Revenue trends

advertisement

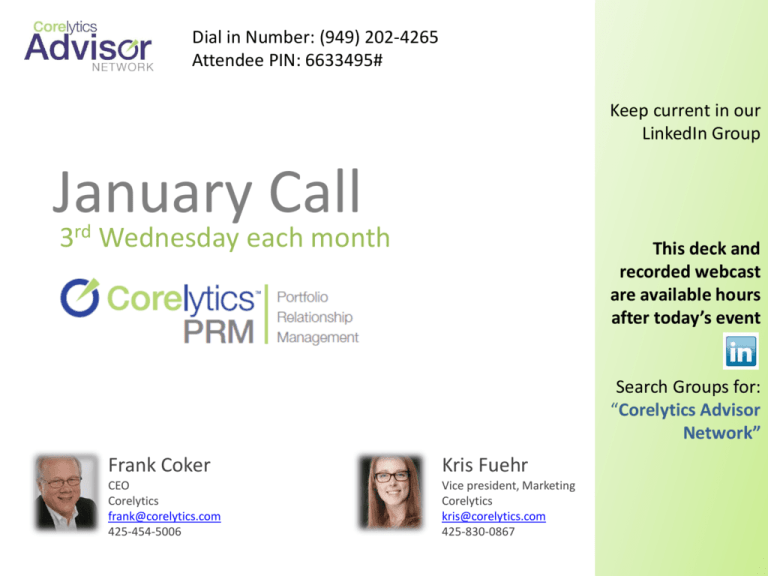

Dial in Number: (949) 202-4265 Attendee PIN: 6633495# Keep current in our LinkedIn Group January Call 3rd Wednesday each month This deck and recorded webcast are available hours after today’s event Search Groups for: “Corelytics Advisor Network” Frank Coker Kris Fuehr CEO Corelytics frank@corelytics.com 425-454-5006 Vice president, Marketing Corelytics kris@corelytics.com 425-830-0867 Agenda • Portfolio Relationship Management (PRM) for more opportunities with clients • Benefits of working with Corelytics Guests stay for an introduction to the Corelytics Advisor Network (veterans can drop off the call.) Who is a Portfolio Manager? · · · · · · · Accountants Advisors Analysts Associations Attorneys Auditors Bankers · · · · · · · Brokers Channel Managers Coaches Consultants Co-ops Franchise Networks Fund Managers · · · · · · · Insurers Investor Groups Lenders M&A Experts Marketing Agencies Partner Networks Peer Group Leaders · · · · · · · PR Agents Researchers Resource Providers Supplier Networks Trade Groups Trading Partners Venture Capitalists What is PRM? • Consolidated view to spot portfolio patterns • Respond to needs of client base as a whole or prioritize individuals • Identify opportunities for specialized or additional services Control Panel View • Manage client access from one place • Configure once for automatic management • You decide where to get the data and how often Group & Spot Portfolio Patterns • Spot problems and opportunities • Define marketing programs based on profiles Trend Analysis Understand portfolio trends • Build a balanced portfolio • Set goals for your advisory team • Change damaging trends Portfolio Alerts • Save time and improve focus • Let the system do the work • You spend time on interpretation and planning Group Views • Use more granular alerts to group clients into solution sets • Stop solving problems one-client-at-a-time • Bring more value by developing solutions for groups of clients Interested? Existing advisors: • Participate in our beta roll-out (now) • Beta participants will be involved in giving feedback on our pricing • Request a pilot setup: frank@corelytics.com • Your request will be queued and prioritized based on your volume of accounts New to Corelytics? • Set up your first 3 accounts • Get in queue at that point *Custom options are available. For Newcomers OVERVIEW OF THE ADVISOR NETWORK Advisor Value • • • • More value Less time data-wrangling New value-added services Marketing, sales & tech support 30 clients, 1 hour/month, $300/mo each client = $100K supplemental annual revenue Typical Advisor Offerings • Subscription-based pricing, usually $300-500/month whereby the advisor remotely consults through monthly or quarterly recurring meetings by logging into the dashboard, reviewing trends for a few minutes before the call, then jointly logging in and reviewing with the client for an hour. This is a 2-hour/month investment of your time at most per client. When client needs rescuing or more help, standard consulting rates apply. • Promotional offer, typically a free initial consultation (phone or in person) and often coupled with a custom “Financial Report” derived from the numbers you get from the dashboard. For a time (until we hit capacity), we can run these for you on request. • Reports and Summaries: Sometimes as simple as a blog, others do webinars with the findings from their industry. We’re doing an Advisor Call Wed this week to talk about “Building your Brand” and this is a key component. + an industry affiliation AND a relationship with the top 2 or 3 associations in your industry. Your ecosystem for growth Corelytics aggregate industry data Clients Industry associations Getting Started Decide if you pay or client pays for dashboard Set up your offerings and pricing Get your first 3 clients (we’ll set them up with you) Co-market/sell, certify, specialize, more… $99/mo retail direct $79/mo $60/mo Thanks! Kris Fuehr Marketing Director Corelytics, Inc. www.corelytics.com kris@corelytics.com 425-830-0867 Frank Coker CEO CoreConnex, Inc. www.corelytics.com frank@corelytics.com 425-454-5006 Industry Focus 1.IT Service (5 Lines of Business = LOBS) ◦Service ◦Project ◦Time & Materials ◦Product ◦Other 2.Restaurant (5 LOBS) ◦Food ◦Beverage ◦Retail ◦Offers/Coupons ◦Other 3.Telecom (10 LOBS) ◦Maintenance Contracts ◦Time & Materials Voice ◦System Sales ◦Commission Sales ◦Structure Cabling ◦Managed Services ◦Project ◦Time & Materials ◦Product Resell ◦Other 4.Audio Visual (7 LOBS) ◦Integration ◦Service ◦Consulting & Design ◦Product Sales ◦Staging ◦Rental ◦Other 23.Landscape Design & Services (Default LOB Set) 24.Legal Services (Default LOB Set) 25.Management Consulting (Default LOB Set) 5.General Business (Default LOB Set) 6.Hotels (General Business (Default LOB Set) 8.Advertising (Default LOB Set) 9.Architecture & Engineering (Default LOB Set) 10.Automotive Repair and Maintenance (Default LOB Set) 11.Biotech (Default LOB Set) 12.Business Consulting (Default LOB Set) 13.Construction: Non- Residential (Default LOB Set) 14.Construction: Residential (Default LOB Set) 15.Dental (Default LOB Set) 16.Dry Cleaning and Laundry Services (Default LOB Set) 17.Electrical Engineers & Contractors (Default LOB Set) 18.Event Planning (Default LOB Set) 21.Industrial Design (Default LOB Set) 22.Interior Design (Default LOB Set) 19.Graphic Design (Default LOB Set) 20.Gym / Fitness (Default LOB Set) 26.Medical Labs (Default LOB