principals of book keeping. - Indian Institute of Banking & Finance

advertisement

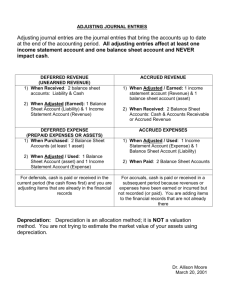

ACCOUNTING AND FINANCE FOR BANKERS – Book Keeping - Module B K.ESWAR. MBA( XLRI) CHIEF MANAGER & FACULTY SPBT COLLEGE. MUMBAI DEFINITION AND SCOPE ACCOUNTING STANDARDS. • ACCOUNTING IS LANGUAGE OF BUSINESS. • COMMUNICATE THE RESULT OF BUSINESS OPERATIONS AND ITS OTHER ASPECTS. • ACCOUNTING IS AN ART OF RECORDING CLASSIFYING AND SUMMARIZING IN A SIGNIFICANT MANNER AND IN TERMS OF MONEY TRANSACTIONS AND EVENTS WHICH ARE IN PART AT LEAST OF FINANCIAL CHARACTER AND INTERPRETING THE RESULTS THEREOF. DIFFERENCE BETWEEN ACCOUNTANY AND BOOKKEEPING. • BOOK KEEKPING IS MERELY RECORDING THE BUSINESS TRANSACTIONS IN BOOKS AND LEDGERS . • ACCOUNTANCY IS WIDER CONCEPT: COMPLIATION OF ACOUNTS IN SUCH A WAY THAT ONE IS IN A POSITION TO UNDERSTAND STATE OF AFFAIRS OF BUSINESS. • USERS OF FINANCIAL STATEMENTS ARE INCOME TAX DEPARTMENT, S.T DEPARMENT SHAREHOLDERS, INVESTORS ,BANKS AND FIS AND SO ON. • IT IS IN THE INTEREST OF ALL THAT FINANCIAL STATEMENTS REFLECT TRUE AND FAIR VIEW OF STATE OF AFFIAIRS OF A BUSINESS ENTITY. ACCOUNTANCY • ACCOUNTANCY INVOLVES: • SYSTAMATIC CLASSIFICATION OF BUSINESS TRANSACTIONS IN TERMS OF MONEY AND FINANCIAL CHARACTER. • SUMMARIZING : TRAIAL BALANACE AND B/S • INTERPRETING THE FINANCIAL TRANSACTIONS. PURPOSE OF ACCOUNTANCY • TO KEEP A SYSTAMATIC RECORD • TO ASCERTAIN THE RESULTS OF OPERATIONS • TO ASCERTAIN FINANCIAL POSITION OF BUSINESS. • TO FACILITATE RATIONAL DECISION MAKING • TO SATISFY REQUIREMENT OF LAW AND USEFUL IN MANY RESPECTS. CONCEPTS OF ACCOUNTANCY. • COST CONCEPT: BUSINESS TRANSACTIONS ARE RECORDED IN BOOKS AT COST PRICE. • FIXED ASSETS ARE KEPT AT COST OF PURCHASE AND NOT AT THEIR MARKET PRICE. • EVERY TRANSACTION IS RECORDED WITH PRESENT VALUE AND NOT ANY FUTURE VALUE. • UNREALIZED GAINS ARE IGNORED. • COST OF AN ASSET THAT HAS LONG BUT LIMITED LIFE IS SYSTAMATICALLY REDUCED BY A PROCESS CALLED DEPRECIATION. BUT SUCH DEPRECIATION HAS NO RELATION TO MARKET VALUE OF ASSET. MONEY MEASUREMENT CONCEPT • MONEY MEASUREMENT CONCEPT: EVERY TRANSACTION IS MEASURED IN TERMS OF MONEY. VIZ PRODUCTION/SALES/WAGES ETC ALL CONVERTED TO MONEY. • INFLATION OR DEFLALTION NOT INCLUDED IN VALUE OF ANY ASSET. BUSINESS ENTITY CONCEPT • THIS CONCEPT SEPARATES THE ENTITY OF PROPRIETOR FROM THE BUSINESS TRANSACTION. • CAPITAL CONTRIBUTED BY THE OWNER IS LIABILITY FOR BUSINESS BECAUSE BUSINESS IS DIFFERENT FROM OWNER. • ANY