Tax Credits vs. Section 8 - Berkeley Program on Housing and Urban

advertisement

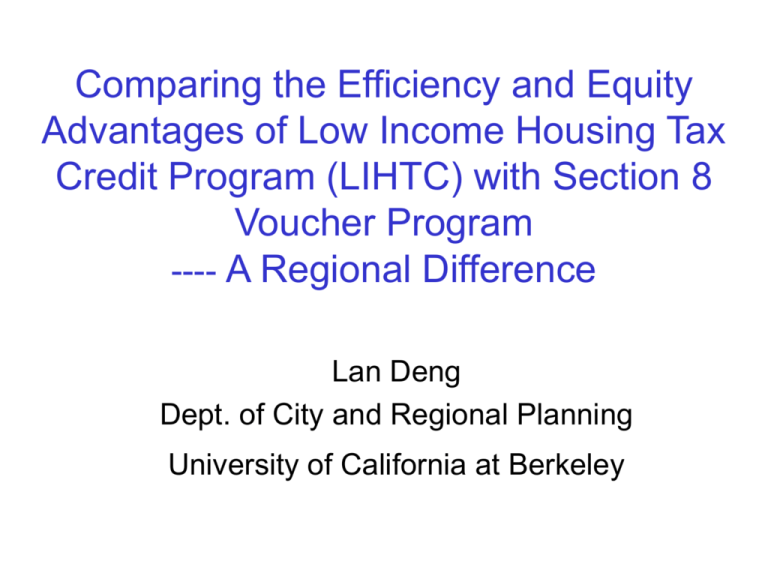

Comparing the Efficiency and Equity Advantages of Low Income Housing Tax Credit Program (LIHTC) with Section 8 Voucher Program ---- A Regional Difference Lan Deng Dept. of City and Regional Planning University of California at Berkeley Research Question How should limited government housing subsidies be directed – via supply-side investment programs such as public housing or the LIHTC program? – or by demand-side programs like housing vouchers? Two Sets of Evaluation Criteria Which approach is better at providing quality neighborhoods and economic opportunity to lowincome families? Which approach is more efficient in terms of lifetime costs? Organization Of This Presentation Case Study Identification and Data How the LIHTC differs by MSAs Comparison of Spatial Outcomes (LIHTC vs TB-Section 8) Comparison of Cost Effectiveness (LIHTC vs TB-Section 8) Case Study Identification and Data Case Study Regions Four case study regions: Tight Markets: San Jose PMSA, Boston PMSA Balanced Markets: Miami MSA, Cleveland PMSA Differences among these regional housing markets: Growth difference New regions vs. established regions. Difference in the severity of housing segregation and discrimination Data for this Research LIHTC Database, collected from the following state agencies: Florida Housing Finance Corporation Ohio Housing Finance Agency California Tax Credit Allocation Committee Massachusetts State Dept. of Housing and Community Development Dataset 1: General Project Information for all LIHTC projects in each region from 1987 to 2000. Dataset 2: Financial Structure, Unit Composition, Rent Information for available projects, extracted from a project’s Final Cost Certification File or Underwriting Reports etc. How Many LIHTC Projects? Where? Dataset 1: General Project Information (used for spatial analysis) Dataset 2: Project Financial Information (used for cost analysis) No. of Projects No. of Projects Miami, FL 126 29 Cleveland, OH 131 29 San Jose, CA 96 66 Boston, MA 210 51 Region Other Data Sources Section 8 Voucher / Certificate Data, from A Picture of Subsidized Households in 1998, HUD 1990 and 2000 census data, Summary Tape File 3 Public school performance data, from the Education Department in individual state. Also, Fair Market Rent and Area Median Family Income, HUD R.S. Mean’s Historic Construction Cost Index; Historic 30-year conventional mortgage rate from Federal Reserve Bank How the LIHTC differs by MSAs Miami vs. Cleveland: For-profit New Construction dominates in Miami. It’s the opposite in Cleveland. Cleveland Miami Nonprofit Nonprofit 8 16 18 31 15 43 43 36 For-Profit 37 Forprofit 3 New Construction Acquisition & Rehabilitation Both NC and A/R For-profit San Jose vs. Boston: New Construction dominates in San Jose, the opposite in Boston. Non-profits dominate in both. Boston San Jose Developer Unknown Developer Unknown 5 23 6 20 8 Nonprofit Nonpro 5 20 51 43 13 Forprofit 26 3 Nonprofit 35 Forprofit New Construction Acquisition & Rehabilitation Both NC and A/R For-profit Development costs vary widely by region, with Miami at the low end and Boston at the high end. (Dollar in 1996 Value) 200,000 Project Cost per Unit 167,727 160,000 130,999 103,394 120,000 76,815 80,000 109,671 89,580 72,504 50,197 40,000 0 Miami Cleveland New Construction San Jose Boston Acquisition / Rehabiliation Comparison of Spatial Outcomes (LIHTC vs Tenant Based Section 8) Neighborhood Income Neighborhood Racial Composition School Quality Except for San Jose, most of LIHTC and Section 8 units are located in very low income and low Income neighborhoods 100% 75% 80% 77% 75% 73% % of Units 66% 60% 49% 40% 32% 27% 20% 0% LIHTC Section 8 Miami LIHTC Section 8 Cleveland Very Low Income Neighborhoods LIHTC Section 8 San Jose LIHTC Section 8 Boston Low Income Neighborhoods Tenant-based Section 8 program not always works better than LIHTC program in bringing low income families to middle income neighborhoods 30% 26% 21% 18% 20% 14% 12% 11% 8% 10% 9% 0% Miami Cleveland San Jose Boston LIHTC % of Units in Middle Income Neighborhoods Section 8 (Except for Boston) similar proportions of assisted families are located in the most segregated neighborhoods, regardless of program type. % of Units 60% 53% 40% 20% LIHTC Section 8 