Consumer Discretionary/Staples

advertisement

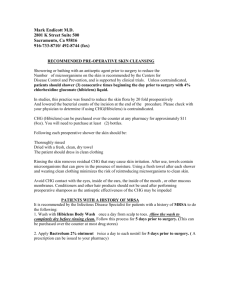

Consumer Discretionary/Staples Mike Becher Julie Berens Beth Blue Sanaata Brown Brian Creek Mick Kozlowski Industry/Sector Overview Due to cyclicality of the economy we suggest: – Overweight Consumer Discretionary – Underweight Consumer Staples Recommendation Buy: Wal-Mart 0% 1.73% Buy: Harley Davidson 0% 1.21% Trim: Altria 1.56% .95% Trim: McDonald’s 6.58% 3.25% – Overall, Consumer stocks decrease by 1% of portfolio value. Wal-Mart Business Analysis Catalysts: • Wal-Mart’s Business Plan • Purchasing Power • • Move into rural areas Supply Chain Management Economies of scale Size Market capitalization Wal-Mart Financial Analysis Cash Flow Analysis WAL-MART STORES INCORPORATED (WMT) FYE Jan Net Income Reported ($ Mil) Accounting Adjustment Net Income Adjusted StockVal ® 2003 % Chg 2002 % Chg 2001 % Chg 2000 % Chg 1999 % Chg 8039.0 21 6671.0 6 6295.0 17 5377.0 21 4430.0 26 235.0 0 235.0 -29 332.0 0.0 0.0 8039.0 16 6906.0 6 6530.0 14 5709.0 29 4430.0 24 3432.0 4 3290.0 15 2868.0 21 2375.0 27 1872.0 15 11471.0 13 10196.0 8 9398.0 16 8084.0 28 6302.0 21 Capital Expenditures 9355.0 12 8383.0 4 8042.0 30 6183.0 66 3734.0 42 Free Cash Flow Adjusted 2116.0 17 1813.0 34 1356.0 -29 1901.0 -26 2568.0 0 Dividends Common ($ Mil) 1333.8 6 1254.7 17 1076.2 20 894.8 25 717.6 13 Free Cash Flow After Dividends 782.2 40 558.3 100 279.8 -72 1006.2 -46 1850.4 -4 Net Cash From Operations 12532.0 22 10260.0 7 9604.0 17 8194.0 8 7580.0 6 Net Cash From Investing -9709.0 -36 -7146.0 18 -8714.0 48 -16846.0 -281 -4418.0 0 Net Cash From Financing -2222.0 25 -2978.0 -574 -442.0 8553.0 -2756.0 -29 -4.0 86 -29.0 88 -250.0 76.0 597.0 458 107.0 -46 198.0 -23.0 Depreciation & Amort Cash Flow Adjusted Other Cash Flow s Change In Cash & Equiv • Net Income is increasing • Free cash flows are increasing by a greater percent than net income 192 26.0 432.0 -23 Wal-Mart Financial Analysis DuPont Analytics WAL-MART STORES INCORPORATED (WMT) Price 56.190 07/25/03 FYE Jan INT MARGIN% BURDEN EBIT EBT ------- ------- Sales EBIT TAX BURDEN% T StockV ASSET TURN LEVERAGE Sales Assets 1 - ---- ------- ------- ROE Acct ROE EBT Assets Equity Rpt% Adj% Adj% 2003 5.69 0.91 64.72 2.74 2.39 21.60 0.00 21.60 2002 5.62 0.88 63.75 2.69 2.43 20.08 0.71 20.79 2001 6.06 0.87 63.50 2.58 2.60 22.02 0.82 22.84 2000 6.16 0.89 63.25 2.74 2.56 22.91 1.41 24.32 1999 5.93 0.90 62.58 2.89 2.41 22.37 0.00 22.37 1998 5.54 0.88 63.02 2.78 2.38 19.78 0.19 19.97 1997 5.47 0.85 63.01 2.72 2.42 19.16 0.00 19.16 1996 5.64 0.82 63.05 