Individual

advertisement

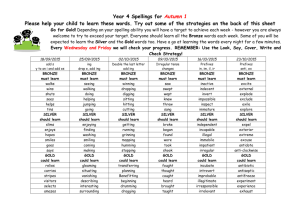

Healthy Business Chat 07/10/2014 1 What Is An Insurance Exchange? • An Insurance Exchange is an organized marketplace for insurance plans to compete and offer services efficiently in the small group and individual markets. • An Exchange provides a level playing field for health insurance plans to comply with benefit requirements and consumer protections required under the ACA. The same health insurance plans that are offered on the Connecticut Health Insurance Exchange website, will also be available directly from the insurer. 2 Basic Introduction to PPACA 3 3 Basic Introduction to PPACA • INDIVIDUALS must have health insurance by January 1, 2014. • SMALL EMPLOYERS are not required to offer health coverage or pay for coverage for their employees. • LARGER EMPLOYERS who do not offer health coverage to their employees may be subject to a penalty if they do not offer minimal essential coverage (MEC) or offered coverage is unaffordable. – 100 FTEs – 2015 – 50 to 99 FTEs - 2016 4 Key Affordable Care Act (ACA) Provisions • • • • • • • • • No medical underwriting No denial of coverage due to a pre-existing condition Minimum medical loss ratio (“MLR”) established No more than a 90 day waiting period for new hires Minimum coverage requirements (Essential Health Benefits) Extensive preventative services provided at no cost Elimination of industry and gender rating Qualified plans evaluated and given seal of approval Plans organized in metal tiers – bronze, silver, gold and platinum 5 Health Insurance Options Under ACA 6 Small Employers 7 7 Some quick “stats”‐ Connecticut • In 2008 the Connecticut Office of Legislative Research Report provided the following numbers for businesses in Connecticut relating to health insurance coverage: • Private employers offering health coverage : 65% • Businesses with 50 or more offering health coverage: 98% • Business with fewer than 50 employees offering health coverage: 55% • These rates of private insurance offerings are above the national average. Subject to change based on State and Federal Guidance as well as final decisions made by the Exchange. 8 8 How Will the Marketplace Affect Small Businesses? •Starting in 2014, a SHOP was available in the State. •Starting October 1, plans will be available for review and enrollment for coverage starting as soon as January 1, 2014. –Rolling monthly enrollments for employers after January 1 •Once a group is enrolled, its rate is guaranteed for 12 months. 9 How Will the Marketplace Impact Small Businesses? (cont’d.) •To enroll, employer must: –Have its principal place of business or an employee worksite in a SHOP’s service area. –Have at least 1 eligible employee: o In most cases, spouses and children cannot be counted. o Sole proprietors without other employees may enroll through the individual market Marketplace. 10 SHOP = Small Business Health Options Program • Currently, the following insurance carriers have said they will participate in the SHOP: – Anthem Blue Cross & Blue Shield of CT – HealthyCT – United Healthcare 11 The SHOP Continued • SHOP will have multiple health plan options, including bronze, silver, and gold plans. • Small Businesses Owners can decide to have their employees purchase vertically, horizontally or use a single choice. 12 The SHOP Continued • Small businesses will have consolidated billing. • No Membership Fee will be charged to participate in the SHOP. 13 The SHOP continued • Employers can decide how much to contribute toward premium costs. • Employers can collect employee share of premiums through payroll deduction. • Premium contributions can be made with pre-tax dollars. • Tax Credits for Small Businesses and Nonprofits can only be obtained through the Connecticut Health Insurance Marketplace. 14 Qualifying for the Small Business Tax Credit • Contribution to health care coverage – Do you cover at least 50% of the cost of health care coverage for your workers based on the single rate? • Firm size – Do you have fewer than 25 Full Time Equivalents (FTEs) • Average annual wage – Do you pay average annual wages below $50,000? • Both taxable (for-profit) and tax-exempt organizations qualify 15 Calculating the Small Business Tax Credit • Firm Size (FTEs) = Total Full Time Employees + Total Annual Part Time Hours/2080 – Owners are excluded from FTE count and employer cannot receive tax credit for owner’s insurance – All employee hours counted and based on 40 hour week • Wages = Total Wages Paid/ FTEs – Owner and family member wages are excluded from total wages • Maximum Small Business Tax Credit – Up to 50% of a small business' premium costs in 2014 for two years – Up to 35% for tax-exempt employers (refundable via payroll tax) for two years 16 Four Inputs for Small Business Tax Credit • Input 1. Full Time Employees 2. Part Time Employee Total Hours 3. Total Wages 4. Employer Portion of Total Premiums 17 Small Business Tax Credit : Illustration 18 Small Business Tax Credit : Illustration 19 Small Business Tax Credit : Illustration 20 Example of IRS form for Small Employers 21 Employer Health Care Arrangements • Q1. What are the consequences to the employer if the employer does not establish a health insurance plan for its own employees, but reimburses those employees for premiums they pay for health insurance (either through a qualified health plan in the Marketplace or outside