signs of the times for developing nations

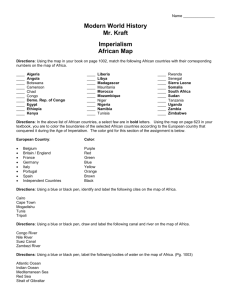

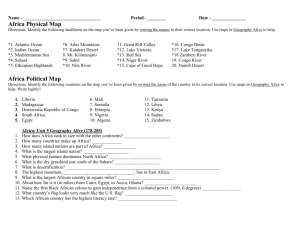

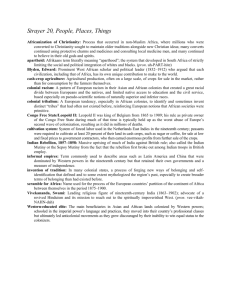

advertisement

CHAPTER 13 DEVELOPING NATIONS Developing Nations PRISMs 1. Should all forms of trade protectionism be outlawed? 2. Do Godzilla nations have any community responsibilities in Tiger nations? 3. Should nations adopt a “living wage” compensation policy for the indigenous employees of foreign companies? 4. Should Tigers be required by economic GGOs to convert to private capitalism? SIGNS OF THE TIMES FOR DEVELOPING NATIONS 1. About half of the workers in the world (1.2B people) make less than $2 a day, including 90% of workers in subSaharan Africa. These “working poor” can’t make enough money to survive. 2. 800M people suffer from chronic malnutrition; 40% suffer from communicable diseases such as malaria & AIDS; 33% experience serious water shortages. 3. 20% of the world consumes 80% of the world’s resourses; the income of the richest 20% has risen from 30 times greater than the poorest 20% to 82 times greater. WAGES OF CLOTHING WORKERS IN DEVELOPING NATIONS Cambodia: 32 cents/hour India: 38 cents/hour Pakistan: 41 cents/hour Sri Lanka: 48 cents/hour China: 68 cents/hour Jordan: 81 cents/hour Thailand: 91 cents/hour Honduras: $1.48/hour El Salvador: $1.59 Mexico: $2.45/hour DEPENDENCE ON CLOTHING/TEXTILE EXPORTS Macau: 82% the nation’s total exports Bangladesh: 82% Cambodia: 77% Pakistan: 75% Sri Lanka: 58% Tunisha: 42% Turkey: 38% China: 21% AFRICAN BUSINESS PROBLEMS 27 of the world’s worst business environments are African. Business taxes in Sierra Leone are 3 times higher than the total profits most local businesses make annually. Registering a new business in the Democratic Republic of Congo takes an average of 155 days and costs five times more than the annual income ($120) of the average Congolese citizen. Enforcing a business contract in Angola entails 47 legal steps and takes over 1,000 days. The impossible business environment of most African nations drives about half of small business owners into the illegal informal underground economy. In Malawi, only 50,000 people (out of a total population 12M) work in the official economy. Other business challenges faced by business in Africa include bad roads, unreliable electricity, frequent currently fluctuations, employees lost to AIDS, and the high cost of business-related bribery. Africa currently captures only 3% of global foreign direct investment. AIDS 1. 78M people are currently HIV positive in the world (with Africa having the 7 most infected nations) 2. 34M have died worldwide from AIDS thus far 3. Sub-Saharan Africa has been losing 10-18% of its working population annually to AIDS 4. Between 11.5-15M children have been orphaned by AIDS 5. HIV rates increased by half (1.1M) in East Asia between 2002-2204 6. The death rate from AIDS has starting declining in 30 nations 7. Global funding for AIDS increased from $2.1B in 2001, to $6.1B in 2004 8. As a group, developing nations owe more than a trillion dollars to foreign creditors. 9. The 43 mostly sub-Saharan African nations (500 million total population) are getting poorer. They lost one quarter of their income between 1980-2000. 10. Africa & South Asia had more malnourished children in 2000 than in 1975. 11. During the 1990s in Russia, the percent of people living in poverty went from 2% to over 50%. 12. Business scams and frauds of unprecedented magnitude ($30B+) hit Eastern European nations during the 2000s. Romania had 600+ Ponzi schemes, where crooked finance companies continuously borrow money from a growing chain of unsuspecting investors and create the short-term appearance of financial gain using money from new “suckers.” Romania had 600+ Ponzi schemes & more than half of Albanians and their government were fooled by similar scams. 13. Over the past 2 decades, the following nations were classified for varying amounts of time as “failed nation states” (with corrupt nonfunctioning governments/institutions & lack of law & order): Ethiopia, Eritrea, Afghanistan, Somalia, Liberia, Yemen, Sierra Leon, & Rwanda. st 21 CENTURY PROFILE OF DEVELOPING NATIONS PROFILE OF DEVELOPING NATIONS 1. Dependence on agriculture, commodities, & labor-intensive, low value-added manufacturing 2. Weak institutions 3. Strong historical commitment to protectionism 4. Small middle class 5. Often former colonies 6. Often struggling with ethnic or religious tensions MICs Middle income nations (MICs) have a per capita annual income ranging from $1,000-$6,000: China, Philippines, Brazil, Mexico, Argentina, Venezuela, Indonesia, etc. These nations have at least an emerging middle class social structure, if not an established one (amidst numerous pockets of poverty). Global corporations target MICs for both short-term & long-term market development. 1. 2. 3. 4. 