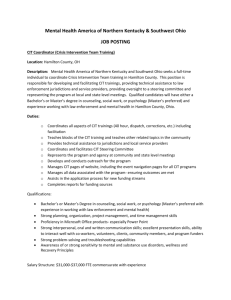

tax issues relating to transactions in real estate

advertisement

STRUCTURING OF

TRANSACTIONS IN REAL ESTATE

Ashok Raghavan

Chartered Accountant

Bangalore

Critical definitions to be studied

Real Estate industry suffering

from the cascading effect of a

plethora of taxes.

Cost of material and services

will only go up

Only way to reduce cost is to

consumer is by minimizing tax

incidence.

Structuring is therefore

essential and rather a prerequisite.

Tax

Planning

1. Union of India and Another v.

Azadi Bachao Andolan and

Another 263 ITR 706 (SC)

2.Vodafone International Holdings

B.V. v. Union of India and Another

341 ITR 1 (2012) (SC).

3. Bhoruka Engineering Inds Ltd

Vs DCIT (2013) 356 ITR

25(Kar)

Definition of “Transfer” U/s 2(47)

Definition of “Immovable Property” U/s 269 UA (d) read with

section 2 (47)

Immovable property includes rights therein and benefits

arising there from.

Section 269UA(d) and Section 3(26) of the General Clauses

Act- TDR, Development Right etc.

Section 45 deals with transfer of a Capital Asset.

Taxable normally in the year of transfer with specific

exceptions such as Section 45 (1A), 45(2), 45 (5), etc…

SALE OF LAND AND BUILDING UNDER

COMPOSITE AGREEMENT

Composite Agreement for sale of land

and building

Land – Long Term and Building – Short Term

Bifurcation of consideration has to be made

CIT Vs Vimal Chand Golecha 201 ITR 442 (Raj)

CIT Vs DR.D.L.Ramachandra Rao 236 ITR 51 (Mad)

CIT Vs C.R. Subramanian(2000)242ITR 342(Kar)

INDIVIDUAL OR CO-OWNERS

CONTRIBUTING IMMOVABLE

PROPERTY INTO A FIRM AND THEN

ENTERING INTO DEVELOPMENT

• Partner contributing property as capital into the firm under

Section 14 of Partnership Act

• Value recorded in the books of the firm is deemed value of

consideration

• Firm to convert and treat the property as stock-in-trade in its

books

• Taxed as business income in the year in which property is sold

or otherwise transferred

• Joint Development to be entered into by firm after conversion

into stock-in-trade

• Specific wordings to be included in the development

agreement

• Applicability of Section 50C ?

TRANSFER OF PROPERTY THROUGH

RECONSTITUTION OF A FIRM

• Properties owned and held by the firms can

be transferred by reconstitution of the firm

• Rigors of the Schedule to the Stamp Act to be

noted

• Decision of Gurunath Talkies overruled by

recent decision of Dynamic Enterprises

• Decision of Sudhakar M Shetty (2011) (Mum

Tribunal) and Girija Reddy (Hyd Tribunal)

opens interesting tax planning opportunities

Distribution of properties owned and

held by a firm between the partners

Straight forward distribution of

assets between partners on

dissolution would have

implications u/s 45 (4)/ 43 CA of

the Income Tax Act

Firm to convert into an LLP under

Sec 55 r/w Second Schedule of

LLP Act

All properties of the firm vests

with the LLP- Refer Sec 58 (4)(b)

of LLP Act,

No stamp duty, no capital gainsRefer case laws under Part IX

STAGE-1

Balance Sheet of Partnership Firm AB

Enterprises

• LIABILITIES

A’s Capital

B’s Capital

Other Liabilities

13,50,000

13,50,000

3,00,000

• ASSETS

Immovable Prop-I 10,00,000

Immovable Prop-II 15,00,000

Other Assets

5,00,000

TOTAL

30,00,000

TOTAL

30,00,000

STAGE-2

Balance Sheet of the LLP-AB Enterprises

• LIABILITIES

A’s Capital

B’s Capital

Other Liabilities

• ASSETS

13,50,000 Immovable Prop-I 10,00,000

13,50,000 Immovable Prop-II 15,00,000

5,00,000

3,00,000 Other Assets

TOTAL

30,00,000 TOTAL

30,00,000

Contribute the immovable property of

the LLP as capital contribution to

different partnership firms

Shown in the illustrations as below-

A Estates (Partnership Firm)

