Private Investment Allowed in the Upstream Sector HOW?

advertisement

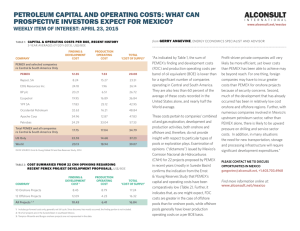

Mexico Energy Reform: Opportunities and Challenges Miranda Ferrell Wainberg, Senior Advisor Mexico’s Transformative Energy Reform 2013-2014 • • • • • Three articles (25, 27 and 28) of the Mexican Constitution were amended 16 new laws created 12 existing laws modified 8 enabling laws published Guidelines, procedures and standards are being prepared • Private investment allowed in oil and gas exploration and production for the first time in 75 years • Gas imports by pipeline from US accelerated • Pemex to transfer gas pipeline assets to system operator CENAGAS • Generators can sell into wholesale power market and/or directly to customers • T & D system to be operated by ISO CENACE • 35% of power generation from clean sources by 2024 • Clean Energy Certificates to ensure investment beginning 2018 Energy Sector Framework Source: Analitica Energetica S.C. December 2014 Upstream Sector (Oil and Gas Exploration and Production) Private Investment Allowed in the Upstream Sector WHY? 3P & Prospective Reserves (Billion BOE) Substantial Resource Potential Sources: JP Morgan 2/9/15; U.S. EIA Falling Oil and Gas Production Private Investment Allowed in the Upstream Sector WHY? Pemex Duty and Taxes Pemex Net Income Underinvestment by Pemex due to high fiscal burden – 53% of total revenue in 2013 Source: JP Morgan 2/9/15 Private Investment Allowed in the Upstream Sector WHY? Pemex Proved Reserves Replacement Rate Pemex inability to replace production Source: JP Morgan 2/9/15 Private Investment Allowed in the Upstream Sector HOW? Round Zero – August 2013 • CNH granted Pemex 83% of Mexico’s proved & probable reserves and 21% of prospective resources • Majority of the resources are in southeastern shallow waters • 42% of deep water prospective resources were granted to Pemex • The CNH will conduct bidding rounds for investments in the remaining 17% of 2P resources and 79% of prospective resources Round Zero balances the resources Pemex will operate and those resources which the State will manage and grant by subsequent bidding rounds. Source: CNH Private Investment Allowed in the Upstream Sector HOW? • 109 fields or 14.6 billion BOE in prospective resources including 22% in deep water; 61% in Chicontepec; 5% in onshore, shallow water, and heavy oil fields; 1% in unconventional gas • 60 fields or 3.8 billion BOE in 2P reserves including 71% in Chicontepec and other nearby unconventional fields • Bids open to Pemex as well as domestic and foreign private companies and other NOCs • SENER expects Round 1 to attract $50.5 billion in investment by 2018 or about $12.6 billion per year Source: CNH Private Investment Allowed in the Upstream Sector Round 1 Bidding Processes Source: CNH Private Investment Allowed in the Upstream Sector HOW? Initial Tender: 23 fields (19 contracts) of 169 Round 1 fields • 14 shallow water exploration contracts (PSCs) with prospective resources of about 11 billion BOE • Province accounts for 80% of Mexico cumulative production • Bids due and winners announced July 15, 2013 • 5 shallow water development contracts (PSCs) • Low production costs • Bids due and winners announced September 30, 2015 Source: CNH Private Investment Allowed in the Upstream Sector HOW? In addition to Round 1, Pemex initially plans to farm out six shallow water fields with estimated potential of 1,097 million boe and requires $12.5 billion of investment. Additional farm outs are expected in 2015. Source: CNH Potential Investment Capital from Private Investors Private investment in the upstream sector from 2015 to 2020 could be $56 billion or 45% of total oil and gas sector private investment Source: Marcos y Associados 2/15 Mexican Upstream Sector Reform Opportunities • • • • Substantial investment opportunities for companies in all phases of hydrocarbon exploration and production Tax revenues from non-Pemex investors should reduce the Pemex fiscal burden while contributing to a public budget that relies on oil and gas production for 33% of its revenues Increased production from Mexico will enhance North American oil and gas security Post-reform Mexico’s GDP expected to grow at 3.7-3.9% annually compared to 3.3% pre-reform Challenges • • • • • • • Low oil prices Very aggressive timing Security The fledgling CNH has new and expanded responsibilities with tight deadlines – is it up to the task? Safety and environmental regulation and enforcement is the responsibility of a brand new and inexperienced agency Industry has many concerns about the PSCs in Tender 1 Minimum national content of 25% required in 2015 increasing to 35% by 2025 in a country without a developed oil services industry Natural Gas Midstream Sector (Pipelines, Processing & Storage) Gas Imports By Pipeline From US Accelerated WHY? Gas Production Vs. Gas Consumption Source: BCG 4/2014 Impact of Gas Shortages on Quarterly GDP Source: JP Morgan 2/9/15 • Natural gas consumption, especially in the power sector, continues to grow while production declines • Shortfalls have been met by gas pipeline imports from the US and LNG Gas Imports By Pipeline