MONEY WITHDRAWN BY PROP. IS DRAWINGS. • PROFIT IS LIABILITY AND LOSS IS AN ASSET. • ALL ENTRIES ARE KEPT FROM THE POINTOF VIEW OF BUSINESS AND NOT FROM OWNER. • AN ENTERPRISE IS ECONOMIC UNIT SEPARATE FROM OWNER. REALISATION CONCEPT. • THIS CONCEPT TELLS US WHEN REVENUE IS TREATED AS REALISED OR EARNED. IT IS TREATED AS REALIZED ON THE DATE WHEN PROPERTY IN GOODS PASSES TO BUYER AND HE BECOMES LEGALLY LIABLE TO PAY. • NO FUTURE INCOME IS CONSIDERED. • GOODS SOLD ON APPROVAL WILL BE INCLUDED IN SALES BUT ON COST ONLY. GOING CONCERN CONCEPT • BUSINESS IS A GOING CONCERN AND TRANSACTIONS ARE RECORDED ACCORDINGLY. • IF AN EXPENSE IS INCURRED AND UTILITY IS CONSUMED DURING THE YEAR, THEN IT IS TREATED AS AN EXPENSE OTHERWISE IT IS RECORDED AS AN ASSET. • RESERVES AND PROVISIONS ARE CREATED FOR ANY FUTURE LIABILITY. • DEFERRED REVENUE EXPENDITURE IS WRITTEN OFF OVER NUMBER OF YEARS. • WHY LOSS IS SHOWN UNDER ASSETS SIDE ? DUAL ASPECT CONCEPT • EVERY TRANSACTION HAS DOUBLE EFFECT. • ACCOUNTING EQUATION: ASSETS= CAP+ LIABILITY. ACCOUNTING PERIOD CONCEPT. • BUSINESS WILL RUN THROUGH LONG PERIOD. HENCE ACCOUNTS OF EACH PERIOD IS RECORDED. • RESULTS OF OPERATIONS CAN BE KNOWN PRECISELY ONLY AFTER BUSINESS CEASES TO OPERATE AND ENTIRE ASSETS ARE SOLD AND ENTIRE LIABILITIES PAID. • BUT ONE IS INTERESTED IN KNOWING PERIODICALY OPERATING RESULTS OF BUSINESS SAY YEARLY OR HALF YEARLY OR QUARTERLY. • HENCE ALL THE EXPENSES OR INCOME DURING THIS ACCOUNTING PERIOD HAS TO BE TAKEN INTO CONSIDERATION IRRESPECTIVE OF WHETHER THEY ARE REALISED IN CASH OR PAID IN CASH. ACCOUNTING FOR FULL DISCLOSURE • DISCLOSURE OF MATERIAL FACTS.( MATERIAL AND IMMATERIAL FACT IS MATTER OF JUDDGEMENT) • CONTINGENT LIABILITY • MARKET VALUE OF INVESEMENTS. CONVENTION OR PRINCIPLES OF CONSERVATISM • ALL POSSIBLE LOSSES TO BE TAKEN INTO CONSIDERATION AND ANTICIPTED PROFITS TO BE IGNORED. • CREATION OF PROVISION FOR DOUBTFUL DEBTS. • VALUE OF STOCK • CONVENTION OF CONSISTENCY: METHOD OF DEPREICATION. DOUBLE ENTRY SYSTEM • SCIENTIFIC SYSTEM: • EVERY TRANSACTION HAS TWO ASPECTS. • CRUX OF ACCOUNTANCY IS TO FIND OUT WHICH TWO ACCOUNTS ARE EFFECTED AND WHICH IS TO BE DEBITED AND WHICH IS TO BE CREDITED. JOURNAL • JOURNAL RECORDS EACH AND EVERY RECORD. • BUT TO FIND OUT A TRANSACTION EFFECTING A PERSON, EXPENSES ACCOUNT OR ASSET ONE HAS TO TURNOVER ALL PAGES OF JOURNAL . • HENCE TRANSACTIONS ARE POSTED FROM JOURNAL TO PARTICULAR PAGES OF LEDGER. • HENCE JOURNAL CONTAINA COLUMN L.F JOURNAL