Ch10_EE_Daly_Farley

advertisement

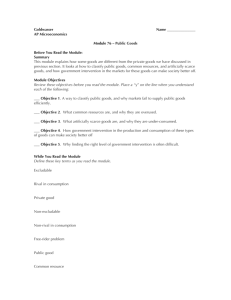

Chapter 10: Market Failures Ecological Economics: Principles and Applications Herman E. Daly and Joshua Farley Chapter Overview • Market Constraints – Excludability – Rival/non-rival – Congestion • Public Goods • Open Access Regimes • Coase Theorem – Transaction costs • Missing markets – Intertemporal discounting and net present value Market Constraints: Necessary elements for affective market forces “One of the underlying assumptions of ecological economics is that many of the scarcest and most essential resources are public good (services provided by natural resource funds), ye the existing economic system only addresses market goods.” page 172 -Goods and resources must be both excludable and rival - Market actors must be able to make transactions with zero cost - People must have perfect information concerning all the costs and benefits of every good Market Constraints: Necessary elements for affective market forces - An excludable resource is one for which exclusive ownership is possible. - A rival good is one for which use of a unit by one person prohibits use of the same unit at the same time by another. - Congestibility is an issue of scale. At a particular threshold some nonrival goods acquire attributes of rival goods. The Market Relevance of Excludability, Rivalness, and Congestibility Excludable Nonexcludable Rival Market goods: food, clothes, cars, houses, waste absorption capacity when pollution is regulated Open access regimes, e.g., ocean fisheries, logging of unprotected forests, air pollution, waste absorption capacity when pollution is unregulated Nonrival Potential market good, but if so, people consume less than they should (i.e., marginal benefits remain greater than marginal costs); e.g., information, cable TV technology Pure public good, e.g., lighthouses, streetlights, national defense, most ecosystem services Nonrival but congestible Market goods, but greatest efficiency would occur if price fluctuates according to usage; e.g., toll roads, ski resorts Nonmarket good, but charging prices during high-use periods could increase efficiency: e.g., non-toll roads, public beaches, national parks. Market Failures: When goods and services aren’t market players -Market failures occur with goods and services outside the narrow constraints of functioning market services. -Monopolies - the absence of competition -Patents - arguably stifles innovation -Public goods - nonrival and nonexcludable Public Goods: Open Access Regimes The open access problem Garret Hardin’s “Tragedy of the Commons” - Rational self-interest creates short term personal gain for long term collective degradation and loss. - It assumes no regulation at any level - Can result from a lack of enforceable property rights but for many resources property rights would not lead to efficient outcomes. Public Goods: Open Access Regimes - A market failure Examples of the open access problem -The tale of 100 Cows -The Atlantic Cod Fishery -The difficulty of property rights -Overpopulation as “tragedy of the commons” Excludable and Nonrival Goods: a market failure Information Patents - Quell the incentives to the money driven - Disallow participation by everyone else Examples - GMOs (and naturally occurring plants) - Pharmaceuticals - Linux Operating System - open source Pure Public Goods: a market failure - Can be used by anyone regardless of who pays for it. - Nonrival and nonexcludable Three challenges for market based solution 1) Ecosystems services values - most people ignorant 2) The Free-Rider Effect - beneficiaries acting in self interest 3) Currently no institutions suitable for transferring resources from the beneficiaries of ecosystem services to the farmer who suffers Public Goods and Substitution: a market failure The market is poor at assigning a value to public goods - It will not be able than to function correctly concerning scarcity Externalities: a market failure An externality occurs when an activity or transaction by some parties causes an unintended loss or gain in welfare to another part, and no compensation for the change in welfare occurs. The marginal external cost is the cost to society of the negative externality that results from one more “unit” of activity by agent Example: Farmer’s Cows in the stream Addition of pollutants Adverse change to flow Deforestation of riparian zone Externalities: a market failure Coase Theorem - Market based balance of welfare from externalities The coal plant and the air-drying laundry service Laundry service needs a specific level of air quality Coal Plant needs to burn coal The Coase Theorem predicts these two parties will come to an agreed upon level for emissions levels that is mutually benifical. It assumes equal standing between the two businesses. High transaction costs could justify government intervention. Missing Markets: a market failure A missing market is when a population with a vested interest is not able to affect the market price. i.e. Future generations and ecosystem services - Markets do not account for future generations. Intertemporal Discounting - the process of of systematically weighting future costs and benefits as less valuable than present ones. (more in Chapter 15) Conclusions: on market failure Markets only balance supply and demand under a very restrictive range of assumptions. The market doesn’t understand the ecosystem nor its services. It will take more than consumer self interest and purchasing power to conserve ecosystem services.