• LIABILITIES

AB Enterprises-LLP

A’s Capital

C’s Capital

Other Liabilities

TOTAL

11,00,000

1,00,000

1,50,000

1,50,000

15,00,000

• ASSETS

Immovable Prop-I

Other Assets

Bank

TOTAL

10,00,000

2,50,000

2,50,000

15,00,000

B Estates (Partnership Firm)

• LIABILITIES

AB Enterprises-LLP

B’s Capital

D’s Capital

Other Liabilities

Total

• ASSETS

16,00,000 Immovable Prop-II

1,00,000 Other Assets

1,50,000 Bank

1,50,000

20,00,000 Total

15,00,000

2,50,000

2,50,000

20,00,000

STAGE-4

AB Enterprises -LLP

• LIABILITIES (in Rupees)

• ASSETS (in Rupees)

A’s Capital

B’s Capital

Share Capital in

A Estates

Share Capital in

B Estates

16,00,000

TOTAL

27,00,000

TOTAL

13,50,000

13,50,000

27,00,000

11,00,000

• Properties acquired through voluntary liquidation of the

company.

Can be used to unlock property from the company.

Title is passed by virtue of a deed of allotment through the order of the court.

No stamp duty payable on transfer of property {Madurai Mills (1973) 89ITR

45 as shareholder has pre-existing right.

Ideal where subsidiary Company’s assets has to be sold to redeem Holding

Company’s liabilities or where shareholder has losses in his business/es.

U/s 46(1) – there is no transfer in the hands of the Company

U/s 46(2) – Capital gain in the hands of share holder on market value less

deemed dividend U/s 2(22) (c)

Period of holding for shareholder –Refer Expn to Section 2(42A) r/w Section

49(iii)(c) of the Income Tax Act.

Capital Gains

in case of

slump sale

Definition u/s Slump Sale u/s

2(42C) and undertaking under

explanation to Section 2(19AA)

to be strictly adhered to.

Value Adopted for sale of

immovable

property

for

Registration Purpose does not

dilute definition of Slump Sale.

Period of Existence of the

division or undertaking is to be

reckoned

Values cannot be assigned to

individual assets except for

purposes of stamp duty in the

case of immovable property

Capital Gains in case of slump sale

Short term assets may get long

term benefit if they are part of

the

undertaking

being

transferred which is in

existence for more than 36

months.

No implications of VAT if

entire business of undertaking

is transferred as per rule

3(2)(g) of KVAT Rules 2005

and no Service Tax under

entry 25 of Mega exemption

notification dated 20-6-2012.

Interse gifts among relatives prior to

sale/ development transfer

Interse gifts to be made to

relatives to ensure spread of

exemption post transfer.

Each donee can invest in a

house property or bonds

under Section 54EC.

Clubbing provisions would

apply only on net income

after exemptions.

Ideal in the case of a small

joint development agreement.

Development of immovable property by a

person- conversion to stock in trade

In the case of an individual self

declaratory affidavit and change in books

of accounts.

In the case of a firm/LLP, change in deed

of partnership and disclosure in the books

of the firm.

In the case of company change in

Memorandum and Articles of Association

and disclosure in the books.

This treatment is ideal to postpone the

incidence of tax by applying provisions of

Section 45 (2)

This treatment is ideal before entering into

a joint development / revenue share

agreement.

Certain critical clauses to be inserted in

joint development agreement.

Refer observations in Ishikawajima’s case.

Transfer of immovable property in a

company

Acquisition in conventional route could involve higher taxation.

Acquisition through shares results in saving in stamp duty, saving

in capital gain for transferors.

Purchaser of shares unable to reflect value of property in his/ its

books.

Company could pay money for acquiring the brand or as an non

compete fee to the promoters to reduce the difference in

consideration being paid in excess of book value of shares.

Company contributing property into the firm at sale value.

Transferee becoming partners of the firm

Company (transferor) drawing the sale consideration introduced

as capital by transferee in the firm.

New firm carrying out development.

Ideal in cases where consideration is to be paid over a period of

time.

Point of conveying immovable

property critical post L&T judgment

VAT and service tax applicable throughout

construction phase.

VAT and service tax not applicable when

property is conveyed as immovable property

post completion without any advance

consideration for sale.

Lease cum sale model could be adopted for

acquisition of built to suit premises.