5. ECONOMIC SPECIALIZATION OF DEVELPING NATIONS Low wages manual labor : China, Indonesia, Philippines, Skilled labor manufacturing: South Korea, Taiwan Specialized foods: Thailand, Vietnam, New Zealand, Chile Computer hardware: & electronics: China, Taiwan Oil, gas, & minerals: Mexico, Venezuela, Indonesia, Russia A LEGACY OF COLONIZATION 1. The vast majority of developing nations were former European colonies in the 19th & 20th centuries. The following “settler colonies” were heavily infiltrated by ex-patriot Europeans & their institutions in the 19th century: Argentina, Australia, New Zealand, & Uruguay. 2. These nations were partially colonized by European settlement: Algeria, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, South Africa, & Venezuela. 3. The modern history of colonization & civil war in many developing nations (India, the Middle East, most of subSaharan Africa, etc.) produced an unstable social & cultural foundation for (historically late) nationalism. 4. When many of these nations (Pakistan, Bangladesh, Eritrea, Bosnia/Serbia, East Timor, etc.) received independent statehood in the 20th century, their diverse and often fractious population groups produced only the semblance (“holograph”) of nationalistic identity. 5. These new nations (Sierra Leone, Congo, Rwanda, South Africa, Darfur, the Palestinian territory, etc.) were seldom politically united, frequently fracturing themselves into incompatible sub-populations (various African tribes, Muslims vs. Hindus, ethnic minorities, etc.) that competed and warred against each other for dominance—hardly a healthy foundation for building the institutional stability needed for democracy & economic growth in the integrated 21st century global economy. A LEGACY OF PERPETUAL ECONOMIC STRUGGLE 1. Africa, Middle East, South America, Central America, India, China 2. Colonial legacy of exploitation and political disruption 3. Reliance on low value-added commodities (crops, minerals, natural resources) for national income and exporting 4. Plutocracies: In many developing nations, weak institutions have enabled a small minority of power elites to perpetually control the vast majority of wealth and political power. The resulting absence of a viable middle class restricts business activity & economic growth. A status quo society assures that the rich get richer & the poor get poorer. 5. Political instability and civil wars 6. Population problems (subsistence standard of living) 7. Protectionism: Keeping foreign companies out, and thus their superior technology, management, and competitive know-how that could help local companies learn how to compete more effectively) 8. Systemic corruption in politics, the legal system, human rights, etc. 9. Large debt owed to international agencies such as the International Monetary Fund 10. Poorly trained workforce and lack of business infrastructure (transportation networks, banks, stock markets, warehousing, etc.) 11. Rich nations play a significant role in sustaining poverty in developing nations by not importing the three categories of exports that are most lucrative to these nations: agricultural products, clothing, and textiles. Many rich Western nations, including the USA, heavily subsidize (at $360 billion annually) their agricultural, clothing, and textile industries even though DCs have a strong labor cost advantage that would enable them to sell their products at lower prices in Western markets if rich nations actually practiced what they preached about free trade. UNSAFE PRODUCTS 1. Several DCs have experienced serious product safety deficiencies in recent years. 2. The U.S. FDA rejected 1900 shipments of Chinese food or cosmetics in 12 months time; 1787 Indian shipments; & 1560 Mexican export shipments (especially cantaloupes & candy). 3. The most common reasons for food export rejections include use of poisonous pesticides, contaminated fresh food, & adulterated substances. “If developed countries do not reduce their protectionism and deepen their flows of trade and foreign investment with developing countries, the expected large increase in the population of developing countries (combined with the current population stagnation of most developed nations) may generate massive and likely chaotic migratory flows (illegal immigration) with grave consequences. Developed countries must accept increased immigration over the coming decades to avoid social and economic chaos.” POSITIVE DEVELOPMENTS IN AFRICA 1.The New Partnership for African Development (NEPAD) seeks to boost foreign direct development in Africa through reassuring investors that Africa is becoming more politically stable and economically healthy. NEPAD is targeting internal development via education, agriculture, and energy. 