Attached File

advertisement

INTRODUCTION OF SEBI (LISTING OBLIGATIONS

AND DISCLOSURE REQUIREMENTS)

REGULATIONS,2015

Listing Regulations has two fold objective:

Time Span

of 90 days

for

implementation

Bringing the basic framework governing the regime of listed entities in line with the

Companies Act, 2013

Compiling all the mandates of varied SEBI Regulations/ circulars governing equity

as well as debt segments of capital market under the ambit of single document

Passing

of

Ordinary

Resolution

instead

of

special resolution in case of

material

related

party

transactions subject to

related parties abstaining

from voting

on such

resolutions in terms of

regulation 23(4)

IInd

Provision

Ist

Provision

The following Two Provisions of the Listing Regulations are

applicable with immediate effect which are as follows:

Reclassification of Promoters as

public

shareholders

under

special circumstances prescribed

in Regulation 31A

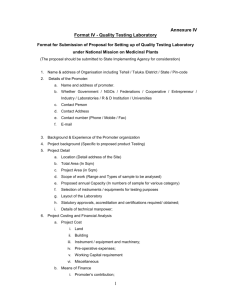

MAIN HIGHLIGHTS

Regulation 9:

Preservation of Documents

The listed company is required to formulate a policy for preservation of documents duly

approved by the Board of Directors, classifying them in at least two categories as follows-

documents whose preservation shall be permanent in nature;

documents with preservation period of not less than eight years

after completion of the relevant transactions.

(Maintenance of documents in electronic mode will be deemed to be

complying with the aforesaid regulation.)

This Regulation is, to some extent, in line with the provisions of

Companies Act, 2013 and ensures better governance

in the operations of the company.

Regulation 13:

Grievance Redressal Mechanism

Every listed company is required to comply with the following:

To get itself registered on the SCORES platform or any other similar platform to

electronically handle the investor complaints as specified by the Board.

To file a Statement within 21 days from the end of the relevant quarter to the stock

exchange pertaining to the status of investors complaints detailing the following

information:

• No. of Complaints Pending:

• pending at the beginning,

• Received and disposed of during the quarter,

• Unresolved at the end of the quarter;

The said statement is also required to be placed before the Board of Directors on a quarterly

basis.

In the erstwhile Listing Agreement, the information pertaining to pending investors

complaints were being submitted on a quarterly basis only along with the Financial Results

required to be filed with the stock exchange within 45/60 days (as the case may be) from the

end of the relevant quarter.

Regulation 23

Related Party Transaction

Important Provisions relating to Related Party Transaction (RPT)

Seek approval from shareholders in General Meeting by passing an ordinary resolution for

approving material related party transactions subject to the stipulation that such related parties

shall be abstained from voting on such resolution.

Special Resolution was required

With the intent to harmonize the provisions with the Companies Act, 2013,

the requirement of shareholder approval for material related

party transaction has been relaxed from Special Resolution to

Ordinary Resolution.

Regulation 29:

Prior Intimations

The listed company is required to give prior intimation to Stock Exchange about the

Board Meeting held, from time to time in the following manner:

For Financial

Results

At least 5 days

advance

notice(excluding the

date of intimation and

date of meeting)

before consideration

of Financial Results of

the company.

at least 7 clear calendar

days advance notice

(excluding the date of

intimation and date of

meeting)

For Corporate

Actions

At least 2 working days

advance notice

(excluding the date of

intimation and date of

meeting) for considering

the proposals related to

buyback of securities,

voluntary delisting, fund

raising including

determination of issue

price.

For alteration in the date of payment of

interest or nomenclature of the specified

securities

At least 11 working days 'advance notice for

considering the proposals pertaining to:

a. Change in nomenclature of any of the securities

listed on the Stock Exchange;

b. Alteration in the date on which,

•the interest is required to be paid on

debentures or bonds;

• the redemption amount is required to be paid on

redeemable shares or debentures or bonds.

at least 21 advance notice was required

Regulation 30:

Disclosure of Events or Information.

The main highlights of the Regulations are outlined as follows:

The responsibility is casted on the Board of listed entities, to authorize one or more

KMPs for the purpose of determining materiality of an event or information and making

disclosures to the stock exchange.

The Listed Entity is required to frame a Policy For Determination Of Materiality Of

Events, duly approved by the Board of Directors of such entity.

The criteria for determining the materiality of events/information is prescribed in the

regulation and they are narrated as below:

a)the omission of an event or information, which is likely to result in discontinuity or

alteration of event or information already available publicly; or

b)the omission of an event or information is likely to result in significant market reaction

if the said omission came to light at a later date; or

c) In case where the criteria specified in sub-clauses (a) and (b) are not applicable, an

event/information may be treated as being material if in the opinion of the board of

directors of listed entity, the event / information is considered material.

Post 5 years, the requirement of disclosure of such events is as per the

archival policy of the Listed Company.

Any delay in filing disclosures beyond the timeframe of 24 hours shall be

accompanied by an explanation for delay.