Observations of Ishikawajima relevant.

Tax Incidence on Development Agreement

Popularly known as “Joint Development”

Developer is empowered to act on owners’ behalf

No right or interest in the immovable property or right to have

possession of the property is conferred on the Developer in any manner

whatsoever .

Developer’s right to entry is only ‘license’ as understood u/s 52 of the

Indian Easements Act 1882..

Point of Tax Incidence

Tax Planning Possibilities

Transfer of property through Development Agreements.

A. Broad features of Development Agreement.

B. Main points relating to Taxation Highlighted.

C. Owner can convert the Lands into Stock-in-trade.

D. Recent judicial decisions under the Income Tax law and the decision of

L&T on works contract necessitates the need for new strategies.

E Possible incidence of Service Tax and VAT on Owners Share forces a

rethink on conventional development agreements

Decisions against:

Charturbuj Dwarakadas Kapadia Vs CIT (2003) 260 ITR 491 (Bom)

Jasbir Singh Sarkaria (2007) 294 ITR 196(AAR)-

CIT Vs Dr T K Dayalu (Karnataka HC) 202 Taxman 531 (Kar)

CIT Vs H B Jairaj ( Karnataka HC) - SLP Dismissed by SC.

Potla Nageswar Rao Vs DCIT (2014) 365 ITR 249 (AP).

Decisions favouring deferring of Capital Gains to the year of commencement of

development activity.

Fibars Infratech , Dilip Anand Vazirani etc.

Decisions in favour:

CIT Vs Attam Prakash & Sons 175 Taxman 499 (Del)

Naju Daru Deboo 218 Taxman 473 (All)

Vaswani Estates and Developers Vs State of Karnataka(Tribunal Decision under KVAT)

Refer wordings of Section 53A and 54 of the Transfer of Property Act,1882.

Obervations in the case of Highness Maharani Shantidevi P Gaikwad Vs Savjibhai

Haribhai Patel AIR 2001 (SC) 1462 (2001)- Agreement with developer does not create

an interest in property

Observations in the case of Govind Saran Ganga Saran v/s Commissioner of Sales Tax

and Others (1985) 155 ITR 145 (SC)

Observations in the case of Ishikawajima – Harima Heavy Industries Ltd. Vs Director of

Income Tax, Mumbai (2007) (SC) 288 ITR 408.

Amendment to Section 17 of the Indian Registration Act 1908

Owners can convert the lands into Stock-in-trade - To avoid incidence of capital gains at the

stage of signing the Development Agreement or at the point when the construction activity

commences, it is advisable for the Owners to convert the immovable property into stock in trade

either in the books of the proprietary concern of the Owner or by introducing the said

immovable property into a partnership firm as capital contribution and converting the said

property into stock in trade in the books of the firm.

•

R Gopinath (HUF) v. ACIT (2010) 5 Taxmann.com ITA Nos. 29 & 30/ MDS/2008 rendered by

the ITAT Chennai ‘A’ Bench on 24th July, 2009 also reported in 133 TTJ (Chennai) 595.

•

Ramesh Abaji Walavalkar v. Addln CIT 150 TTJ 725 Mum Trib. (D Bench)

•

Vidyavihar Containers Ltd v. Dy. CIT (2011) 133 ITD 363 (Mum. Trib)

•

DCIT vs Crest Hotels Ltd (2001) 78 ITD 231 (Chennai Bench).

•

Fardeen Khan Vs ACIT 11(1) Mumbai- ITA No 1588/1589 of 2013 rendered on 25-2-2015,

169 TTJ 398 ( ITAT F Bench Mumbai)

•

Dheeraj Amin Prop JV Builders Vs ACIT Circle 2(1) Mangalore, ITAT NO 1709/Bang/2013

rendered on 30-6-2015

Structure to be evolved

Formation of a Partnership firm between the

land Owner and the Developer.

Land owner to contribute immovable property as

capital contribution

Firm to pay 1% Registration Fee to enable entry into

Book I

Developer will become partner in the firm by

making initial capital contribution.

The profit sharing and drawings clause in the deed would be suitably

worded.

Owner will draw as profits a % of gross revenue less cost of land

contributed less proportionate income tax.

Developer to draw as profits a % of gross revenue less cost of

construction, selling cost, finance cost etc. less proportionate income

tax.

VAT, service tax & deposits for facilities would be retained by the firm

and paid accordingly.