2. It proposes that African nations engage in mutual peer review to break the entrenched “good old boy” pattern of crony leadership. Currently the most responsible/accountable African regimes are those led by Thabo Mbeki (/South Africa), Olusegun Obasanjo (Nigeria), John Kufour (Ghana), and Abdoulaye Wade (Senegal). DC’s HELP BUILD U.S. ECONOMY Emergent economies (those making significant progress towards industrialization and middle class social structure) are investing heavily in U.S. government bonds to help finance America’s trade deficits and government spending deficits. This helps keep the dollar strong (higher in value than it should be) thus helping Americans to purchase more exports from the developing world. ECONOMIC GROWTH IN DCs DEPENDS ON SOCIAL INSTITUTIONS THAT CAN DELIVER: 1. Good statistics about the nation’s economic growth & conditions 2. A framework of workable commercial laws 3. Efficient markets for raising money 4. Efficient means of productivity 5. Employee development & training opportunities 6. Social acceptance of capitalism, competition, & wealth THE INVISIBLE SYSTEM OF SWEATSHOPS 1. Corporations, like people, usually take everything available to them, including the many advantages of working in developing nations: low-priced, plentiful labor & suppliers; diminished, or even non-existing, business regulations; absence of unions; few human rights, etc. 2. For as long as such profitable external circumstances exist, many developing nations go through the “sweatshop” period of economic development. Many policy-makers tolerate sweatshops as are the lesser of two evils (better than unemployment) & temporary until the nation can move up the value-added curve, eventually erasing sweatshops. 3. During the sweatshop “stage” of economic development, it is possible for some corporations to “feast” on what often amounts to a selfperpetuating system of low wages, non-existent worker rights, lack of job security, open pollution, low public visibility, & often cozy relationships with politicians. 4. This system remains largely invisible because it’s culturally endorsed, the workers are in dire need of jobs, & few consumers realize how low-priced their products really are. 5. If sweatshops are at least temporarily inevitable, should the international community seek to hold sweatshops abuses during the temporary period of their economic development to a minimum & minimize how long they flourish? THE WORLD’S FLAWED TRADING SYSTEM & UNFAIR DISTRIBUTION OF WEALTH The vast majority of wealth is controlled by a small minority of the (developed) world. Some estimate that as much of 80% of the world’s total wealth is controlled by less than 20% of the global population. Numerous cultural factors account for much of this phenomenon, but the world’s unfair trading system is also a factor. Agricultural subsidies paid by rich nations to their farmers distort global wealth distribution by enabling subsidized farmers to out-price their competitors in developing nations who don’t receive subsidies. Developing nations charge that the IMF’S program of import substitution (developing nations indebted to the IMF must import goods when they are cheaper than those made at home) takes takes away their food self-sufficiency and subjects them to erratic food sourcing when agriculture-exporting nations experience crop shortages. DCs also claim that global financial & economic institutions (IMF, WTO, World Bank) are dominated by Western policy interests, thus protecting their over-sized share of the global GDP. CHANGING THE GLOBAL TRADING SYSTEM Realigning the global trading system to produce more equitable income distribution will require progressive action from 3 spheres: national governments, global government organizations (such as the UN, WTO, & IMF), and global corporations. National governments must continue to pursue free trade regimes, but not at the expense of DCs. GGOs must provide DCs with greater access to policy-making power, while global corporations must enlarge their circle of stakeholders beyond financial stockholders. 3-WAY INFRASTRUCTURE PROBLEMS DCs are plagued with weak infrastructure in 3 major areas: (1) Weak political infrastructure (representative government, weak governments checks & balances, government corruption); (2) Weak physical infrastructure (roads, sanitation systems, communications wiring, airports, etc.); (3) Weak business infrastructure (financial markets, warehousing, technology, transportation, business services such as insurance, etc.) THE MOST COMMON FORMS OF BUSINESS CORRUPTION IN DEVELOPING NATIONS 1. Product pirating & black markets: Selling stolen or “knock-off” versions of brand name products at cut rate prices & without taxes 2. Bribery: In the absence of business institutions & professionals (lawyers, CPAs, title companies, stock markets, civil courts, etc.), “facilitating payments” are a fact of business life in developing nations. Many times, these “bribes” are nothing more than informal ways of paying for business services not available via legitimate institutions. 3. A 2006 World Bank study showed that corruption has declined somewhat in 26 ex-communist (mostly Eastern European) nations. “Corruption is becoming less frequent, costly, & damaging.” 4. The report found that corruption hurts private firms more than stateowned, small more than large, & new firms more than old. “In short, weak firms suffer more than the strong.” 5. According to a Kenyan economic expert, Western economic aid to Africa often does more harm than good. For example, when corn is donated from the West, much finds its way into the hands of corrupt political officials who sell large volumes of it for personal gain or to feed their rebel armies. Another large portion is dumped on the black market. “Local farmers may as will put down their hoes; no one can compete with the UN’s World Food Program.” 