Adding Value To Your Portfolio In Alternatives

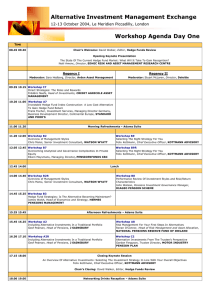

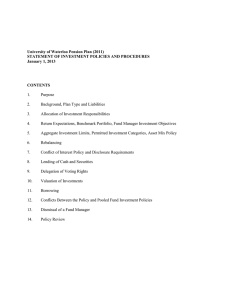

advertisement

7th Annual Economic & Financial Development Conference Today’s Challenges, Tomorrow’s Opportunities & Pension Funds July 11-13, 2012 The Biltmore Hotel Miami, Florida Presented by: Tim Johnson, Allegheny County Administrative Director and Past Retirement Board Trustee YOUR LEADERSHIP ROLE AS A STEWARD OF PUBLIC FUNDS GETTING YOUR EMPLOYEES FINANCIALLY FIT IN 2012 NEW STRATEGIES IN ALTERNATIVE INVESTMENTS THE EVOLVING ROLE OF INVESTMENT CONSULTANTS LEGAL ISSUES FACING PUBLIC PENSION PLANS THE FUTURE OF PUBLIC PENSION PLANS IN ALLEGHENY COUNTY TRUSTEE BOOT CAMP Background: Established by the County Commissioners in 1915 to invest retirement funds for the benefit of fund members. Board of Trustees: Consists of seven members each serving a four year term. Employees/Retires: 7,479/4,407 Contribution: 6% (8% Member/8% Employer) Market Value of Assets: $729 Million Return Assumption: 7.75% Formula: Highest 52 contributions of the last four years Benefit Multiplier: 2.5% (Full Pension at age 60 with 20 years of service) Consultants: Wilshire, PFM and Asset Strategy Actuary: Cowden Associates Attorney: Campbell, Durant, Beatty, Palombo and Miller Act ”leadership drives performance!” Allocate “Put your money where your mouth is!” Asset “Alternatives continue to win pension assets” Advise “Bigger isn’t always better!” Administer ”from 1.21 to 1.46!” “The ultimate measure is not where you stands in moments of comfort, but at times of challenge and controversy.” Martin Luther King, Jr. “Great leaders are almost always great simplifiers, who can cut through argument, debate, and doubt to offer a solution everybody can understand.” General Colin Powell “One who knows the way, goes the way, and shows the way.” - John C Maxwell RBAC Asset Allocation Products of March 31, 2012 Market Val. Allocation Target of March 31, 2009 Var. Market Val. Allocation Target Var. EQUITY 317.1 43.5% 40% 3.5% 211.9 38.8% 52.5% -13.7% FIXED INCOME 208.9 28.6% 27% 1.6% 184.2 33.8% 30% 3.8% ALTERNATIVES 194.6 26.7% 33% -6.3% 137.9 25.3% 17.5% 7.8% Private Equity 93.6 12.8% 15% -2.2% 53.6 9.8% 5% 4.8% Real Estate 47.9 6.6% 10% -3.4% 46.8 8.6% 10% -1.4% 26 3.6% 8% -4.4% 15.3 2.8% 2.5% .3% 26.6 3.6% 0% 3.6% 0 0% 0% 0% .5 .1% 0% 1.2% 22.2 4.1% 0% 4.1% CASH 8.6 1.2% 0% 1.2% 11.7 2.1% 0% 2.1% TOTAL 729.1 100% 100% 0% 545.7 100% 100% 0% Commodities Life Settlement Hedge Asset… Some of the characteristics of alternative investments may include: •Low Alternative investments comprise groups of investments with risk and return characteristics that differ markedly from those of traditional stock and bond investments. correlation with traditional financial investments such as stocks and shares •Alternative investments may be relatively illiquid •It may be difficult to determine the current market value of the asset •There may be limited historical risk and return data •A high degree of investment analysis may be required before buying •Costs of purchase and sale may be relatively high Alternatives Continue to Win Pension Assets By Emma Boyde Financial Times Limited July 7, 2012 http://www.ft.com/cms/s/0/0e32eeb6-c42c-11e1-9c1e-00144feabdc0.html#axzz20FRY7s5n Public Pension Suckers For Private Equity By Edward Siedle Forbes Feb 16, 2012 http://www.forbes.com/sites/edwardsiedle/2012/02/16/public-pension-suckers-for-privateequity/ Alternatives pioneer PennSERS trims sails PennSERS cites liquidity needs in slashing its allocation By Rob Kozlowski June 25, 2012 http://www.pionline.com/article/20120625/PRINTSUB/306259980/alternatives-pioneerpennsers-trims-sails?goback=%2Egde_1830538_member_127867746 Advise… A Premier Boutique Investment Consulting Firm Very Focused: Consulting only with endowments, foundations and retirement plans in middle market Independent and Objective: Our firm has no affiliation with brokerage firms, banks, insurance companies, or any other product vendors Professional Fee Basis Only: No acceptance of commissions or finders fees from any product providers “We assist clients in the pursuit of achieving superior investment performance, reducing risks, and controlling expenses of their portfolios.” Edwin R. Boyer www.assetstrategyconsultants.com Investments Commitments 11 Investments 2003 – 2008 $100,733,000 $85,093,632 $103,294,276 1.21 14 Investments 2009 – 2012 $60,750,000 24,768,225 36,132,811 1.46 $161,483,000 $109,861,857 $139,427,087 1.27 25 Investments Amounts Contributions Asset Value + Distributions Return Act – Objectives are the building blocks of the portfolio. Allocate – Translate objectives into allocation by directing consultant to construct model. Asset – Learn the asset before investing. Advise - Select the consultant that meets your needs. Administer - Monitor portfolio closely. Timothy H. Johnson, Director Allegheny County Department of Administrative Services 436 Grant Street – Room 202 Courthouse Pittsburgh, PA 15219 412-350-6109 tjohnson@alleghenycounty.US