcatel Nortel Nokia Ericsson Samsung LGIC A1000 R3, R4, A1540 UE-IMAS D50 SpeedLink ANX Metral FCI Dataquest 38 Electronics SBG - January 26, 2001 Communications - Key HPLs 2000 400 350 2001 39% Top 15 = 86% Std Margin% Sales KK Euros 300 250 200 150 33% 44% 32% 100 7% 39% 18% 16% 19% 37% 27% 26% 13% 28% 50 0 M CA F S CAS Nc PC FO MP B BP MJ CA BB All values in M EUROS 39 Electronics SBG - January 26, 2001 BP PRODUCTS Traditional Technology YEF '00 2001B DELTA % N 46.5 35.4 -11.1 -24% F 78.0 55.3 -22.7 -29% HC 29.6 27.6 -2.0 -7% D 74.6 78.0 3.4 5% 228.7 196.3 -32.4 -14% 271.0 410.0 139.0 51% MP 25.3 41.8 16.5 65% FO 24.5 38.0 13.5 55% 320.8 489.8 169.0 53% Subtotal New Technology M Subtotal 40 Electronics SBG - January 26, 2001 Communications - Product Success Factors New product introductions Fiber Optics - multi-fiber array connector High Speed Mezzanine High Speed backpanel products to volume Leverage BGA technology Increase capacity to match demand Implementing Fiber Optics strategy Roadmapping to match technology requirements Continued focus on cost reduction Technology (Am Ni); Location (low labor regions); Systems; Prod/Proc Tech Time to market improvement (PACE) 41 Electronics SBG - January 26, 2001 Communications - Product Roadmap MATURE Brd to Brd Backplane Conan HS cable EMERGING MegArray 0.8 mm BTB HS Mezzanine Metral/Millipacs 0.1” Systems HS HM Series 1000/2000 cPCI Series 3000 SFF FO Fiber Optics Mod Jacks GROWTH SC RJ11 BP adapters Cat 3 RJ45 Metral GBIC Multi Fibre Array SMT, LED, Mag Cat 6 & 7 Cat 5/5e Series 1000/2000 Gigabit Link Series 3000 MetaGig No active FCI program PACE program 42 Electronics SBG - January 26, 2001 Communications - Key Accounts (includes CEM derived demand) 2000 300 2001 Top 11 = 87% Sales KK Euros 250 200 150 100 50 0 L E A N CS Nk M NC S 43 SM HW All values in M EUROS Electronics SBG - January 26, 2001 Communications - Account Success Factors Design wins/shipments to high growth equipment SONET/SDH, DWDM, xDSL, Base Stations Leverage existing relationships OEMs - L, N, A, E, CS CEMs - S, Sn, Cl, Sc, J, V Provide complete solutions platform design-in Monitor equipment start-ups acquisition targets for large OEM portfolio completion Operational excellence Global account management Gain market share through capital investment 45 Electronics SBG - January 26, 2001 Communications - SWOT STRENGTHS WEAKNESSES Product breadth Fiber optic portfolio OEM relationships -Customer Intimate Lack of backpanel (BP) design expertise/partner Lucent, Nortel, Alcatel, Ericsson Late to market with high speed BP connectors 2mm Futurebus (FB/Metral) market leader Mature high margin products Value added capabilities Lack of RF solutions and focus CEM relationships Hard Metric position Signal Integrity expertise Capacity constrained: 2 mm Automated assembly systems not enough FB suppliers, FB share shrinking OPPORTUNITIES THREATS Fiber optics value added Lose technical leadership High Speed BP design-ins for next gen platforms Teradyne/Molex VHDM alliance HS backpanel alliance/partner Foxconn entering Comm market PCB/backpanel/cable assembly CEMs & Cable mfrs entering assembly business OEMs outsourcing FO /box build Trend to outsourced bp turn-key