All events or information of material subsidiaries are to be disclosed by

such listed entity.

The details of above stated authorized KMPs is required to be disclosed to

the Stock Exchange(s) as well as on the Company’s website.

“material subsidiary” shall mean a subsidiary, whose income or net

worth exceeds twenty percent of the consolidated income or net worth

respectively, of the listed entity and its subsidiaries in the immediately

preceding accounting year.

•

•

Material event/ information are needed to be disclosed as per the following

timeline:

Within 24hours from the occurrence of the events as specified in Part - A of

Schedule III of the said regulations.

Within 30minutes of the conclusion of the Board Meeting regarding events

specified in sub- para 4 of Para A of Part A of Schedule III of the said

regulations.

Every Listed Company is required to update material developments on a

regular basis pertaining to the disclosures made till the event is resolved/

closed and host the said events along with all updated information on its

website at least for a period of 5 years.

The listed company is required to update any change in the content of its

website within 2 working days from the date of such change in the content.

The provisions of this Regulation have removed all the ambiguities of

Clause 36 of the erstwhile Listing Agreement and addition of provisions related to

explanation for delay in disclosure would surely bring more transparency in the

business affairs of the Company.

Regulation 31(A)

Disclosures of Class of Shareholders and

Conditions For Reclassification

The Stock Exchange may allow for reclassification upon receipt of a request from the listed

company or the concerned shareholder, along with requisite evidence. The reclassification

will be allowed subject to compliance of specified conditions.

I. Reclassification of Promoter as Public Shareholder

A. In case of change in Promoter

When a new promoter replaces the previous promoter subsequent to an open offer or

in any other manner, re-classification shall be permitted subject to approval of

shareholders in the general meeting.

Shareholders need to specifically approve whether the outgoing promoter can hold

any KMP position in the company. In any case, the outgoing promoter cannot act as

KMP for a period of more than 3 years from the date of shareholders’ approval.

The outgoing promoter along with the promoter group and persons acting in

concert cannot hold more than 10% of the paid-up equity share capital of the

company and shall not have any special rights through any formal or informal

arrangements.

B. In case of Inheritance:

In case of transmission/succession/inheritance, the inheritor shall be classified as

promoter.

C. In case of Company not having any identifiable promoter:

Existing promoters may be re-classified as public in case the company becomes professionally

managed and does not have any identifiable promoter subject to the approval of shareholders

in a general meeting. A company will be considered as professionally managed for this

purpose, if:

No person or group along with Persons Acting in Concert (PACs) taken together

holds more than 1% of the paid-up equity share capital of the company (including

any convertibles/outstanding warrants/ADR/GDR Holding).

Mutual Funds/Banks/Insurance Companies/Financial Institutions/FPIs can each hold

up to 10% of the paid-up equity share capital of the company (including any

convertibles/outstanding warrants/ADR/GDR Holding).

Erstwhile promoters and their relatives may hold KMP position in the company only

subject to shareholders’ approval and for a period not exceeding 3 years from the

date of shareholders’ approval.

The outgoing promoter shall not have any special rights through any formal or

informal arrangements.

D. Other Conditions:

The outgoing promoter shall not, directly or indirectly, exercise control over the

affairs of the company.

Increase in public shareholding pursuant to re-classification of promoters shall not

be counted towards achieving compliance with minimum public shareholding (MPS)

requirement under clause 40A of equity listing agreement.

The event of re-classification may be disclosed as a material event in accordance with

the listing agreement/regulations.

E Power to relax the provisions on a case to case basis

SEBI may relax any condition for reclassification in specific cases, if it is satisfied

about non-exercise of control by the outgoing promoter or its person acting in concert.

II. Reclassification of Public Shareholder as a Promoter:

Then Public shareholder is required to make an open offer in accordance with the

provisions of SEBI (SAST) Regulations, 2011.

To resolve the ambiguities as to re classification, SEBI has inserted this

regulation to place a regulatory framework for re-classification of

promoters in listed companies as public shareholders

under various circumstances.

Regulation 35

Annual Information Memorandum

The annual Information Memorandum is needed to be submitted by the

listed entities to the stock exchange, in the manner as may be specified by

SEBI from time to time.

SEBI has proposed the format of Annual

Information Memorandum in its Discussion

paper

SECRETARIAL STANDARDS

Setting grounds for Corporate Governance

Secretarial

Standards

Effective from

July 01,2015

SECRETARIAL

STANDARD -1

(SS-1)

• Meeting of the

Board of

Directors

SECRETARIAL

STANDARD -2

(SS-2)

• General

Meetings

APPLICABILITY

OF SECRETARIAL

STANDARDS

• Except OPCs

applicable on

all companies

• All General

Meetings

• All Committee

Meetings

• All Board

Meetings

Brief Highlights of SS -1

Any Director at any time have the authority to summon a Meeting of the Board

unless the articles provide otherwise

Agenda setting out the businesses to be transacted at the meeting of the Board along

with their notes shall be served to the Directors at least 7 days before meeting

Notes on item of the business which are in the nature of unpublished Price

sensitive Information may be given at a shorter Notice (i.e. can be less than 7

days)

Any item not included in the Agenda may be taken up for consideration with the

permission of chairman and with the consent of majority director present which

shall include 1 independent director, if any

Presence of all the members of any committee constituted by the Board is necessary

to form the quorum for Meeting of such committee.