2.66 2.56 19.94 0.00 19.94 1995 6.11 0.85 62.90 2.78 2.52 22.84 0.00 22.84 1994 6.35 0.86 63.21 2.87 2.41 23.92 0.00 23.92 6.43 0.89 •1992 ROE is stable 6.53 0.89 •1991 Margins are also stable 6.88 0.91 63.00 3.08 2.29 25.33 0.00 25.33 63.00 3.27 2.17 26.04 0.00 26.04 63.20 3.33 2.10 27.67 0.00 27.67 1990 63.01 3.55 2.09 30.86 0.00 30.86 1993 7.15 0.93 Wal-Mart Financial Analysis First Call FY1 & FY2 Revision Trend StockVal® WAL-MART STORES INCORPORATED (WMT) FY1 JAN 2004 CURRENT EST 2.03 DOWN 1.46% FROM JUL 2002 1% 2.07 0% 2.07 2.06 2.06 2.05 2.05 -1% 2.04 2.04 2.04 2.03 2.03 2.03 2.03 4/03 5/03 6/03 LAST 2.32 2.32 2.31 2.31 6/03 LAST -2% 7/02 8/02 9/02 10/02 11/02 12/02 1/03 2/03 3/03 FY2 JAN 2005 CURRENT EST 2.31 UP 2.21% FROM OCT 2002 3% 2% 2.31 2.31 2/03 3/03 2.30 1% 0% 7/02 8/02 9/02 2.26 10/02 11/02 2.27 2.27 12/02 1/03 • Earnings estimate revisions are stable 4/03 5/03 Wal-Mart StockVal ® Growth & Margin Check WAL-MART STORES INCORPORATED (WMT) Price 56.190 07/25/03 Percent Change Quarter Revenue REV RPS EARN EPS Default Growth Rate Estimate 12.0% Analyst Growth Rate Estimate 12.0% Actual Year Profit EPS Ago Margin % Momentum % SF REV EPS Jul 01 52,799.0 15 15 0 0 0.37 0.37 3.1 0 +14 0 Oct 01 52,738.0 15 16 6 6 0.34 0.32 2.9 0 +14 +5 Jan 02 64,210.0 14 14 8 9 0.50 0.46 3.5 0 +15 +11 Apr 02 54,960.0 14 15 15 16 0.37 0.32 3.0 0 +13 +13 Jul 02 59,694.0 13 14 23 24 0.46 0.37 3.4 0 +12 +23 Oct 02 58,797.0 11 13 19 21 0.41 0.34 3.1 0 +10 +17 Jan 03 71,073.0 11 12 13 14 0.57 0.50 3.5 0 +12 +16 Apr 03 57,224.0 4 6 9 11 0.41 0.37 3.1 0 +4 +9 T4Q 246,788.0 10 11 16 17 1.85 9 0.50 High Estimate 11 0.51 Median Estimate Low Estimate 7 0.49 Number of Estimates Jul 03 Mean Estimate Next Quarter Number of Estimates 25 REV RPS EARN Long-Term Growth Rate Estimates 14.0% 21 Standard Deviation Point-to-Point Growth Rates (%) Years 3.3 2 Least Squares Growth Rates (%) EPS Years REV RPS EARN EPS 1 10 11 16 17 1 9 11 13 15 3 13 13 11 11 3 13 13 10 11 5 15 15 17 18 5 16 16 15 15 7 14 15 17 17 7 16 16 18 19 10 16 16 15 15 10 15 16 16 16 15 20 20 18 18 15 19 19 17 17 20 24 23 22 22 20 23 23 21 21 Wal-Mart Valuation Analysis StockVal® WAL-MART STORES INCORPORATED (WMT) Price 56.2 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2.2 2.0 1.8 HI LO ME CU 1.6 1.4 2.05 0.66 1.28 1.46 1.2 1.0 0.8 0.6 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P CONS. STAPLES SECTOR COMPOSITE A (SP-30) 2.2 07-23-1993 07-25-2003 1.8 1.5 HI LO ME CU 1.2 1.0 1.93 0.47 1.00 1.61 0.8 0.6 0.5 07-23-1993 07-25-2003 0.4 PRICE RELATIVE TO S&P CONS. STAPLES SECTOR COMPOSITE