FORMAT DATE PARTICULARS L.F DEBIT RS. CREDIT RS. CASH BOOK • CASH BOOK KEEPS RECORDS OF ALL CASH TRANSACTIONS I.E CASH RECEIPTS AND CASH PAYMENTS. ALL RECEIPTS ARE RECORDED ON RIGHT SIDE AND ALL PAYMENTS ON LEFT SIDE. • CASH BOOK IS BOOK OF ORIGINAL ENTRY. CASH BOOK FORMAT DR. DATE CR PARTI CULA RS R.NO L.F CASH BANK DISCO UNT DATE PARTI CULA RS VR.N O. LF CASH BANK DISCO UNT RECORD KEEPING BASIS • RECORDING: JOURNALISING AS AND WHEN TRANSACTION TAKES PLACE. JOURNAL IS BOOK OF ORIGINAL OR FIRST ENTRY. • CLASSIFYING: ALL ENTRIES IN JOURNAL OR SUBSIDIARY BOOKS ARE POSTED TO LEDGER ACCOUNT(POSTING) TO FIND OUT AT A GLANCE THE TOTAL EFFECT OF ALL SUCH TRANSACTIONS. LEDGER IS BOOK OF SECONDARYENTRY. • SUMMASRISING: LAST STAGE IS TO PREPARE THE TRIAL BALANCE AND FINAL ACCOUNTS WITH A VIEW TO ASCERTAIN THE PROFIT OR LOSS DURING PARTICULAR PERIOD. • IT IS CUSTOMARY TO USE TO AND BY WHILE POSTING LEDGER. • BALANCING AN ACCOUNT MEANS EQUALIZTING TWO SIDES. • IF DEBIT SIDE OF ACCOUNT EXCEED CREDIT SIDE, DIFFERENCE IS PUT ON CREDIT SIDE AND IT IS SAID TO HAVE DEBIT BALANCE AND VICE VERSA.. LEDGER DR DATE CR PARTICU LARS J.F AMOUN T(RS) DATE PARTICU LARS J.F AMOUN T RS. Questions. • CREDIT BALANCE IN CAPITAL ACCOUNT IS LIABILITY OR AN ASSET: • A. LIBILITY • B. A REVENUE • C. AN EXPENSE • D. NONE OF THESE. QUESTION • AMOUNT BROUGHT IN BY PROPRIETOR IN BUSINESS SHOULD BE CREDITED TO • A. PROPRIETORS ACCOUNT • B.DRAWINGS ACCOUNT • C.CAPITAL ACCOUNT • D.ASSET ACCOUNT QUESTIONS • • • • • WAGES PAID TO RAJU TO BE DEIBED TO A. RAJU B WAGES C. CASH D. BANK QUESTIONS. • Q. CREDIT SALES MADE TO ROHIT TO BE DEIBTED TO • A. SALES • B. PURCHASE • C. CASH • D. ROHIT QUESTIONS • FURNITURE PURCHASED BY ISSUING CHEQUE • WHAT ENTRIES TO BE PASSED • A. DEBIT FURNITURE AND CREDIT BANK ACCOUNT • DEBIT BANK ACCOUNT AND CREDIT FURNITURE • DEBIT FURNITURE AND CREDIT CASH. • DEBIT BANK AND CREDIT FUNITURE SHOP ACCOUNT QUESTIONS • • • • • RETURN OF GOODS SHOULD BE CREDITED TO A. SALES RETURN B PURCHASE RETURN C.CUSTOMER ACCOUNT D. GOODS ACCOUNT MATCH FOLLOWING A B A RAMESH 1 REAL B DENA BANK 2 PERSONAL C RENT 3 NOMINAL D COMPUTER 4 REAL E LAND 5 NOMINAL F DISCOUNT 6 PERSONAL QUESTION • • • • • WHAT IS JOURNAL ENTRY A. ORIGINAL ENTRY B. DOUBLE ENTRY C DUPLICATE ENTRY NONE QUESTION • TRANSACTION IN BANK COLUMN ON CREDIT SIDE OF THREE COLUMNAR CASH BOOK INDICATE • A. AMOUNT WITHDRAWN FROM BANK • B.AMOUNT DEPOSITED IN BANK • C.BOTH A AND B • D. NONE QUESTION • PASS JOURNAL ENTRY: • RENT PAID