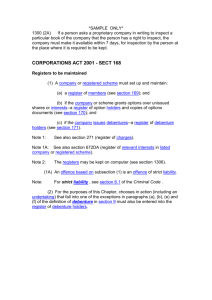

LECTURE NOTES FINANCIAL ACCOUNTING II PBAC 301/PWAC 312

advertisement

FINANCIAL ACCOUNTING II PBAC 301 BY RICHARD AMANKWA FOSU Lecture 1 ACCOUNTING FOR SHARES AND DEBENTURES SHARES • Share defined – share is evidence of ownership of a company. – It is an ownership right acquired in a company which may be transferable – Share is issued by a company at par value or no par value – Par value share is a share that has a face value, that is, its issue price is written on it. – No par value share has no face value. That is the issue price is not stated on it. Shares (contd) • Classification of Shares – The law allows for the creation of different classes of shares with certain rights regarding dividend, voting, repayment or otherwise. – Generally, there are two classes of share • Preference shares • Ordinary /equity or common shares – Note that American refers to shares as Stock Shares (contd) • Preference shares – Preference shares are those shares on which fixed and specified amounts are paid to the holders as dividend or capital redistribution. – Dividend payable on preference shares may be cumulative or non cumulative. • Cumulative preference shares are entitled to dividend in arrears in period where no dividends are declared and paid. • Non cumulative preference shares are not entitled to dividend arrears. • All preference shares are deemed to be cumulative unless otherwise indicated. Shares (contd) • Ordinary shares – These are also known as equity shares or common shares. – These are shares which entitled the holders to the residue of profit or assets after the dividend or capital of preference shareholders has been determined – They do not carry fixed rates of dividends Issue of shares: legal considerations • Shares up to the total number authorized by the regulations may be issued at any time and for any consideration determined by the co. • Shares issued may be paid for at such time as are agreed between the member & co or as determined by the regulation • All shares, except for bonus shares, should be issued for valuable consideration paid or payable to the co. • Shares shall be paid for in cash unless otherwise agreed. Issue of shares: legal considerations (contd) • Where payment is agreed in forms other than cash, registrar of companies should be informed of such agreement in writing within 28 days after allotment. • A company must deliver a share certificate to the registered holder within 2 months after issue. Issue of shares - Terms • Stated share capital – It is the total maximum consideration (cash or kind) received upon share issue or transfers from surplus. – Notes that the consideration received on the reissue of treasury shares is not part of the stated capital. – Issue share capital is the consideration received for shares issued to date. This may be lower or equal to stated share capital – Stated share capital is also termed the authorized share capital Issue of shares – Terms (contd) • Treasury shares – these are shares which have been lawfully redeemed, purchased or acquired or forfeited while in the custody of the company prior to their re-issue • Share deals refers to all dealings in own share resulting from redemption of shares, or reissue of treasury shares. This is accounted for through a share deal account. Methods of issuing shares • There are different methods of issuing shares. – Public issue (prospectus): • This is where prospectus is advertized in the media inviting the public to subscribe to the shares of the company. – Offer for sale • Here the company sells all the shares to an issuing house, usually a financial institution which in turn sells them to the public at profit. – Placing • A stockbroker is contracted and he finds persons or financial institutions who which to buy the shares. He reward is called brokerage – Underwriting • It involves providing advice on the issue, buying a new issue from issuing company and reselling it to the public. The underwriter earns a spread on the transaction. In some case, the underwriter or syndicate enters into fixed commitment and deals with the issue on “Best effort or all-or-none basis,” Methods of issue (contd) – Right Issue • Existing company may wish to raise additional capital by offering the existing shareholders an additional shares to subscribe to on pro-rata basis. The price of issue is usually lower than the existing market price. The shareholder has the option to take up the offer, sell the right or renounce it. – Bonus issue or capitalization issue. • Existing shareholders are offered additional shares in the company without payment of cash. The consideration involves transfer surplus to stated capital. Stages of Issues • The following stages may the involved – Application invited and received with the agreed consideration – Applications considered and unsuccessful ones rejected and monies refunded – Allotment is made to successful applicants and monies received accordingly – First call and subsequent calls (per the agreement) made and monies received – Shares of defaulting shareholders forfeited and share retired to treasury. – Treasury share re-issue and monies sent to share deals. Accounting for share Issue • Note that the price for a share offer may paid – full upon application or – In installment at application, allotment through to the calls. • Accounting issues are uncomplicated when full payment is required on application. The issue of forfeiture will not apply. In this case we debit bank account and credit stated capital with the amount. • Where