GMB 1Q'12 ANCMT-05.06.12 for Legal Dept (final)

advertisement

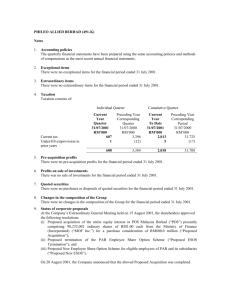

Gas Malaysia Berhad (240409-T) Page 6 of 19 Notes to the interim financial statements 1. Basis of preparation The consolidated condensed interim financial information for the first quarter accordance Appendix ended with 9B Malaysia. MFRS (Part The information 31 March 134 A) of 2012 “Interim the be been financial Listing consolidated should has in reporting” Requirements condensed read prepared interim conjunction of in and Bursa financial with the annual financial statements for the financial year ended 31 December 2011, which have been prepared in accordance with the Financial Reporting Standards and the Companies Act, 1965. Since the previous annual audited financial statements as at 31 December 2011 were Malaysian Financial issued the by issued, Reporting Malaysian the Group Standards Accounting has adopted ("MFRS") Standards Board the framework (“MASB”). This MFRS framework which became effective for period beginning on or after 1 January 2012 was introduced by the MASB in order to fully converge with Malaysia's existing Financial Reporting Standards ("FRS") Reporting framework Standards with ("IFRS") the International framework issued Financial by the International Accounting Standards Board. Whilst all FRSs issued under the previous FRS framework were equivalent to the MFRSs issued under the MFRS framework, there are some differences in relation to the transitional provisions contained in certain of the FRSs. and effective dates Gas Malaysia Berhad (240409-T) Page 7 of 19 These consolidated condensed interim financial statements are the Group's first MFRS condensed consolidated interim financial information for part of the period covered by the Group's first MFRS 31 annual December Malaysian financial 2012 and Financial statements hence MFRS Reporting for 1: the year First-Time Standards ending Adoption (MFRS1) has of been applied. The transition from FRS to MFRS has not had a material impact on the financial performance and financial position of the Group. 2. Changes in Accounting Policies The significant accounting policies, method of computation and basis of consolidation applied in the consolidated condensed interim financial information are consistent with those adopted in the audited financial statements for the financial year ended 31 December Financial Committee 2011 except Reporting for Standards Interpretations the adoption (“MFRS”) (“IC Int.”) of the framework effective Malaysian and Issues for the financial period beginning on 1 January 2012: Malaysian Financial Reporting Standards (“MFRS”) On 19 November 2011, MASB issued a new MASB approved accounting standard framework, the Malaysian Financial Reporting Standards Framework (“MFRS Framework”) which comprises Standards as issued by the International Accounting Standards Board (“IASB”) that are effective on 1 January 2012. It also comprises new/revised Standards recently issued by the IASB that will be effective after 1 January 2012 such as Standards on financial instruments, consolidation, joint arrangements and fair value measurement. Gas Malaysia Berhad (240409-T) Page 8 of 19 The MFRS Framework is to be applied by all Entities Other Than Private Entities for annual periods beginning on or after 1 January 2012, with the exception of entities that are within the scope of MFRS Agreements parent, for 141 Agriculture Construction significant Entities”). investor Transitioning and/or of Real and Entities IC Interpretation Estate, venturer will be including 15 its (“Transitioning allowed to defer adoption of the new MFRS Framework for an additional one year. Consequently, adoption of the MFRS Framework by Transitioning Entities will be mandatory for annual periods beginning on or after 1 January 2013. The transition from FRS to MFRS has not had a material impact on the financial performance and financial position of the Group 3. Audit qualification The report of the auditors on the Group’s financial statements for the year ended 31 December 2011 was not subject to any qualification. 4. Seasonal or cyclical factors The Group’s operations are not significantly affected by seasonal or cyclical factors. 5. Unusual or significant event/transactions There was no individual unusual or significant transaction that has taken place that materially affected the financial performance or financial position since the end of the previous annual reporting period. Gas Malaysia Berhad (240409-T) 6. Page 9 of 19 Changes in estimates There was no material change in financial estimates that could materially affect the current interim period’s financial results for the 3 months ended 31 March 2012. 7. Debt and equity securities There was no material issuance, cancellation, repurchase, resale and repayment of debt and equity securities during the first quarter ended 31 March 2012. 