FOR OFFICE PREMISES RS.30000 OUT OF WHICH PART AMOUNT OF RS.10000 PAID BY CHEQUE AND REST BY CASH. QUESTION • PASS JOURNAL ENTRY: • PURCHASED 100 SHARES OF CENTRAL BANK OF INDIA FOR RS.100 PER SHARE. QUESTIONS • PASS JOURNAL ENTRY: • SOLD GOODS TO TENDULKAR RS.15000 QUESTIONS • PASS JOURNAL ENTRY: • DRAVID INVOICED GOODS FOR RS.12000 TO US. QUESTIONS • PASS JOURNAL ENTRY: • RECEIVED DUE AMOUNT FROM TENDULAKAR AND ALLOWED HIM DISCOUNT OF 10% QUESTIONS • PASS JOURNAL ENTRY: • PAID SALARY AND RENT RS.1200 AND 1500 RESPECTIVELY. QUESTIONS • PASS JOURNAL ENTRY: • KIRAN BECAME INSOLVENT. HE HAD TO PAY 10000 TO US. BUT WE RECEIVED ONLY 25 PAISE A RUPEE. QUESTION • PASS JOURNAL ENTRY: • PAID MONTHLY CAR INSTALMENT OF PROPRIETOR’S PERSONAL CAR RS.12000 QUESTION • PASS JOURNAL ENTRY: • BOUGHT FURNITURE FROM GODREJ AND PAID BY CHEQUE RS.50000 QUESTION • PASS JOURNAL ENTRY: • DEPOSITED CASH IN BANK RS.1000 QUESTION JOURNALIZE FOLLOWING: COMMENCED BUSINESS WITH Rs.15000 OF WHICH RS.5000 WAS BORROWED FROM HIS WIFE AT 12% INTEREST P.A. QUESTIONS • PASS JOURNAL ENTRY: • PURCHASED GENERATOR FROM RAMA & CO. RS.50000 QUESTIONS • PASS JOURNAL ENTRY: • PAID CARRIAGE AND CARTERAGE ON GOODS SOLD TO NAYAN ON HIS BEHALF. QUESTION • PASS JOURNAL ENTRY: • BOUGHT GOODS FROM SATISH AT ONE MONTHS CREDIT RS.6000 • OUT OF WHICH HALF WAS INVOICED TO MR. RAM AT 30% ABOVE COST. Adjusting and closing entries. • While preparing trading and profit and loss account all expenses and income for the full period are to be taken into consideration. If expenses have been incurred but not paid during that period ,liabilities for unpaid amount should be created before the accounts can be said to show the actual profit and loss. All expenses and income should properly be adjusted through accounting entries. Adjusting and closing entries. • Trial balance is prepared from the books of accounts of organiztion. Final accounts are the final processof accounting. Once the trial balance is prepared the books are half way closed. • Now all ajusting enties passed at the time of preparing the final accounts have dual effect i.e both debit and credit. • Hence all adjusting entries passed after Trial balance drawn will have two effects. Adjusting and closing entries. • One in either trading and profit and loss account and other in Balance sheet or one in trading account and other in Profit and loss account. Adjusting and closing entries. • Some examples: • Closing stock adjustment: • Will be shown in asset