PostonSOXforAAA36x72

advertisement

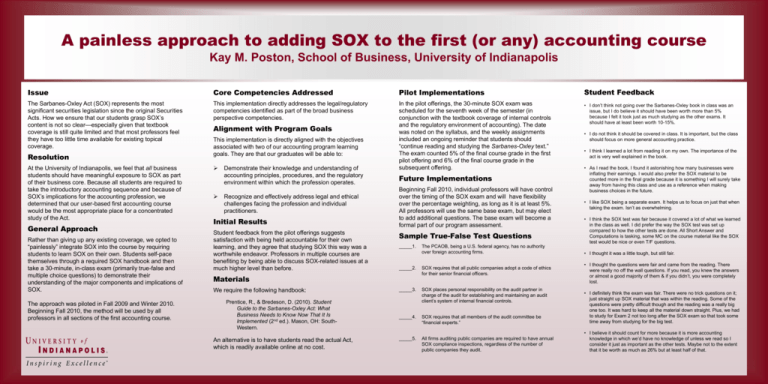

A painless approach to adding SOX to the first (or any) accounting course Kay M. Poston, School of Business, University of Indianapolis Issue Core Competencies Addressed Pilot Implementations Student Feedback The Sarbanes-Oxley Act (SOX) represents the most significant securities legislation since the original Securities Acts. How we ensure that our students grasp SOX’s content is not so clear—especially given that textbook coverage is still quite limited and that most professors feel they have too little time available for existing topical coverage. This implementation directly addresses the legal/regulatory competencies identified as part of the broad business perspective competencies. In the pilot offerings, the 30-minute SOX exam was scheduled for the seventh week of the semester (in conjunction with the textbook coverage of internal controls and the regulatory environment of accounting). The date was noted on the syllabus, and the weekly assignments included an ongoing reminder that students should “continue reading and studying the Sarbanes-Oxley text.” The exam counted 5% of the final course grade in the first pilot offering and 6% of the final course grade in the subsequent offering. • I don’t think not going over the Sarbanes-Oxley book in class was an issue, but I do believe it should have been worth more than 5% because I felt it took just as much studying as the other exams. It should have at least been worth 10-15%. Resolution At the University of Indianapolis, we feel that all business students should have meaningful exposure to SOX as part of their business core. Because all students are required to take the introductory accounting sequence and because of SOX’s implications for the accounting profession, we determined that our user-based first accounting course would be the most appropriate place for a concentrated study of the Act. General Approach Rather than giving up any existing coverage, we opted to “painlessly” integrate SOX into the course by requiring students to learn SOX on their own. Students self-pace themselves through a required SOX handbook and then take a 30-minute, in-class exam (primarily true-false and multiple choice questions) to demonstrate their understanding of the major components and implications of SOX. The approach was piloted in Fall 2009 and Winter 2010. Beginning Fall 2010, the method will be used by all professors in all sections of the first accounting course. Alignment with Program Goals This implementation is directly aligned with the objectives associated with two of our accounting program learning goals. They are that our graduates will be able to: Demonstrate their knowledge and understanding of accounting principles, procedures, and the regulatory environment within which the profession operates. Recognize and effectively address legal and ethical challenges facing the profession and individual practitioners. Initial Results Student feedback from the pilot offerings suggests satisfaction with being held accountable for their own learning, and they agree that studying SOX this way was a worthwhile endeavor. Professors in multiple courses are benefiting by being able to discuss SOX-related issues at a much higher level than before. Future Implementations Beginning Fall 2010, individual professors will have control over the timing of the SOX exam and will have flexibility over the percentage weighting, as long as it is at least 5%. All professors will use the same base exam, but may elect to add additional questions. The base exam will become a formal part of our program assessment. Sample True-False Test Questions _____1. Prentice, R., & Bredeson, D. (2010). Student Guide to the Sarbanes-Oxley Act: What Business Needs to Know Now That It Is Implemented (2nd ed.). Mason, OH: SouthWestern. An alternative is to have students read the actual Act, which is readily available online at no cost. • I think I learned a lot from reading it on my own. The importance of the act is very well explained in the book. • As I read the book, I found it astonishing how many businesses were inflating their earnings. I would also prefer the SOX material to be counted more in the final grade because it is something I will surely take away from having this class and use as a reference when making business choices in the future. • I like SOX being a separate exam. It helps us to focus on just that when taking the exam. Isn’t as overwhelming. • I think the SOX test was fair because it covered a lot of what we learned in the class as well. I did prefer the way the SOX test was set up compared to how the other tests are done. All Short Answer and Computations is tasking, some MC on the course material like the SOX test would be nice or even T/F questions. • I thought it was a little tough, but still fair. • I thought the questions were fair and came from the reading. There were really no off the wall questions. If you read, you knew the answers or almost a good majority of them & if you didn’t, you were completely lost. _____2. SOX requires that all public companies adopt a code of ethics for their senior financial officers. _____3. SOX places personal responsibility on the audit partner in charge of the audit for establishing and maintaining an audit client’s system of internal financial controls. _____4. SOX requires that all members of the audit committee be “financial experts.” • I definitely think the exam was fair. There were no trick questions on it; just straight up SOX material that was within the reading. Some of the questions were pretty difficult though and the reading was a really big one too. It was hard to keep all the material down straight. Plus, we had to study for Exam 2 not too long after the SOX exam so that took some time away from studying for the big test. All firms auditing public companies are required to have annual SOX compliance inspections, regardless of the number of public companies they audit. • I believe it should count for more because it is more accounting knowledge in which we’d have no knowledge of unless we read so I consider it just as important as the other tests. Maybe not to the extent that it be worth as much as 26% but at least half of that. Materials We require the following handbook: The PCAOB, being a U.S. federal agency, has no authority over foreign accounting firms. • I do not think it should be covered in class. It is important, but the class should focus on more general accounting practice. _____5.