8. Dividend paid There were no dividends paid during the first quarter ended 31 March 2012. The Company paid a single tier final dividend in respect of financial year ended 31 December 2011 amounting to RM99,670,000 on 30 April 2012. Gas Malaysia Berhad (240409-T) 9. Page 10 of 19 Segment Reporting The Group’s segmental report for the first quarter ended 31 March 2012 is as follows: Natural Gas & LPG Others Total RM’000 RM’000 RM’000 - 506,581 31 March 2012 Revenue: Total segment revenue external 506,581 Results: Profit/(loss) before taxation 46,102 (32) 46,070 Finance income (2,276) - (2,276) Depreciation and amortisation 11,459 32 11,491 55,285 - 55,285 Earnings before finance income, taxation, depreciation and amortisation (segment results) Gas Malaysia Berhad (240409-T) The Group’s segmental report for ended 31 March 2011 is as follows: Page 11 of 19 the corresponding Natural Gas & LPG RM’000 first Others RM’000 quarter Total RM’000 31 March 2011 Revenue: Total segment revenue 464,064 external - 464,064 Results: Profit/(loss) before taxation 99,209 Finance income (3,001) Depreciation and amortisation (33) 99,176 - (3,001) 10,719 33 10,752 106,927 - 106,927 Earnings before finance income, taxation, depreciation and amortisation (segment results) The Group’s operations are mainly conducted within Malaysia. 10. Events subsequent to the end of reporting period There was no material event which occurred subsequent to the end of the first quarter ended 31 March 2012 except for share split exercise by the Company. As at 23 April 2012, the Company’s number of share increased from 642,000 to 1,284,000,000 from the share split exercise undertaken as part of the corporate proposal disclosed in note 21. Gas Malaysia Berhad (240409-T) 11. Page 12 of 19 Changes in composition of the Group There was no change in the composition of the Group during the current quarter. 12. Changes in contingent liabilities or contingent assets There was assets no since change the in last contingent audited liabilities financial or contingent statements for the financial year ended 31 December 2011 except for the following bank guarantees issued to third parties: Group 31.03.12 31.12.11 RM’000 RM’000 7,490.6 7,490.6 Bank guarantees issued to authorities and suppliers were mainly for gas licenses, performance bonds and payment guarantees for supply of Liquefied Petroleum Gas (LPG). 13. Capital commitments Capital commitments consolidated for condensed the Group interim not financial provided for information in are follows: 31.03.12 RM million Property, plant and equipment: Authorised and contracted for Authorised but not contracted for 4.0 135.2 139.2 the as Gas Malaysia Berhad (240409-T) 14. Page 13 of 19 Related party transaction Significant related party transaction for the first quarter ended 31st March 2012: 3 months ended 31.03.12 RM’000 3 months ended 31.03.11 RM’000 (430,750) (336,359) Parties transacted PETRONAS Gas Berhad Purchased of Natural Gas Tolling Fee Income 3,871 3,319 (4,220) (3,613) 9,110 8,542 PETRONAS Dagangan Berhad Purchased of Liquefied Petroleum Gas Central Sugar Refinery Sdn Bhd Sales of Gas Additional information required by the Bursa Securities Listing Requirements 15. Review of performance The Group’s revenue for the first quarter was RM506.6 million compared to ended 31 March 2012 RM464.0 million in the corresponding period in 2011, representing an increase of 9.2%. The profit before taxation for the first quarter ended 31 March 2012 was RM46.1 million, a decrease of 53.5% compared to RM99.2 million in the corresponding period last year. Gas Malaysia Berhad (240409-T) Page 14 of 19 Natural Gas & LPG The increase in Natural Gas & LPG segment’s revenue for the first quarter ended 31 March 2012 to RM506.6 million from RM464.0 million in the corresponding period last year was mainly due to higher volume of gas sold by 1.5% and the upward revision in tariff which was effective beginning 1st June 2011. No such impact was noted in the prior corresponding period. The lower profit before taxation for the first quarter ended 31 March 2012 by RM53.1 million compared to the corresponding period last year was mainly due to margin compression resulting from the revision in gas tariff. 16. Variation of results against preceding quarter The Group recorded a profit before taxation of RM46.1 million in the current quarter as compared to RM72.9 million in the preceding quarter mainly driven by lower sales volume due to shorter billing days, coupled with Chinese New Year holidays during the current quarter, and the adjustment of gas cost and reversal of provision for shared cost in the previous quarter. 17. Current prospects The Board expects the Group’s revenue to be better than previous financial year. However, profit is expected to be lower than previous financial year due to the full impact of the revised tariff which was enforced on the 1st of June 2011. Gas Malaysia Berhad (240409-T) 18. Page 15 of 19 Profit before taxation Profit before taxation is stated after charging/(crediting) the following items: First Quarter Financial Ended Period Ended 31.03.12 31.03.11 31.03.12 31.03.11 RM’000 Finance income (2,276) Depreciation & amortisation 11,491 RM’000 RM’000 RM’000 (3,001) (2,276) (3,001) 10,752 11,491 10,752 Gain on disposal on: -property, plant and equipment 19. (28) (0.3) (28) (0.3) Profit forecast or profit guarantee The Group did not issue any profit forecast or profit guarantee for the reporting period in a public document. 