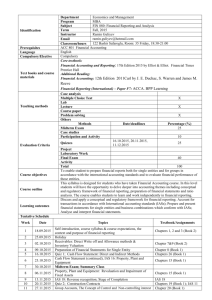

ch.6

advertisement

CHAPTER 6 THE INCOME STATEMENT The Economic Consequences of Financial Reporting • Financial reporting has economic consequences including: 1 Financial information can affect the distribution of wealth among investors. More informed investors, or investors employing security analysts, may be able to increase their wealth at the expense of less informed investors. 2 Financial information can affect the level of risk accepted by a firm. As discussed earlier, focusing on short-term, less risky, projects may have long-term detrimental effects. 3 Financial information can affect the rate of capital formation in the economy and result in a reallocation of wealth between consumption and investment within the economy. 4 Financial information can affect how investment is allocated among firms. • These economic consequences may have a differential impact on different user groups and future deliberations of standards must consider these economic consequences Elements of the Income Statement • the primary focus of financial reporting is to provide information about a company’s performance • The income statement reports on performance and the elements of the income statement were defined IAS 1 as: – – – – Revenues Gains Expenses Losses IAS1 International Acc. - IASs 4 IAS 1 Presentation of Financial Statements • This Standard drescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of other entities. • It sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. International Acc. - IASs 5 IAS 1 • A complete set of financial statements comprises: – – – – – (a) a statement of financial position as at the end of the period; (b) a statement of comprehensive income for the period; (c) a statement of changes in equity for the period; (d) a statement of cash flows for the period; (e) notes, comprising a summary of significant accounting policies and other explanatory information; and – (f) a statement of financial position as at the beginning of the earliest comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it reclassifies items in its financial statements. International Acc. - IASs 6 IAS 1 • IAS 1 requires an entity to present, in a statement of changes in equity, all owner changes in equity. • All non-owner changes in equity (i.e. comprehensive income) are required to be presented in one statement of comprehensive income or in two statements (a separate income statement and a statement of comprehensive income). • Components of comprehensive income are not permitted to be presented in the statement of changes in equity. International Acc. - IASs 7 SFAS No 130 - Reporting Comprehensive Income • Original issues: 1 Whether comprehensive income should be reported? 2 Whether cumulative accounting adjustments should be included in comprehensive income? 3 How the components of comprehensive income should be classified for disclosure 4 How comprehensive income should be disclosed in the financial statements 5 Whether the components of other comprehensive income should be disclosed before or after their related tax effects International Accounting Standards • International Accounting Standards Committee has: 1 Defined the concepts of performance and income in “Framework for the Preparation and Presentation of Financial Statements” 2 Discussed the content and format of the income statement in IAS No. 1, “ Presentation of Financial Statements” 3 Defined the concept of revenue in IAS No. 18, “Revenue.” 4 Described the preferred format for interim financial statements in IAS No. 34 - “Interim Financial Reporting” 5 Described the preferred format for reporting discontinued operations in IAS No 35 “Discontinued Operations” IASC Definitions of Performance and Income •Profit is used to measure performance or as the basis for other measures •Measurement of income is dependent on the concept of capital maintenance used by the enterprise – Physical capital maintenance – Financial capital maintenance IASC Definitions of Performance and Income • The IASC definition of income encompasses both revenue and expenses • The IASC has not made the distinction between ordinary and nonordinary operations contained in SFAC No. 6 • A proposed standard would require a “Statement of Non-owner Movements in Equity” • Encourages an analysis of income and expenses based on their nature or function in the enterprise IAS No. 1 Presentation of Financial Statements • Requires an operating/non operating separation and disclosure of the following components of income: Revenue Results of operating activities Finance costs Income from associates and joint ventures Taxes Profit or loss from ordinary activities Extraordinary items Minority interest Net profit or loss • FASB Staff Reaction IAS No. 8 - Net Profit or Loss for a Period, Fundamental Errors and Changes in Accounting Policies • Defined the concept of net profit and loss for: normal operations, extraordinary items and accounting changes in a manner similar to U. S. GAAP • Discontinued operations and errors defined somewhat differently: – Errors allowed alternate treatment – Discontinued operations are ordinary unless they qualify as extraordinary • FASB Staff Reaction IAS No. 18 - Revenue • Revenue should be recognized when: 1 The enterprise has transferred to the buyer the significant risks and rewards of ownership of goods 2 The enterprise doesn’t retain managerial involvement or control over the goods sold 3 The amount can be measured reliably 4 It is probable that economic benefits associated with the transaction will flow to the enterprise 5 The costs associated with the transaction can be measured reliably • U. S. GAAP does not specifically address the issue of revenue • If it did, there would probably be a difference because of the IASC use of the term probable future economic benefit • FASB Staff Reaction IAS No 34 Interim Financial Reporting • Does not specify which enterprises should present interim financial reports - left to be decided by laws or regulations • The minimum content of an interim financial report is a condensed balance sheet, condensed income statement, condensed cash flow statement, condensed statement of changes in equity and explanatory notes. • Also requires disclosure of unusual events • FASB Staff Reaction