exploitation of oil and gas: lessons from international

advertisement

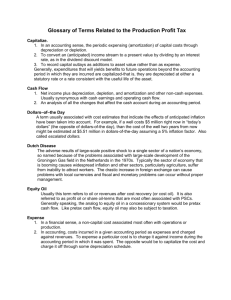

MINING TAXATION AND LEGAL FRAMEWORK Gangadhar Prasad Shukla Duke Center for International Development Duke University May 2007 Outline of Presentation • Some special features of the exhaustible natural resource sector • Designing an appropriate fiscal policy for the mining sector • Alternative tax regimes and their implications for government revenues and economic efficiency • Hidden costs, nuisance taxes and tax incentives • Costs of administration and compliance • Cost of uncertainty • Concluding observations Exhaustible Natural Resources and the World Economy • • • • Some Basic Data About Exhaustible Natural Resources Contribution of exhaustible natural resources (Minerals, Oil, and Gas) in more than 30 countries exceeds 10% of GDP. In about 20 countries, share of Oil and Gas alone ranges between 18 to 87 percent of the economy and the annual average revenues from this sector comprise between 43 to 85 per cent of total government revenues. The exports earnings from Oil and Gas make up for any where between 50 to 95 percent of total exports earnings in these countries. The non-fuel sector constitutes between 10 to 35 percent of GDP and 25 to 95 percent of exports earnings in 15 countries. What is Unique About this Sector? Special features: • As the resources are exhaustible, a user cost associated with their exploitation; resource used today not available in future. • Inter-temporal exploitation an important issue; a certain extraction profile maximizes the wealth or Net Present value (NPV) of the resource. • A “Resource Rent” associated with exploitation of this sector; unlike other sectors optimization rule not simply “marginal revenue equals marginal cost”. • Though producers have some market power, generally prices determined in world market and producers are price takers. • With several benefits to economy, many costs also involved. Costs Associated With Extraction • In addition to cost of extraction, following costs to economy: – Cost of environmental degradation: Damage to air and waterways used by the community. – Dutch disease: Increased payment to factors of production in the resource sector may increase cost of production of other tradable sectors whose output prices are internationally fixed, thus causing a squeeze on those sectors; also appreciation of currency may cause problems to other tradable sectors. – Cost of administration and compliance: different tax regimes have different costs of compliance and administration. – Cost of uncertainty of government revenues: Mainly due to uncertainty about future costs and prices. Revenues from different types of taxes (royalty to income tax) exhibit different levels of uncertainty and thus impose different costs on the economy. Designing an Appropriate Fiscal Policy for the Sector • Most resource rich developing countries have low capacity for domestic investment and require foreign investment by multinational corporations. • While fiscal policy plays important role in creating appropriate environment for attracting investment in general, it has added significance for investment in this sector. • Fiscal policies could be designed in two ways: (a) Maximize tax revenues from the resource sector; do not impose any conditions on investors; and government itself undertakes the development work using the revenues. (b) Create linkages with other sectors of economy; e.g. investors required to use indigenous raw materials and labor, develop downstream processing, sell a minimum share of production in domestic market. In this case, investors often ask for concessions on fiscal measures to comply with the constraints. Fiscal Policy for The Sector (Contd.) • The preferred fiscal policy in most resource rich countries has been to maximize tax revenues since the loss in tax revenue from concessions is generally much greater than the potential benefits associated with such linkages. • The tax system applied to the mining sector is generally of concessionary type. The title of the resource is transferred to the investor and the government primarily uses taxes, royalties and different kinds of fees as instruments to collect revenues. • The contractual type where the government retains ownership of the resource - more common to oil/gas sectors where the oil/gas companies have a right to the production or revenues from sale depending upon the contract. In addition, government applies taxes, royalties and bonuses on the contractor’s share. Optimization and Extraction Profile The Optimal Extraction Rule flows out of the resource owner’s efforts to maximize the wealth from the resource body: n NPV = Σ [P(t) × q(t) – C(q(t))]/(1+r)t - K t=1 Where: P(t) = price of the resource in period t, q(t) = quantity of resource extracted in period t, C(q(t)) = cost of extraction, a function of quantity extracted, K = fixed costs, n = years of extraction or life of the mine; r = discount rate. Plus some side conditions specifying rate of extraction, nature of cost function, quantity of total resource. • Prices may be modeled either as known with certainty or as stochastic. • Usually a non-linear optimization problem. Various optimization techniques employed (Euler's equation, maximum principle, dynamic optimization) and the solution yields both optimum extraction period (life) and quantity to be extracted in each year. Alternative Fiscal Regimes • Severance tax or royalty – either specific (unit) or ad valorem; administratively simpler, ensures early and steady government revenues but is not linked to profits; changes