installment basis is applied then the stages will be followed through and through. Accounting Entries – Installment Basis Transaction Account to Debit Account to Credit Application monies received Bank Application Unsuccessful (excess) Applications rejected Application Bank Excess application monies occurred Application Allotment Application completed & allotment made Application Stated capital Allotment Monies received Bank Allotment Allotment completed Allotment State capital First and Subsequent calls monies received Bank 1st,2nd etc call Calls end 1st etc calls Stated capital Share declared forfeited upon default No entry No entry Treasury share re-issued Bank Share deals Share Redemption • The Law frowns on indiscriminate redemption of shares by companies. Why? • When can a company redeem or repurchase it own shares: – Where there is credit balance on the share deal account – Where transfer is made from surplus to share deal for that purpose – Where fresh issues are made purposely for the redemption. (should be used within 12 month) Share deal Accounts • Purchase of own share or redemption can only be effected through share deal account • Share deal account is credited with: – Transfer from income surplus – Consideration received on treasury share reissue. • Where a fresh issue is made is should be credited to stated capital temporally and used to pay for the redemption • Share deal account can only be debited with – Transfer to stated capital for bonus issue – Purchase/ redemption of shares. Reasons for redemption • To buy out troublesome shareholders • To reduce the dividend bill of the company • To take advantage of declining share prices in the market and buy it at a discount • Take out the company from public market • To enjoy the market prospect of the shares • Employment-based share offering may be redeemed when employee resigns. Accounting entries • Three scenarios exist: – Redemption is made through Share deal account – Redemption from fresh issue of shares – Combination of share deal and fresh issue Accounting entries- Share deal • Enough monies on share deal – Dr. Share deal accounts – Cr. Bank account • No enough money on share deal but income surplus exist – – – – Dr. income surplus Cr. Share deals with top required Dr. share deal account Cr. Bank with amount of redemption. *similar entries are required where no money is in share deal account but here you transfer full amount needed from income surplus to share deal *Note that preference share capital will remain on the balance sheet as treasury share (but no voting /dividend right) Accounting entries: Fresh issue • When fresh issue is made for the redemption – Dr. bank – Cr. Stated capital with monies received – Dr. Stated capital (redeemable preference share) – Cr. Bank Accounting entries: Combined • Share deal account + income surplus top up + fresh issue – – – – – – – – Dr. income surplus Cr. Share deal with amount transferred from IS Cr. Bank Dr. Share deal with amount redeemed from share deal account Dr bank Cr. Stated capital with the fresh issue Dr. Stated capital (preference share) Cr. Bank with amount redeemed from fresh issue Debenture • Definition – Debenture is a written acknowledgement of indebtedness by the company setting out the terms and conditions of the loan. – A company may raise loan by issue a debenture or debenture stock. – A debenture holder is a special creditor who is entitled to fixed interest whether profit is made or not. Debenture (contd) • Types of debenture – Redeemable or perpetual debenture – Convertible debenture – Secured or naked debenture • debenture may be secured by a floating charge or a fixed charge or both. Issue of Debenture • The mode of issue of debenture is similar to that of shares and the accounting entries are the same except the change in account names. • Debenture may be payable full on application or installment basis. • Debenture may be issued at par, discount or premium. Issue of Debenture (contd) • Issue of debenture at Par – It means that the debenture is issued at a price equal to the nominal value – Accounting entry: • Dr. bank • Cr. Debenture (specific) with the amount received – Example: GHS20,000 20% debenture was issued at par to the public payable on application. • Dr bank 20,000 • Cr. 20% Debenture 20,000 Issue of Debenture (contd) • Issue at Discount – here the issue price is lower than the nominal value, hence there is a to the issuer. – Accounting entry • Dr. Bank with amount received • Dr. Discounts on debenture with discount • Cr. Denture (specific) – Example: GHs20,000 20% debenture was issued at 98 to the public. • Dr. bank GHs 19,600 • Dr. Discount 400 • Cr. 20% debenture 20,000 Issue of debenture • Issue at Premium – debenture is issued at a price above nominal value, resulting in capital gain. – Account entry • Dr. Bank with all amounts • Cr. Premium with the gain • Cr. 20% debenture with value of debenture – Example: GHs20,000 20% debenture issue at 102. • Dr bank 20,400 • Cr. Premium 400 • Cr 20% debenture 20,000 Redemption of Debenture • Redeemable debentures are redeemed in accordance with the trust deed. • Redeemed debentures may be cancelled or reissued. • Debenture may as well be redeemed at par, discount or premium. • Modalities for redemption – One –off redemption on a specific date – Installment redemptions over agreed period of time. Redemption of Debenture • One –off- redemption – May be funded through • Fresh issue of debenture under different deed • Fresh issue of shares • Internally generated fund – Creation of capital