6. 7% of world merchandise ($500B) is counterfeit, with 2/3 coming from China. 7. Rampant TV piracy in Asia, especially India & Thailand, cost U.S. providers $1B annually. Brazilian cable pirates have erected 600,000 illegal cable connections. 8. Sales of black market computers in India outsell legitimate retail computers 2 to 1. 9. 70% of cell phones in Malaysia are pirated black market knock-offs. 10.The Brazilian “underground” (untaxed & often illegal) economy makes up 40% of the total GDP & 60% in Zimbabwe. 11. The frequent price booms & busts of the global oil market & other commodities (minerals, crops, etc.) are especially hard for the shaky unstable economies of developing nations to adjust to, as are the frequent ups and downs of the imports/exports of these fragile nations. 12. Many developing nations have not able to sustain meager periods of economic progress due to the unintended consequences of austerity programs imposed by foreign lenders, such as rise in unemployment & debt interest payments; sell off of assets owned by governments in private enterprises; political unrest; & high interest rates used to curtain inflation. BUSINESS CHALLENGES IN DEVELOPING NATIONS 1. Material inputs to the production process are sometimes very scarce (typewriters instead of computers). 2. An irregular supply of raw materials can create havoc with production scheduling. 3. Energy supplies are often erratic and sometimes rationed (water, electricity, gas, oil). 4. Capital equipment industries are underdeveloped, and resources for scientific and technological development are generally severely limited. 5. In protected markets, local companies face no competitive pressures to update their technology and competitive practices. 6. Problems with suppliers: insufficient quality; high costs; different product control standards; inaccuracy in meeting design standards; delivery delays 7. Companies are almost forced in the short run to be their own suppliers because of the shortage of outside suppliers. 8. Sometimes it is advantageous to locate in an industrial park, where infrastructure is better and also available to suppliers. 9. One complication of competing in price-controlled settings is the emergence of illegal black markets for the goods. 10. Serious weaknesses in transportation infrastructure and services, telecommunications, and storage tend to make product distribution a slow and expensive process. 11. Poor quality of roads often causes greater wear and tear on vehicles. 12. Prices, supply and demand data, and product flow information are not readily available. 13. In developing countries where capital and commercial credit are scarce, sellers must often engage in credit extension activities. 14. Most consumers are not very mobile, buy in small quantities, shop frequently, and require credit because of constraints of income (low and irregular cash flow) and storage (refrigeration). 15. DCs frequently engage in regional trade wars with one another instead of working together as a united trade block against more developed competitor nations. “FRONTIER ECONOMIES” (OPERATING WITHOUT BUSINESS INSTITUTIONS) 1. China, Russia, Vietnam, Cuba 2. Business is unregulated and corrupt, dominated by black markets, smuggling, bribery, organized crime, extortion 3. Due to the absence of legitimate capitalistic institutions and a checks and balances government, it is virtually impossible to do business ethically in frontier economies. CORPORATE PROTECTION MONEY Chiquita Brands was fined $25M by the U.S. Justice Dept. in 2007 for paying $1.7M in “protection money” bribes to two terrorist organizations in Colombia: the United SelfDefense Forces of Colombia (responsible for some of the worst terrorist massacres in ongoing Columbian civil wars) & the Revolutionary Armed Forces of Colombia (FARC, a major cocaine exporter). Chiquita’s CEO explained that “The payments were motivated by our good-faith concern for the safety of our employees.” 1. To succeed in emerging markets, “we need different mind-sets and market strategies. We need managers who can envision creating a business selling sachets of shampoo for pennies, distributing products in stores the size of phone booths, or offering credit cards to people whose idea of banking is storing rolls of coins in a money belt.” 2. Emergent market strategy requires innovative "outside the box” strategic thinking in such areas as doing business in a primitive infrastructure, marketing to small and diverse segments of customers, & redefining how sales are financed. 3. For example, India’s small villagers house 600M potential customers, but 42% of the villages are under 500 people. Emergent marketers have to take the product to the people, even in small diverse groups. 