design & build Time to capacity Time to capacity to support A/P demand Amorphous Ni & BGA technology CEMs threaten OEM relationships Low-cost capability/Am Ni& automated assy Gaps in customer coverage A/P Hard Metric market Hard Metric dominance 46 Electronics SBG - January 26, 2001 Data 47 Electronics SBG - January 26, 2001 Product Portfolio Data - Company Market Position TOP SUPPLIERS (1999 - Bishop) 1) Tyco 934.8 14.1% 2) Molex 667.4 10.0% 3) FCI 502.4 7.6% 4) FoxConn 491.1 7.4% 5) 3M+RN 351.0 5.3% 6) Hirose 210.3 3.2% 7) Yamaichi 206.7 3.1% 8) JAE 198.9 3.0% 9) Amphenol 168.9 2.5% 10) T&B 160.1 2.4% 15) Teradyne 44.2 0.7% 1999 SAM = $6.65B Tyco Molex FoxConn F Hirose 3M Amph JAE Teradyne Yama Technology 48 Electronics SBG - January 26, 2001 Data - Company vs Market Data - 2000 SAM = $8.5B Data - 2001 SAM = $9.4B Asia 37% Asia 38% Americas 49% Americas 48% MARKET CAGR = 10.7% Europe 14% Europe 14% Source: Bishop Data - 2001 Total Sales = 354M Data- 2000 Total Sales = 348M Americas 39% Americas 41% Asia 58% Asia 56% Europe 3% 4.1% share Company CAGR = 1.7% 49 3.8% share Europe 3% Electronics SBG - January 26, 2001 Data - Sub-Segments Market Size 1B PC Compaq Dell IBM HP SUN Servers RAID STORAGE Seagate Quantum Maxtor Fujitsu IBM WD Peripherals 5% HDD Compaq Dell IBM HP Compaq IBM Dell HP SUN EMC Mobile Computing HP Lexmark Canon 10% Handheld 15% 50 Toshiba Compaq IBM Dell Fujitsu Palm Handspring SONY Compaq Casio HP Growth Rate Electronics SBG - January 26, 2001 Data - Key Market Trends Price pressures and erosion approaching “low end” consumer Accelerating shifting of manufacturing to: low cost regions & CEMs Explosion of Internet globally driving segment growth High growth in entry/mid-level servers for data management Double digit growth for storage systems Bandwidth expansion between servers/storage/networks High performance connector and I/O assembly needs Reduced life cycles, standardization of components and rapid growth of CEMs have changed “Rules of the Game” 51 Electronics SBG - January 26, 2001 Data - Key HPLs 2000 90 13% 2001 Top 15 = 86% Std Margin% 80 70 Sales KK Euros 38% 60 18% 39% 50 40 2% 37% 31% 30 26% 23% 32% 13% 38% 8% 38% 20 10 0 CA Pc M BC C SC FP Mg 52 Hc CASAll values Dm Pw in M SC Mx EUROS Electronics SBG - January 26, 2001 Data - Product Roadmap MATURE DIMM Memory HS Cable GROWTH SO DIMM InfiniBand MetaGig Serial ATA Mini USB DVI 1394 VHDCI USB SCSI D-subs Backplane Card Edge 2mm Systems 0.1” Systems Metral 1000/2000 Metral 3000 InfiniBand PCI Slot 1 Combo Other EMERGING RIMM DDR DIMM MiniPCI VRM9 PwrBlade Sockets MegArray CardBus SCA2 Merced PwrBay LGA UDS PowerPod No active FCI program PACE program 53 Electronics SBG - January 26, 2001 Data - Key Accounts (includes CEM derived demand) 2000 70 2001 Top 11 = 47% Sales KK Euros 60 50 40 30 20 10 0 Cq D I It Mk Q H Nr Ht 54 Sn Ac All values in M EUROS Electronics SBG - January 26, 2001 Data - Key Success Factors Focus on standards activity InfiniBand (BP & IO), Serial ATA SCSI (VHDCI), FibreChannel (MetaGig) JEDEC (DDR DIMM) Cost reduction efforts for commodity products Focus on profitable area of market Notebook, Servers, Storage Work closer with Intel competitors AMD, Transmeta, others