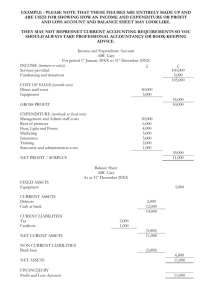

Movement in Reserves Statement

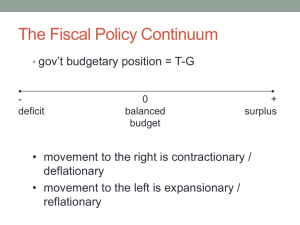

advertisement