Mergers and Acquisitions

advertisement

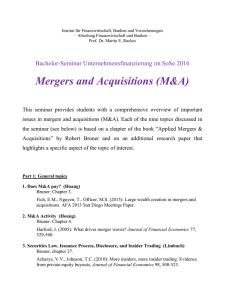

Mergers and Acquisitions Course for the Master’s Level Course description The syllabus for the Mergers and Acquisitions course is prepared specifically for the students of the Master Program in Economics Department of NSU in order to them acquire knowledge and special skills in M&A deals. The course assumes the basic knowledge in such disciplines as Corporate Finance, Financial Markets, and Financial and Managerial Accounting. The topics of the course are devoted to the topical problems of M&A field of finance. They connected with discussing the main factors that influence successful M&A deals, their important characteristics and modern peculiarities. The course deals with a lot of business cases that is aimed to analyze the best practice in Mergers and Acquisitions financial field. Each topic of the course covers theoretical and practical issues, and analyzing some up-to-date research papers as well. Topics of the course are as follows: the Market for Corporate Control and M&A Deals; Valuation: Firms, Options, and Synergies; Risk Management in M&A; Negotiating and Governing in M&A; Divestures; Financing Mergers and Acquisitions; Leveraged Buy-Outs. Course objectives To get the knowledge of a theoretical framework in Mergers and Acquisitions. To teach the fundamental and advanced methods, techniques, and skills of successful mergers, acquisitions, and some useful methods of financing in M&A deals. To prepare students to make sound personal and professional decisions. To provide students with a better understanding of the importance and role of M&A deals in a modern concept of corporate control. To develop skills of a scientific researcher in such financial field as Mergers and Acquisitions. Assessment The student’s performance in the International Monetary Relations course will be evaluated on the basis of the following: Homework assignments and essays (20%); Class working: participation in lectures and practice sessions including case study, discussions, short presentations of homework exercises or reading assignments (20%); Course project (20%) Final exam (40%). Main reading 1. 2. Robert F. Bruner. Applied Mergers and Aquisitions. 2004. Enrique R. Arzac. Valuation for Mergers, Buyouts, and Acquisitions. 2008.