Stronger & more integrated relationship with A/P 56 Electronics SBG - January 26, 2001 Data - SWOT STRENGTHS Position with ODMs in Taiwan Ability to serve/supply globally Leading position with HDD OEMs Focused product positions PCMCIA, CardBus, Metral, MegArray, DIMM/DDR, Combo and compression, Pwrblade, SCA2 WEAKNESSES Cannot and will not compete on price (Foxconn) Limited high volume/low cost capabilities Weak product position in desktop PCs and peripherals TTM/TTV vs competition Lack of top tier private label supplier alliances Weak position with leading Japanese OEMs Not viewed as technology leader OPPORTUNITIES THREATS Double digit CAGR’s Foxconn position, relationships and focus Wins in Korea, Japan, Taiwan can be leveraged Foxconn box build strategy and focus on 2 mm Localized design+competitive production in “New Tyco/AMP” aggressiveness Taiwan and China Reduced life cycles and standardization of components reduce margins and ROIs Increased bus speeds driving to Communications solutions Growth and expansion of low cost niche suppliers Cable assembly upside Open market bidding for conn and cable assys expansion of ODMs in A/P Attraction/retention of key personnel in A/P Trend toward reduced supplier base and pkg deals 57 procurement Electronics SBG - January 26, 2001 Consumer 58 Electronics SBG - January 26, 2001 Consumer - FCI Market Position Product Portfolio 1999 SAM = $0.9B TOP SUPPLIERS (1999 - Bishop) 1) Molex 267.0 28.8% 2) Tyco 126.8 13.7% 3) F 40.4 4.4% 4) JAE 36.2 3.9% 5) Hirose 33.2 3.6% 6) Elco 30.0 3.2% 7) Hosiden 25.6 2.8% 8) FoxConn 22.7 2.4% 9) Amphenol 11.8 1.3% 10) 3M 8.2 0.9% Note: Bishop estimates excludes Mobile. (stimates * $1.5B including MP Molex Tyco *includes Mobile Phone FoxConn Hirose Elco Amph Hosiden JAE 3M Technology 59 Electronics SBG - January 26, 2001 Consumer - Company vs. Market Consumer - 2000 SAM = $2.0B Consumer - 2001 SAM = $2.16B Americas 20% Americas 19% Europe 13% Asia 67% Europe 12% MARKET Asia 69% CAGR = 8.5% Source: FCI Consumer- 2000 Total Sales = 151M Consumer - 2001 Total Sales = 186M Americas 21% Asia 60% Americas 20% Europe 19% Europe 19% Asia 61% Company 7.6% share CAGR = 23.2% 60 8.6% share Electronics SBG - January 26, 2001 Consumer - Sub-Segments Market Size Nokia Motorola Ericsson Panasonic Siemens Samsung MOBILE PHONES 500M Phillips Thomson Hughes Motorola/GI Scientific Atlanta 100M SONY Nintendo Sega Microsoft Video Games Set Top Box Residential Gateways Motorola/GI Thomson Nortel Terayon 3Com Efficient Modems* * includes xDSL, cable, analog DSC Video 10% 20% 61 SONY Kodak Canon Panasonic Growth Rate Electronics SBG - January 26, 2001 Electronic Packaging - Handheld RF- Integrated Antenna LEVEL 5 LEVEL 5 I/O + Accessory Battery LEVEL 5 LEVEL 3 Microphone LCD LEVEL 3 BtB SIM LEVEL 3 LEVEL 3 62 Electronics SBG - January 26, 2001 Consumer - Key Market Trends Growth in digital consumer devices Integrated cell phones, new application for Internet access Mobile equipment (PDA, Camcorder, CD/MP3 players) Residential Gateways, set top boxes, high end game systems Autosystems (navigation, entertainment, smart toll) Lacking standardization but beginning to attempt Moving away from PC centric world Broadband