If you attend concerts–you gotta know this guy….

advertisement

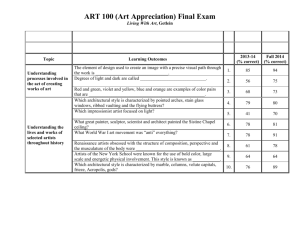

Rock’s New Republic Posted By Ethan Smith | Photographs by Jeff Riedel On December 2, 2008 @ 1:59 pm In The Big Interview, Features | 4 Comments Rapino’s high-wire strategy is to transform Live Nation from ATM to the stars to real business partner. It was well after midnight and Jay-Z was presiding over a private dining room at Katsuya, the Philippe Starck–designed Los Angeles sushi restaurant, following a sold-out show at the nearby Hollywood Palladium. The concert marked the historic 1940 venue’s reopening, after a yearlong, $18 million renovation—it is now operated by concert-promotion giant Live Nation. Seated on the rapper’s right was 19-year-old Hayden Panettiere, star of the television series “Heroes.” JayZ’s bodyguard, a towering 34-year-old veteran of the Dutch Special Forces named Norm, watched over the phalanx of security guards keeping paparazzi at bay on the sidewalk outside. Lakers center Andrew Bynum, who had spent much of the concert dancing shirtless with three young women, had disappeared. When Live Nation Chief Executive Michael Rapino strode into the restaurant, Jay-Z had a waiter squeeze in an extra chair on his left. He then gestured for the server to fill Rapino’s glass with Armand de Brignac “Ace of Spades” rosé—after having told another guest not to even look at the $500 metallic-pink bottle of Champagne. But Rapino, 43, isn’t just any music exec, despite his three-day beard, black T-shirt, jeans and leather motorcycle jacket. He has suddenly become one of the most closely watched figures in the music industry. Thanks to the high-wire deals he has struck with a handful of superstars—Madonna, U2 and Jay-Z among them—he has positioned Live Nation as the most aggressive player in the industrywide scramble among the record labels, advertisers and managers to find profit in the music business now that CD sales have cratered. Rapino’s strategy has been to leverage Live Nation’s strengths (as the biggest concert promoter in the world, it has relationships with top touring acts, who routinely sign up for 18-month tours, and years of experience marketing them globally) to overcome its pathetic profit margins (though it stages more than 15,000 concerts a year, its cut of ticket sales can be as low as 5 percent). “We’ve always been the lowest-margin business in the entire music industry,” he says. “We were the middleman in the middle.” The company was locked into a low-return “river of nickels” strategy, as a Goldman Sachs Group analyst put it. Rapino needed to transform Live Nation from an ATM to the stars—a mere conduit for the giant percentage of box-office take that flows to the acts—into a real business partner. “We’re already spending billions of dollars on the artists’ rights,” he maintains. “Is there a better way to buy the rights? Longer, wider, highermargin rights?” His answer has been to commit hundreds of millions of dollars to all-encompassing “360 deals” with individual musicians. Live Nation opens the checkbook on the front end—$120 million to Madonna, $150 million to Jay-Z—in exchange for 10 years’ worth of a sizable share of revenue from nearly every aspect of the performer’s career, including recorded-music sales, concert tours, merchandise sales, Web site operations, endorsements and even some entrepreneurial business ventures. Just over a year in, it’s too soon to say whether these massive gambles will pay off. But their audacity has all eyes riveted. At Katsuya, Rapino handled his chopsticks deftly, even though his right forearm and hand were enveloped in a splint. Ten days before, he’d undergone surgery after slicing open the knuckle at the base of his right middle finger. It happened while repairing the dishwasher in the Hollywood Hills home he shares with his wife, Jolene Blalock, a model and actress who played a freakishly sexy Vulcan on “Star Trek: Enterprise.” The injury seemed minor and Rapino finished the repair. But Blalock persuaded him to go to the emergency room, and he learned he’d severed a tendon, immobilizing the finger. “Because I grew up with no money, I like fixing s— myself,” Rapino says the day after the concert, sitting on a veranda at his Spanish-style villa. “I used to rebuild car engines in my dad’s driveway, and I never needed a single stitch. Now a stainless-steel dishwasher did this to me.” For Rapino, the road to Hollywood and midnight snacks with rap stars began about as far away as it gets: in Thunder Bay, Ontario, a declining lumber-mill town 16 hours from Toronto with a mean year-round temperature of 37 degrees Fahrenheit and a mean bling quotient of approximately zero. As a teenager, Rapino says, he moved comfortably among three usually distinct social groups. He played hockey with the jocks, took college-prep classes with the brains and partied on the weekend with the beer-drinking, hard rock–loving “bangers.” “I still start from the position of hanging out with my banger buddies,” Rapino says about the late nights in crowded clubs his line of work requires. Holding his own with an artist into the small hours is just as important as being able to make a PowerPoint presentation to investors. Rapino goes to concerts 100 nights a year—75 of them in L.A. and the remainder in the dozens of cities, from New York to London to Dubai, where Live Nation does business. “Things happen at a show that you can’t get done in a suit during the day,” Rapino says. “You can connect with the staff, and you can connect with the artist and their manager. Think about it: You’re hired to promote the show. What better way to show you mean it than to come in person?” He got his first taste of the music business at Thunder Bay’s Lakehead University, where he studied accounting. He landed