File - BAF3M Fundamentals of Accounting

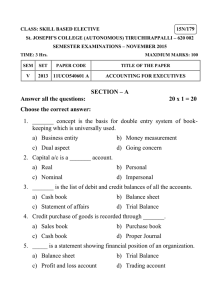

advertisement

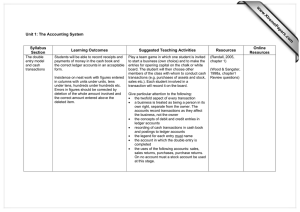

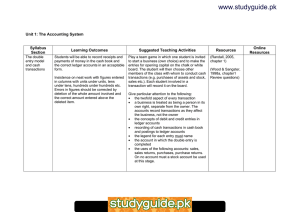

Review…. Types of Accounts Beginning Value Increases Decreases ASSETS DR DR CR LIABILITIES & OWNER'S EQUITY CR CR DR Your Homework was… • Page 96, Exercises 1,2,3 • Page 107, ‘Exercise’ 1 A. – (Use a T Account Ledger) – Do the transactions for this ‘new’ business – what will the opening balances be for each account? – Calculate account totals when complete. Page 96, Exercises 1 (A,B) • A. – A debit balance in an A/R account means that person owes us. • B. – A credit balance in an A/P account means we owe that person money. 2. • A. – Bank account is usually a DR balance. – A/R account is usually a DR balance. – A/P account is usually a CR balance. • B. – Overdraft on a bank account can cause this. – Overpayment by a creditor. ($ paid to us.) – Overpayment to a debtor. (We paid more than we owed.) 3. • a. the left side of an account is a DR • b. the balance of an A/R is a DR. • c. The balance of a supplier’s account (someone who we buy from) is a CR. • d. A decrease in a liability is a DR. • e. An exceptional (unusual) bank account balance is a CR. • f. The balance of an equipment (asset) account is a DR. • g. The right side of an account is a CR • h. The balance of a Bank Loan account is a CR • • • • • • • • • • i. An exceptional balance on an A/P is a DR. j. The larger side of a liability account is a CR. k. A creditor’s account is a DR. l. A customer’s account (who will also owe us money) is a DR. m. To increase an asset, we use a DR. n. A debtor’s account is a CR. o. The effect on accounts receivable when we sell on account (increases it) is a DR. p. The effects on accounts payable when we buy on account is a CR. q. The effect on A/R when we have a receipt (we make a sale) on account is a DR. r. The effect on A/P when we purchase on account is a CR. As s et s 1A. ban k Liabil it ies & Ow n er 's Eq u it y The Trial Balance • To set up our ledger, we use information from the balance sheet. • Changes caused by transactions are recorded in the ledger. (T Accounts) • Periodically, it is necessary to check the accuracy of the ledger. • This is done with a ‘Trial Balance’ ‘Taking off’ a trial balance • Making a trial balance is called ‘taking off’ a trial balance. • The trial balance is simply a listing of the accounts and their balances in the ledger. • If all the debit balances = all the credit balances, the ledger is said to be in balance. (Otherwise it is out of balance.) What does a trial balance look like? Pacific Trucking Trial Balance July 2, 20-Accounts Bank A/R - D. Johnston A/R - J. Seinfeld Supplies Trucks Equipment Bank Loan A/P - J. Dimagio A/P - M. Monroe B. Johson, Capital Headin g! DEBITS CREDITS 215 150 85 350 63000 22180 85980 Ac c o u n t bal an c e in c o r r ec t c o l u mn s ! Ac c o u n t s l is t ed in l edger o r der ! 18000 6516 4146 57318 85980 T o t al s mu s t agr ee! Taking off a trial balance… • Step 1 – List all the accounts and their balances • Step 2 – Place debit balances in debit column and credit balances in credit column • Step 3 – Add up the two columns • Step 4 – See if your two columns are the same. • Step 5 – Write a heading at the top. • Name of the business • Title of the document (Trial Balance) • Date prepared Balance • It is important to have your ledger in balance. • If it is not in balance, your work is not accurate. • A ledger out of balance is a certain sign at least one error has been made in the accounts. • A good accountant does not rest until all errors are found and corrected! Finding Errors • Re-add the trial balance columns • Check that numbers have been transferred from the ledger to the trial balance correctly. • Recalculate the account balances. • Check that there is a balanced accounting entry for each transaction! (DR = CR ?) Homework… • Page 102, Exercise 2 • Using the answers from your homework exercise 1A (pg 107) – take off a trial balance. (Use the handout provided for both.)