A (SP-30) M-Wtd • Both are trending upward Wal-Mart Recommendation Buy: Wal-Mart 0% 1.73% Risks: – Future growth is already priced into stock – International growth may not be successful – May over-diversify their product offerings Harley Davidson Business Analysis Catalysts: • • • Returns Have Been Increasing and are Projected to Continue High Long-Term Growth Rate Estimates Mid-life Crisis & Early Retirees (excess cash) Harley Davidson Financial Analysis Cash Flow Analysis HARLEY-DAVIDSON INCORPORATED (HDI) FYE Dec Net Incom e Reported ($ Mil) Accounting Adjustm ent Net Incom e Adjusted StockVal ® 2002 % Chg 2001 % Chg 2000 % Chg 1999 % Chg 1998 % Chg 580.2 33 437.7 26 347.7 30 267.2 25 213.5 23 0.0 0.0 -6.9 0.0 0.0 580.2 33 437.7 28 340.8 28 267.2 25 213.5 23 175.8 15 153.1 15 133.3 17 113.8 30 87.4 25 756.0 28 590.8 25 474.2 24 381.0 27 300.9 23 Capital Expenditures 323.9 12 290.4 43 203.6 23 165.8 -9 182.8 -2 Free Cash Flow Adjusted 432.1 44 300.4 11 270.6 26 215.2 82 118.2 103 Dividends Com m on ($ Mil) 41.2 17 35.2 17 30.1 11 27.3 13 24.1 15 Free Cash Flow After Dividends 390.9 47 265.2 10 240.4 28 188.0 100 94.0 153 Net Cash From Operations 779.5 3 756.8 34 565.3 31 431.6 31 330.7 7 Net Cash From Investing -1018.0 -32 -771.5 -351 -170.9 43 -299.6 12 -340.2 16 Net Cash From Financing 79.9 132 34.4 -158.1 -39 -113.8 27.1 -73 0.0 0.0 0.0 -158.5 19.7 Depreciation & Am ort Cash Flow Adjusted Other Cash Flow s Change In Cash & Equiv • Income Increasing by 33%!!! • Free Cash Flow Increasing by 47%!!!! • Increased Capital Expenditures -92 236.3 1195 0.0 40 0.0 -55 18.2 3 17.7 255 Harley Davidson Financial Analysis DuPont Analytics HARLEY-DAVIDSON INCORPORATED (HDI) Price 45.700 07/25/03 FYE Dec INT MARGIN% BURDEN EBIT EBT ------- ------- Sales EBIT StockV TAX BURDEN% T ASSET TURN LEVERAGE Sales Assets 1 - ---- ------- ------- ROE Acct ROE EBT Assets Equity Rpt% Adj% Adj% 2002 21.65 1.00 65.50 1.17 1.75 29.09 0.00 29.09 2001 19.77 1.00 65.00 1.23 1.76 27.69 0.00 27.69 2000 18.64 1.00 63.39 1.29 1.77 27.09 -0.53 26.56 1999 16.95 1.00 63.50 1.23 1.84 24.39 0.00 24.39 1998 16.11 1.00 63.50 1.19 1.90 23.00 0.00 23.00 1997 15.68 1.00 63.00 1.21 1.96 23.37 0.00 23.37 1996 14.87 1.00 63.00 1.32 2.01 28.69 -3.91 24.78 1995 13.13 0.99 63.10 1.61 1.81 24.25 -0.31 23.94 1994 13.56 1.00 61.51 1.92 1.59 27.51 -2.13 25.38 1993 13.66 1.00 60.05 1.86 1.52 -3.60 26.72 23.12 • Margins have been increasing since 1995 11.79 0.94 62.13 1.83 • ROE continues to rise 1991 12.19 0.90 62.44 1.69 1.57 18.76 1.00 19.76 1.90 16.93 5.18 22.11 1990 8.57 0.85 61.18 2.20 