Owners share of drawings will be transferred to a separate bank

account.

Dissolution clause in Deed to be drafted suitably

The firm will convert or treat the immovable property as stock in trade on the

happening of certain events

Advantages:

1)No need of POA to developer due to mutual agency in partnership

2)Question of giving a possession to the builder as a licensee or prospective

buyer does not arise

3) Incidence of Income tax postponed to the year of sale or transfer of stock

in trade

4) Recent judicial judgments on development agreements will not apply.

5) No VAT & Service Tax on Owners share being constructed by the Developer

Disadvantages:

Unlimited liability in partnership concept could affect the venture- mutual

indemnity to be given by owner and developer.

Property would be stuck in the firm in the event the development is abandoned

mid way and hence dissolution clause to be suitably worded.

Formation of LLP between the Owner and the Developer

LLP is a distinct legal entity registered under the LLP Act, 2008 but is

treated as a “firm” U/s 2(23) of the IT Act.

Advantages:

• Limited liability

• Mutual indemnity between owner and developer not required or

optional.

Disadvantages:

• Value of immovable property to be recorded in the books of LLP

should be in accordance with Sec 32(2) of the LLP Act r/w Sec 23 of

the LLP rules.

• Change in Karnataka Stamp Act with insertion of Article 40 A.

DEVELOPER TO BE TREATED AS A

CONTRACTOR

-Owner to retain legal title and possession of land till it is

transferred to the ultimate buyer.

- Construction Contract to be given to the builder for the

entire super built area allowed as per FSI.

- Builder to recover contractors fee by being entitled to sell

specified percentage of UDI in land and SBA.

- POA to be suitable worded to indicate agency coupled

with interest.

- VAT/ Service Tax to be collected in the name of the

Owner.

- Set off available on VAT/ Service Tax charged by the

builder on the Owner.

- Entire sales revenue minus contractor fee = Owners share

of revenue

- Contractors fee minus cost of construction = Developers

share of revenue

TAX INCIDENCE IN THE CASE OF REVENUE SHARING

AGREEMENTS/ARRANGEMENTS

• The Land Owner and Developer agree to share the "distributable revenue"

in a specified percentage.

• The Land Owner and the Developer join together in a tripartite agreement

with the ultimate purchaser of the apartment wherein the Land Owner

agrees to convey undivided right, title and interest in land to and in favour

of the prospective purchaser of apartments and the Developer agrees to

convey the specified super built up area being constructed on the land in

favour of ultimate purchaser of the apartments.

• A General Power of Attorney is executed by the Land Owners in favour of

the Developer giving him the powers to do all acts, deeds and things in

pursuance to the Revenue Sharing Agreement/Arrangement including the

power to sell the UDI in land in favour of the prospective purchasers.

• The agreement could be worded in a manner to indicate that the revenue

share accruing to the Land Owner is in essence only for the transfer of the

undivided share of right, title and interest in land and the revenue share of

the Developer is for transfer of specified super built up area.

• The insurable interest of the super built up area being constructed on the

land would be on the Developer during the period of construction and till the

date of its transfer.

• The legal ownership, domain and control of the land remains vested with the

Land Owner and no portion of it will be transferred to the Developer or his

nominees as the case maybe.

• There is no allocated area designated as Owner's share and Developer's share

as the case maybe.

• If the agreement is drafted keeping the above principles in mind, it can be

ensured that the Land Owner pays tax as " Business Profits" or as “Capital

Gains “ only at the point of transfer of risks and rewards of ownership in

favour of the transferees i.e., the purchaser of apartments, which event

would occur either at the point of execution of Sale Deed or handing over

possession of the apartment whichever is earlier.

• Further by entering into Revenue Sharing Agreement/Arrangement the

possibility of levy of VAT and Service Tax on the Owner's share of revenue

does not arise. Whereas, in the case of Joint Development Agreement based

on area share, there is a need for the Developer to levy VAT and Service Tax

on the Owner's share of super built up area.

Compensation Received for delay in delivery of Owner’s share

whether capital or revenue receipt?

i.

