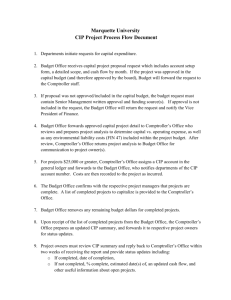

Reporting Policies and Procedures Manual

advertisement