From US Accelerated WHY? Natural Gas Share in Electric Generation Electric Generation by Fuel, 2027 • Natural gas demand from electric generators will continue to grow as more expensive fuel oil is displaced • Initial domestic production focus post-reform is oil and US natural gas is currently abundant and inexpensive • Natural gas is considered a “clean fuel” by Mexico and is important in meeting the country’s emissions targets Source: JP Morgan 2/9/15 Gas Imports By Pipeline From US Accelerated HOW? Total gas midstream investment for cross-border and domestic infrastructure could reach $34 billion by 2020 Source: RBN Energy Gas Imports By Pipeline From US Accelerated (Import Now, Domestic Production Later) • Agua Dulce-Frontera and Los Ramones Phase 1 began operation in Dec. 2014 with 2.3 Bcf/d capacity expandable to 3 Bcf/d • A $935 million contract was awarded by Pemex to Brazil’s Odebrecht and others for construction of Los Ramones Phase 2 to be complete in 2Q 2016 with capacity of 1.4 Bcf/d • Construction contracts for three connecting pipeline projects moving up to 1.4 Bcf/d of Permian Basin gas from West Texas to CFE power plants were awarded in early 2015 • The Sonora Pipeline which will carry 510-700 MMcf/d to several CFE power plants is under development by Ienova (Sempra) Source: RBN Energy • These projects alone will add 3.9 Bcf/d of gas export capacity (gas exports in 2013 were 1.8 Bcf/d) Domestic Natural Gas Infrastructure Requires Expansion Natural Gas Infrastructure 2013 Natural Gas Infrastructure 2028 • • • • • Current domestic infrastructure has limited capacity and coverage. The center, west and Baja California lack capacity. Much capacity is old – 20 years plus – many bottlenecks. From 1995-2013 natural gas demand more than doubled but the gas pipeline system grew by only 19%. Since Nov. 2012 Pemex has issued 35 critical alerts which pause imports and limit national gas supply. Estimated losses due to pipeline limitations were $1.4 billion in 2012. Substantial investment in domestic gas infrastructure is required. Expansion of Domestic Gas System • The gas midstream sector has been open to private investment since 1995 • Significant new non-Pemex open-access transportation has not been significant due to Pemex domination of the gas pipeline system and its limited capacity • Under the reform Pemex and CFE must transfer their gas pipeline assets to a new independent regulator, CENAGAS. CRE ordered the Pemex asset transfer in February 2015. • CENAGAS will operate the existing gas pipeline system and will ensure safety and equal access for transportation as well as permit new infrastructure and establish transport rates. New projects will be tendered through open seasons. • These measures should help stimulate new private investment approaching $21 billion in natural gas infrastructure Natural Gas Midstream Sector Opportunities • • • Substantial investment opportunities for private companies in cross-border and within Mexico midstream infrastructure The removal of Pemex from the gas transmission and distribution will allow new marketing companies to emerge bundling pipeline capacity and the gas commodity CENAGAS to ensure open access to pipelines creating a more level playing field for investors Challenges • Pemex initial capacity reservation contracts could result in continued Pemex dominance of the mid-stream, at least in the short term • CENAGAS is a new and inexperienced regulator • Uncertain timing of the build out of the domestic Mexican infrastructure which is critical for a robust market Electric Power Sector Why Reform the Electric Sector? Electric Rates Mexico vs. US (cents per Kwh) CFE Historical Net Income (pesos billion) Sources: SENER, JP Morgan 2/9/15 • Electric rates are high and uncompetitive, especially for industrial customers • Negative impact on Mexican manufacturing sector and country GDP • Underinvestment by CFE due to budgetary constraints and the company’s financial losses. Heavy subsidies for residential and agricultural customers and huge distribution losses (20.8% - almost triple the OECD average) contribute to the losses. • Capacity growth has significantly lagged demand growth. Transmission and distribution networks are old (30% are past their useful life spans) and inefficient creating major bottlenecks in the system. The Post-Reform Mexican Electric Sector • CFE has two years to separate its generation function from its transmission and distribution function • Generation is open to private investors who can sell to a new wholesale power market or directly to qualified end users whose consumption is greater than 3MW* • CFE T & D grid will be operated by CENACE, a new ISO, which will dispatch generation based on lowest cost, guarantee open access to the T & D grid and run the wholesale market • Private investors will be able to contract with CFE to build, finance and operate T & D networks • Should stimulate significant private investment in both generation and transmission and distribution • With the participation of more efficient private investors electricity rates should fall *Since 1992 private participation has been allowed but all surplus