a $200-a-month gig with the Labatt Brewing Company plugging beer and staging concerts to showcase the Labatt brand. Although most of the acts he booked were no-name local bar bands, the enterprise of staging and promoting shows really got him going. After graduation, he went through the motions of interviewing with accounting firms in Thunder Bay. But the lure of music, beer and Toronto was powerful, and he opted for a full-time job with Labatt. Backstage at the Hollywood Palladium: Rapino (right) has signed the artist Jay-Z (left) to a rich, long-term rights deal worth $150 million over 10 years that gives Live Nation a cut of his recording rights, tour profits and merchandising. The brewer in the ’80s and ’90s played a role in the Canadian entertainment and sports industries that an American might find unusual. It owned part or all of the Toronto Blue Jays, the SkyDome and Concert Productions International, led by the storied Michael Cohl. More than any other single figure, Cohl is credited with launching the modern, big-money global concert tour, integrating corporate sponsors, huge guarantees to performers and commensurately scaled ticket prices. The first band he did all this for was the Rolling Stones, on their 1989 Steel Wheels Tour, for which he bought up all the rights he could—concerts, merchandising, TV and radio broadcasts—and parceled them out to contractors throughout the world. Between ticket sales, merchandising, sale of rights and sponsorships, the band netted at least $90 million from the 61 dates on the tour’s North American leg alone. As a 23-year-old junior marketing executive watching Cohl in action when Steel Wheels came to Toronto, Rapino remembers thinking: “I don’t want to be Keith Richards. I want to be Michael Cohl.” Rapino rose through the ranks at Labatt, gaining increasing responsibilities for marketing and music promotion. Eventually, he realized it was far more difficult to convince consumers that there was a meaningful difference between, say, Labatt Bleue Dry and Labatt Extra Dry than to interest them in seeing Guns N’ Roses or Robert Plant. “We had 52 brands of beer that in a blind taste test you couldn’t tell apart,” Rapino recalls. In 1998, Rapino left Labatt and, with some partners, founded a company, Core Audience Entertainment, that quickly became Canada’s second-largest promoter. The timing was good. New York entrepreneur Robert F.X. Sillerman’s SFX Entertainment was buying up dozens of regional operators, and acquired Core Audience for an undisclosed sum. Rapino jumped at a low-level marketing job in the big leagues, at SFX headquarters in New York City. That summer, San Antonio–based Clear Channel Communications bought SFX Entertainment for $3 billion, and before long Rapino had talked his way into a gig overseeing concertsponsorship efforts in Europe. He was back in his comfort zone, cajoling outfits like Carling Breweries to underwrite festivals and tours, and soon he worked his way up to president of world-wide music operations. But a year later, with the concert division still the least-profitable piece in the Clear Channel empire, top brass decided to spin it off in an initial public offering that raised about $871 million—Clear Channel ended up declaring a loss of $2.4 billion. “When it became clear that there was a rift, Rapino morphed from CEO into hockey-rink brawler.” This turned into another golden opportunity for Rapino. Clear Channel Entertainment’s CEO left in the run-up to the offering, and Rapino was tapped to head what would, post-IPO, be known as Live Nation. Rapino recalls telling Clear Channel President and Chief Financial Officer Randall Mays, “Hey, I’ve been preparing for this job for 20 years.” Rapino saw his primary task as bulking up Live Nation’s anemic margins; for 2005, the company reported a net loss of $130 million on $2.9 billion revenue. Live Nation bought the House of Blues club chain, expanded internationally and sold off theater-production and auto-racing divisions. It snapped up several businesses related to concert promotion—T-shirt manufacturers and operators of online fan clubs and stores. By 2007, it had narrowed the loss to $12 million, on $4.2 billion revenue. But to push things to the next level he needed something bigger. “If you want to simplify it, we stole it from the TV upfronts,” Rapino says, citing the inspiration for the 360 deals—the networks’ early presentations of coming seasons to advertisers. “It was the only way we could think of that would let us sit sponsors in a room and say, this is what we’re going to do for the next couple years.” Longer contracts with artists would let Live Nation negotiate further in advance with the sponsors that underwrite tours. The idea to get involved with recording rights came later. “But with so many other parts of the artists’ business in play,” Rapino says, “it quickly became a natural extension.” He says he could get artists to the table because performers were already becoming dependent on concert promoters, rather than record labels, for their biggest paychecks. “People used to tour to promote albums,” Madonna’s manager, Guy Oseary, says. “Now they put out albums to promote tours.” Rapino realized the new model, where the promoter becomes the artist’s primary corporate partner, could be a massive game-changer. Rather than functioning as a consumer of artistic talent, Live Nation is aiming to align itself with the talent, at the high end of the business, where he believes it will always be a seller’s market. After all, he reasons, there are more big venues around the world (a disproportionate number of which are owned or operated by Live Nation) than there are blockbuster acts to fill them. “There are more buildings than there are artists,” Rapino says. “That’s why I want to be in the artist