Brief Highlights of SS -1

The Chairman of the Board or in his absence the Managing Director/Whole Time

Director/Director other than the interested Director have the authority to decide whether the

approval of the Board for a particular matter be obtained by means of a resolution by

circulation.

SS-1 has list out the following items that need to be noted in the minutes:

• The fact that interested director was not present during the discussion and did not vote.

• The views of the director particularly the independent director, if specially insisted upon by such

director provided the views are not defamatory, irrelevant or immaterial.

• If any Director has participated only for a part of the meeting, the agenda item in which he did not

participated

• The fact of the dissent and the name of the director who dissented.

• Ratification by Independent Director or majority of Director in case meeting held at a shorter notice &

transaction of any item not included in the agenda.

Office copies of notices, agenda, notes on agenda & other related papers shall be preserved in

good order in physical or in electronic form for as long as they remain current or (8) eight

financial years (whichever is later)

Brief Highlights of SS - 2

A General Meeting shall be convened by or on authority of the Board

In all cases relating to appointment or re-appointment and/or fixing of remuneration

of Director (all categories), details of each such directors (as prescribed in SS-2)

shall be given in the explanatory statement

If any Director is unable to attend the meeting , the chairman shall explain such

absence at the Meeting

The Statutory and Secretarial Auditor, should attend the Annual General

Meeting unless exempted by the company.

The Chairman shall explain the objective and implications of the resolution

before they are put to vote at the meeting

Modification to any resolution which do not change the purpose of the resolution

materiality may be proposed/seconded & adopted at the meeting, thereafter the

modified resolution shall be duly passed

Brief Highlights of SS - 2

In case of public companies, the chairman shall not propose any resolution in

which he is deemed to be concerned

A member who is a related party is not entitled to vote on resolution relating to

approval of any contract or arrangement in which such member is a related party

Resolutions for items which are likely to affect the market price of the securities

of the company shall not be withdrawn. However, any resolution for consideration

through e-voting shall not be withdrawn.

Reading of Report by the Statutory Auditor at the Annual General Meeting

Reading of Report by the Secretarial Auditor at the Annual General Meeting

EXEMPTIONS TO PRIVATE COMPANY

(vide notification no. GSR 446 (E) dated 5.06.2015 )

KEY HIGHLIGHTS :

Definition of related party {Section 2(76)}

The transaction done between a private company and following companies noted below is

out of the purview of the Related party transaction referred to u/s 188

• Holding Company

• Subsidiary Company

• Associate Company

• Subsidiary of the Holding Company to which it is also a Subsidiary

Now a private company can offer shares to employees under the scheme of

employee’s stock option with an ordinary resolution instead of a special resolution.

{Section 62(1) (b)}

Private Company can accept from its members deposit upto (paid up share capital +

free reserves ) without complying with the conditions of { section 73 (2) (a) to (e)}:

(a) issuance of circular

(b) Filing of circular with MCA

(c) Maintaining Deposit repayment reserve

(d) Provide deposit insurance etc as prescribed u/s 73 (2) (a) to (e)

EXEMPTIONS TO PRIVATE COMPANY

(vide notification no. GSR 446 (E) dated 5.06.2015 ) contd

Now there is no need to file Form MGT-14 for the purposes of resolution passed u/s 179

read with Rule 8 of the Companies (Meeting of Board and its power) Rules, 2014.

{Section 117 (3) (g)}

The provisions relating to giving notice of 14 days along with the deposit of Rs. 1 lakh

etc. for contesting for directorship shall not be applicable on private companies

{section 160}

At a general meeting of a private company, the motion of appointment of more than one

director can be made by a single resolution {Section 162}

EXEMPTIONS TO PRIVATE COMPANY

(vide notification no. GSR 446 (E) dated 5.06.2015 ) contd

An interested director can now participate in the Board Meeting in which he is interested

subject to a condition that he discloses his interest in such contract or arrangement.

{Section 184 (2)}

Loan to Director are allowed for private companies which not falls in the criteria as

prescribed {Section 185}

A member even after being related party, is allowed to vote on special resolution passed

u/s 188 (1) of the Act. {Second proviso of section 188(1)}

Now there is no need to pass resolution for appointment of managing director , whole time

director or manager u/s 196 of the Act and no need to comply with Schedule V of the Act.

{Section 196 (4) & (5)}

![2. Promoter – if applicable [2]](http://s3.studylib.net/store/data/007765802_2-78af5a536ba980fb6ded167217f5a2cf-300x300.png)