4. China & India lack true national homogenous markets, but instead are made up of a series of submarkets (numerous regional areas & cultures) which require unique business strategies for one market a time. China has 660 cities, but only 71M of its 1.3B people reside in the largest 4 urban areas. MICROFINANCE Muhammad Yunas, an economist from Bangladesh, won the Nobel price in 2006 for his pioneering work in the creation of markets in developing nations (via Grameen Bank) for small (micro) loans which harnessed the personal business efforts of millions of grassroots entrepreneurs. The emerging microloan movement spread geographically to Latin America, where Mexico’s CompartamosBanco has generated a billion dollar portfolio from its 900,000 microloan clients. On average, Compartamos loans $450 to each client, generating $152 annually via a controversial average interest rate of 79%. Critics say that makes the Mexican bank “an old-fashioned loan shark,” but Compartamos argues that its profits are nurturing a microfinance industry financed by outside investors pouring much-needed new capital into into a truly globalized new industry. Seven new microloan lenders have followed Compartamos in the Mexican market, driving down interest rates. Since becoming a public company, Compartamos has also enrolled 60,000 of its clients in financial literacy courses. THE VALUE ADDED CHAIN (VAC) 1. Adding value to products is the key to profitability. 2. Different degrees of value are added are each stage of the product’s production. For most products, value added increases the closer you move towards the ultimate consumer of the product. 3. Thus, designing and marketing the product adds greater value (profit) than providing the raw materials from which the product is made or assembling the product. 4. Innovative (patented or copyrighted) products garner the most profit because of their intellectual capital. CLASSIFYING NATIONS ON THE VALUE-ADDED CHAIN 1. NATURAL RESOURCE EXPORTING: Oil (Middle Eastern nations), rubber (Malaysia) , minerals (sub-Saharan African nations), agricultural commodities, etc. (Lowest classification on the value-added chain, & hence lowest profitability) 2. NATURAL RESOURCE MANUFACTURING: petrochemicals (Middle Eastern), cement (India) 3. INTERMEDIATE GOODS (Supplying manufacturers): textiles, building materials, plastics, etc. 4. LABOR-INTENSIVE assembled products: toys, sunglasses, etc. 5. TECHNOLOGY-INTENSIVE manufacturing: nations (such as Mexico & Brazil) that have moved beyond the developing stage are on the way to becoming middle class economies; are still manufacturing-focused 6. INNOVATION: Nations that improve, extend, & perfect the manufacturing of products invented by other nations (Japan, South Korea, Taiwan, etc.) 7. INVENTION: Nations that invent products which become major new global markets or even new global industries (USA, Japan, Sweden, France, etc.). This is the highest classification on the VAC & generates the highest standard of living. HOPE ON THE HORIZON FOR DEVELOPING NATIONS 1. 86% of the world's population is located in developing countries, but because many of these nations are beginning to develop a middle class, thus making them “emerging markets” with strong future potential for both economic growth & business profit. 2. These emerging markets will be the key driver of the global economy over the first half of the 21st century. 3. If just 6% of the developing world succeeds in achieving a annual income of $10,000, 350M people (more than the population of the U.S.) will gradually become middle class consumers. 1. U.S. corporations on the Standard & Poor’s 500-stock index generate 35% of profits from foreign markets. 2. America’s General Electric projects that 66% of its growth over the next decade (vs. just 20% over the past decade) will come from emerging markets. 3. China’s Haier is currently the second largest refrigerator company in the world; Mexico’s Cemex is the third largest cement maker; Turkey’s Koc group of manufacturing & service companies grossed over $11B in 2003. 4. “Bollywood” (India’s movie industry) makes over 4500 movies annually (vs. 1,200 for Hollywood) & sells 12M movie tickets daily. 5. India’s Hindustan Motors Rural Transport Vehicles (RTVs) are a big profit generator because their versatile design (people carriers, delivery vans, troop carriers, school buses, ambulances, etc.) meets the needs of multiple target markets. 6. China’s retail market has been growing 15% annually for the past 20 years (with Nestle being the only Western company among the top 5 packaged goods companies in China). 7. America’s share of the Indian high-turnover consumer goods industry is already $10B & expected to double in the next decade. 8. Western Union has 225,000 outlets in 200 countries (including 21,000 in China) for transferring funds electronically (a highly profitable and growing market, since emerging market countries lack strong consumer banking services). 9. Frito-Lay has experienced considerable success marketing its Mexican Sabritas brand to the U.S. Hispanic market. 10.Mexico's largest mortgage company recently opened a New York office to accommodate the number of work visa Mexicans who want to wire money back to relatives in Mexico. 11.More than 100 US. banks now accept “matricula consular” identity cards for Mexicans who want to open temporary bank accounts. 12.Carnegie Mellon University is developing a low cost ($250) wireless communication device that combines PC-TV-DVD-phone. It’s targeted for the 4B people in emerging markets who make less than $2000 annually. 