2.22 21.31 2.69 24.00 1989 8.97 0.75 61.52 2.03 2.81 23.71 -0.24 23.47 1988 9.68 0.67 59.02 1.81 4.24 25.91 7.05 32.96 1992 Harley Davidson Financial Analysis First Call FY1 & FY2 Revision Trend StockVal® HARLEY-DAVIDSON INCORPORATED (HDI) FY1 DEC 2003 CURRENT EST 2.41 UP 18.72% FROM JUL 2002 20% 2.41 15% 2.32 2.32 5/03 6/03 2.26 10% 2.22 2.22 2.22 2.22 11/02 12/02 1/03 2/03 3/03 2.13 5% 0% 2.21 2.03 7/02 2.07 2.08 8/02 9/02 10/02 4/03 FY2 DEC 2004 CURRENT EST 2.67 UP 0.00% FROM DEC 2002 2.67 0% LAST 2.67 -1% 2.63 2.63 5/03 6/03 2.62 -2% 2.61 2.60 -3% 2.59 7/02 8/02 9/02 10/02 11/02 12/02 1/03 2/03 3/03 • Earnings estimates revised to increase 18.72% for 2003 4/03 LAST Harley Davidson StockVal ® Growth & Margin Check HARLEY-DAVIDSON INCORPORATED (HDI) Price 45.700 07/25/03 Percent Change Quarter Revenue REV RPS EARN EPS Default Growth Rate Estimate 16.0% Analyst Growth Rate Estimate 16.0% Actual Year Profit EPS Ago Margin % Momentum % SF REV EPS Sep 01 861.6 19 19 33 33 0.36 0.27 12.8 +1 +18 +29 Dec 01 905.9 18 19 25 26 0.39 0.31 13.2 +1 +17 +24 Mar 02 927.8 19 20 30 30 0.39 0.30 12.8 +1 +18 +25 Jun 02 1,001.1 16 17 23 24 0.47 0.38 14.3 +1 +16 +24 Sep 02 1,135.5 32 33 49 50 0.54 0.36 14.5 +1 +30 +45 Dec 02 1,026.5 13 13 25 26 0.49 0.39 14.6 +1 +12 +22 Mar 03 1,113.7 20 20 56 56 0.61 0.39 16.7 +2 +18 +47 Jun 03 1,218.9 22 22 40 40 0.66 0.47 16.5 +1 +20 +36 T4Q 4,494.6 22 22 42 43 2.30 Sep 03 Mean Estimate Next Quarter 4 0.56 Long-Term Growth Rate Estimates High Estimate 19 0.64 Median Estimate Low Estimate -4 0.52 Number of Estimates Number of Estimates 14 REV RPS EARN 18.0% 13 Standard Deviation Point-to-Point Growth Rates (%) Years 15.6 2 Least Squares Growth Rates (%) EPS Years REV RPS EARN EPS 1 22 22 42 43 1 18 18 41 41 3 18 18 32 33 3 18 19 32 33 5 19 19 31 31 5 18 19 29 30 7 17 17 28 27 7 18 18 26 26 10 17 17 26 26 10 17 17 25 25 15 14 11 25 23 15 14 13 23 22 20 20 Harley Davidson Valuation Analysis StockVal® HARLEY-DAVIDSON INCORPORATED (HDI) Price 45.7 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 1.7 1.6 1.5 HI LO ME CU 1.4 1.3 1.2 1.63 0.83 1.15 1.00 1.1 1.0 0.9 0.8 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P CONSUMER DIS. SECTOR COMPOSITE A (SP-25) 7.3 07-23-1993 07-25-2003 5.8 4.6 HI LO ME CU 3.6 2.8 2.2 6.20 0.94 1.75 4.53 1.7 1.3 1.0 07-23-1993 07-25-2003 0.8 PRICE RELATIVE TO S&P CONSUMER DIS. SECTOR COMPOSITE A (SP-25) M-Wtd • Both graphs are trending upward and are off their highs Harley Davidson Recommendation Buy: Harley Davidson 0% 1.21% Risks: – If economy does not recover, sales volume may decline – Money could be spent on a new trend Altria Business Analysis Catalysts: • • • Pending Future Litigation Decrease in Earnings Projections Decrease in Domestic Sales Pressure from Generics Fewer New Addicts Altria Financial Analysis Cash Flow Analysis ALTRIA GROUP INCORPORATED (MO) FYE Dec StockVal ® 2002 % Chg 2001 % Chg 2000 % Chg 1999 % Chg 1998 % Chg Net Incom e Reported ($ Mil) 11102.0 30 8560.0 1 8510.0 11 7675.0 43 5372.0 -15 Accounting Adjustm ent -1371.3 1328.5 208 431.0 31 327.9 -87 2485.8 216 Net Incom e Adjusted 9730.7 -2 9888.5 11 8941.0 12 8002.9 2 7857.8 11 1331.0 -43 2337.0 36 1717.0 1 1702.0 1 1690.0 -1 11061.7 -10 12225.5 15 10658.0 10 9704.9 2 9547.8 9 Capital Expenditures 2009.0 5 1922.0 14 1682.0 -4 1749.0 -3 1804.0 -4 Free Cash Flow Adjusted 9052.7 -12 10303.5 15 8976.0 13 7955.9 3 7743.8 12 Dividends Com m on ($ Mil) 5194.8 6 4906.2 7 4589.4 4 4421.5 8 4109.3 5 Free Cash Flow After Dividends 3857.9 -29 5397.3 23 4386.6 24 3534.4 -3 3634.5 21 Net Cash From Operations 10612.0 19 8893.0 -19 11044.0 -3 11375.0 40 8120.0 -3 Net Cash From Investing -2471.0 15 -2916.0 83 -17506.0 -553 -2682.0 -5 -2554.0 -313 Net Cash From Financing -8165.0 -27 -6440.0 -7497.0 -93 -3894.0 29 Depreciation & Am ort Cash Flow Adjusted 2658.0 Other Cash Flow s 136.0 -21.0 94 -359.0 Change In Cash & Equiv 112.0 -484.0 88 -4163.0 • Strong Cash Flows from Operations • Losses Due to Litigation Future Implications -103 -177.0 1019.0 127.0 -43 1799.0 -12 Altria Financial Analysis DuPont Analytics ALTRIA GROUP INCORPORATED (M O) Price 40.280 07/18/03 FYE De c INT MARGIN% BURDEN EBIT EBT ------- ------- Sales EBIT StockV TAX BURDEN% T ASSET TURN LEVERAGE Sales Assets 1 - ---- ------- ------- ROE Acct ROE EBT Assets Equity Rpt% Adj% Adj% 2002 24.16 0.93 64.50 0.93 4.41 56.79 -7.01 49.78 2001 19.71 0.90 62.15 0.99 4.74 49.44 7.68 57.12 2000 20.63 0.93 61.31 1.05 4.63 56.15 2.85 59.00 1999 19.27 0.92 60.85 1.20 3.85 48.73 2.08 50.81 1998 15.04 0.88 59.69 1.20 3.72 34.53 15.97 50.50 1997 16.58 0.90 59.80 1.30 3.80 43.31 5.40 48.71 1996 17.26 0.89 59.00 1.27 3.85 44.70 0.00 44.70 1995 16.18 0.87 58.61 1.24 3.98 40.72 0.20 40.92 1994 14.71 0.86 57.51 1.25 4.25 38.71 0.00 38.71 1993 12.74 0.80 57.59 1.20 4.18 25.56 7.72 33.28 1992 17.28 0.84 57.38 1.21 3.88 39.39 0.00 39.39 15.50 Due to 0.80 56.33 3.84 24.58 9.78 • Strong ROE Leveraged Position 1.20 15.93 0.77 56.09 1.20 3.95 32.90 0.00 •Over 70% of Non-Current assets (including good will) are funded by LTD 1989 15.74 0.73 58.24 1.17 4.38 34.16 -1.77 1988 0.82 55.38 1.07 4.03 32.23 -0.84 •Over 14.58 112% of Productive assets (not including good will) funded by LTD • Accounting Adjustment Due to55.08 Litigation One Time Expense? 