power had to be sold to CFE, limiting the attractiveness of the IPP model. Mexican Electric Power Sector Opportunities Challenges • • • • • Substantial investment opportunities for private companies: $50 billion from 2016-2020 per SENER Growth of the wholesale electricity market should generate opportunities for marketing and trading firms Competition in all sectors of the power value chain should lead to lower electric rates Mexico will become more attractive to industries with adequate electricity supply and lower rates • • • • • CENACE is a new, inexperienced agency Initial CFE capacity reservations could dominate T & D system SENER must craft a “never done before in Mexico” legal regime which will ensure open access to the T & D networks Residential and agricultural subsidies – do they continue? Timing of electricity rate reductionsinfrastructure construction is multiyear Security/theft Renewable Energy Sector Pre-Reform Renewables Sector • Robust legal framework in place to promote renewables: 2008 Law for the Application of Renewable Energy and Financing the Energy Transition; 2012 General Climate Change Law and 2013 National Climate Change Strategy • In 2013 renewables accounted for 24% of installed generation capacity and 14% of gross generation • Mexico has aggressive targets in terms of reducing power generation from fossil fuels and lowering greenhouse gas emissions: • In 2013 fossil fuels accounted for 82% of gross generation. The target is 65% by 2024 with 35% of generation coming from “clean sources.” • Emissions reductions targets: 30% by 2020 and 50% by 2050 Post-Reform Renewables Sector The “Clean Energy” vs. Renewables Controversy • Reform Objective: Promote the use and development of “clean energy” • Under the 2014 Law of the Electricity Industry “clean energy” includes renewables (hydroelectric, wind, solar, geothermal, biomass) as well as efficient cogeneration, nuclear power and other low carbon emission technologies which could include highly efficient fossil fuel-based generation • The renewables industry is concerned that renewables will not be able to compete with less expensive natural gas, especially current “cheap gas” from the US • Others argue that natural gas is complementary to wind and solar by providing a back-up to these intermittent resources H2 2014 Costs for Mexico Selected Technologies Unsubsidized ($/MWH) Source: Bloomberg New Energy Finance 2/2015 Post-Reform Renewables Sector Clean Energy Certificates (CECs) • The objective of the CEC program is to incentivize the private sector to invest in clean energy by providing an additional revenue stream for investors, thereby improving the investment’s attractiveness and competitiveness • Beginning in 2018, Clean Generators will receive CECs for each MWH generated without fossil fuels; when fossil fuels are used, the CEC is multiplied by the non-fossil generation percentage of the facility’s total generation • The following entities will be required to purchase CECs: suppliers and distributors that sell electricity to end users; qualified users that consume at least 3 MW in year one of the program, 2 MW in year two and 1 MW in year one and end users who generate or import electricity for their own use without using the national T & D grid • The initial requirement for power users to purchase CECs is 5% of electricity consumed which corresponds to Mexico’s target for clean generation by 2018. The requirement will be reset annually by SENER based on its estimates of the costs of achieving Mexico’s policy objectives regarding clean energy • SENER’s estimating procedures put a priority on low costs over low emissions given the goal of reducing electricity prices Forecast Growth of the Renewables Sector • SENER forecasted that about $41 billion of investment in renewable generation is required between 2013 and 2027 • This investment results in renewables (hydroelectric, geothermal, wind, solar and unidentified new clean technologies) accounting for about 30% of installed capacity and 20% of gross generation in 2027 • Wind and hydroelectric power represent 79% of the renewables installed capacity Source: SENER • For Mexico to meet its 2024 goal of 35% of generation from clean sources, additional investment in renewables is required and/or nuclear and gas-fired generation will make up the difference Renewable Energy Sector Opportunities Challenges • Mexico’s emissions reduction targets and clean energy generation targets create a significant space for renewable energy investments • Mexico’s geothermal potential is large (2310 GWe) and CFE has not had the capital to develop. Sector could grow by 40% by 2020. • CECs will enhance the economic attractiveness of renewables investments • Inexpensive natural gas imports from the U.S. could be a serious competitor for renewables, at least initially • CECs do not come into effect until 2018 • The preference for low costs over low emissions could hurt renewables in the short term Mexico Energy Reform • Bold and Transformative Vision of the Mexican Energy Sector • The Execution Risks Should Not Be Underestimated • Multi-year Process to Achieve Reform ObjectivesManage Expectations