13.Consumer companies in China have cashed in profitably on economical beds & tables with built-in drawers. 14.Advanced Micro Devices has just developed a $185 Personal Internet Communicator (including monitor) that is capable of connecting ½ of the global population with Internet hook-up. 15.The Indian Institute of Science markets the $200 “Simputer,” which uses a stylus-based text system instead of a keyboard. 16.India’s Grameen Bank (with a staff of 11,000) has made grassroots “microloans” (small uncollateralized loans to sole proprietor businesses) to 3M borrowers in 43,000 villages. 17.Makers of Islamic “halal” products (consumer items with approved organic ingredients similar to “kosher” products in Jewish cultures) are experiencing rapid growth via developing new food & hygiene products not previously available with halal standards. 18.India’s largest private bank, ICICI, provides a vast array of financial services (banking, insurance) & other electronic services (games, e-commerce, email, etc.) via computer kiosks in high traffic retail areas. 1. Ready-to--eat meals to overcome lack of refrigeration 2. Water purification systems 3. E-learning where business training schools are scarce 4. Portable gas-powered generators where electrical grids are weak 5. Retail kiosks where computers are scarce 6. Waste recycling machines where trash collection is poor 7. Proto-SUV vehicles where road conditions are poor THE GREATEST RESOURCE IN st THE 21 CENTURY WORLD Throughout world history, women have always been the most underutilized economic resource. Not until the second half of the 20th century were women in Western cultures “liberated” to make major professional contributions to economic development. Slowly, but surely, a similar social movement is underway in much of the developing world, thanks in large part to digital technology (computers, PDAs, cell phones, etc.) undergirding female entrepreneurial activity. Microloan businesses, free trade coops, & cottage industries are ushering in a new era of productivity in the developing world. REGIONAL ANALYSIS OF DEVELOPING NATIONS THE RISE OF INDIA 1. India will likely become the world’s third largest economy (after the U.S. & China) by 2040, with a per capita income 20 times higher than today. 2. But today India struggles with underdevelopment, with 40% of the world’s poor & second-largest HIV-positive population. 3. India’s biggest assets are a strong, entrepreneurial private sector, strong democratic institutions, & a fast growing service economy (due to Western offshoring). 4. India’s incredible ethnic & cultural diversity (17 languages, 22,000 dialects, hundreds of largely independent political entities) create a huge problem to centralized economic development. “But India can still capitalize on its advantages: a vast, growing economy, an attractive political democracy, a vibrant model of secularism & tolerance, a keen knowledge of both East & West, & a special relationship with America.” 5. India is currently the 12th largest economy in the world with a per capita income of $4, 542. Since 1990, India has emerged as one of the wealthiest nations in the world. 6. Two-thirds of the Indian workforce is still agricultural, but numerous welleducated young workers are fueling a boom in pharmaceuticals, biotechnology, nanotechnology (atomic-size technology applications), & telecommunications. RUSSIA’S FAULTY TRANSITION FROM COMMUNISM TO CAPITALISM The former Soviet botched its late 20th century transition from Communism to capitalism by abruptly converting from a the government’s “command” pricing approach to free market pricing practically overnight. “The end result was an enormous concentration of wealth and a general understanding that the process of privatization favored a small group of investors. The outcome was tragic for a large segment of the population. ” By 1996, Russia’s economy had shrunk almost 36%; its infant mortality rate soared & birth rates fell below replacement level; and wealth became highly concentrated. Most Soviet satellite nations experienced income declines of 25% or more, with 6 suffering a 50% income decline. Two civil wars also broke out. NO LONGER A “COMMUNIST PARADISE” 1. Life is tough in post-Communist Russia due to the economic & social chaos caused by the overthrow of a totalitarian system that is still searching for a viable replacement. The “propellers” fell off the old Soviet Union in mid-flight, & the plane is now gliding without power. 2. Homelessness & runaway children has reached epidemic proportions; the Russian population is shrinking by 750,000 annually; alcoholism is rampant; pessimism & cynicism are omnipresent. WHY RUSSIA IS NOT DEVELOPING 1. No independent parliament 2. No independent judicial system 3. No independent media 4. State-influenced elections 5. Strong police state powers 6. Extreme state-business collusion/corruption THE ROUGH AND TUMBLE OF BUSINESS IN RUSSIA 1. Systemic, ingrained lawlessness due to centuries of bad government: Throughout history, Russia has been an orderly (via dictatorial control), but lawless, nation. 