side of balance sheet and will be shown in credit side of trading account. • Goods lost by fire: • Will be shown in credit side of trading account. • Will be shown on debit side of profit and loss Adjusting and closing entries. • Outstanding expenses: • Will be shown in debit side of profit and loss account. • Will be shown in liabilities side of balance sheet. • Prepaid expenses: • Prepaid expensesshown in Asset side ( Dr Pre paid expenses) and Credit P&L Expenditure as they do not pertain to current year. Adjusting and closing entries. • Depreciation: It is fall in value of asset due to use or passage of time. • Depreciation Dr. • To asset account. ACCOUNTING STANDARDS. • INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA RECOGNISING THE NEED TO HARMONISE THE DIVERSE ACCOUNTING POLICIES AND PRACTICES CONSTITUTED AN ACCOUNTING STANDARDS BOARD IN THE YEAR 1977. • ASB FORMULATE ACCOUNTING STANDRDS SO THAT COUNCIL OF ICAI MAY MANDATE SUCH STANDARDS. OBJECTIVES QUESTIONS ON ACCOUNTING STANDARDS • Q. MANDATORY ACCOUNTING STANDARD IF NOT FOLLOWED REQUIRES AUDITORS WHO ARE MEMBERS OF ICAI TO : • A. QUALIFY THEIR AUDIT REPORTS. • B. INFORM TO MANAGEMENT OF COMPANY • C. INFORM TO ICAI • D. NEED NOT REPORT ANYTHING. QUESTIONS • SEBI AND COMPANY’S ACT REQUIRE AUDITORS TO QUALIFY AUDIT REPORTS THAT • A. THAT DO NOT CONFORM TO MANDATORY ACCOUNTING STANDARDS. • B. CONFORM TO MANDATORY ACCOUNTING STANDARDS. • C. DO NOT CONFORM TO ACCOUNTING STANDARDS. • D . NO RESPOSIBILITY ON AUDITORS. QUESTIONS. • Q WHICH SECTION OF COMPANIES ACT CAST RESPONSIBILITY ON BOARD OF DIRECTORS TO COMPLAY WITH MANDATORY ACCOUNTING STANDARDS: • A. SECTION 217(2AA) • B. SECTION 215 • C. SECTION 125 • D. SECTION 44. DAY BOOK AND GLB POSTING IN A BANK.. • IN THE CONTEXT OF ACCOUNTING IN BANKS DAY BOOK OR CASH BOOK (BOTH ARE USED IN SAME CONTEXT : SOME BANKS CALL IT CASH BOOK SOME BANKS CALL IT DAY BOOK) HAS SUMMARY OF TOTAL TRANSACTIONS IN RESPECT OF EACH ACCOUNTING HEAD OF BALANCESHEET AND PROFIT AND LOSS ACCOUNT. • THE AMOUNT OF EACH OF TRANSACTIONS DONE IN BRANCH OF BANK IN THE DAY ARE DAY BOOK AND GLB POSTING IN A BANK.. • SUMMARIZED AND RECORDED HERE. FOR INSTANCE ALL THE TRANSACTIONS IN SAVINGS ACCOUNTS OR ALL TRANSACTIONS IN CURRENT DEPOSITS ACCOUNTS ARE RECORDED IN SUMMARIZED FORM WITH REGARD TO BOTH DEBIT AND CREDIT SIDE. WHICH ARE BROUGHT FROM SUPPLEMENTARY BOOKS WHICH ARE AGAIN SUB SUMMARY OF TRANSACTIONS IN AN ACCOUNT SAY SAVINGS OR CD. DAY BOOK AND GLB POSTING IN A