Freddie Mac Bridging the Gap - Pinellas Realtor Organization

advertisement

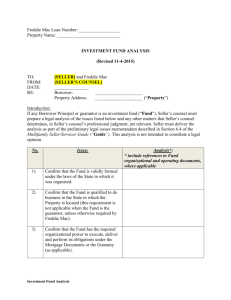

Bridging the Gap for Today’s Homebuyer Stacey M. Walker Director, Strategic Markets October 27, 2011 It’s A Great Time To Buy Inventories are at all-time highs at lower prices, increasing affordability Mortgage interest rates at historical low Opportunity based on the type of supply © Freddie Mac 2011 Market Drivers Influence Purchase Patterns Market Drivers Influence Purchase Patterns Past Few Years (2005 – 2007) Today (2011) Summary Consumers anxious to become homeowners to catch the appreciation wave Consumers waiting on the sidelines for prices to bottom out or the market to stabilize The demographic profile of homebuyers has not changed. Minimal savings required for down payment Consumers unsure whom to trust The value proposition of becoming a homebuyer has changed for most consumers, resulting in a change in their behavior and approach toward homeownership. Homeownership viewed as a short-term investment (Market Created Equity) Equity used as ATM for other purposes beyond homeownership Consumers took advantage of exotic low initial payment mortgages Savings now required for down payment and closing costs (5%-20%) Homeownership a longer term investment (Homebuyer Creates the Equity) Consumers feel unprepared for mortgage obligation Consumers seeking simple mortgage products with no surprises New value proposition is long-term investment versus short-term reward/ATM. Given these changes, how do we attract, prepare, and serve well-qualified homebuyers going forward? Source -- Freddie Mac © Freddie Mac 2011 4 Borrower Segments Face Challenges and Heightened Anxiety Borrower Segments Challenges Lack of down payment Anxiety over housing prices Inability to find financing Lack of information Lower equity in existing home Challenges of selling home Fear of declining house values Universal Fear of making wrong choices Fear of foreclosure Fear of unemployment Fear of continuing decline in home prices (investment loss) Not the right time to buy Monthly payment and cash upfront issues Repairing credit Fear of unemployment/ foreclosure Lack of down payment Down payment struggles Costs are higher for credit scores from 620 – 640 Source -- Freddie Mac © Freddie Mac 2011 5 Who Are Today’s Homebuyers? Homebuyers Today 2010 Homebuyer Profile First-time Homebuyer – Demographic Characteristics Share increased from 47% in 2009 to 50% in 2010 Married couples represent 48% of FTHBs Single female buyers represent 23% of FTHBs Repeat Buyer 50% First-time Homebuyer 50% Single male buyers represent 15% of FTHBs First-time Homebuyer Demographics Other 1% Unmarried couple 12% Single male buyers 15% Married couple 48% Single female buyers 23% Source -- NATIONAL ASSOCIATION of REALTORS Profile of Home Buyers and Sellers 2010 © Freddie Mac 2011 7 Age of First-time Homebuyers Age of Homebuyer Homebuyer Age 2009 2010 First-time homebuyers are typically younger than repeat buyers. 18-24 6% 11% 25-34 34% 56% More than half of first-time homebuyers were between 25-34 years old. 35-44 22% 19% 45-54 18% 10% 55-64 13% 4% 65-74 6% 1% 75+ 2% 2% Source -- NATIONAL ASSOCIATION of REALTORS Profile of Home Buyers and Sellers 2010 © Freddie Mac 2011 8 Projected Population Increase 2010–2025 Projected Population Increase – 2010-2025 30% 25% (16.06%) (33.46%) (52.38%) 5% 0% White 5.58% Black 14.65% 16.75% 10% 11.23% 15% 7.97% 49,726 57,711 66,365 75,772 52.38% 2010 2015 2020 2025 20% 12.02% (14.65%) (30.11%) (46.44%) 3.92% 14,415 16,527 18,756 21,109 33.46% 35% 30.11% (5.58%) (11.23%) (16.75%) Hispanic 2010 2015 2020 2025 45% 40% 39,909 42,137 44,389 46,594 Asian 2010 2015 2020 2025 50% Asian 16.06% (3.92%) (7.97%) (12.02%) 46.44% 246,630 256,306 266,275 276,281 Black 2010 2015 2020 2025 Percentage Change 55% White 2010 2015 2020 2025 Population Growth 2010–2025 Hispanic Source -- U.S. Census Data 2000 © Freddie Mac 2011 9 The Echo Boomers Echo Boomers are the largest generation in U.S. History since the Baby Boomers There are approximately 80 million Echo Boomers between the birth dates 1982 to1995 Echo Boomers are also called Millennials and are part of Generation Y