Financing Infrastructure Through Capital Market

advertisement

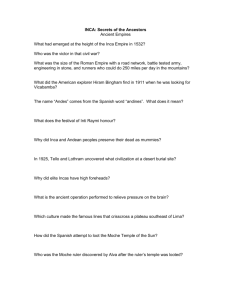

National Pension Commission of Nigeria and The IFC Abuja March 2008 Alternative Asset Classes for Pension Funds Transforming Need into Opportunities: Financing Infrastructure Trough Capital Markets –The Inca Model Johan Kruger 1 Topics The Democratisation of South Africa The Rationale for an Intermediary The INCA Model Prerequisites for Pension Fund Investments In Infrastructure The Advantages of Infrastructure Investments Possible Intermediaries Conclusion 2 The Democratisation of South Africa Pre Democratisation Local Authorities White, Black, Indian, Coloured White -economic base –strong cash flowinstitutional capacity-good infrastructureGovernment support – no problem accessing capital markets Black etc - no economic base-grant dependant=weak institutional structureinadequate infrastructure-no private funding 3 The Democratisation of South Africa Post Democratisation Priority amalgamation of local authorities Investor withdrawal Service Boycotts Tremendous Backlogs Lack of policy framework Fruits of the new South Africa has to be delivered Market gap in private sector infrastructure funding 4 Rationale For Inca Local authority portion minute in comparison with total contractual savings institution’s portfolio (0.2%) Lack of understanding of local government Uncertain policy environment But Private sector know they must invest or jeopardise stability of Country 5 Inca Started in 1996 with $10 m Peaked in 2004 at of $1000 m Portfolio Started in response to government appeal to private sector Structured as intermediary between infrastructure providers and capital markets Listed and rated bonds on market Created two subsidiaries:non profit capacity building fund and distressed bond company 6 Basic Business case Classic aggregation/disaggregation intermediary Issue bonds in domestic market and conclude international loans to raise money Pre approved credit limits Provide funds to borrowers Amortizing or bullet/coupon Bulk is on balance sheet lending Provide assistance trough an non profit company 7 The Inca Model Offers investors Understandable financials of single entity Opportunity for social investment Market related return - listed and AA-rated bond Liquidity by market makers Diversified risk and equity/reserve buffer Dedicated expertise & risk assessment Second corporate bond in South Africa 8 The INCA Model (2) Offers Local Authorities Access to private sector finance Reasonable rates given risk profiles Transparency Assistance Offers Shareholders Opportunity to invest at market related rates Benefit of participation 9 Structure of Inca Choice of shareholders Financial institutions Empowerment and gender partners DFI’s ( political insurance and credibility) Rated (AA-) Back to back bonds in inception phase no interest rate risk No expensive treasury Government stock hedging 10 Structure of Inca (2) General obligations Computerised credit model Pre assessment Shadow rating Turn around time 3 weeks Determines capital requirements Determines pricing Caveats Limited but incentivised staff Non banking entity International Funding 11 Capital Structure Of Inca Equity Mezzanine debt Senior debt 6% 23.5% 70.5% • Return Govt plus 12-14% • Return Govt plus 2- 3.5% • Return Govt plus 0.82.0% 12 Credit Model Solvency Liquidity Turnover Standardization Financial position Income Cash flow Growth indicators Economic environment Shadow rating Diversity of tax Score Physical factors Peer Deviation Management Competence Institutional capacity Dispute resolutions Backlogs Payment levels Policies Practices Socio-economic analysis Environmental Potential problem areas Capital,pricing, caveats 13 Typical Projects Funding of: Municipal and regional infrastructure Roads Sewerage Water Electricity other Parastatal infrastructure 14 Performance Portfolio peaked in 2004 at more than $ 1 Billion Defaults never exceeded 0.2% Return to shareholders always in excess of 20% Capacity building fund had a major Impact 15 Prerequisites for Successful Intermediaries Rule of law –fair and timely Decentralised authority and autonomy Creditworthy or credit enhanced borrowers Acceptance of cost recovery principles and/or appropriate subsidy where required Developed capital market – access - yield curves to price risk- tradability Risk/reward in balance Clear policy framework Capacity to deal with defaults Trust from investment sector in management Credible shareholders 16 Prerequisites for Pension fund Investment in Infrastructure Pension fund’s first responsibility is to their members Risk must be acceptable Reward must be market related and competitive Appropriate listed and rated tradable instruments must be available Long term yield curves Must be socially acceptable projects 17 The Advantages of Investment in Infrastructure Natural match between long term fixed rate requirement of infrastructure funding and the long term needs of the contractual savings sector Diversification opportunity Higher yields possible Stimulates economic growth Benefits members 18 Risks for Pension Funds Failure of infrastructure providers Failure of intermediary Market risks Reputational risks In Nigeria administration problems with intercepts 19 Possible Borrowers and Intermediaries State governments Local authorities Utility Companies Private sector intermediaries UDBN Banks Spv’s 20 Conclusion Infrastructure is a natural area for the pension fund industry and Inca in South Africa has proved the viability of investment in development 21