Guffic Chem (P) Ltd v. CIT (2011) 198 Taxmaan 78 (SC), 332 ITR

602 (SC)

ii. Gillanders Arbuthnot & Co Ltd v. CIT (1964) 53 ITR 283 (SC)

iii. CIT & Anr. v. Sapthagiri Distilleries Ltd (2014) 366 ITR 271 (Kar)

iv. CIT v. Spencers & Co Ltd (No.1) (2013) 359 ITR 612 (Mad)

v. G. Raveendran v. CIT (2015) 57 Taxmann.com 2014 (Mad)

Compounding fee r/w Explanation 1 to Section 37 – Not a

deductible expenditure

Explanation 1 to Section 37 : For the removal of doubts, it is hereby

declared that any expenditure incurred by an assessee for any

purpose which is an offence or which is prohibited by law shall not

be deemed to have been incurred for the purpose of business or

profession and no deduction or allowance shall be made in respect

of such expenditure.

Case Laws:

1. CIT Vs Mamta Enterprises (2004) 266 ITR 356 (Kar)

2. Nahar Spinning Mills Ltd V CIT Ludhiana(2014) 226 taxmann 364

(P & H )

3. Modi Builders Vs JCIT Range 5 Pune (2015) 60 Taxmann.com 54

(Pune Trib)

4. Maddi Venkataraman and Co Pvt Ltd (1988) 229 ITR 534 Para 534

(SC)

5. Millenia Developers Pvt Ltd Vs Dy.CIT (2010) 322 ITR 401(Kar)

Interest on borrowed capital- assessee engaged in

development of properties- Income from projects assessed

in year of completion- entire interest on borrowed capital is

allowed as deduction and is conformity of AS 7 issued by

the ICAI.

Joint CIT v. K. Raheja P. Ltd. [2007] 290 ITR (AT) 69 (Mumbai)

Cases Referred:

1. Calico Dyeing and Printing Works v. CIT [1958] 34 ITR 265 (Bom)

(para 16)

2. CIT v. Lokhandwala Construction Industries Ltd. [2003] 260 ITR

579 (Bom) (para 11, 13, 15, 16, 18)

3. CIT v. V.S. Dempo and Co. P. Ltd. [1996] 131 CTR 203 (Bom) (para

3)

4. India Cements Ltd. v. CIT [1996] 60 ITR 52 (SC) (para 16)

5. S.K. Estates P. Ltd. v. Asst. CIT [1997] 60 ITD 621 (Mum) (paras

3,4,6,9,10)

Amount collected by Developer from buyers towards Flat Owners

Association Corpus Fund is not an income in the hands of the

Developer.

Asst. CIT vs. Smt.C.Rajini (2011) 9 ITR (Trib) 487 (Chennai).

Assessee who is a Developer and not a contractor can declare the

revenue from the project as and when the risks and rewards of

ownership are transferred as per the principles laid down under

Accounting Standard 9 formulated by the ICAI.

1. Dy. CIT V Sudhir V Shetty (2014) 35 ITR (Trib) 115 (Mum “H” Tribunal)

2. S N Builders and Developers Vs ACIT 4(1) Bangalore ITA No

487/Bang/2013 rendered on 11-4-2014

3. Prestige Estate Projects Ltd V DCIT ITA 218/Bang/2009 (ITAT Bangalore)

4. CIT Vs Rema Country Holdings Pvt Ltd ITA No 1041 and 1042/2006

order dated 29-9-2011 (Kar HC)

Where a building complex has apartments exceeding

1500sq.ft, proportionate deduction should be allowed u/s

80IB (10) in respect of the Income relating to apartments

below 1500 sq.ft.

1. ACIT Vs Bengal Ambuja Housing Development Ltd (Kolkata-ITAT) 39-D

BCAJ 546

2. Sanghvi And Dishi Enterprise Vs Income Tax Officer (2011) 141 TTJ (Chn)

(TM) 1, Chennai ‘A’ Bench (Third Member Bench)

3. Sri Mahalakshmi Housing and Sri Mahalakshmi Builders Vs Income Tax

officer ITR (Trib) Vol 18 608 (Chn)

4. Brahma Associates v. JCIT 313 ITR (AR) 268 (Pune) (SB))

5. CIT v SJR Builders ITA No. 32 of 2010 dated 19.03.2012 (Kar HC)

6. DCIT vs. Brigade Enterprises (P) Ltd. 119 ITJ 269 (Bangalore –ITAT)

7. ITO v. Satyanarayan Ramswaroop Agarwal (2014) 163 TTJ (Pune ’A’-Trib)

17

8. Ramsukh Properties v. Dy.CIT (2013) 84 DTR (Pune) (Trib) 383

Ownership of land was not an essential condition to be

eligible for claiming deduction of income from construction

and development of residential housing project u/s 80IB

(10) of the IT Act, 1961.