Set) 27.Non-Profit (Default LOB Set) 28.Optometrists (Default LOB Set) 29.Physicians: General Practice (Default LOB Set) 30.PR Firms (Default LOB Set) 31.Real Estate Agents / Brokers (Default LOB Set) 32.Real Estate Leasing (Default LOB Set) 33.Retail (Default LOB Set) 34.Salon / Spa (Default LOB Set) 35.Software Development (Default LOB Set) 36.Sports / Recreation (Default LOB Set) 37.Surveying & Mapping (Default LOB Set) 38.Technical Product Manufacturing (Default LOB Set) 39.Travel / Tourism (Default LOB Set) 40.Tree / Plant Nurseries (Default LOB Set) 41.Veterinary Services (Default LOB Set) 42.Wholesale: Durable Goods (Default LOB Set) 43.Wholesale: Non-Durable Goods (Default LOB Set) Call for Stories! Seeking interviews with customers for book (not necessarily Dashboard users) Stories of stagnant small business Industry overviews from experts (Advisors, thought-leaders) Publish date: Dec 2013 Top 10 Areas to Investigate w/Clients Corelytics top 10 things to investigate each month 1. 2. 3. 4. 5. Revenue trends – look at the leading indicator (6 month trend) and at the 24 month trend to see “where the curve is bending.” Whatever the long term growth trend is, the leading indicator is bending that curve up or down. Taken together these curves tell you a lot about where the company is headed. Caution: the goal can’t be to only increase revenue. Increasing revenue can drive a company into the ground if everything else is not working correctly. More companies die from increased sales than from flat or even slowly declining sales. Solutions must be holistic. Expense to revenue trend – compare the 24 month revenue growth rate to the 24 month expense growth rate; if expenses are growing faster than revenues the company is not sustainable in the long-term. Revenue / expense forecast – on the revenue forecast screen click on expenses (red box) and see how the expense trend lines up with the high and low performance scenarios. If these lines cross, that is a highly important clue that expenses and revenues trends are on a potential collision course. Short-term cash trend – go to the cash leading indicator to see where cash is headed in the short-term. The cash leading indicator shows your average cash balance at the end of the month compared with average monthly revenue in the past 3 months. Ideally a company should have the equivalent of more than one month of revenue in cash. The Cash leading indicator should ideally show a number greater than 100% under “actual”, but all too often companies operate close to the line. If they are nearly out of gas, nothing else matters. Long-term cash trend – go to balances, cash and look at the 24 month trend line to see how cash is tracking with revenue and expense. If the long-term cash growth percent is less than the long-term revenue growth trend, you are looking at a company that is not healthy. It means that the company is not building cash. If a company can’t build cash over time, there is a clue that they are not managing their resources and they are putting their company at risk by not conserving cash. 6. 7. 8. 9. 10. Margin growth – compare the 24 month margin growth rate with the 24 month revenue growth rate. If revenue is growing faster than gross margin, the company is actually losing ground as it grows. Companies in this condition should stop revenue growth and should focus on underlying costs (specifically on COGS) and figure out if costs are too high or prices are too low. The underlying problem should be fixed before the company pushes for growth. COGS validation – be sure that all direct costs are mapped to COGS, if not, you will not know if your pricing is correct and you will not know where to make adjustments to improve net profit. Profit growth – if revenue is increasing faster than profit, your company is working harder and you are getting smaller profits as you grow and basically have a business that is going downhill. This is generally a big clue that the business is fundamentally unhealthy. This problem should have been noticed in one of the earlier steps, but, if not, this is the final proof that the company is either healthy or unhealthy. if your COGS are accurate and your gross margin is increasing faster than revenue, then the only thing left that will improve profits is a reduction to overheads. Progress against goals – and big problems are going to be discovered in the prior 8 steps. The big problem areas need to have goals. Then each month, review progress against the most important goals. Only focus on 2 or 3 goals per month. The charts showing progress toward goals should be copied to a word document or a slide and shared with the broader management team. They need to see the gap between actual and goal and they need to participate in closing the gap. The gap should be monitored every month until progress is made and the gap is on a track to close. [Recommendation – set the start date for growth goals to at least 6 months in the past; 12 months is better. That way you can see much more clearly how trends compare with goals over the long term. Goals are not the same as a budget. They are there to show desired direction.] LOB performance – don’t dig too deep into LOB performance until the company is comfortable with the combined view of their financials. The goal of LOB analysis is to find the LOB that is contributing the most to profitability and the one that is performing the worst. Thought should then be given to maximizing winners and minimizing losers.