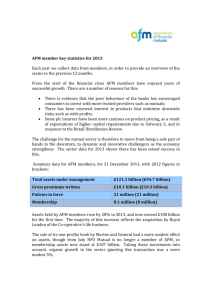

AFM key statistics 2011 - Association of Financial Mutuals

advertisement

Market-leading performances by AFM members in 2011- again Mutuals have on the whole continued to fare very well, despite the turbulent economy and a tough insurance market. Data collected from AFM members for the year to 31 December 2011 show that premiums written grew during the year by a very impressive 15%. On a like-forlike basis, ie excluding new members, premiums rose 12.5%. During the year, 63% of AFM member premiums were in life and investments, 34% in general insurance, with the remaining three per cent in health care. Assets too were up, increasing by a healthy 5% in the year, and exceeding £90 billion for the first time. And a report from Money Management from August 2012 showed that, judged by Realistic Free Asset Ratios, eight of the strongest life offices are mutual. These levels of growth are all the more striking, given general trends in the insurance market for lower sales: for example FSA reports new retail investments sales down over 11% in 2011 (data on general insurance volumes in 2011 is not yet available, but volumes appear to have been generally flat). At the end of 2011, key statistics included the following (2010 figure in brackets): Total assets under management £90.3 billion (£85.9 billion) Gross premiums written £9.7 billion (£8.4 billion) Employees 16,224 (16,030) Policies in force 21,175,000 (20,300,000) Claims paid £6.7 billion (£8.3 billion) Amongst the 21 million policyholders in the sector, around 8.5 million are also members (against 8.55 million in 2010). This marks the fourth year of growth for the sector, as the charts below demonstrate. AFM member assets (£bn) 100 90 80 70 60 50 2008 2009 2010 2011 Healthy increases in premium income within mutuals in the past few years are in stark contrast to the UK insurance sector as a whole- whilst 2011 data is not yet available, FSA data shows the life sector in particular has seen a rapid fall in volume since 2007. This means of course that the mutual sector’s market share has increased significantly over the last few years. AFM member premiums (£bn) 10 9 8 7 6 5 2008 2009 2010 2011 However it would be wrong to assume that the sector is unaffected by the continuing recession and fall in consumer confidence: not all organisations reported strong growth, and of course in 2011 a number of long-established brands disappeared. But many people are beginning to appreciate the better standards of service and potential for higher returns from mutuals, and this has made mutuals increasingly attractive to consumers and their advisers. The following tables reinforce the level of concentration in the sector, with the largest five mutuals accounting for 83% of assets and 80% of premium income in 2011. Whilst we would expect that trend to continue, there are however some less familiar names in the mutuals that have grown most rapidly over the last three years. Largest AFM Members at the end of 2011, by asset size 1 Royal London Group £38.6 billion 2 NFU Mutual £12.3 bn 3 LV= £10.3 bn 4 Equitable Life £8.7 bn 5 Wesleyan Assurance £4.8 bn 6 MGM Advantage £2.2 bn 7 Ecclesiastical £1.8 bn 8 Reliance Mutual £1.7 bn 9 Family Investment £1.1 bn 10 B&CE Benefits £0.9 bn Largest AFM Members at the end of 2011, by premiums written 1 Royal London Group * £2,861 million 2 LV= £2,197 m 3 NFU Mutual £1,384 m 4 Family Investment £781 m 5 Ecclesiastical Insurance £484 m 6 Wesleyan Assurance £333 m 7 MGM Advantage £320 m 8 Scottish Friendly £130 m 9 Equitable Life £117 m 10 Forester Life £117 m Most rapidly growing members over three years, by change in assets 2009-2011 1 Compass Friendly Society Limited 66% 2 Red Rose Friendly Society 43% 3 Healthy Investment 32% 4 Sheffield Mutual Friendly Society 25% 5 Druids Sheffield Friendly Society 25% 6 Oddfellows Manchester Unity 23% 7 Ecclesiastical 21% 8 Transport Friendly Society Limited 18% 9 MGM Advantage 16% 10 LV= 14% Most rapidly growing members over three years, by premium income increase 2009- 2011 1 Oddfellows Manchester Unity 2 Red Rose Friendly Society 3 Transport Friendly Society 4 Druids Sheffield Friendly Society 5 Family Investments 6 Kingston Unity Friendly Society 7 Engage Mutual 8 MGM Advantage 9 LV= 10 Healthy Investment 114% 91% 75% 51% 37% 32% 31% 29% 27% 26% Further information on AFM member statistics is available on the AFM website, with more information on 2011 data available soon: http://www.financialmutuals.org/advantage/key-statistics