Case 6_2 and seminar 3 excersises 52KB Sep 10

advertisement

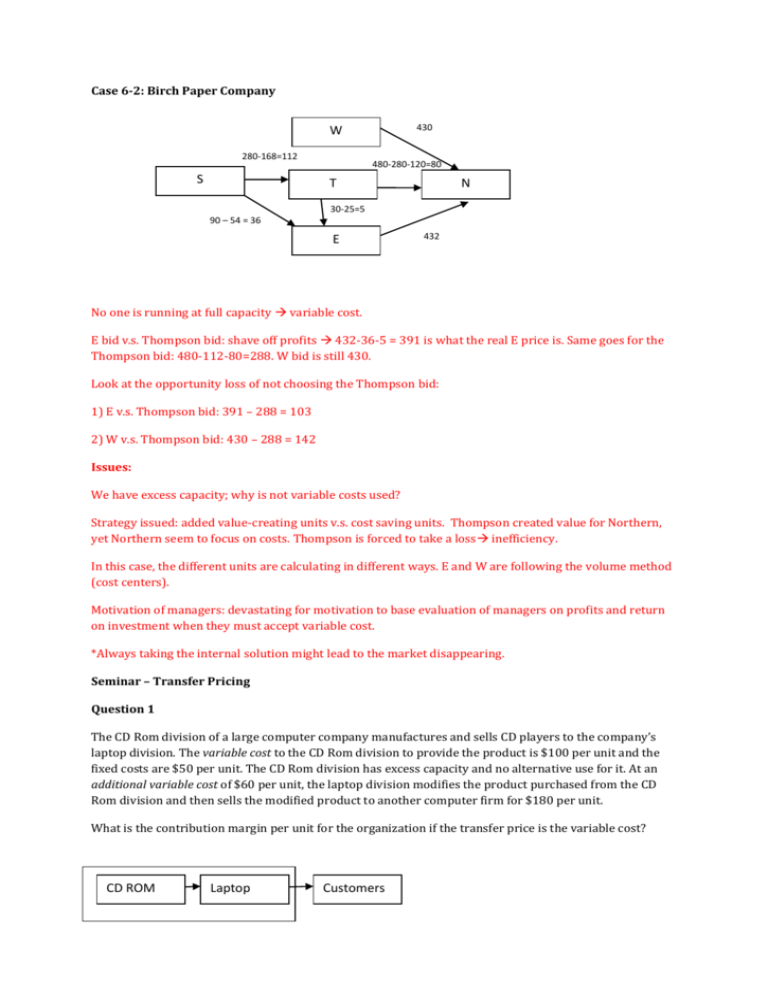

Case 6-2: Birch Paper Company 430 W 280-168=112 S 48 480-280-120=80 T 90 – 54 = 36 N 30-25=5 48 E 432 No one is running at full capacity variable cost. E bid v.s. Thompson bid: shave off profits 432-36-5 = 391 is what the real E price is. Same goes for the Thompson bid: 480-112-80=288. W bid is still 430. Look at the opportunity loss of not choosing the Thompson bid: 1) E v.s. Thompson bid: 391 – 288 = 103 2) W v.s. Thompson bid: 430 – 288 = 142 Issues: We have excess capacity; why is not variable costs used? Strategy issued: added value-creating units v.s. cost saving units. Thompson created value for Northern, yet Northern seem to focus on costs. Thompson is forced to take a loss inefficiency. In this case, the different units are calculating in different ways. E and W are following the volume method (cost centers). Motivation of managers: devastating for motivation to base evaluation of managers on profits and return on investment when they must accept variable cost. *Always taking the internal solution might lead to the market disappearing. Seminar – Transfer Pricing Question 1 The CD Rom division of a large computer company manufactures and sells CD players to the company’s laptop division. The variable cost to the CD Rom division to provide the product is $100 per unit and the fixed costs are $50 per unit. The CD Rom division has excess capacity and no alternative use for it. At an additional variable cost of $60 per unit, the laptop division modifies the product purchased from the CD Rom division and then sells the modified product to another computer firm for $180 per unit. What is the contribution margin per unit for the organization if the transfer price is the variable cost? CD ROM Laptop Customers VC 100 VC 60 Fixed 50 180 60 100 ---------- -------- 150 20 180 – (60 + 100) = 20 What happens if the full cost is used as the transfer price? 180 –(60 + 100 + 50) = -30 Fixed costs are not covered. Discuss: Variable cost v.s. fixed costs. Responsibilties (unit being a profit or cost center). Question 2 Situation A AlfaLaval has a Valve division that manufacturers and sells a standard valve Capacity in units 100 000 Selling price to outside customers $30 Variable cost per unit $16 Fixed costs per unit (based on capacity) $9 AlfaLaval has a pump division that could use the valve in one of its pumps. The pump Division is currently purchasing 10 000 valves from an overseas supplier at a cost of $29 per valve. a) Assume that the Valve Division has ample idle capacity to handle all of the Pump Division’s needs. What is the acceptable range, if any, for the transfer price between the two divisions? 16 - 29 b) Assume that the Valve Division is selling all of the valves it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions? 30 (no incentives for internal transactions; pump can buy for 29, valve can sell for 29) c) Assume, again, that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $3 in variable expenses can be avoided on transfers within the company, due to reduced selling costs. What is the acceptable range, if any, for the transfer price between the two divisions? 27-29 Situation B Assume that the Pump Division needs 20 000 special high pressure valves per year. The Valve Division’s variable cost to manufacture and ship the special valves would be $20 per unit. To produce these special valves the Valve Division would have to reduce its production and sales of regular valves from 100 000 units per year to 70 000 units per year. d) As far as the Valve Division is concerned – what is the lowest acceptable transfer price? VC 20 (we should at least be able to get paid for this) + (30 – 16)*30 000/20 000 = 20 + 21 = 41 When should market price be used as the transfer price? When we have a market price Why are we not using full cost as the transfer price? If there is no market (market price) No excess capacity