personal budget assignment

advertisement

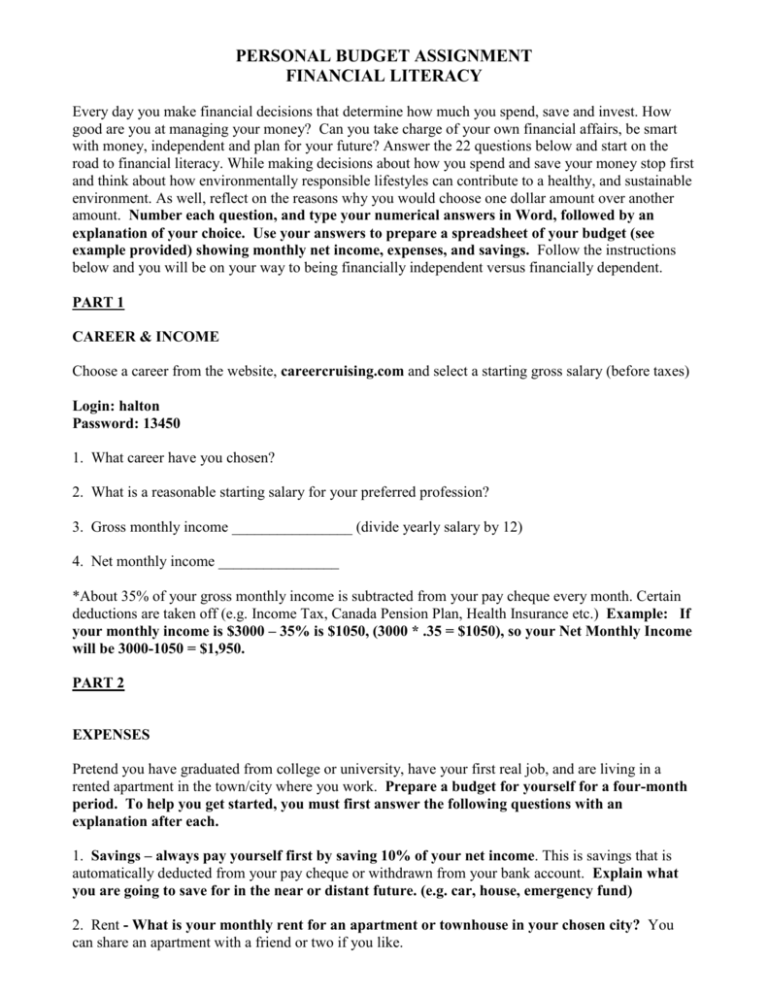

PERSONAL BUDGET ASSIGNMENT FINANCIAL LITERACY Every day you make financial decisions that determine how much you spend, save and invest. How good are you at managing your money? Can you take charge of your own financial affairs, be smart with money, independent and plan for your future? Answer the 22 questions below and start on the road to financial literacy. While making decisions about how you spend and save your money stop first and think about how environmentally responsible lifestyles can contribute to a healthy, and sustainable environment. As well, reflect on the reasons why you would choose one dollar amount over another amount. Number each question, and type your numerical answers in Word, followed by an explanation of your choice. Use your answers to prepare a spreadsheet of your budget (see example provided) showing monthly net income, expenses, and savings. Follow the instructions below and you will be on your way to being financially independent versus financially dependent. PART 1 CAREER & INCOME Choose a career from the website, careercruising.com and select a starting gross salary (before taxes) Login: halton Password: 13450 1. What career have you chosen? 2. What is a reasonable starting salary for your preferred profession? 3. Gross monthly income ________________ (divide yearly salary by 12) 4. Net monthly income ________________ *About 35% of your gross monthly income is subtracted from your pay cheque every month. Certain deductions are taken off (e.g. Income Tax, Canada Pension Plan, Health Insurance etc.) Example: If your monthly income is $3000 – 35% is $1050, (3000 * .35 = $1050), so your Net Monthly Income will be 3000-1050 = $1,950. PART 2 EXPENSES Pretend you have graduated from college or university, have your first real job, and are living in a rented apartment in the town/city where you work. Prepare a budget for yourself for a four-month period. To help you get started, you must first answer the following questions with an explanation after each. 1. Savings – always pay yourself first by saving 10% of your net income. This is savings that is automatically deducted from your pay cheque or withdrawn from your bank account. Explain what you are going to save for in the near or distant future. (e.g. car, house, emergency fund) 2. Rent - What is your monthly rent for an apartment or townhouse in your chosen city? You can share an apartment with a friend or two if you like. Check the classified sections of newspapers. (e.g. The Toronto Star, Hamilton Spectator or Burlington Post (print the classified ad to hand in with your assignment) 3. Food – Create a weekly shopping sample menu (see example provided) by going to such sites as grocerygateway.com to get prices for your food items. Multiply your weekly total $ amount of groceries by 4 to come up with an estimated monthly total. Compare your monthly total with the monthly average that follows: Groceries including snacks, plus household cleaning supplies: Daily average $12.50 to $15.00 per person. (12.50 X 30 days = $375/month) Ask yourself, is my monthly grocery bill realistic or not? 4. Transportation - Your options are: taking the bus, leasing (or renting) a car, or purchasing a used car. A city bus pass costs $80.00 a month. Please explain why you would be taking a bus, instead of having a car, and tell me why it would benefit you. Research your monthly car or lease payment by checking out such websites as www.autotrader.ca, www.leasebusters.com and www.driverlane.com/calculator/calc.asp Car loans or lease arrangements usually are for 3 to 5 years. (print the