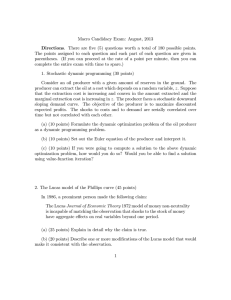

FE431: PUBLIC FINANCE

advertisement

FE431: PUBLIC FINANCE Fall 2014 Professor Schmitt Homework 4 – due October 22nd 1. (50 points) The supply and demand for books are given by the following equations: Demand: Q 2000 100 P Supply: Q 400 100 P a) Find the equilibrium price and quantity in this market. b) If a $3 per unit tax is imposed in this market, then what will the consumer’s price be? (Recall: While you can add the tax to supply or demand, you will have to find the inverse demand.) What will the producer’s price be? How many books will be sold in this market with the $3 tax in place? c) What are the price the producer receives and the price the consumer pays? Under this per unit tax who pays a larger share of the tax – the producer or the consumer? Why? d) What is the efficiency-loss ratio of this tax? e) Graph. Be sure to show the excess burden, total tax revenue, quantity with the tax, producer price and consumer price. 2. (50 points) What if instead an ad valorem (sales) tax was used, in which the tax percentage was 25% of the price. What will the consumer price be? What will the producer price be? How many books will be sold in this market? a) How much tax revenue is generated? Who pays a larger share of the tax? b) What is the efficiency-loss ratio of this tax? c) Graph. Be sure to show the excess burden, total tax revenue, quantity with the tax, producer price and consumer price. d) Which tax would you recommend? Why?