EOC review notes

advertisement

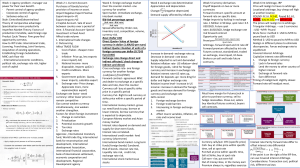

ECONOMICS EOC/MILESTONES REVIEW GUIDE FUNDAMENTAL ECONOMICS Define scarcity. Define and give examples of the factors of production What does efficiency mean and why is it important? What is specialization? Give an example. Define and give an example of opportunity cost What is the production possibilities curve? What 2 things cause PPC to shift? What does a point inside the PPC mean? What is a rational decision? Define the command, market, and mixed economic systems with regards to what, how, and for whom to produce. Define private ownership, profit motive, consumer sovereignty, competition, and government regulation. Explain the role of profit as an incentive for entrepreneurs. Define economic goals: freedom, security, equity, growth, efficiency, stability. Which goals do each system (Command, Mixed, Market) follow? Why does the government provides public goods and services, redistribute income, protect property rights, and resolves market failures? Give an example of government regulation and deregulation. How does regulation and deregulation affect consumers and producers? Define productivity: Define standard of living: Draw the circular flow diagram. Include: Resource (factor) and Product markets and the flow of goods & $ Define medium of exchange. Why is having a medium of exchange important? MICROECONOMICS Define the Law of Demand. What factors cause demand to shift? Draw a shift in demand (increase and decrease). Define the Law of Supply. What factors cause a shift in supply? Draw a shift in supply (both increase and decrease). Define price elasticity of demand and supply. What is equilibrium/market clearing price? Illustrate on a graph how supply and demand determine equilibrium price and quantity. Draw on a graph how price floors create surpluses and price ceilings create shortages. Define the 3 forms of business organizations: sole proprietorship, partnership, and corporation. Name an advantage and disadvantage for each type of business organization. Explain the different market structures: monopoly, oligopoly, monopolistic competition, and pure competition. MACROECONOMICS Define Gross Domestic Product (GDP). How is economic growth measured? Label and Define the business cycle: peak, contraction, trough, recovery, expansion, recession and depression. Define unemployment. How is unemployment measured? Identify and give an example of structural, cyclical, and frictional unemployment. Define inflation, stagflation, and Consumer Price Index. How is inflation measured? Give examples of who benefits and who loses from inflation. Define aggregate demand. What shifts AD? Define aggregate supply. What shifts AS? How is the Federal Reserve System organized? Define monetary policy. What tools does the Federal Reserve use to promote price stability, full employment, and economic growth? Easy money policy / Tight Money Policy Define fiscal policy. Explain the tools the government uses to influence the economy. Expansionary Fiscal Policy / Contractionary--Restrictive Fiscal Policy What is the difference between the national debt and deficit Define and give an example of: Progressive, Regressive, and Proportional tax. How does an increase in sales tax affect different income groups? INTERNATIONAL Define Absolute Advantage and Comparative Advantage. When does most trade take place - absolute or comparative advantage? What is the difference between balance of trade and balance of payments? Define and give examples of: Tariffs, Quotas, Embargoes, Standards, Subsidies What is the purpose of: EU, NAFTA, ASEAN? What are the costs/benefits of trade barriers? Why is free trade good/bad? Define exchange rate. How do you convert: USD into foreign currency? Foreign currency to USD? Explain why, when exchange rates change, some groups benefit and others lose. Explain what happens when a nation’s currency is strong and when a nation’s currency is weak. PERSONAL FINANCE Compare services offered by different financial institutions. Explain reasons for the spread between interest charged and interest earned. What is the difference between the interest charged on loans and the interest charged on credit cards? Give examples of the direct relationship between risk and return. Evaluate a variety of savings and investment options; include stocks, bonds, and mutual funds. What factors affect credit worthiness? What is the difference between simple and compound interest rates? Describe the different types of insurance: automobile, health, life, disability, and property. Describe the following costs and benefits associated with insurance: Deductible, premiums, shared liability, asset protection How does the investment in education, training, and skill development help someone in the workplace?