BANK.. • FROM DAY BOOK THE FINAL DEBITS AND CREDITS ARE POSTED IN THE RESPECTVE LEDGERS WHICH IS KNOWN AS GENERAL LEDGER. GENERAL LEDGER IS NOTHING BUT BOOK CONTAINING INDIVIDUAL LEDGERS FOR EACH INDIVIDUAL TYPE OF ASSET OR LIABILITIES. FOR INSTANCE ENTIRE CURRERNT DEPOSIT TRANSACTIONS ARE POSTED IN CURRENT ACCOUNTING HEAD IN GENERAL LEDGER. SIMILARLY FOR SAVINGS ACCOUNT OR FURTNIUTE ACCOUNT OR STATIONERY ACCOUNT AND SO ON. DAY BOOK AND GLB POSTING IN A BANK.. • THE GENERAL LEDGER BALANCE IS VIRTUALLY TRIAL BALANCE OF THE BANK ON A PARTICULAR DAY. IT REFLECT THE BALANCES OF ALL ACCOUNTS . WHILE PREPARING BALANCESHEET AND PROFIT AND LOSS ACCOUNT OF BRANCH OF BANK THE GLB BALANCES ARE TAKEN. • BALANCESHEET OF ALL BRANCHES TOGETHER WHEN CONSOLIDATED BECOMES THE BALANCE SHEET OF BANK. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES. • The common set of accounting principles, standards and procedures that companies use to compile their financial statements. GAAP are a combination of authoritative standards (set by policy boards) and simply the commonly accepted ways of recording and reporting accounting information. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES • GAAP are imposed on companies so that investors have a minimum level of consistency in the financial statements they use when analyzing companies for investment purposes. GAAP cover such things as revenue recognition, balance sheet item classification. Companies are expected to follow GAAP rules when reporting their financial data via financial statements. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES That said, keep in mind that GAAP is only a set of standards. What is important that its underlying objectives are followed in true perspective. ACCOUNTING STANDARDS • AS -1 • ALL SIGNIFICANT POLICIES ADOPTED IN PREPARATION OF FINANCIAL STATEMENTS SHOULD BE DISCLOSED. • ANY CHANGE IN ACCOUNTING POLICIES WHICH HAS MATERIAL EFFECT IN CURRENT PERIOD OR IN LATER PERIOD SHOULD BE DISCLOSED. AS 2 • DEALS WITH DETERMINATION OF VALUE AT WHICH INVENTORIES ARE CARRIED/VALUED • INVENTORIES TO BE VALUED AT LOWER OF COST OR NET REALISABLE VALUE. • AVERAGE COST OR FIFO METHODS ARE PERMITTED IN CASE WHERE GOODS ARE INTERCHANGEABLE. AS-3 • PREPARATION OF CASH FLOW STATEMENT AND ITS PRESENTATION ALONGWITH FINANCIAL STATEMENTS • CASH FLOW TO BE CLASSIFIED BY OPERATING/INVESTING/FINANCING ACTIVITIES. AS 4 • TREATMENT OF CONTINGENCIES AND EVENTS IN FINANCIAL STATEMENTS. • EG. CASES IN HIGH COURT