2. “Mutant capitalism”: An unholy alliance between corrupt government officials gangsters, and industrialists 3. Government officials form entrepreneurial networks with gangsters to exploit business opportunities: import bribes, money laundering, factory licensing, illicit drugs, patent/copyright stealing, etc. 4. Corrupt Russian government officials sometimes suppress legitimate corporate competition via dirty tricks (jailing executives on false charges, forcing buyouts by state companies, etc.). 5. The Russian central bank borrowed tens of billions of dollars from the IMF and then laundered it in a shadow bank in New Jersey to use in speculative bond buying around the world. 6. Limited competition between companies means that the only way new companies can get started is to bribe their way in. 7. Bureaucratic working environment: every minor inefficiency is somebody’s livelihood 8. Krisha (“roof”) infrastructure: gangsters extort companies to buy otherwise non-existent business services (insurance, property protection, access to govt. officials, tax evasion, etc.) in exchange for 1020% of profits. 9. Reliance on bartering, IOUs and counter trading to compensate for Russia’s non-tradable ruble and lack of legitimate money in circulation PRAGMATIC ADVICE FOR DOING BUSINESS IN RUSSIA 1. Avoid involvement in “strategic” national industries such as natural resources. 2. Don’t partner with former Communist Party insiders who are probably corrupt. 3. Make friends in high places, such as governors & mayors. 4. Look the other way at rigged elections & other forms of institutional corruption. The impersonal marketing approach of Western capitalism (large self-service retailers, massive advertising, credit card purchasing, etc.) is poorly suited for selling to the burgeoning populations of developing nations. Affluent Westerners have more wants than needs, while most people in developing nations have way more needs than wants. The 86 Percent Solution: How to Succeed in the Biggest Market Opportunity of the 21st Century (by Ijay Mahajan and Kamini Banga) address markeing strategy approppriate for devleoping markets. IRAQ’S CIVIL WAR CHAOS The violence in Iraq comes from multiple and conflicting directions: small gangs of Sunnis and Shiites killing each other in territorial-control clashes; Baathists (former loyalists to Saddam Hussein) and jihadists attacking U.S. and Iraqi forces in a more organized way; Sunnis fighting with Kurds for turf in northern Iraq. On top of all this, there is widespread crime and corruption. “Saddam Hussein and the Taliban ran cruel dictatorships. But in uprooting them, the West exposed deep tribal and sectarian schisms, unleashing violent forces that the dictators had kept in check and which could not be reconciled simply by installing democratic procedures. Although Afghans and Iraqis voted eagerly for democratic constitutions and new governments, these governments are not working well. The losers have not accepted defeat; meanwhile, the winners, especially in Iraq, have determined to take it all.” 1. 2. 3. SUDAN & DARFUR Black African & Arab tribal cultures meet in the Darfur region of western Sudan (Northwest Africa). The non-Arab black people (the Fur, Masalit, & Zaghawa) have clashed throughout history with Arab tribes (the Baggara). All of these tribes are Muslim. In 2003-2003, Darfur’s non-Arab Muslim tribes sought to secede (in protest against historical mistreatment & discrimination) from the Baggarabacked Arab government in Sudan’s Khartoum. In an attempt to quash the rebellion, the Arab government armed ethnic Arab para-military death squads (the “Janjaweed”) to pillage & “ethnically cleanse” nonArab Muslim rebel villagers. 300,000 people have been killed thus far in this civil war & a more extensive civil war is imminent between Sudan & neighboring Chad (where over 200,000 fleeing Darfuris have fled). CIVIL WAR IN COLOMBIA 4. The Columbian army has unsuccessfully battled with 2 different rebel groups for nearly a decade. 5. The Revolutionary Armed Forces of Columbia (FARC) is a Stalinist (Communist) guerrilla army of 18,000 mercenary soldiers financed by various drug lords in Columbia (who are in turn financed by American drug users). FARC has resorted to indiscriminate terrorist activities (bombings, property destruction, & death squads) in the attempt to demoralize Columbians in their support of the national army (which has dispatched 7000 soldiers to deal with FARC). 6. The National Liberation Army (ELN) is Columbia’s second guerilla group also backed by drug lords seeking to control the nation’s political terrain. 7. Various right wing para-military squads have been organized by major Columbian land owners to protect their property from civil war fallout. 8. The U.S. has also fielded intermittent military campaigns in Columbia to stem the flow of drugs & to stabilize the national army’s counter-guerilla activity. 9. Columbia produces 90% of all the cocaine consumed in America (the world’s most voracious drug user) & is a major supplier of heroin & marijuana. 1. 2. 3. 4. 5. 