Financial Cycles: What? How? When?

advertisement

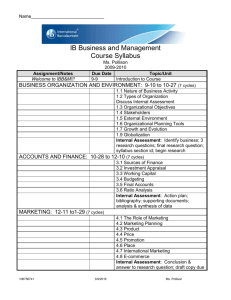

Comment on “Financial Cycles: What? How? When?” by Stijn Claessens, M.Ayhan Kose and Marco Terrones Jeff Frankel Harvard University and NBER International Seminar on Macroeconomics, De Nederlandsche Bank Amsterdam, 19 June, 2010 Statistical analysis of financial cycles Four types of financial events: Credit volume House prices Equity prices Exchange rates Impressively comprehensive body of work: Data in base: > 750 financial cycles 21 advanced countries, 1960:1-2009:4. That implies almost one cycle per year - our first indication that the frequency used to define cycles is too high. Important that the net is cast wide Similar advantages to work by Reinhart & Rogoff (2009), This Time is Different, and various economic historians. True meaning of the “Black Swan.” True meaning of the “Black Swan” Black Swan has come to be used as if to mean a very unlikely event, “a 7-standard-deviation realization.” Or else Knightian uncertainty: an “unknown unknown.” The “fat tails” interpretation is marginally better. In my view, it should mean an event: that is considered impossible by those whose frame of reference is limited in time span and geographical area, but that is well within the probability distribution for those whose data set includes other countries and other decades or centuries. Black Swan examples 1. 2. 3. 4. 5. 6. All swans are white (in England). Terrorists don’t blow up big office buildings. Housing prices don’t fall (in post-war US). Volatilities, e.g., VIX-implicit (2004-06), are low. Big banks don’t go bankrupt. European governments don’t default (1999-2010) nor go to the IMF. Black swan: “House prices don’t go down” 7 Black Swan: risk is low (2004-2006) In 2003-07, market-perceived volatility, as measured by options (VIX), plummeted. So did spreads on US junk & emerging market bonds. In 2008, it all reversed. Source: “The EMBI in the Global Village,” Javier Gomez, May 18, 2008 juanpablofernandez.wordpress.com/2008/05/ 8 Black swan: “European countries don’t default” Relationship of this paper, which dates financial cycles, to business cycle dating “…in parallel with the business cycle literature, we use a well-established and reproducible methodology for the dating of financial downturns and upturns.” Since this is an NBER conference, we should clarify that the NBER Business Cycle Dating Committee’s procedures are very far from reproducible: No rules of thumb; no econometric model. “An Art, not a Science,” for good reasons: the data set is not big enough. “ ‘Classical’ methodology focuses on changes in levels of variables” “An alternative methodology would be to consider how a variable fluctuates around its trend, and then to identify a financial cycle as a deviation from this trend” (p.14) or ‘business cycle’ in Stock & Watson (1999). Burns and Mitchell (1946) Fn. 24: BCDC Exception: calling end of recession We haven’t called trough of 2007-09 because Y << peak. The paper is very long > 60 pages, single spaced. Findings are numerous and diffuse. Too many cakes and ingredients. Perhaps the paper could be shortened, so focus on fewer findings. Consider taking out exchange rate cycles. Three facts highlighted: Financial declines are more abrupt than upturns. Equity & house price cycles are (even) longer and more pronounced than others Fits conventional wisdom (crashes), but not what I had understood from other papers. Housing recoveries take more than 3 years. Evolution: Shortening of equity price cycles, and housing price upturns. Among other findings “Positive duration dependence” (CW, but…) (p.30-31) ≡ the longer a cycle lasts, the more likely a reverse. I had thought not: “expansions don’t die of old age.” U.S. asset prices have stronger effects in EU, than vice versa. Yes, but why? EU is as large as US. We knew why before EMU. But why still now? Another finding more surprising: “Greater trade and financial openness are significantly associated with shorter financial downturns… (p.32). Really? I would like to think so. E.g., Frankel & Cavallo (2008) found trade openness reduces crises. But I am skeptical with respect to the 2008-09 crisis. E.g., Frankel & Saravelos (2010) on Early Warning Indicators. In conclusion… an interesting paper, with lots of findings to think about.