surplus ( debenture redemption reserve) through regular annual appropriation from income surplus. – The redemption reserves created are managed through a sinking fund. Redemption of Debenture The Debenture Redemption Reserve/Surplus operates under one of the two following principles: • An amount equal to the nominal value of the Debenture to be redeemed is debited to the Income Surplus account and credited to Debenture Redemption Reserve/Surplus . After the redemption of the Debentures, any balance on the Debenture Redemption Reserve/Surplus is transferred to the general Capital Surplus. • Where one-off or one lump sum redemption is to be effected, then the annual appropriations to the fund is managed on a sinking fund basis. That is, the company annually appropriates an amount, which together with reinvested interest, will produce an amount which on maturity, will be sufficient to redeem the debentures.. Annual appropriations are debited to Income Surplus Account and credited to Sinking Fund specifically labeled as Debenture Redemption Reserve/Surplus Fund. Redemption of Debenture • Installment Basis – Here, the debenture redemption is credited annually with the amount due for redemption from the income surplus. – The debenture due is transferred to the debenture redemption account and paid off. Redemption of debenture (contd) • Accounting entry for installment redemption – Under this debenture redemption reserve is created. Transaction Account to debit Account to credit Annual installment due Income surplus D. Redemption reserve Redemption approved Debenture D. Redemption Premium resulted from redemption Premium / P&L D. Redemption Discount resulted from redemption D. Redemption Discount/P&L Payment effected for the redemption D. Redemption Bank Balance on redemption reserve Capital surplus D. Redemption reserve Redemption of debenture (contd) • Example – Tanye Ltd issued GHS400,000 20% Redeemable Debentures in 1990. Under the terms, the debentures were to be redeemed by equal annual drawing over 10 years starting from 1993. Payment was to be made on 31 Dec each year. As on 1 Jan 2001, GHS80,000 and GHS320,000 were standing on the debenture account and reserve accounts respectively. The redemption of 2002 was effected at 98 and the final redemption was made in 2003 at par. Show the entries in the journal & ledger accounts. Journal entries Dr. 31/12/2002 20% redeemable debenture Debenture redemption 40,000 31/12/2002 Income surplus Debenture redemption reserve 40,000 Cr 40,000 40,000 31/12/2002 Debenture redemption (40000 * 0.98) 39,200 Discount on redemption 800 Bank 40,000 31/12/2003 20% redeemable debenture Debenture redemption 40,000 40,000 31/12/2003 Income surplus Debenture redemption reserve 40,000 31/12/2003 Debenture redemption Bank 40,000 31/12/2003 Debenture redemption reserve Capital surplus 400,000 40,000 40,000 400,000 Redemption of Debenture • Sinking fund is maintained where one-off redemption is required. – Here annual appropriation is made from the income surplus to a sinking fund which is later invested in an interest bearing instrument. Upon reaching the specified date of redemption the investment is realized and used to redeem the debenture on a one-off basis. Redemption of Debenture – Sinking fund • Accounting entries Events Debit Credit Annual appropriation are made to the sinking fund Income surplus Sinking fund Investment made out of sinking fund SF investment Bank SF Investment income received Bank Sinking Fund Realization of investment Bank SF Investment Profit on realization of investment SF investment SF Loss on realization of investment SF SF investment Redemption approved by directors Redeemable Debenture Debenture redemption Premium upon redemption SF/ premium Debenture redemption Discount upon redemption Debenture redemption SF/discount Redemption effected Debenture redemption Bank Redemption – Sinking fund • Example; – A company issues 10% GHS10,000 redeemable debenture some years ago. A debenture redemption fund backed by marketable securities was established for the redemption. On 31 December 2010 the following balance were available; 10% Redeemable debenture stock GHs10,000, Debenture redemption fund GHs 4,900 and Debenture redemption fund investment GHS 4,100. Redemption- Sinking fund • Example (contd) – The ff took place in 2003: – 25/1: investment bought at cost GHs800 – 30/6: half year debenture interest paid – 15/7:Investment income received GHs200 – 30/7: investment (cost 2,400) sold for GHs 3300 – 1/8: debenture stock redeemed ( nominal GHS4,000) 3,400 – 15/9; investment (cost GHS 1,000) sold GHS 900 – 30/9: Investment purchased at cost GHs,1,060 – 31/12: Investment income received GHS 150 – 31/12 Annual appropriation GHS 800 – 31/12 half year interest paid. *Show entries in journal and ledger. Redemption -Sinking fund Dr. 25/1 SF investment Bank 800 30/6 Debenture interest Bank 500 15/7 200 Bank Sinking fund 30/7 Bank Cr. 800 500 200 3,300 SF investment 3,300 30/7 SF Investment (profit) Sinking Fund 900 1/8 Debenture stock Debenture redemption 4,000 1/8 Debenture interest Debenture redemption 33 1/8 Debenture redemption Bank 3,400 1/8 Debenture redemption Sinking fund (profit + interest) 633 900 4,000 33 3,400 633 Redemption: sinking fund Dr 15/9 Bank SF investment Sinking fund SF investment 900 30/9 SF investment Bank 1,060 31/12 Bank SF investment 150 31/12 Income surplus sinking fund 800 31/12 Debenture interest Bank 300 31/12 Debenture interest P&L Sinking Fund Capital surplus 833 Cr 900 100 100 1,060 150 800 300 833 4,000 4,000