6. MAJOR DRUG-PRODUCING DEVELOPING NATIONS Cocaine: Columbia (#1), Peru (#2), Bolivia (#3) Opium (heroin): Afghanistan (#1), Burma (#2), Mexico, Azerbaijan Marijuana: Mexico, Columbia, Afghanistan, Azerbaijan, USA Hashish: Morocco, Syria Methamphetamines: Burma (& USA) Synthetic drugs: Belgium, Poland, (& USA) CIVIL WAR IN SRI LANKA 1. The island of Sri Lanka, south of India, has a decade-long civil war between the majority Buddhist Singhalese & the minority Tamils (about 8% of the island’s population) who occupy the Jaffna peninsula (which they call Eeslam) on the NE part of the island. Muslims make up another sizable minority group who live in the NE sector of the island & tend to side with the Singhalese. 2. The Tamil Tiger rebel group has waged a bloody terrorist campaign (of 60,000 violent casualties) seeking Tamil independence in Eeslam. They are bitter about social & economic discriminatory behavior by the Singhalese, including making Singhalese the official language of Sri Lanka. CIVIL WAR IN CYPRUS 1. The island of Cyprus south of Turkey is partitioned into 2 nations, one officially recognized by the world (the Republic of Cyprus, an EU member), & the other not recognized (the Turkish Republic of Northern Cyprus). 2. When a Greek military junta in the late 1960s took over Cyprus by coup, Turkey also invaded, securing 37% of the island & engaging in ethnic cleansing of the indigenous Greek Cypriot population. 3. 8 years of subsequent political negotiations failed to solve the island’s bifurcation, prompting Turkey to form the “rump” Turkish Republic. CIVIL WARS IN EASTERN EUROPE 1. 9 civil wars, based mainly on historically deep ethnic/religious tensions, erupted in 1991-1995 after the dissolution of Communist rule, splitting former Yugoslavia & Czechoslovakia into 7 new nations: Bosnia/Herzegovina, Croatia, the Czech Republic, Macedonia, Serbia, Slovenia, & Slovakia 2. In the worst of these conflicts, historically Christian Serbs sought to expand its borders at the expense of Muslim minorities in bordering nations. 3. Serbia attempted to carve out a new nation for Serbs out of the borders of Bosnia & Croatia, nations with large Serb minorities. This Serbian campaign sought to remove all non-Serbs (mainly Muslims) from the enlarged Serbia through summary executions, terror, & forcible expulsion. 4. Hundreds of thousands of Muslim Albanians died and millions were displaced. 5. This civil war of “ethnic cleansing” was eventually brought to a violent end when NATO (military partnership between the USA & the EU) launched heavy bombing raids against the Serbs. AFRICAN CIVIL WARS 1. Massive colonialization of Africa by Europe over the past 150 years rearranged ancient African tribal boundaries, plunging much of continent into civil wars over the past 50 years when European nations withdrew. 2. In 1884, a meeting of European colonial powers was hosted in Berlin to plot out the final game plan for the final take-over phase of African territory. By the end of the 19th century, all African nations (9 million square miles) had been colonized, except for Liberia & Ethiopia. 3. Rwanda (former Belgian colony): Possibly 2/3 (800,000) of the Tutsi population was exterminated in the 1990s by their age-old economic rivals, the Hutu. 4. Sierra Leone: The Revolutionary United Front (RUF) repeatedly clashed with different dictatorships during the 1990s over diamond mining profits. Child soldiers have been aggressively recruited by both sides. UN peacemaking efforts have made some progress. 5. Congo: Four million people (half of them children) have died since 1998 in a complex multi-tribal civil war involving the governments of Congo (formerly Belgian Congo, then Zaire), Uganda, & Rwanda. At the peak of the civil war, an average of 1250 people died every day (2 children per minute) from mostly preventable causes. 30,000 children have been forced into rebel militia groups or into toxic diamond & gold mines. 6. Ethiopia vs. Eritrea: On and off again civil war (with hundreds of thousands of casualties) since the 1990s over Eritrea's secession from Ethiopia (North Africa) 1. British colonies (30% of Africa's population): Botswana, Gambia, Ghana, Guyana, Kenya, Sierra Leone, South Africa, Somali, Sudan, Uganda, Zambia, Zimbabwe 2. French colonies (15% of population): Algeria, Benin, Burkina Faso, Chad, Comoros, Congo, Djibouti, Gabon, Guinea, Ivory Coast, Madagascar, Mali, Mauritania, Morocco, Niger, Senegal, Tunisia, 3. Germany (9% of population) : Burundi, Cameroon, Namibia, Rwanda, Tanzania, Togoland 4. Spain: Western Sahara, Guinea Belgium: Rwanda 5. Italy: Eritrea, Somalia 6. Portugal: Angola, Guinea-Bissau, Mozambique 7. Belgium: Congo ISREAL & THE PALESTINIANS 1. During the “Six-Day War” of 1967, Israel expanded its borders (in an effort to establish a safe buffer zone between itself & hostile bordering Arab nations) by taking the following territories from Egypt, Jordan, & Syria: the West Bank, the Gaza Strip, East Jerusalem, & the Golan Heights. 2. The Muslims living in these regions lost their nationalities & citizenships & have been referred to since simply as “Palestinians.” 3. The Palestinians have struggled to form their own nation state in a process fraught with terrorism, violence, & America's military & economic backing of the Israelis.