the Marketplace)? • Under IRS Notice 2013-54, such arrangements are described as employer payment plans. An employer payment plan, as the term is used in this notice, generally does not include an arrangement under which an employee may have an after-tax amount applied toward health coverage or take that amount in cash compensation. As explained in Notice 2013-54, these employer payment plans are considered to be group health plans subject to the market reforms, including the prohibition on annual limits for essential health benefits and the requirement to provide certain preventive care without cost sharing. Notice 2013-54 clarifies that such arrangements cannot be integrated with individual policies to satisfy the market reforms. Consequently, such an arrangement fails to satisfy the market reforms and may be subject to a $100/day excise tax per applicable employee (which is $36,500 per year, per employee) under section 4980D of the Internal Revenue Code. 22 Employer Health Care Arrangements • Q2. Where can I get more information? • On Sept. 13, 2013, the IRS issued Notice 2013-54, which explains how the Affordable Care Act’s market reforms apply to certain types of group health plans, including health reimbursement arrangements (HRAs), health flexible spending arrangements (health FSAs) and certain other employer healthcare arrangements, including arrangements under which an employer reimburses an employee for some or all of the premium expenses incurred for an individual health insurance policy. • DOL has issued a notice in substantially identical form to Notice 2013-54, DOL Technical Release 2013-03, and HHS will shortly issue guidance to reflect that it concurs with Notice 2013-54. On Jan. 24, 2013, DOL and HHS issued FAQs that addressed the application of the Affordable Care Act to HRAs. 23 Individuals 24 24 What is the Enrollment Process for the Individual Market Marketplace? 25 Advanced Premium Tax Credit for Individuals For exchange plans only Income ranges for 133% to 400% FPL To be eligible, individuals must: Have incomes between133% and 400% of federal poverty level (FPL) Not have access to minimum essential coverage through their employer or have access to coverage, but it is not affordable Premium credits – for any level plan Cost-sharing subsidies – Silver Plan only Individual: $15,282 to $45,960 Family of four: $31,322 to $94,200 26 26 Commercial Carriers offered in Individual Marketplace • Anthem Blue Cross & Blue Shield of CT • Connecticare Benefits Inc • HealthyCT 27 When Can Individuals Enroll? • Annual Open Enrollment (after first year) –November 15, 2014 to February 15, 2015 –Coverage begins January 1 •Consumers eligible for Medicaid and CHIP can enroll at anytime. • Special Enrollment Period 28 Special Enrollment (SE) • Occurs almost entirely outside of open enrollment • For how long? – 60 day SE window for most Individual SE events – 30 day SE window for most SHOP SE events • Who is eligible? – The directly effected party – The rest of the QHP household that was effected • (not a dependent for a previous EE plan if no dependents were offered coverage previously) – No SE event for those who could have enrolled previously* 29 Individual Market SE events (examples) • loss of Minimum Essential Coverage (MEC) • gaining or becoming a dependent • Such as birth, marriage, adoption, placement for adoption • person who gains lawfully present status • error, misrepresentation, or inaction of an officer, employee, or agent of the Exchange or HHS, or its instrumentalities • Qualified Health Plan substantially violated a contract provision 30 Recap 31 31 Things you can do • Learn about different types of health insurance. Through the Marketplace, you’ll be able to choose a health plan that gives you the right balance of costs and coverage. • Make a list of questions you have before it’s time to choose your health plan. For example, “Can I stay with my current doctor?” or “Will this plan cover my health costs when I’m traveling?” • Make sure you understand how insurance works, including deductibles, outof-pocket maximums, copayments, etc. You’ll want to consider these details while you’re shopping around. • Start gathering basic information about your household income. Most people will qualify to get a break on costs, and you’ll need income information to find out how much you’re eligible for. • Set your budget. There will be different types of health plans to meet a variety of needs and budgets, and breaking them down by cost can help narrow your choices. 32 Plan Management: Qualified Health Plan (QHP) Issuers QHP Issuers Individual Standard Plans Individual SHOP Non-Standard Standard Plans Plans SHOP Non-Standard Plans Anthem 1 Gold 1 Silver* 1 Bronze 1 Gold 1 Silver* 2 Bronze 1 Catastrophic 1 Gold 1 Silver 1 Bronze 1 Gold 1 Bronze ConnectiCare Benefits, Inc. 1 Gold 1 Silver* 1 Bronze 2 Bronze 1 Catastrophic 0 0 HealthyCT 1 Gold 1 Silver* 1 Bronze 1 Bronze 1 Catastrophic 1 Gold 1 Silver 1 Bronze 1 Bronze UnitedHealthcare 0 0 1 Gold 1 Silver 1 Bronze 0 *All Individual Silver Plans include three cost sharing reduction plans 33 Questions 34 34 Contact Information Access Health CT Website for Individuals : http://www.accesshealthct.com/ Phone Number for Individuals is 855-805-4325 Access Health CT Website for Small Businesses: http://www.accesshealthctsmallbiz.com/ Phone Number for Small Businesses is 855-762-4928 35 Small Print 36