OR PENALTY PROCEEDINGS UNDER LAW. • CONTINGENCIES MUST BE PROVIDED IF LOSSES CAN BE ESTIMATED. • EVENTS AFTER BALANCESHEET DATE AND BEFORE APPROVAL OF BOARD OF DIRECTORS SHOULD BE APPROPRIATELY ADJUSTED IN VALUE OF ASSETS AND LIABILITIES. • IF INSUFFECIENT EVIDENCE, DISCLOSURE TO BE MADE • CONTINGENT GAINS ARE NOT RECOGNIZED. AS-5 • DEALS WITH TREATEMENT OF PRIOR PERIOD AND EXTRAORDINARY EVENTS. • DEBITS OR CREDITS WHICH ARISE IN CURRENT YEAR OR AS A RESULT OF OMMISSION/MISTAKES IN PRIOR YEAR. • ALSO EXTRAORDINARY ITEMS LIKE WRITING OFF IVENTORIES. • DISPOSAL OF FIXED ASSETS. AS -6 • DEPRECIATION IS MEASURE OF WEARING OUT ASSETS. • DEPRECIATION METHOD SHOULD CAREFULLY BE SELECTED AND CONSISTENCY APPLIED FOR YEAR TO YEAR. • TREATMENT FOR REVALUATION OF ASSETS • DEPRECIATION METHOD TO BE DISCLOSED. AS-7 • ACCOUNTING OF CONSTRUCTION CONTRACTS .CONTRACT FOR CONSTRUCTION EXCEED ONE YEAR OR SO. • ACCOUNTING ISSUES OF REVENUE, TREATMENT OF ADVANCE RECEIVED, WORK IN PROGRESS, IN FINANCIAL STATEMENTS. • TYPES OF CONTRACTS: FIXED PRICE CONTRACT + ESCALATION COST OR COST PLUS A FIXED FEE. • AMOUNT AND METHOD USED TO DETERMINE REVENUE RECOGNIZED. AS-8 • STAND DELETED FROM 1.4.03 R&D EXPENSES ARE NOW COVERED ON AS-10 AS-9 • BASIS FOR RECOGNITION OF REVENUE I.E INCOME AND TIME WHEN INCOME IS SAID TO HAVE ARISEN • WHEN REVENUE RECOGNITION POSTPONED , DISCLOSURE OF CIRCUMASTANCES TO BE MADE. AS-10 • ACOUNTING OF FIXED ASSETS AND DISCLOSURE THERE OF. • COMPONENTS OF COST. • PURCHASE PRICE: + IMPORT DUTY+TAXES+DIRECT COST TO BRING ASSET TO ITS WORKING CONDITIONTRADE DISCOUNTS. • FINANCING COST TO THE EXTENT SUCH COST RELATE TO PERIOD AFTER SUCH ASSETS ARE READY TO USENOT TO BE CAPITALIZED. • TEST RUN EXPENSES CAPITALIZED. AS-11 • TRANSLATION OF ACOUNTING TRANSACTION IN FOREIGN CURRENCIES IN REPORTING CURRENCY. • FINANCIAL STATEMENT OF FOREIGN OPERATIONS • FORWARD EXCHANGE CONTRACTS. • EXCHANGE DIFFERENCE INCLUDED I.E PROFIT OR LOSS TO BE DISCLOSED. AS-12 • GOVERNMENT GRANTS RECEIVED BY AN ENTITY. • SUBSIDIES/CASH INCENTIVE/DUTY DRAWBACK • DOES NOT INCLUDE ANY TAX EXEMPTION OR TAX HOLIDAY. AS-13 • ACCOUNTING FOR INVESEMENTS MADE BY AN ENTITY. • CURRENT AND LONG TERM. AS-14 • AMALGAMATION OF TREATMENT OF RESULTANT GOODWILL OR RESERVES • TAKE OVER OF EXISTING BUSINESS AND FORMATION OF NEW BUSINESS. AS-15 • ACCOUNTING OF RETIREMENT BENEFIT TO EMPLOYEES IN FINANCIAL STATEMENTS • PF/PENSION/GRATUIITY LEAVE ENCASHMENT POST RETIREMENT WELFARE SCHEME • METHOD BY WHICH