Esame di Microeconomia avanzata (16 aprile 2004)

advertisement

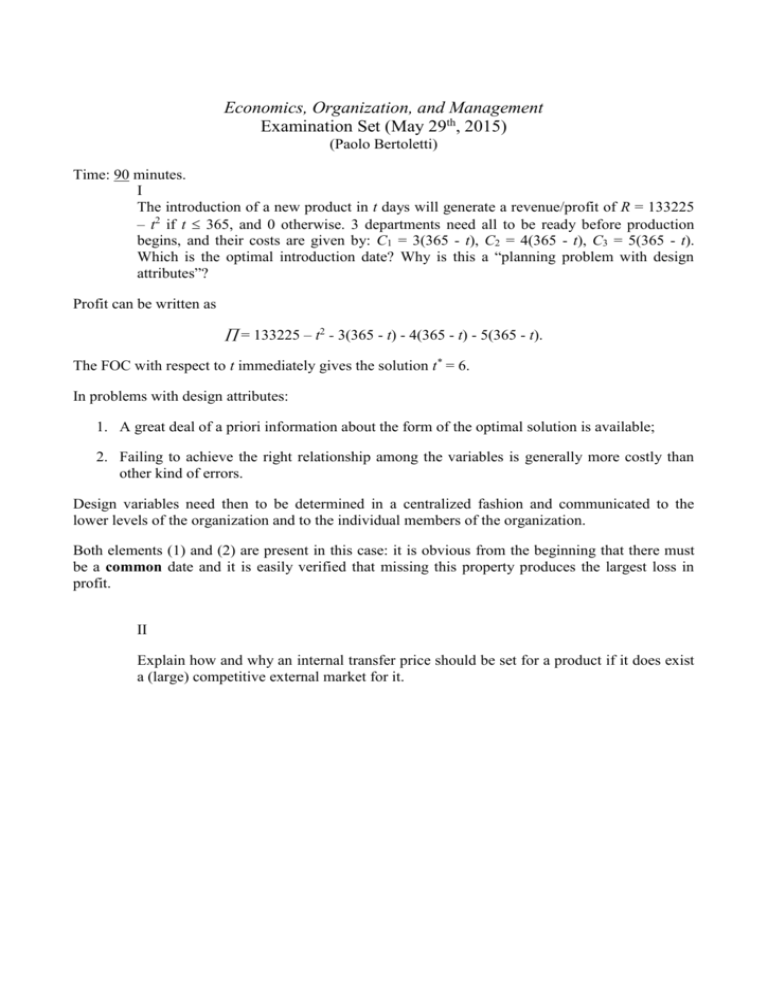

Economics, Organization, and Management Examination Set (May 29th, 2015) (Paolo Bertoletti) Time: 90 minutes. I The introduction of a new product in t days will generate a revenue/profit of R = 133225 – t2 if t 365, and 0 otherwise. 3 departments need all to be ready before production begins, and their costs are given by: C1 = 3(365 - t), C2 = 4(365 - t), C3 = 5(365 - t). Which is the optimal introduction date? Why is this a “planning problem with design attributes”? Profit can be written as = 133225 – t2 - 3(365 - t) - 4(365 - t) - 5(365 - t). The FOC with respect to t immediately gives the solution t* = 6. In problems with design attributes: 1. A great deal of a priori information about the form of the optimal solution is available; 2. Failing to achieve the right relationship among the variables is generally more costly than other kind of errors. Design variables need then to be determined in a centralized fashion and communicated to the lower levels of the organization and to the individual members of the organization. Both elements (1) and (2) are present in this case: it is obvious from the beginning that there must be a common date and it is easily verified that missing this property produces the largest loss in profit. II Explain how and why an internal transfer price should be set for a product if it does exist a (large) competitive external market for it. Suppose that the curves MR and MC represent respectively the marginal revenue of the buying division and the marginal cost of the selling division on. Clearly, under the hypothesis that the decision on the quantity is decentralized to the division managers, if no transaction is allowed with the external market, the internal price generating the largest corporate profit is P3 (the profit allocated to the buying division would be equal to the area P3ED and the profit of the selling division would be P3DA), and it is given by the area ADE. Consider in fact any other price, say P1: in such a case only the quantity x1 would be exchanged, leading to a smaller corporate profit (represented by the area between MR and MC up to x1). If on the contrary the transfer price is fixed at the external market price, say P2, and external transaction are allowed, then the buying division will buy the quantity y2, obtaining a profit equal to the area P2FE, while the selling division will sell x2 (for example, by selling y2 to the buying division and (x2 - y2) to the external market) obtaining a profit equal to the area AGP2 and creating a corporate profit equal to the area AGFE. III Which are the economic consequences of an imperfect ability to commit? Essentially, the inability to fully commit makes the potential contract unable to guide properly the behavior of the counterparts. The concrete possibility of opportunistic behaviour, including reneging, emerges if there is for instance private information before the signing of a contract or if there is insufficient information after the signing of the contract to tell whether the terms of agreement have been honoured, or acquiring that information may be costly. This gives raise to a number of so-called adverse selection and moral hazard problems that severely limit the contracts that can be enforced producing inefficiency (with respect to the case of full commitment ability).