17 Means Tested or Universal Benefits

advertisement

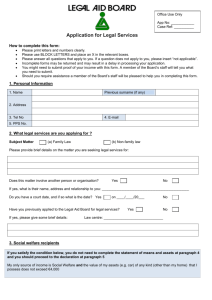

MEANS TESTED AND UNIVERSAL BENEFITS How should we allocate welfare benefits? This presentation looks at • • • • 21st challenges to Beveridge’s welfare vision Different approaches to the welfare state Examples of universal and means-tested benefits The debate over which benefits should be means-tested FOUNDING PRINCIPLES OF THE WELFARE STATE The founding principles of the welfare state were that the state would look after each individual “from the cradle to the grave.” The Beveridge Report advocated collective government assistance to individuals from “cradle to grave” funded by social insurance. State benefits would be paid to the sick, the old and the unemployed. These would be paid for from taxes and national insurance payments from the working population. Post war reconstruction BEVERIDGE’S FIVE GIANT EVILS Disease (lack of health care) Idleness (unemployment) Want (poverty) Squalor (poor housing) Ignorance (lack of education) 21ST CENTURY CHALLENGES Beveridge’s founding principles were designed in the 1940s. By the 1990s, British society had changed in many ways. How do we pay for: Long term care for the elderly? The long term unemployed? Lone parents? Beveridge’s welfare state could not foresee these challenges! SHOULD THE RICH PAY MORE? Left, Lakshmi Mittal, the UK’s richest “resident”. He is a non domicile. Right, Jimmy Carr, the comedian who was criticised by the Prime Minister for his tax avoidance scheme. The UK is home to some fabulously rich people who, due their non-domicile status or clever tax avoidance schemes pay little or no tax. City bonuses to investment bankers have returned. According to George Monbiot, tax avoidance in the United Kingdom deprives the Exchequer of between £25bn and £85bn a year. That’s more than the UK spends on the entire NHS. Tax avoidance THE INDIVIDUALIST PHILOSOPHY POLITICAL CHALLENGE TO THE WELFARE STATE The individualist philosophy is not new. It is, in principle, no different from the “laissez faire” approach of the 19th century. Individualists believe that the state should have as little to do with the workings of society. It should tax as little as possible and leave individuals to be responsible for their own wealth and health. DAVID CAMERON’S “BIG SOCIETY” “Circumstances; where you’re born, your neighbourhood, your school and the choices your parents make have a huge impact. But, social problems are often the consequence of the choices that people make” David Cameron, Glasgow, July 2008 David Cameron on poverty Following on from his theme of “Broken Britain”, Prime Minister David Cameron has developed the idea of the “Big Society”. In some ways it is the Conservatives’ own third way; between the individualism of Margaret Thatcher and government help for those in need. Cameron seeks to “heal” the so-called broken society by encouraging greater individual responsibility (a traditional Conservative approach) and use of the voluntary sector to help those prepared to face up to their problems. DEFICIT REDUCTION In June 2010, Chancellor George Osborne delivered his “emergency budget” to reduce the size of the country’s budget deficit. The UK, like most countries, has had a budget deficit for some time, but this boomed after the Labour Government spent money on saving the big banks during the “credit crunch” of 2008. The main aspects of the Coalition Government’s economic plan until 2015 are: • VAT increase (back to 17.5%) • Public sector pay freeze • Child benefit cuts • Housing benefit cuts • Disability Living Allowance cuts • Tax cut for lowest paid • Capital Gains Tax increased Public sector workers have been protesting at cuts to services, proposed increases in pension contributions, the end of the final salary pension scheme and the raising of the retirement age. UNIVERSAL BENEFITS Universal benefits are those which people receive automatically, with no reference to their economic circumstances. In July 2012, Child Benefit (CB) amounted to £20.30 a week for the eldest child and £13.40 a week for each additional child with payments continuing until the age of 19 for those in fulltime education. About 7.7 million families with children currently get CB, costing about £12bn a year. CB is a tax-free payment to anyone bringing up a child or young person. In theory, the Beckhams, should they return to the UK, would receive CB for young Harper Seven, as well as for their other children. It is not affected by income or savings, so most people who are bringing up a child or young person qualify for it. From January 2013, those earning over £50,000 will no longer be entitled to full CB. For every £100 earned over £50,000, 1% of CB will be deducted. The Government estimates that 85% of families will continue to receive CB in full. MEANS-TESTED BENEFITS Means tested benefits include; •Working Tax Credit •Child Tax Credit •Pensions Credit •Housing Benefit •Council Tax Benefit •Income Support TOO COMPLICATED? Tax Credit forms can be very complicated meaning some people do not claim. Others have been getting too much! In February 2008 the House of Commons Accounts Committee reported that £1 billion of tax payers money had been wasted in errors or over payments. The report says that some £65bn has been paid in tax credits since 2003. Of that, £6bn was overpaid in the first three years. By the end of 2010 HMRC had collected £2bn of the overpayment but written off £700m. Of the £3.3bn still to be collected, the committee says £1.6bn is unlikely to be recovered. INCAPACITY BENEFIT In July 2012 2.58 million people were officially unemployed; 8.1% of the labour force. This does not include the 1.6 million who receive Incapacity Benefit (IB), those who have chosen to stay in full time education or teenagers who are not entitled to Jobseekers Allowance (JSA). The tabloid press have, predictably, sensationalised data released by the Coalition Government that many Incapacity Benefit claimants could, with the proper support, work. THE UNIVERSAL CREDIT The Welfare Reform Bill was given its Royal Assent in March 2012. It’s main features include: A single universal credit to come into force in 2013. It will replace • • • • • • The Universal Credit Income-based Jobseeker’s Allowance Income-related Employment and Support Allowance Income Support Child Tax Credits Working Tax Credits Housing Benefit There will also be an annual benefit cap of about £26,000 per family. SNP’S COLLECTIVIST POLICIES The SNP Government has been remarkably collectivist. Prescription charges have abolished. Road bridge tolls have been abolished. The Graduation tax has been abolished and Scotland still has no tuition fees for higher education. Free school meals for S1-S3 are planned (subject to local authority funding!) WHAT IS THE BEST WAY TO ALLOCATE BENEFITS? Which benefits, if any, should be universal or means-tested? Are benefits too high or too low? Do we have a problem with welfare dependency or this is this made up by the tabloid press? CAN WE AFFORD SOME OF OUR POPULAR BENEFITS? In Scotland we have two very popular but very expensive universal “benefits.” All students in Scotland, regardless of their income, have their university fees paid. Is this a subsidy for the better off? Likewise, the National Entitlement Card provides all over 60s in Scotland, regardless of their income, free travel on buses in Scotland. Is this also a subsidy for the better off? Should we consider means-testing these benefits and “ring fence” the funds for early years support for the poorest?