connected home (networks, etc.) Increasing use of handheld devices New application for Smart Cards associated with e-business Secure Data Card 63 Electronics SBG - January 26, 2001 Consumer - Key HPLs 2000 80 2001 Std Margin% 24% 70 Top 15 = 98% 23% Sales KK Euros 60 50 40 21% 30 48% 20 13% 26% 17% 27% 27% 41% 5% 8% 48% 13% Bt D 10 0 MP FP SC C CA MJ PPP PC US Bs Bd S All values in M EUROS 64 Electronics SBG - January 26, 2001 Consumer - Success Factors Mass production culture: Ability to meet volume ramp-up High degree of customization Technology leadership in mobile I/O Presence on accessories Focus on major players: few but dominate market Utilize Global marketing/operation network Focus market strategy cell phones, set top box, residential gateways Program Management Organization 65 Electronics SBG - January 26, 2001 Consumer - Product Roadmap MATURE GROWTH FFC/FPC Brd to Brd 0.8 mm BTB Conan I/O Mod Jacks USB D-subs Card Systems Other PCMCIA EMERGING HS FFC/FPC Compression LP BTB 0.5 mm BTB BTVM 0.8 mm MegArray Mobile I/O RF Antenna 1394 1394b Mini USB CardBus CompactFlash Smart Card MMC SDC Sockets No active FCI program PACE program 66 Electronics SBG - January 26, 2001 Consumer - Top 10 Key Accounts (includes CEM derived demand) 2000 30 2001 Top 10 = 47% Sales KK Euros 25 20 15 10 5 0 Pi Mt Sy Ma Cn Ta Th Nk So 67 Pi All values in M EUROS Electronics SBG - January 26, 2001 Consumer - SWOT STRENGTHS WEAKNESSES Product breadth for cell phones Limited number of accounts as customers Infrastructure for strategic sourcing for Low presence in design houses Mobile Strategy unclear beyond cell phones Process in place for project management Lack of focus on FFC connectors outside Asia Global organization for sales and ops No 0.3 mm BTB offering Access to low labor cost internal No wire to board offering capability China, Hungary OPPORTUNITIES Improving OEM relationships THREATS Resources capacity issues limit growth potential Motorola, Nokia, Thomson, Phillips, SA smart card, mobile I/O Residential gateways/set top box Wireless Internet/RF Antenna technology Clear focus segment/product strategy Tyco/AMP aggressiveness SD card Strengths of competition New technology for high speed assembly Expand FFC/FPC offering Major technology changes expected within 3 years 69 Bluetooth, etc. Molex, Hirose, JST and Taiwan/China companies Price war in many segments Electronics SBG - January 26, 2001 I&I 70 Electronics SBG - January 26, 2001 I&I - Company Position Product Portfolio 1999 SAM = $7.17B TOP SUPPLIERS (1999 - Bishop) 1) Tyco 1261.9 17.6% 2) FCI* 381.2 5.3% 3) Molex 249.8 3.5% 4) Harting 214.1 3.0% 5) 3M+RN 171.4 2.4% 6) Amphenol 153.2 2.1% 7) JAE 134.7 1.9% 8) Hirose 135.8 1.9% 9) ITT Cannon 119.7 1.7% 10) T&B 84.5 1.2% Tyco * includes Interconnection Molex JAE Amph Harting ITT T&B Hirose 3M Technology 71 Electronics SBG - January 26, 2001 I&I - Company vs Market I&I - 2000 SAM = $8.4B Asia 32% I&I - 2001 SAM = $9.0B Asia 32% Americas 35% Americas 35% MARKET Europe 33% CAGR = 7.1% Europe 33% Source: Bishop I&I - 2000 Total Sales = 155M Asia 15% Europe 56% 1.8% share I&I - 2001 Total Sales = 194M Asia 14% Americas 29% Americas 29% Europe 57% Company CAGR = 25.2% 72 