extraction profile and may cause inefficiency and high grading. • Progressive royalty to capture windfall gains. • Income Tax - administration complicated, no efficiency loss but government revenues not guaranteed. • Progressive income tax or resource rent tax – again to capture windfall gains by applying higher tax rates on above-normalreturn. • Property tax – not very common sometimes used by local governments, administration complicated and creates inefficiency. • Royalty plus income tax – a combination of the two, causes inefficiency but some revenues ensured to government. Other Taxes, Fees and Equity Participation • Withholding taxes on dividends and interest payments generally applied on transnational companies. • Normal indirect taxes such as VAT are common but exports taxes sparingly applied (on precious metals). • Generally mining equipment exempt from import duty. • A variety of license fees at different stages of exploration and development (prospecting, retention, extraction) may be applied. • Sometimes equity participation sought by the government (fully paid, concessional or carried interest basis). • In some cases, joint venture or full ownership through State Owned Enterprises (SOE). Generally, the revenues from SOEs are quite uncertain. Nuisance Taxes and Hidden Costs • In addition to the main stream taxes, some governments in developing countries employ a set of taxes that do not generate a lot of revenues but add considerably to the cost of compliance; e.g. employment related taxes, development levies, stamp duties etc. • Mining investors in many developing countries are subject to a variety of indirect hidden costs in the form of high electricity tariff, high prices of fuel, road toll and vehicle taxes, and restrictions imposed on extracting ground water etc. These “hidden” costs act like additional indirect taxes on mining companies. • It may seem surprising but these costs may often create as onerous a burden as the burden of all taxes put together, subjecting the investor to a form of second taxation. To Give or Not to Give Tax Incentives? • Various types of tax incentives in vogue – – – – Tax holidays and reduced tax rates Tax credit or accelerated depreciation Liberal loss carry forward rules Immediate expensing • But the question remains: do incentives pay? No concrete evidence that tax incentives effective in attracting more investment while loss of revenues is certain. However, tax incentives quite common and given mostly due to tax competition. • Better to offer a stable tax system and a sound social and physical infrastructure by using tax revenues. Cost of Administering (Including Compliance) Different Types of Taxes • Income tax Cost of administration and compliance high as both revenues and costs of extraction have to be assessed and income tax laws are fairly complex (estimated at about 2.74% of the total tax revenue). • Severance tax for unit tax, cost very low. For advalorem royalty, a little higher but still low (cost estimated at about 0.34% of total tax revenue). • Property tax Cost of administration of the same order as for income taxes, some variation in cost depending on whether revenues or net present values used as the tax base. Stochastic prices and Cost of Uncertainty • With price uncertainty, another issue arises: uncertainty of prices and quantities of extraction. • Actual quantity of extraction, and thus government revenues, in a specific future year will be any one of the several probable values estimated today. The divergence between the expected revenue and the realized revenue for any future year imposes a cost on society, referred to as cost of uncertainty or risk. • This is a function of the spread among the different probable values of revenues in future, which in turn are a function of the type of tax regime. Estimation of the cost of uncertainty for different taxes, yields the following: Income tax - High; Severance tax - medium; Property tax - low Variability of Revenues Under Alternative Tax Regimes No. Tax Scenarios Coefficient of Variability I II III IV Base case: all taxes Unit royalty Ad valorem royalty Income tax 0.070 0.024 0.038 0.126 V VI VII Royalty & Income tax Variable royalty Presumptive income tax 0.075 0.124 0.115 VIII Resource rent tax 0.132 The Trade-off: Comparing Costs of Different Taxes Cost Type Income Taxes Royalty Property Tax 0 High High Administration High Low Medium Uncertainty High Low Medium Medium Lowest Highest Inefficiency Total In Conclusion • • • Output related taxes – specific or ad valorem royalty - are easy to administer, produce a stream of tax revenues with lower variability. But these taxes cause economic inefficiency. For variable royalty, economic inefficiencies persist and variability of revenue stream increases. Income related taxes do not create economic inefficiency but have high administrative and compliance costs and produce a revenue stream with higher uncertainty/variability. Additional profits tax or resource rent tax are again economically efficient but are harder to administer and produce revenue streams with higher uncertainty/variability. In Conclusion (Contd.) • Property taxes are both economically inefficient and hard to administer. • A better option may be to use a combination of royalty and corporate income tax. Rather than trading royalty for a resource rent tax, it may be better to keep normal corporate income tax along with a moderate ad valorem royalty. • Tax incentives should be eliminated or reduced. A better approach may be to improve the basic infrastructure, remove the nuisance taxes and lower hidden costs of doing business.