1987 14.93 0.81 1.35 3.28 29.52 0.36 1991 34.36 1990 32.90 1986 14.23 0.76 53.45 1.34 3.68 28.44 0.00 32.39 31.39 29.88 28.44 Altria Financial Analysis First Call FY1 & FY2 Revision Trend StockVal® ALTRIA GROUP INCORPORATED (MO) 0% FY1 DEC 2003 CURRENT EST 4.63 DOWN 15.36% FROM JUL 2002 5.47 5.40 5.39 -4% -8% 4.99 4.86 -12% 4.77 4.73 -16% 7/02 0% 8/02 9/02 10/02 11/02 12/02 1/03 4.63 4.62 4.62 4.61 4.62 4.63 2/03 3/03 4/03 5/03 6/03 LAST 4.97 4.96 4.95 5/03 6/03 LAST FY2 DEC 2004 CURRENT EST 4.95 DOWN 20.93% FROM JUL 2002 6.26 6.24 6.23 -6% 5.92 -12% 5.46 5.25 -18% 5.22 5.02 5.02 2/03 3/03 5.10 -24% 7/02 8/02 9/02 10/02 11/02 12/02 1/03 • Earnings revisions have decreased each quarter 4/03 Altria StockVal ® Growth & Margin Check ALTRIA GROUP INCORPORATED (MO) Price 40.990 07/25/03 Default Growth Rate Estimate 8.0% Analyst Growth Rate Estimate 8.0% Percent Change Quarter Revenue REV RPS EARN EPS Actual Year Profit Momentum % EPS Ago Margin % SF REV EPS Sep 01 20,249.0 10 13 10 12 1.19 1.06 12.9 +1 +10 +12 Dec 01 19,882.0 12 15 12 15 1.08 0.94 11.9 +1 +11 +13 Mar 02 20,535.0 3 6 4 7 1.14 1.07 12.1 0 +3 +6 Jun 02 21,103.0 2 4 6 9 1.24 1.14 12.7 0 +2 +9 Sep 02 19,996.0 -1 3 2 6 1.26 1.19 13.4 0 -1 +6 Dec 02 18,774.0 -6 0 -18 -14 0.93 1.08 10.2 0 -5 -13 Mar 03 19,371.0 -6 0 -12 -6 1.07 1.14 11.3 0 -6 -6 Jun 03 20,831.0 -1 5 -5 2 1.26 1.24 12.3 +1 -1 +2 T4Q 78,972.0 -3 2 -8 -3 4.52 -2 1.23 High Estimate 0 1.26 Median Estimate Low Estimate -6 1.19 Number of Estimates 9 Number of Estimates 10 Standard Deviation 1 Sep 03 Mean Estimate Next Quarter Point-to-Point Growth Rates (%) Years REV RPS EARN 11.8 Long-Term Growth Rate Estimates 9.0% Least Squares Growth Rates (%) EPS Years REV RPS EARN EPS 1 -3 2 -8 -3 1 -4 2 -11 -6 3 2 7 4 8 3 3 7 3 7 5 2 6 5 8 5 4 8 6 10 7 2 5 7 10 7 3 5 7 10 10 3 5 7 10 10 3 5 10 13 15 7 9 10 13 15 5 7 10 12 20 10 12 13 15 20 10 11 13 15 Altria Valuation Analysis StockVal® ALTRIA GROUP INCORPORATED (MO) Price 40.3 1993 0.72 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 0.66 0.60 HI LO ME CU 0.54 0.48 0.42 0.67 0.23 0.54 0.46 0.36 0.30 0.24 0.18 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P CONS. STAPLES SECTOR COMPOSITE A (SP-30) 1.6 07-16-1993 07-18-2003 1.4 1.2 HI LO ME CU 1.0 0.8 1.43 0.48 1.11 0.93 0.7 0.6 0.5 07-16-1993 07-18-2003 0.4 PRICE RELATIVE TO S&P CONS. STAPLES SECTOR COMPOSITE A (SP-30) M-Wtd • Historically Inexpensive Relative to Consumer Staples due to unpredictability