1. Radhe Developers VS. ITO (Ahmedabad-ITAT) (2012) 341 ITR 403(Guj)

2. CIT v. Safal Associates (2014) 58 (I) ITCL 376 (Guj-HC) : 2014 TaxPub

(DT) 2405 (Guj-HC)

3. CIT v. Nikhil Associates (2014) 58 (I) ITCL 452 (Guj-HC), 45

taxmann.com 278 (Gujarat)

4. Nihil Associates v ITO (2011) 12 Taxmann.com 76 (Ahd- Trib) (URO)

5. CIT vs. Moon Star Developers 2014 TaxPub(DT) 2231 (Guj HC)

6. CIT vs. Mahalakshmi Housing 2014 TaxPub (DT) 1542 (Mad HC): (2014)

222 Taxman 356 (Mad).

7. Asst. CIT vs. Smt.C.Rajini (2011) 9 ITR (Trib) 487 (Chennai)

Amendment to Section 80IB(10), brought out by Finance Act, 2004

w.e.f 01.04.2005, whereby the definition of super built area was

changed to include projections and balconies and place a restriction

regarding maximum commercial area to be built-up by assessee within

the housing complex, for purposes of claiming deduction under said

section would apply only prospectively and not retrospectively.

1. Arun Excello Foundations (P.) Ltd. Vs. ACIT, (Chennai-ITAT) 166 Taxman 53

2. CIT and Another Vs G R Developers (2013)353 ITR 1(Kar).

3. CIT and Another V Anriya Project Management Services P Ltd (2013) 353 ITR 12

(Kar)

4. CIT Vs Brahma Associates (2011) 333 ITR 289( BOM)

5. Manan Corporation V ACIT (2013) 356 ITR 44(Guj)

6. CIT vs Happy Home Enterprises (2015) 372 ITR 1(Bom)

7. CIT Vs Sarkar Builders (2015) 375 ITR 392(SC)

The land on which the housing project is to be developed need not be vacant

as long as the housing project is on the land which exceeds one Acre.

CIT vs.Vandana Properties (2013) 353 ITR 36 (Bom HC)

Disallowance u/s 40(a)(ia) will not affect deduction u/s 80IB(10) as the

deduction is based on “Profits and Gains” derived from business.

Favour:

S. B. Builders & Developers v. ITO (2011) 39 (II) ITCL 548 (Mum ‘E’-Trib): (2011) 136

TTJ (Mum-Trib) 420: (2011) 45 SOT 335 (Mum-Trib)

Income Tax Officer, Ward-9(3), Pune v. Kalbhor Gawade Builders (2013) 141 ITD

612 (Pune ‘B’-Trib): (2013) 155 TTJ (Pune ‘B’-Trib) 124

Income Tax Officer v. Keval Construction (2013) 53 (I) ITCL 386 (Guj-HC)

Against:

Deputy Commissioner of Income Tax v. Rameshbhai C. Prajapati (2013) 49 (II) ITCL

250 (Ahd ‘C’-Trib): (2013) 23 ITR (Trib) 516 (Ahd ‘C’-Trib): (2013) 140 SOT 486

(Ahd ‘C’-Trib)

Deduction u/s 80IB- Computation- Interest received for delayed payment

of consideration

1.

CIT v. Suzlon Energy Ltd. (2013) 354 ITR 630 (Guj)

Followed by:

2.

Nirma Industries Ltd. v. Dy. CIT (2006) 283 ITR 402 (Guj)

Composite Housing scheme consists of six blocks in area exceeding one acre,

plan approved block wise, assessee entitled to deduction u/s 80 IB (10).

CIT Vs Voora Property Developers Pvt Ltd (2015) 373 ITR 317 (MAD)

Car parking area not to be included as part of permissible area for claiming

deduction U/s 80IB (10)

Asst. CIT Vs Smt Rajini and Dy CIT Vs C Subba Reddy, HUF (2011) 9 ITR (Trib) 487

(Chn).

Area of car park not included in built up area for deduction u/s 80 IB (10)

CIT Vs Subba Reddy (HUF) (2015) 373 ITR 103 (Mad)

Proportionate deduction available under section 80IB (10) in respect of

apartments not exceeding 1500 sq ft even though some apartments in the

same complex exceed 1500 sq ft.