RETIREMENT BENEFITS VALUED. AS-16 • CAPITALIZATION OF BORROWING COST ATTTRIBUTABLE TO ACQUISITION/CONSTRUCTION OR PRODUCTION WHERE QUALIFYING ASSET TAKES SUBSTANTIAL PERIOD TO GET IT READY FOR INTENDED USE OR SALE. AS-17 • SEGMENT REPORTING • REPORTING OF INFORMATION ABOUT DIFFERENT TYPES OF PRODUCT AND SERVICES OF AN ENTERPRISE AND ITS OPERATIONS IN DIFFERENT GEOGRAPHICAL AREAS. • FOR ASSESSING RISK AND RETURN OF DIVERSIFIED OR MULTILOCATIONAL ENTERPRISE. AS-18 • REPORTING OF RELATED PARTY RELATIONSHIP AND TRANSACTIONS BETWEEN A REPORTING ENTERPRISE AND RELATED PARTY. • NAME OF RELATED PARTY AND RELATIONSHIP WHERE CONTROL EXIST TO BE DISCLOSED. AS-19 • LEASE: A LEASE AN AGREEMENT WHEREBY THE LESSOR CONVEYS TO THE LESEE IN RETURN FOR A PAYMENT OR SERIES OF PAYMENTS THE RIGHT TO USE AN ASSET FOR A AGREED PERIOD. • ACCOUNTING POLICIES FOR LESSOR AND LESSEE AND DISCLOSURE IN RELATION TO FINANCIAL LEASE AND OPERATING LEASE. AS-20 • PRINCIPLES & DETERMINATION OF EARNING PER SHARE • COMPARISON BETWEEN ENTERPRISES. • NET PROFI(LOSS)/ WEIGHTED AVERAGE NUMBER OF SHARES. AS 21 • CONSOLIDATED FINANCIAL STATEMENT OF PARENT AND SUBSIDARIES. AS-22 • METHOD OF DETERMINATION OF AMOUNT OF EXPENSES OR SAVING RELATING TO TAXES ON INCOME IN RESPECT OF AN ACCOUNTING PERIOD. • DEFERRED TAX ASSETS AND LIABILITIES SHOULD BE DISTINGUISHED FROM CURRENT TAX ASSETS AND LIABILITIES AS-23 • ACCOUNTING FOR INVESTMENT IN ASSOCIATES. AS-24 • DISCONTINUATION OF OPERATION OF PARTICULAR SEGMENT. • DISCLOSURE OF PRE TAX PROFIT OR LOSS FROM ACTIVITIES ATTRIBUTABLE TO DISCONTINUING OPERATIONS. AS-25 • INTERIM REPORTING WHICH IS NOT FOR COMPLETE REPORTING PERIOD. • CONDENSED B/S • CONDENSED P&L • CONDENSED CASH FLOW STATEMENT • EXPLANATORY NOTES. AS-26 • OTHER THAN INTANGIBLE ASSETS COVERED IN AS22( DEFERRED TAX ASSETS) • RELATE TO START UP COST ( EG ADVT ETC) • R&D • PATENTS AND COPY RIGHT • GOODWILL • DISCLOSURE: USEFUL LIFE OR AMORATIZATION RATE • AMORATIZATION METHOD. AS-27 • TWO OR MORE PARTIES UNDER TAKE ECONOMIC ACTIVITY WITH JOINT CONTROL • ACCOUNTING FOR JOINT VENTURE IN A CONSOLIDATED FINANCIAL STATEMENT. • DISCLOSURE: ANY CONTINGENT LIABILITY INCURRED BY VENTURER AND ITS SHARE. • ANY CAPITAL COMMITMENT AND ITS SHARE. AS-28 • EQUITY OR DEBT LISTED • TURNOVER EXCEED RS.50 CRORES • PRINCIPAL OF THIS A.S IS TO ENSURE CARRYING COST OF ASSET IS NOT MORE THAN RECOVERABLE VALUE OF ASSET. • NOT APPLIED TO INVENTORIES AS 2 • CONSTRUCTION CONTRACT AS 7 • FINANCIAL ASSETS AS 13 & DEF TAX AS 22