car information to hand in with your assignment) 5. Automobile costs – Car operation – (gas/oil) $150 to 175 per month. (consider such factors as: environment, car usage, season, distance, supply and demand) 6. Car Insurance – ($2000-$3600 per year ) (Factors: gender, age, area you live in, driving record, type car) 7. Cellphone – Options: 1) Pay as you go -$20.00 per month, 2) Contract $45.00 to $90.00 per month, 3) Landline – basic charge - $25.00 per month. Choose at least one of the options. (Factors: type of career, features desired) 8. T.V. & Internet – basic cable & Internet $35 to $75 per month. Choose one or both (Factors: high def, speed of modem, number of channels etc.) 9. Credit Card Payments – usually $64 to $74 per month (avoid credit where possible) Explain in detail the types of items you are putting on your credit card each. (e.g. you might put $64 worth of items in one month and then have $74 in another month) Be realistic. 10. Grooming – haircuts, personal hygiene products, soap, shampoo, toothpaste, cosmetics, medications, $35 to $70 per month (what would your money go towards each month e.g Haircut in one month, hygiene products the next etc.) 11. Recreation – movies, books, magazines, DVD rentals, concerts, eating out, $50 to $100 per month. (same as above-explain what you would spend your money on each month) 12. Utilities – heat, hydro, water, depends if it is covered in your rent or not, $50 to $100 per month (Factors: amount of usage, time of year) 13. Hobbies – depends what you do, $25 to $50 per month (describe what interests you would spend your money on) 14. Employment expenses - coffee fund at work, work social committee fund, buying your lunch, $10 to $200.00 per month (explain how much money you would contribute and why?) The following 8 categories don’t require any explanation. Just indicate the realistic amount on your budget spreadsheet: 15. Clothing – boots, shoes, bathing suits, jackets, suits etc. (remember to consider all seasons) $100 to $150 per month. 16. Health and Life Insurance – can range from $100 to $500 per month. Be realistic, that you will most likely need health, dental and property insurance. 17. Sports club membership - $25 to $50 per month 18. Maintenance/Repairs – redecorating, household repairs $15 to $20 per month 19. Buying Gifts for others – birthdays, Christmas etc. $35 to $50 per month 20. Travel/Vacation – once a year and/or small holidays throughout the year $50 to $85 per month 21. Charity – gifts of money to charitable organizations like world wild life, cancer society, food bank, church, $15 to $20 per month. 22. Student loan payment – depends on the location of your post secondary education: $100 per month if you stayed close to home and $200 per month if you moved away for school Now enter your numbers into an Excel Spreadsheet and make sure you use appropriate formulas. PART 3 REFLECTION Once you have completed the budget in Excel, reflect on how you are spending your money. You may discover you are spending more than you are making or have little money left. Describe in 3 to 4 paragraphs what you would do differently to cut down on your monthly expenses and to try and save money. (so that you have more surplus or profit each month) (e.g. you may be spending $10 per day on lunch and coffee, which would equal about $200 a month, so you might consider “brown bagging it” and save that money for a vacation, or maybe work out at home, instead of paying for a gym membership) Keep in mind that you have more control over your variable expenses then your fixed expenses. Look at all your variable expenses first and see if you can save some money. Fixed expenses are