50% 29% 12% 10% 11% 3% 6% 0% Miami Cleveland Boston Ghettos: over 80% are blacks San Jose over 10% are blacks In Miami, 80% of LIHTC units are proximate to lowquality schools, vs. 51% of Section 8 units (Quality is standardized according to the average metropolitan school performance scores) The Cumulative School Quality Distribution of LIHTC Units and Section 8 Voucher/Certificate (V/C) Units in Miami MSA 100 Cumulative % of V/C Units 80 Cumulative % of LIHTC Units 60 40 20 -4 -3.5 -3 -2.5 -2 -1.5 -1 -0.5 0 0.5 1 1.5 2 Standardized School Performance Score Metropolitan Average In Cleveland, 70% of both LIHTC units and Section 8 units are proximate to low quality schools, but more LIHTC units close to the worst schools The Cumulative School Quality Distribution of LIHTC Units and Section 8 Voucher/Certificate (V/C) Units in Cleveland MSA 100 Cumulative % of V/C Units Cumulative % of LIHTC Units 80 60 40 20 - -2.5 -2.0 -1.5 -1.0 -0.5 0.0 0.5 Metropolitan Average 1.0 1.5 Standardized School Performance Score In San Jose, the school quality distribution of LIHTC units and Section 8 units are very similar The Cumulative School Quality Distribution of LIHTC Units and Section 8 Voucher/Certificate (V/C) Units in San Jose MSA 100 Cumulative % of V/C Units 80 Cumulative % of LIHTC Units 60 40 20 0 -3 -2.5 -2 -1.5 -1 -0.5 0 0.5 1 1.5 2 Standardized School Perform ance Score Metropolitan Mean In Boston, 80% of LIHTC units are proximate to low quality school, vs. 60% of Section 8 units The Cumulative School Quality Distribution of LIHTC Units and Section 8 Voucher/Certificate (V/C) Units in Boston MSA 100 Cumulative % of V/C Units Cumulative % of LIHTC units 80 60 40 20 - -3 -2.5 -2 -1.5 -1 -0.5 0 0.5 Metropolitan Average 1 1.5 2 Standardized School Performance Score Comparison of Cost Effectiveness (LIHTC vs Tenant Based Section 8) Average Development Subsidy across Regions Development Subsidy vs. 30-year Voucher Subsidy The Subsidy Story in Dollars: The required subsidy in Boston is more than twice what is in Miami. (New Construction Projects in the Late 90s.) Boston San Jose $124,200 56% of TDC $85,920 67% of TDC $68,239 Cleveland 74% of TDC Miami $58,596 68% of TDC Total Development Subsidy Per Unit ( in 1996 Dollars) TDC: Total Development Cost In Boston and Cleveland,the LIHTC development subsidy is greater than 30-year Section 8 voucher subsidy, but the opposite holds in San Jose and Miami. 1.40 Boston 1.21 Cleveland 0.89 Miami 0.72 San Jose 0.00 0.50 1.00 1.50 2.00 Mean Ratio of Total Development Subsidy over 30-Year Voucher Subsidy In Miami, projects targeting larger family units tend to be more cost effective Cost Effectiveness Ratio (New Construction Projects in the Late 90s) 2.00 1.75 1.50 1.25 1.00 0.75 0.50 0.25 - - 0.50 1.00 1.50 2.00 2.50 3.00 3.50 A Project's Average Unit Size (No. of Bedroom Per Unit) Cost Effectiveness Ratio = A Project’s Total Development Subsidy / 30-Year Voucher Subsidy 4.00 In San Jose, LIHTC Projects have become more cost effective over time (New Construction Projects) Cost Effectiveness Ratio 2.5 2.0 1.5 1.0 0.5 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 Year Cost Effectiveness Ratio = A Project’s Total Development Subsidy / 30-Year Voucher Subsidy 2001 Cost Effectiveness Ratio In San Jose, projects targeting lower income families also tend to be more cost effective 2.0 1.5 1.0 0.5 0% 10% 20% 30% 40% 50% 60% A Project's Average Targeting Family Income (% of AMI) Cost Effectiveness Ratio = A Project’s Total Development Subsidy / 30-Year Voucher Subsidy 70% Concluding Remarks: Differences in spatial outcomes between LIHTC and Section 8 tend to be modest, and the result of local factors. Contrary to the conventional wisdom, a supply subsidy program like LIHTC can actually be more cost-effective than a demand subsidy program like Section 8. Regional variations influence the efficiency and equity advantage of different government housing programs. Relevant factors might include Local housing supply and demand. Local Family Income. Different government practices in administering LIHTC program. The existence of housing segregation and discrimination in local housing markets. Specific project design. I Need Your Help!!! Does anyone here have rent and stock characteristic information for market rate rental housing properties in Boston, Cleveland, Miami, or San Jose? Thank you!!