Accounting and Auditing

Hot Topics for 2011

Finance and Administration Roundtable

Jeff Schragg

Patty Brickett

Leslie Pine

703-893-0600

Agenda

• Employee vs. Independent Contractor

• Proposed New Lease Accounting Standards (ASC 840)

• Update on New Form 1099 Reporting Rules

• Other Hot Topics

– ASC 820 – Fair Value Measurement

– ASC 310 – Receivables

– ASC 958-805 – Mergers of Non-Profits and Goodwill

– ASC 740 – Accounting for Income Taxes

– Increased Number of IRS Examinations

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

2

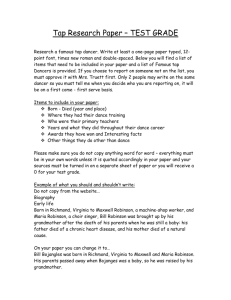

Employee vs. Independent Contractor

Do you know who your employees are?

Do you know who your employees are?

Of course you do

•

Employees are easy to identify…

– Onboarding process through HR so all paperwork is in

place…Right?

– Offices, cubicles, desks and business cards

– Laptops, cell phones and organization email addresses

– They are at your office “every day”

– They receive Forms W-2 to report earnings and withholding

•

And you know you have Independent Contractors…

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

4

Do you know who your employees are?

But what about volunteers, interns, temporary workers and

workers overseas?

• There is no IRS classification for volunteers, interns,

temporary workers and workers overseas

– How are they being handled by your organization?

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

5

Do you know who your employees are?

• The IRS as part of an employment tax National Research

Program has embarked on a multiyear study with 500 audits

of Tax Exempt Entities expected in 2010, 2011 and 2012

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

6

Do you know who your employees are?

As part of this comprehensive audit, the IRS is focused on

• Worker classification - Employee versus Independent

Contractor

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

7

Do you know who your employees are?

The IRS is looking at:

• Workers who have received Form 1099

• Workers who have received both Form 1099 Miscellaneous

and Form W-2 during the audit period

• Workers hired as Independent Contractors and converted to

employees

• Downsized employees rehired as Independent Contractors

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

8

Do you know who your employees are?

How do you determine if you have an “employee” working for

you?

• Review all facts and circumstances of the workers situation

using the factors the IRS has set out at

www.irs.gov/taxtopics/tc762.html

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

9

Do you know who your employees are?

Relationship of the Worker and the Organization

• What agreements or contracts have been entered with the

worker?

• What benefits are available to the worker – insurance,

pension, contributions, vacation pay, sick pay

• How and who provide training for the worker?

• How does the organization represent the worker to others?

• How long has the worker been providing services to the

organization?

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

10

Do you know who your employees are?

Behavioral Control

• What instruction is the worker given?

• Who determines the methods by which assignments are

performed?

• Who does the worker contact regarding problems?

• What is the work product?

• Where does the worker perform services?

• What schedule is the worker required to work?

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

11

Do you know who your employees are?

Financial Control

• Who provides the worker supplies and equipment?

• What expenses are incurred by the worker?

• What expenses are reimbursed and how are expenses

reimbursed?

• Does the worker have other clients or customers?

• How is the worker paid?

• Can the worker realize a profit or incur a loss on the work?

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

12

Do you know who your employees are?

