The Microfinance in Jordan

The Microfinance

In Jordan

????

What is the collection average rate of the Microfinance firms in Jordan?

The Microfinance in Jordan

Introduction:

I would like to present a brief general presentation about the Microfinance in Jordan.

First I will talk about the Microfinance in the Arab world and how did it reach specifically to Jordan.

Then, I will mention the microfinance companies in

Jordan: their policies, organizational structure and their difficulties.

And finally I will explain how these difficulties have been solved by Delta Informatics.

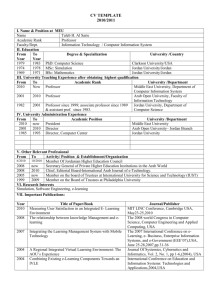

Professor Muhammad Yunus

Recipient of Nobel Peace

Prize in 2006, recognized for his work in poverty and the empowerment of poor women since 1976. He created the Grameen

Bank, a micro-credit institution that provided small amounts of working capital to the poor for selfemployment. Grameen

Bank has loaned out over

6.5 billion dollars to the poorest of the poor.

Muhammad Yunus is a member of the Board

Directors for several companies in Jordan.

Sanabel

The Microfinance network of Arab countries

Sanabel was established in 2002 when 17 representatives from seven Arab countries gathered in Tunisia to launch a network designed to serve microfinance institutions in the

Arab world.

Sanabel organizes an annual conference of Arab

Microfinance practitioners every year in a different Arab country.

The first Sanabel’s annual conference was held in the Dead

Sea in Jordan in 2003. "Shaping the Industry's Future" was the theme of the conference. During this three-day conference, microfinance practitioners and experts, donor agencies, investors and government officials came together to discuss the development of best practice microfinance in the Arab region.

Sanabel’s annual conferences

YEAR COUNTRY THEME

2003

2004

Jordan

Egypt

Shaping the Industry’s future

Microentrepreneur awards

2005

2007

2008

2009-

May

Morocco

Yemen

Tunisia

Lebanon

From Microcredit to Microfinance in the Arab Region

Serving the Poor: 10 million clients by

2010

Advancing Arab Microfinance: Greater

Social Impact through Inclusive

Financial Services

Human Capital in Microfinance:

People, Passion and Value

Members & Partners of Sanabel

Membership in the network is limited to the founders and any MFI who applies for membership and fulfills certain criteria.

Today Sanabel has expanded and has members in Egypt, Iraq,

Lebanon, Mauritania, Morocco,

Palestine, Saudi Arabia, Sudan

,Syria, Tunisia, Yemen and Jordan.

Sanabel’s Members in Jordan

1- AHLI Micro Financing Company -1999.

2- Jordan Micro Credit Company

(Tamweelcom)-1999.

3-Microfund For Women -1994.

4- Middle East Micro Credit Company -2000.

5- National Micro Finance Bank

(Al-Watani) -2005.

6- Development & Employment Fund

(Reyada) -1989.

7- Finca Jordan-2007.

General Information about the companies

Company

Ahli

Mmco

Jmcc

Mffw

Def

Nmb

Finca

N.

Branches

8

Active

Clients

5200

6

16

17

15

8

7

5000

44000

33000

40000

15000

13500

Loan

Process

Loan’s period

2 weeks 6 -36

Months

3 weeks 6 – 36

Months

1 week 2 – 48

Months

1 week 2 – 48

Months

1 month 6 – 72

Months

2 weeks 6 – 36

Months

1 week 2 – 36

Months

Loan

Amount

500-

15000 $

500-

15000 $

300 –

40000 $

200 –

30000 $

500 –

75000 $

300 –

15000$

300 –

15000$

Totals:

By end of 2008, the total sum of Active

Clients = 160,000.

By end of 2008, the total amount of loans that were declined =

100.000.000 JD.

By March 2009, the amount of new loans

= 20.365.000 JD.

Services Provided by the companies

Financial Services:

Loans

Interest rate average for a

Loan depends on the policy and product: 5-20% per year.

Non Financial

Services:

Life Insurance

Show rooms

Buzzards

Business linkage

Training courses

Trips for ideal clients .(as a compensation)

2 Types of Loans

Individual Loans:

Men & Women

Business owners

House hold Loan

Existing projects

Start up projects (Grace period up to 6 months)

Seasonal loan (Ramadan)

Vehicles Loans

Agriculture Loans

Group Loans:

For women only

2-5 persons

House hold loans: knitting

Agriculture loans: cows, sheep, camels..

The Islamic Product

Only 2 companies in Jordan provide a loan as an Islamic Product.

1.

2.

3.

DEF

NMB

FINCA (In the future)

The Islamic Product is named

“Morabha”.

Al Morabha

This product provides people who would prefer to apply the Islamic way since they do not agree to take a loan with a certain percentage of interest.

They can choose the Morabha.

Morabha includes in it’s contract 3 subjects: the company, the trader and the client.

The company buys the product from the trader and resale it to the client when the purchase price is known and must be agreed upon in advance. The profit is around( 6%-7%).

Vision & Mission

-

-

-

The vision and the mission of the microfinance companies in Jordan are quit similar in their targets.

The vision is to improve the low income and productive poor people’s social and living standards through micro and small sized enterprises.

The mission is to provide the financial and non financial services to the Jordanian's lowest income so they can create jobs, build assets and increase their income.

Difficulties of the companies:

1.

2.

3.

4.

Competition

Similarity in their products

Division by areas. (North, Center and South)

Duality of a client.

Duality of a client

The client can be so “clever”: go to a company to ask for a loan and right after he signs the contract, he goes to another company and asks for another loan. This is what we call Duality.

In order to stop this duality, all companies had to sign an agreement at the Ministry of Planning in accordance with

Delta’s company in 2007

Delta Informatics

Delta is an informatics company, that provides to all companies an online contract of an active client: In a case a client has signed an agreement with one company, can’t go to another company unless he has finished his active payments.

Since it was established in Amman in 1993, Delta

Informatics has helped the firms achieve a competitive advantage through the following issues:

1. Reduced costs

2. Increased productivity

3. Higher revenues

The Answer to my question at the beginning of my presentation:

The average

Of the collection rate is:

92% - 99%.

How is it so high???

The Answer is:

The Organizational Structure in all firms.

Organizational Structure of a company

Board of Directors

External Auditor General Manager Internal Auditor

Organizational Structure of a company

General Manager

Operation Department

Finance Department

M.I.S Department

Marketing Department

H.R Department

Organizational Structure of a company

Operation Department

Operation Manager

Credit Manager

Branches Managers

Supervisors

Loans Officers

Conclusion

Jordan is well known as a supportive and active client of the world’s Microfinance.

Microfinance in Jordan is specialized with it’s organizational structure.

Their Vision and Mission are to create and build strong financial projects and products in Jordan.

Companies know how to overcome their difficulties and they reduce poverty in

Jordan and that’s how they accomplish their goal.

Thank you for your presence

Samer Abu Dalo