Post housing collapse, Echo Boomers hold the highest unemployment rate of any U.S. demographic Source: http://echoboombomb.blogspot.com © Freddie Mac 2011 10 Echo Boomers & Housing Do Echo Boomers want homes? "Why would I ever buy a home? You can say that renting is 'throwing money away,' but you'll never get all the money you paid in maintenance back, so ..." ~ One of the many skeptical Echo Boomers about homeownership A real estate agent's worst nightmare: someone who thinks homeownership is "throwing money away." © Freddie Mac 2011 11 You Are the Critical Link You are the critical link to helping well-qualified homebuyers achieve their homeownership objectives: » Utilize your mortgage finance expertise. » Identify and match available financial resources (government, nonprofit, private sources) with a sustainable mortgage solution. First-time homebuyer dream realized – and more business for you – if you know where to find those affordability gap solutions. Freddie Mac Strategic Markets is here to help. © Freddie Mac 2011 12 Building Business Opportunities Sustaining Homeownership © Freddie Mac 2011 CreditSmart® Teaches Consumers About Credit, Money, and Homeownership Tools: Comprehensive Instructor Guide includes speaker notes, worksheets, glossary, and more. User-friendly workshop presentation on CD helps instructors emphasize key points. Information-packed Consumer Workbook includes worksheets, case studies, and glossary. Abridged curriculum provides review of all topics. Great resource for housing fairs, festivals, counseling, etc. The Online Implementation and Promotion Guide gives instructors around-the-clock access to workshop tools, activities, games, etc. Participants access easily customizable flyers, ads, brochures, and more. © Freddie Mac 2011 FreddieMac.com/creditsmart 14 Consumer Education Series Helps You Reach and Teach Tools: Free set of consumer education brochures. Nine-part series spans a range of topics from “Dispelling the Myths of Homebuying” to “Getting Back on Track After Foreclosure.” Brochures can be used individually or as a set; they can be used independently or as part of an initiative. Brochures are easily downloadable and customizable with logo and your contact information. © Freddie Mac 2011 15 Outreach Tools: Consumer Fact Sheets and Postcard Mailers Consumer Fact Sheets in English and Spanish – Add your logo and contact information to these pre-designed, consumerfriendly flyers and distribute them to your area Realtors so they can inform their first-time homebuyer clients. Postcard mailers – Add your logo and contact information to these customizable postcards to advertise your down payment assistance workshops. FreddieMac.com/purchasemarket/downpayment. html?tab=2 © Freddie Mac 2011 16 Community Stabilization We bring together municipalities, nonprofits, lenders, and other stakeholders in local communities. Through these coalitions, we support comprehensive initiatives that address each area’s housing challenges and promote stable neighborhoods. “Take Root” campaigns for use by local coalitions support new homeownership opportunities and reduce the number of vacant properties. Solutions promote foreclosure avoidance and encourage homeowners to seek assistance so they can stay in their homes and in their neighborhoods, whenever possible. Options to generate workforce-housing initiatives that bring together employers, lenders, and others, and encourage employees to live where they work. © Freddie Mac 2011 17 © Freddie Mac 2011 18 What Does This All Mean for You and Your Borrower? The lending paradigm has shifted. There are opportunities out there to attract and build business from first-time homebuyers. Many well-qualified first-time homebuyers need your assistance to overcome fears. Many first-time homebuyers will need to seek ways to bridge small gaps in down payment and closing costs. © Freddie Mac 2011 19 Resources Housing Industry Professionals : » www.freddiemac.com/purchasemarket » www.echoboombomb.blogspot.com Local Market Reports: » www.realtor.org » www.city-data.com » www.mybestsegments.com Eye on the Economy: » www.nahb.org Other: »www.takerootdenver.org »www.takerootmilwaukee.org © Freddie Mac 2011 20