20. Tax expense 3 months ended 31.03.12 RM mil 3 months ended 31.03.11 RM mil Cumulative 3 months ended 31.03.12 RM mil Cumulative 3 months ended 31.03.11 RM mil Current tax expense - current - prior year (11.0) - (23.2) - (11.0) - (23.2) - Deferred tax expense - current - prior year (0.5) - (1.6) - (0.5) - (1.6) - (11.5) (24.8) (11.5) (24.8) The Group’s effective tax rate for the reporting similar to the statutory income tax rate in Malaysia. period is Gas Malaysia Berhad (240409-T) 21. Page 16 of 19 Status of corporate proposals Offer For Sale (OFS) The Company issued its Prospectus on 18 May 2012 in conjunction with its listing of and quotation of its entire issued and paidup share capital on the Main Market of Bursa Securities pursuant to OFS by the Offerors. The OFS involves the following:(a) The Institutional Offering of 303,315,000 Offer Shares to institutional and institutional and Ministry of selected selected International investors investors Trade and and Bumiputera approved by the Industry at the institutional price to be determined by way of bookbuilding (“Institutional Price”), payable in full upon allocation and (b) The Retail Offering of 30,525,000 Offer Shares to the Malaysian Public, eligible directors and employees of GMB at the offer price of RM2.20 per Offer Shares; being initial price payable by the applications (“Retail Price”) The Retail Price is payable in full upon application and is subject to a refund of the difference in the event that the final retail price is less than the Retail Price. The Final Retail Price will equal the lower of : (i) The Retail Price of RM2.20 per Offer Share and (ii) The Institutional Price. The OFS closed on 25 May 2012 and the institutional price and final retail price have been determined at RM2.20 per offer share. The Company’s entire issued and fully paid-up share capital will be listed on the Main Market of Bursa Malaysia Securities Berhad on 11 June 2012. Gas Malaysia Berhad (240409-T) Page 17 of 19 For the details of the Proposed Listing, please refer to the Bursa Malaysia’s website. Pursuant to the approval letter of the Securities Commission (“SC”) dated 7 October 2011 for the listing exercise mentioned above, the SC had imposed a condition for GMB to identify those plots of land erected with stations which are not designated for gas station use and rectify the non-compliance within 12 months from the date of the SC’s approval (“Condition”). As disclosed in the listing Prospectus dated 18 May 2012, GMB has identified that as at 23 April 2012, out of the 1,020 gas stations erected by GMB, there are 22 stations which have been identified as having been erected on land not designated for gas station use where GMB are in the midst of rectifying the same or where GMB has been following up with the relevant land owners or authorities to ascertain the express conditions pertaining to the use of land endorsed on the issue documents of title of the relevant land (“Land Use Conditions”). 22. Borrowings The Group did not have any borrowings for the first quarter ended 31 March 2012. Gas Malaysia Berhad (240409-T) 23. Page 18 of 19 Realised and unrealised profit/losses disclosure The retained earnings for the first quarter ended 31 March 2012 is analysed as follows: As at 31.03.12 RM’000 As at 31.12.11 RM’000 Total retained earnings of the Company and its subsidiaries: - Realised - Unrealised 24. 575,184 540,143 (173,190) (172,689) 401,994 367,454 Material litigation As at this period, neither our Company nor our subsidiaries are engaged in any material litigation or arbitration, either as plaintiff or defendant, and our Board is not aware of any legal proceedings pending or threatened or of any fact likely to give rise to any legal proceeding which have a material adverse effect on the business or financial position of our Group. 25. Earnings per ordinary share Basic/Diluted Earnings Per Ordinary Share (“EPS”): Profit for the first quarter attributable to owners of the Parent (RM mil) Number of ordinary shares in issue (’000) Basic earnings per ordinary share (RM) Diluted earnings per ordinary share (RM) 3 months ended 31.03.12 34.5 3 months ended 31.03.11 74.4 *642.0 *642.0 53.8 53.8 Cumulative Cumulative 3 months 3 months ended ended 31.03.12 31.03.11 34.5 74.4 *642.0 115.9 *642. 0 53.8 115.9 53.8 115.9 115.9 * The number of shares is prior to subdivision of the shares. On 23th April 2012, the company undertook a subdivision of its shares from 642,000 ordinary shares of RM1,000.00 each to 1,284,000,000 ordinary shares of RM0.50 each. Gas Malaysia Berhad (240409-T) Page 19 of 19 The group has not issued any dilutive potential ordinary shares and therefore the diluted EPS is the same as basic EPS 26. Authorisation for issue The consolidated condensed interim financial information have been authorised for issue by the Board of accordance with their resolution on 6 June 2012. By Order of the Board Zainul Abidin bin Hj Ahmad (LS 0008854) Company Secretary Shah Alam Dated : 6 June 2012 Directors in