Sanghvi & Doshi Enterprise v. ITO (2011) 141 TTJ (Chn) (TM) 1, Chennai ‘A’ Bench

(Third Member Bench)

ALV of flats, built by assessee engaged in construction business, lying unsold, is

assessable as Income from House Property

Case Laws:

1. CIT V/s Ansal Housing Finance and Leasing Co., Ltd 354 ITR 120 (Delhi), (2013)

Taxman 143 (Delhi)

2. CIT – 12 Mumbai V/s Sane and Doshi Enterprise (2015) 58 Taxmann.com (Bombay)

3. CIT V/s Discovery Estates (P) Ltd (2013) 31 Taxmann.Com 180 (Delhi)

No Capital gains on the transfer of TDR

There is no Capital gains on the transfer of TDR as there is no cost of acquisition to

acquire the TDR and in the absence of a specific provision to tax the same as provided

in other cases under Section 55.

Case Laws:

1. CIT -18 V/s Sambhaji Nagar Co-op Housing Society Ltd. ITA No. 1356 of 2012

rendered on 11/12/2014 (Bombay HC)

2. New Shailaja Co-op Housing Society Limited (2009) 121 TTJ 0062 (Mum Tribunal)

Practical Issues on TDS u/s 194IA : Construction Linked Finance:- In the above

arrangement the financer is acting purely for and on behalf of the transferee.

In such cases even though the payments are being made by the financer directly to the

transferor, the obligation to deduct Tax at Source under Section 194 IA or Section 194

C as the case may be, would be that of the transferee and not the financer.

It would therefore be necessary for all transferees to consider and adopt the following

optionsa) Instruct the financer to pay the agreed amounts to the transferor after reducing the

amount attributable to Tax Deducted at Source and pay the Tax Deducted at Source on

behalf of the transferee using the PAN of the Transferee directly to the Government in

the prescribed challan.

b) Instruct the financer to pay the amount attributable to Tax Deducted at Source to the

transferee for the onward remission of Tax Deducted at Source by the transferee.

c) Instruct the transferors to remit the Tax Deducted at Source by using the PAN of the

transferees on the prescribed challan in case they receive the entire amount from the

financers directly.

TDS to be deducted by the transferee in the case of Development

Agreements:

In case the deductor insists on deducting tax only on the Owner and not

the Developer the only option for the Owner and Developer would be to

take refuge under Rule 37BA of the IT Rules. The Owner shall have to file a

declaration as provided in the said rule with the deductee (Transferee) that

the Tax has be deducted at source on the Developer.

As a related issue, where the Owner is getting a specified super built area

in future in exchange for the undivided/divided share of land being

transferred to the Developer and/or his nominees in terms of the

Development Agreement, it would be rather prudent and advisable for the

Owners to adopt the view that there is a “transfer” as on the date of

entering into the development agreement as in that way, the credit for the

tax deducted at source by the Developer on the Owners Share can be taken

in the year when the income from Capital Gains is being offered by the

Owner. The Owner could for this purpose adopt the guideline value for the

land as permitted u/s 50D of the Income Tax Act as the “consideration”

for the purpose of transfer and instruct the Developer to deduct tax u/s

194 IA based on such consideration.

Double-taxation where there is transfer of Capital Asset from a person to

another who treats such asset as Stock in Trade.

It is to be noted that where an Individual or HUF acquires immovable

property to be retained and sold as stock in trade for a consideration which

is below the guideline value, he will be taxed on the difference as per the

provisions of Section 56(2)(vii) (b) and when such stock in trade is sold,

only the actual consideration paid is allowed to be deducted with no

provision to include the step up cost. This will amount to double taxation.

It is significant to note that the provisions of section 49(4) of the Income

Tax Act which provides for step up of cost to the transferee is applicable

only to transfers to which the provisions of section 56(2) (vii) and (vii a)

of the Income Tax Act are applicable, and is only for the purpose of

computing Capital Gains.

This hardship could be mitigated only with an identical provision such as

section 49(4) is inserted into Section 43CA of the Income Tax Act as well.

The taxation of the same income in the hands of two persons and also in

the hands of the same person under the Income Tax Act could be held to

be ultra virus Article 265 of the Constitution of India and also against the

well established principle enunciated by several judicial pronouncements.

CA Ashok Raghavan

Bengaluru