expenses that don’t generally change from month to month, like rent, most utilities and car payments. Variable expenses are expenses that can easily change, like the amount spent on food, entertainment or clothing. Total your fixed expenses per month ___________________ Total your variable expenses per month ___________________ PART 4 INVESTMENT You have inherited $10, 000 from the passing away of your Great Aunt May. Create an investment plan in the chart provided, showing how you will invest the money (see Mrs. Oates’ example provided). Fill in the “Amount of each investment”, “Type of Investment” and a description of what you are saving up for. In full sentences in Word, comment on your choice of lifestyle, level of risk and expectant return and why you chose the investment type that you did. Give reference to terms discussed in class. Amount of Investment Type of Investment and Length of time Description of what you are saving for Your assignment must include: -Title Page -Word Document with questions, answers and explanations -Personal Budget Excel Spreadsheet -Reflection on budget and how to save money by cutting back expenses (in Word) -Investment chart and explanation (in Word) Yearly wages: x Gross Pay/Month Net Pay/Month (after taxes) Expenses Savings 10% of net pay Rent Food Transportation Automobile Costs Car Loan/Lease Payment Car Insurance Car Ex. (gas, oil changes) Cellphone TV & Internet Credit Card Payment Grooming Recreation Emergency Savings Clothing Insurance (tenant etc..) Education Sports Clubs Maintenance/Repairs Gifts Travel/Vacation Chairty Utilities Hobbies Student Loan Payment Employment Expenses Add another Add another TOTAL Surplus Deficit PERSONAL BUDGET Name: your name here Date: Job Title: x January February March April Total Percent EVALUATION RUBRIC 1 2 3 4 Research Skills Thing Research is not complete. Most numbers are made up. Research has some holes and non-factual numbers. Research is complete, using a variety of sources, numbers are realistic. Came up with ideas for environmental responsibility. Research is thorough using a variety of sources for each aspect, numbers are realistic. Came up with ideas for environmental responsibility. Spreadsheet (A) Spreadsheet has many formatting problems, no use of formulas. It is difficult to understand, no pie graph. Spreadsheet has some formatting problems but you’re learning. Attempted a pie graph. Spreadsheet is properly formatted and easy to read and use, formulas are used correctly where necessary, pie graph used effectively. Spreadsheet is properly formatted and easy to read and use, formulas are used effectively, pie graph used with advanced knowledge. Knowledge of content (K/U) Demonstrates limited understanding of budgeting and financial literacy. Demonstrates some understanding of budgeting and financial literacy by the way questions are answered and assignment completed. Demonstrates considerable understanding of budgeting and financial literacy by the way questions are answered and through completion of assignment expectations. Demonstrates considerable understanding of budgeting and financial literacy by the way questions are answered and through completion of assignment expectations. Memo Formatting Skills (C) Memo format is not used properly, does not effectively communicate ideas and information required. Memo format is used, communicates ideas and information with some effectiveness. Memo format is used correctly with parent comments and signature, communicates information with considerable effectiveness. Memo format is used correctly with parent comments and signature, communicates information with a high degree of effectiveness.