of litigation Altria Recommendation Trim: Altria 1.56% .95% (market weight) – See what happens next quarter Risks: – Favorable Lawsuit Rulings – Foreign Expansion Opportunities McDonald’s Business Analysis Catalysts: 1. Current growth expected to continue due to new menu items and extended hours 2. Dividend increase and stock repurchase planned for fall 2003 3. Stock is currently undervalued McDonald’s Financial Analysis Cash Flow Analysis Sto MCDONALDS CORPORATION (MCD) FYE Dec 2002 % Chg 2001 % Chg 2000 % Chg 1999 % Chg 1998 Net Income Reported ($ Mil) 893.5 -45 1636.6 -17 1977.3 2 1947.9 26 1550.1 Accounting Adjustment 798.5 460 142.5 12.3 -94 219.0 1692.0 -5 1779.1 -10 1977.3 1 1960.2 11 1769.1 1050.8 -3 1086.3 7 1010.7 6 956.3 9 881.1 2742.8 -4 2865.4 -4 2988.0 2 2916.5 10 2650.2 2003.8 5 1906.2 -2 1945.1 4 1867.8 -1 1879.3 739.0 -23 959.2 -8 1042.9 -1 1048.7 36 770.9 Dividends Common ($ Mil) 307.6 2 301.1 1 298.4 6 280.8 11 253.0 Free Cash Flow After Dividends 431.4 -34 658.1 -12 744.5 -3 767.9 48 517.9 2890.1 8 2688.3 -2 2751.5 -9 3008.9 9 2766.3 -2466.6 -19 -2068.2 7 -2212.6 2 -2261.8 -16 -1948.2 -511.2 18 -623.7 -16 -536.7 14 -626.8 27 -860.3 0.0 0.0 -20 0.0 0.0 -3.6 2.2 -98 120.3 -42.2 Net Income Adjusted Depreciation & Amort Cash Flow Adjusted Capital Expenditures Free Cash Flow Adjusted Net Cash From Operations Net Cash From Investing Net Cash From Financing Other Cash Flows Change In Cash & Equiv 0.0 -87.7 -2336 0.0 • Decrease in 2002 net income and free cash flows not indicative of current and future performance McDonald’s StockVal ® Growth & Margin Check MCDONALDS CORPORATION (MCD) Price 21.440 07/25/03 Default Growth Rate Estimate 6.7% Analyst Growth Rate Estimate 6.7% Percent Change Quarter Revenue REV RPS EARN EPS Actual Year Profit Momentum % EPS Ago Margin % SF REV EPS Jun 01 3,707.5 4 8 -11 -8 0.36 0.39 12.7 +1 +4 -8 Sep 01 3,879.3 3 7 -10 -7 0.38 0.41 12.8 -1 +4 -9 Dec 01 3,771.5 5 8 -3 0 0.34 0.34 11.7 0 +5 0 Mar 02 3,597.4 2 5 1 3 0.30 0.29 10.8 0 +2 +3 Jun 02 3,862.1 4 6 7 8 0.39 0.36 13.0 0 +4 +9 Sep 02 4,047.0 4 6 -1 0 0.38 0.38 12.1 0 +4 0 Dec 02 3,899.2 3 6 -28 -26 0.25 0.34 8.1 0 +3 -26 Mar 03 3,799.7 6 7 -5 -3 0.29 0.30 9.7 0 +5 -3 T4Q 15,608.0 4 6 -7 -5 1.31 Mean Estimate Next Quarter -5 0.37 High Estimate -3 0.38 Median Estimate Low Estimate -5 0.37 Number of Estimates Number of Estimates 15 Jun 03 REV RPS EARN Long-Term Growth Rate Estimates 8.7% 12 Standard Deviation Point-to-Point Growth Rates (%) Years 10.8 2 Least Squares Growth Rates (%) EPS Years REV RPS EARN EPS 1 4 6 -7 -5 1 4 6 -12 -11 3 5 8 -6 -3 3 4 7 -6 -4 5 6 8 0 2 5 6 8 -1 2 7 6 8 2 4 7 7 8 3 4 10 8 9 6 7 10 8 9 7 8 15 8 9 7 9 15 8 9 9 10 20 9 10 9 10 20 9 10 10 11 McDonald’s Financial Analysis DuPont Analytics StockV MCDONALDS CORPORATION (MCD) Price 21.440 07/25/03 FYE Dec INT MARGIN% BURDEN EBIT EBT ------- ------- Sales EBIT TAX BURDEN% T ASSET TURN LEVERAGE Sales Assets 1 - ---- ------- ------- EBT Assets Equity ROE Acct ROE Rpt% Adj% Adj% 2002 13.31 0.81 59.69 0.66 2.35 9.04 8.08 17.12 2001 18.81 0.83 70.25 0.67 2.37 17.51 1.53 19.04 2000 23.37 0.87 68.60 0.67 2.26 20.99 0.00 20.99 1999 24.85 0.88 67.54 0.65 2.13 20.39 0.13 20.52 1998 22.05 0.84 67.18 0.65 2.08 16.93 2.39 19.32 1997 24.49 0.86 68.23 0.64 2.03 18.70 0.00 18.70 1996 24.48 0.86 69.86 0.65 1.98 18.97 0.17 19.14 1995 25.85 0.86 65.80 0.68 1.97 19.36 0.00 19.36 1994 26.59 0.85 64.90 0.65 1.95 18.61 0.00 18.61 1993 27.16 0.83 64.60 0.62 1.95 17.79 0.23 18.02 1992 25.81 0.79 66.20 0.62 2.15 17.87 0.00 17.87 1991 25.65 0.76 66.15 0.61 2.44 19.07 0.00 19.07 2.57 20.75 0.00 20.75 2.49 20.87 0.00 20.87 • First quarter outperformed 2002 25.05 2003 analytics 0.75 64.37 0.67 1990 1989 24.55 0.78 62.80 0.70 McDonald’s Financial Analysis First Call FY1 & FY2 Revision Trend StockVal® MCDONALDS CORPORATION (MCD) FY1 DEC 2003 CURRENT EST 1.33 DOWN 17.90% FROM JUL 2002 8% 0% 1.62 1.63 1.59 1.54 -8% 1.50 1.43 -16% 1.36 1.33 1.33 1.32 1.31 1.32 1.33 2/03 3/03 4/03 5/03 6/03 LAST 1.39 1.39 5/03 6/03 -24% 7/02 0% 1.77 8/02 1.77 9/02 1.77 10/02 11/02 12/02 1/03 FY2 DEC 2004 CURRENT EST 1.41 DOWN 20.34% FROM JUL 2002 1.77 1.77 1.77 -6% 1.64 -12% -18% 1.41 -24% 7/02 8/02 9/02 10/02 11/02 12/02 1/03 2/03 1.39 3/03 1.37 4/03 • Since beginning of 2003, revisions estimates have remained steady 1.41 LAST McDonald’s Valuation Analysis MCDONALDS CORPORATION (MCD) Price 21.4 1993 1994 1995 1996 1997 1998 1999 StockVal® 2000 2001 2002 2003 2004 1.6 1.4 HI LO ME CU 1.2 1.0 1.49 0.59 1.10 0.88 0.8 0.6 0.4 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P CONSUMER DIS. SECTOR COMPOSITE A (SP-25) 1.8 07-23-1993 07-25-2003 1.6 1.4 HI LO ME CU 1.2 1.0 1.72 0.67 1.16 0.87 0.9 0.8 0.7 07-23-1993 07-25-2003 0.6 PRICE RELATIVE TO S&P CONSUMER DIS. SECTOR COMPOSITE A (SP-25) M-Wtd • Stock is currently undervalued McDonald’s Recommendation Trim: 6.58% 3.25% Risks: – Growth due to company’s revitalizations could be short-lived – Foreign sales could continue to weaken Recommendation Buy: Wal-Mart 0% 1.73% Buy: Harley Davidson 0% 1.21% Trim: Altria 1.56% .95% Trim: McDonald’s 6.58% 3.25% – Overall, Consumer stocks decrease by 1% of portfolio value.