business.” The Client List With Rapino’s game-changing 360 deals, Live Nation writes a big check up front in exchange for a sizable share of future revenue from new music, tickets and merchandise WireImage Madonna signed over broad rights in return for $120 million over 10 years. Getty Images U2 signed a 12-year pact covering concert tours but not recordings. WireImage Shakira’s agreement gives the singer $70 million for 10 years of rights. Today, Oseary says, “There’s no us and them.” Since completing the Madonna deal, Oseary has moved his office to Live Nation’s Beverly Hills headquarters—not simply to the same building or floor, but actually within the promoter’s offices. The breakdown of the Madonna–Live Nation deal shows how broad the scope will be. The company is paying Madonna $17.5 million for the right to distribute each of three future albums and $50 million to promote concert tours for 10 years. If Live Nation doesn’t make back its money from those endeavors, it also has a shot with the rest of the Madonna machine. It is entitled to 30 percent of Madonna’s T-shirt and poster sales and 50 percent of any revenues from licensing and endorsements, such as perfume, jeans, sports drinks or anything else a superstar can slap her name on. Not everyone is wowed. Predictably, executives at the record labels whose acts Rapino has poached downplay the deals’ significance, arguing they represent little more than expensive window-dressing. Live Nation, they say, is overpaying for artists who are past their commercial primes. Warner Music Group owns in perpetuity the rights to 25 years of Madonna’s past recordings, while Universal Music Group retains Jay-Z’s old music for several more years— letting the record companies reap the benefits, in sales of past hits, every time Live Nation fires up an expensive new promotion. Marc Geiger, head of contemporary music at the William Morris Agency, says it’s too soon to know whether Live Nation will be able to make good on its agenda, although he says Rapino is positioned to make a convincing effort. Providing big artists and consumers with all the services Live Nation is gearing up for is “a tall order,” Geiger says. “There’s a lot of potential there and Rapino is a very smart guy. But it’s early in the game to call.” Rapino believes the skeptics are too focused on the eye-popping sums Live Nation is paying artists and not enough on the deals’ long-term implications. “Remember, we were never in any business but a 90–10,” Rapino says of the unfavorable split on ticket sales. Making deals with splits of 50–50 and 75–25, “that’s a huge upside for us.” He also found himself talking to seemingly every musician on earth. To keep control of the 360 relationships, Rapino brought in his old Toronto mentor, Michael Cohl. In September 2007, Live Nation completed the purchase of Cohl’s Concert Productions International for $154 million in cash and stock, making Cohl the largest individual shareholder of Live Nation and its chairman, to boot. Cohl oversaw a unit called Live Nation Artists out of Miami Beach, negotiating additional 360 deals with Shakira and Nickelback. When he started pushing a more aggressive growth strategy, the two men clashed over how many more of the costly deals to strike. Rapino wanted to proceed cautiously and sign four to six a year; Cohl wanted authority to sign dozens of artists quickly out of his Miami offices. Such a high-risk strategy—none of the musicians signed to Live Nation Artists had delivered so much as a single album—could sink the company, Rapino said. When it became clear that there was a rift, Rapino morphed from CEO into hockeyrink brawler. After Cohl called an emergency board meeting and was soundly defeated, Rapino stripped his old mentor of power and left him with the title “consultant” to Live Nation. (Reached for comment, Cohl doesn’t dispute this account.) The altercation, Rapino says, sent investors and artists alike a loud, clear message about the prospect of endless 360 expansion: “The tap got turned off.” With the superstar cash stampede quelled, Rapino turned to another, potentially more explosive front: a challenge to Ticketmaster. The massive ticket agent handles nearly all of Live Nation’s events and enjoys a 23 percent cash-flow margin because of the layers of service fees charged directly to audiences. It has long been unpopular with fans and has been accused of being a monopoly. Starting in January, Live Nation plans to start selling tickets directly at the roughly 50 percent of its shows in venues it controls (many others will continue to go through Ticketmaster). Live Nation says it is spending about $20 million to create a new ticketing system and hasn’t offered any details on how it will work—including whether it will break out fees or roll them into the ticket price. The night of the Hollywood Palladium show, Rapino was among those huddled with Gee Roberson, the manager of hip-hop stars Lil Wayne and Kanye West. Although both artists are under contract to major record labels, Live Nation is in talks with West about a version of a 360 deal that could cover everything but recorded music—similar to the arrangement it has with U2. Rapino says the company is still talking to “select” artists it thinks could justify giant new deals. “Kanye? Absolutely,” Rapino says. He describes a recent visit West made to Live Nation’s Beverly Hills offices, where executives presented proposals for businesses they could enter together. “He said, ‘I thought I was just coming in here to get a big check. But you guys can actually help me grow my business!’ ” Rapino parted ways with Roberson, saying, “We’ll send you an offer.” Article printed from WSJ Magazine: http://magazine.wsj.com URL to article: http://magazine.wsj.com/features/the-big-interview/rock%e2%80%99snew-republic/