2.2% share Electronics SBG - January 26, 2001 I&I - Sub-Segments 2B Market Size Rockwell Emerson Honeywell Eaton Hitachi Siemens ABB Industrial Office Equipment 1B Agilent Tektronix Fluke Teradyne Schlumberger Instrm Agilent Medtronic GE HP Xerox Pitney Bowes Kodak Harris/Lanier Medical Emb Comp 5% Motorola SUN Intel 10% Growth Rate Source:Bishop 73 Electronics SBG - January 26, 2001 I&I - Key Market Trends Utilizes standard technologies and interconnects from other segments, primarily Data Segment Has specialty connector needs particularly in Medical and ruggedized applications 50% of all connectors purchased through Distribution Industry moving to standard platforms - Windows/Intel More and more vendor based designs - COTS (Commercial Off The Shelf) initiative Moving to digital technology from analog Can be highly specialized and require customization 74 Electronics SBG - January 26, 2001 I&I - Key Products 2000 60 2001 37% Top 15 = 68% Std Margin% 50 Sales KK Euros 40 30 39% 38% 20 7% 19% 13% 18% 22% 8% 36% 10 40% 27% 26% 26% Us Hc MJ 0 BC M Pc D MP CA P Q 75 S Di Ds All values in M EUROS Electronics SBG - January 26, 2001 Industrial - Product Roadmap MATURE EMERGING RIMM SO DIMM DDR DIMM DIMM Memory Brd to Brd GROWTH 0.8 mm BTB 0.5 mm BTB IEEE 1386 Conan MegArray PC/104 Millipacs Backplane I/O DIN D-subs cPCI USB SCSI Sockets 1394b 1394 VHDCI RF Other HS HM POF HS Link PwrBlade PCMCIA CompactFlash PwrBay No active FCI program PACE program 76 Electronics SBG - January 26, 2001 I&I - Key Accounts (includes CEM derived demand) 2000 9 2001 Top 12 = 15% 8 Sales KK Euros 7 6 5 4 3 2 1 0 Ag Av S Nt PB Sh Ab Hy R 77 As Ht Al All values in M EUROS Electronics SBG - January 26, 2001 I&I - Success Factors Select, focus on target opportunities that are large volume wins Work the distribution network Bundle connectors and value-added Leverage globally, among all groups, and utilize programs such as Basics Design and manufacture in low-cost regions 79 Electronics SBG - January 26, 2001 I&I - SWOT STRENGTHS WEAKNESSES Product breadth across SBGs Little focus on segment Offer value-added supply (breadth) Well established incumbents Strong global Distribution network RF product line, terminal blocks Global supply capability Lack products to serve some Standards: 1386, PC104 OPPORTUNITIES Leverage entire product line Basics+ program initiative Strong press-fit offerings Non user-friendly website THREATS Samtec offering better service level D-sub, DIN, 2mm Good margins Increase Distributor share Expands Basics+ approach to other products 80 Electronics SBG - January 26, 2001 Strategies & Challenges 81 Electronics SBG - January 26, 2001 FCI Electronics - Strategic Direction Strengthen leadership in Communications segment through high-speed copper and fiber optic developments and technology “partnerships” Increase margins through aggressive product management and manufacturing cost reduction Leverage and sustain customer intimacy to provide complete technology and Value Added solutions 82 Electronics SBG - January 26, 2001 FCI Electronics - Strategic Direction Establish financial structure and performance competitive with industry leaders. Improve business balance by selective penetration in segments other than Communications Consumer focus on mobile phone and handheld devices Data focus on wireless computing and mid to hi-end servers I&I penetration through distributor sales 83 Electronics SBG - January 26, 2001 FCI Electronics - Key Challenges To reduce TTM/TTV by optimizing product and process development and resource allocation To establish skills and capabilities at low cost labor sites needed to effectively transfer production from higher cost manufacturing operations To establish processes and systems needed to provide timely and accurate data needed to support business understanding and decision making 84 Electronics SBG - January 26, 2001 FCI Electronics - Key Challenges To establish customer relationships and sales channels needed to further penetrate Data, Consumer, and I&I market segments To align operating and cost structure to support business and financial objectives To continue customer intimacy at key Communications OEMs while establishing preferred supplier status with CEMs 85 Electronics SBG - January 26, 2001 Financial Plan January 26, 2001 86 Electronics SBG - January 26, 2001 2001 EBITDA BUDGET (Euros in millions) 1999* 2000* 2000R** 2001B** Sales 1,112 1,428 1,536 1,709 348 442 475 547 % of Sales 31.3% 31.0% 31.0% 32.0% Planned Cost 235 273 294 332 % of Sales 21.1% 19.1% 19.1% 19.4% 113 170 183 216 10.2% 11.9% 11.9% 12.6% 180 245 263 314 16.2% 17.1% 17.1% 18.4% Gross Earnings Operating Income % of Sales EBITDA % of Sales * 2000 budget exchange rate. ** 2001 budget exchange rate. 87 Electronics SBG - January 26, 2001 OPERATING CASH FLOW 2000 B 2000 A 2001 B EBITDA 225 245 314 Change in Reserve (16) (9) (2) Change in OW/C (11) (21) (26) (104) (126) (174) 94 89 112 Net CAPEX Operating Cash Flow 88 Electronics SBG - January 26, 2001 CASH TO CASH CYCLE 1999 2000B 2000A 2001B 2003P Americas 97 86 82 78 82 Europe 90 76 76 101 95 Asia 64 86 30 55 81 Total 93 93 77 91 95 89 Electronics SBG - January 26, 2001 2001 BUDGET BY SEGMENT (Euros in millions) Trade Sales Connectors 2001 Budget Value 2001 Budget Fiber Optics 2001 Budget Electronics 2001 Budget 1,360.0 311.3 38.0 1,709.3 Gross Earnings % Sales 473.9 34.8% 67.4 21.6% 6.1 16.0% 547.4 32.0% Planned Costs % Sales 274.7 20.2% 47.3 15.2% 9.7 27.1% 331.7 27.1% Operating Income % Sales 199.2 14.6% 20.1 6.5% (3.7) -9.7% 215.7 12.6% EBITDA % Sales 287.4 21.1% 28.9 9.3% (2.2) -5.8% 314.0 18.4% 90 Electronics SBG - January 26, 2001 EBITDA PROJECTION (Euros in millions) 1999* 2000* 2000 R** 2001 B** 2003 P* Sales 1,112 1,428 1,536 1,709 1,793 348 442 475 547 633 % of Sales 31.3% 31.0% 31.0% 32.0% 35.3% Planned Cost 235 273 294 332 352 % of Sales 21.1% 19.1% 19.1% 19.4% 19.6% Operating Income 113 170 183 216 281 % of Sales 10.2% 11.9% 11.9% 12.6% 15.7% 180 245 263 314 379 16.2% 17.1% 17.1% 18.4% 21.1% Gross Earnings EBITDA % of Sales * 2000 budget exchange rate. ** 2001 budget exchange rate. 91 Electronics SBG - January 26, 2001 VERSUS SAP3 1999 2000 2001 2002 2003 SALES SAP3 2000 2001* 1,112 1,260 1,349 1,428 1,496 1,570 1,659 1999 2000 2001 2002 2003 * 2001 budget adjusted at SAP3 exchange rate 92 EBITDA SAP3 2000 2001* 180 231 245 271 289 309 351 Electronics SBG - January 26, 2001