So what should you do now? BE PREPARED

•

Internal audit of worker classification and reporting

– Generally multi-functional team including Finance, HR, Payroll and

Key Management Personnel

– Cooperation of overseas offices, if any, necessary

– Evaluate all classification utilized by the organization; Independent

Contractors, volunteers, interns, temporary employees and overseas

workers

•

Calculate exposure/risk

•

Evaluate options to correct retroactively and prospectively

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

13

Tips to Support Independent Contractor

Classification

•

Always have a signed written contract

•

Only contract with a corporation, partnership or limited liability company

•

Require written invoices with employer identification number for payment

•

Do not set the hours of work

•

Require consultant to provide their own equipment

•

Pay by work project, not hours or days

•

Require consultants to pay their own out-of- pocket expenses

•

Include reimbursed expenses as payments reported on Form 1099

•

Do not closely supervise the work

•

Don’t use consultants for long periods of time

•

Allow the consultant to work for other organizations

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

Resources

• www.irs.gov

• Form SS-8 Determination of Worker Status

• Publication 15 (Circular E), Employer’s Tax Guide

• Publication 15(A), Employer’s Supplemental Tax Guide

• Publication 1729, Independent Contractor or Employee

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

15

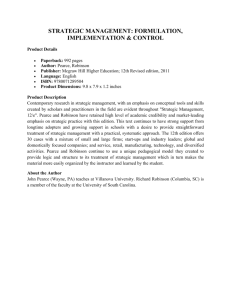

Proposed New Lease Accounting Standards

Making Sense of the New Lease Accounting

Rules

Proposed New Lease Accounting

Standards

• If codified, proposed new accounting rules will represent a

radical shift in how entities have accounted for real and

personal property leases

• The impact on both lessees and owners of the property will

be dramatic and perhaps even shocking for some

• Although many details remain to be finalized before the new

standards for lease accounting are adopted, there is

virtually a 100% consensus that broad-based changes will

occur

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

17

Current Standards

• Current lease accounting under Generally Accepted

Accounting Principles (GAAP) is based on SFAS 13 (now

ASC 840), originally issued in 1976

• Under the current standard, leases are characterized as

either operating or capital

• Operating leases generally are not reflected on an entity’s

statement of financial position, and payments made are

recorded as rent expense

• Tax Accounting Rules for operating vs. capital leases are

different than GAAP rules under SFAS 13/ASC 840

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

18

Why the proposed changes?

• The Financial Accounting Standards Board (the FASB) is

responding to the public outcry stemming from Enron’s creative

accounting debacle

• As a natural extension of the Sarbanes-Oxley Act, the Securities

and Exchange Commission requested a rewrite of the lease

accounting rules

• In a 2005 report, the SEC estimated that there is over $1.25

trillion in non-cancelable operating lease obligations not currently

recognized in financial statements

• Both the FASB and the International Accounting Standards Board

(the IASB) were asked to work jointly to increase transparency in

lease-related financial statement reporting

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

19

Issues with the Current Lease

Accounting Standards

Critics of the current standards contend that:

• Operating leases truly give rise to assets and liabilities that

should be recorded in an entity’s statement of financial position

• Failure to record leases in the statement of financial position

does not allow for transparency for the users of financial

statements

• Comparability of financial statements between entities that

account for leases differently is reduced

• “Off balance sheet” operating lease obligations translate to

significant fixed and contingent liabilities for entities

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

20

Timing of Proposed New Standards

• The FASB and IASB issued a Discussion Paper in March

2009

• An Exposure Draft was issued in August 2010

• While no fixed date has been determined for the issuance of

the final standard, it is generally expected that the final

standard will be issued mid 2011 and could become

effective as early as 2012

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

21

Proposed Changes to the Standards

Lessees:

•

While the Exposure Draft addresses new accounting rules for both lessors and

lessees, the primary focus will be on the basic changes affecting lessees

•

The lease accounting model contemplated by the new standard is a "right of

use" model that assumes that each lease creates an asset (the lessee's right to

use the leased asset) and a liability(the future rental payment obligations)

•

Specifics of the proposed rules provide for the following basic principles:

– No further distinction between operating and capital leases

– Will apply to all leased business assets with few exceptions and not just real estate

leases

– No so-called "grandfathered" leases so that all leases in existence as of the effective

date of the new standard will be subject to the new accounting rules

– A lessee's balance sheet will reflect an asset representing the company's right to use

the leased asset, and a liability representing the company's obligation to make rental

payments

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

22

Proposed Changes to the Standards Continued

• Assets and liabilities will be measured on a basis that

– Assumes the longest possible lease term that is more likely

than not to occur, taking into account the effect of any options

to extend or to terminate

– Uses an expected outcome technique to reflect the lease

payments, including contingent rents (such as percentage

rent), residual payments (such as guaranteed residual value

payments) or expected payments under term option penalties,

and

– is updated when changes in facts or circumstances indicate

that there would be a significant change in those assets or

liabilities since the previous reporting period

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

23

Proposed Changes to the Standards Continued

Lessors

•

Lessors will apply either a performance obligation approach or a

derecognition approach depending on whether the organization retains

exposure to significant risks.

– If the organization retains exposure to significant risks of the underlying

asset, a performance obligation approach will be used. Under this

approach, the lessor would continue to recognize the underlying asset but

would also recognize an asset for the right to receive lease payments and a

liability for the obligation to give another organization the right to use the

asset. The liability would be amortized as lease income over the life of the

lease and interest income would be recognized as payments are received.

– If the organization does not retain exposure to significant risks of the

underlying asset, a derecognition approach will be used. Under this

approach, an organization would account for the lease similar to the current

accounting for capital leases, except that it would be required to estimate

various options and contingencies in each lease.

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

24

Impacts of the Proposed New Standards

on Nonprofit Organizations

The impact of the new standard will have a number of far reaching impacts

on nonprofit organizations, particularly those entities that have a substantial

number of operating leases. Some of the anticipated impacts that will have

immediate effects on nonprofit organizations include:

– Substantial internal efforts, process adjustments and expense will need to be put in

place and expended in order to learn and implement the new reporting and

measurement requirements imposed by the new standard

– Higher rents will have to be recorded based on the most likely term and expected

outcome technique described above which, based on the impact to financial

statements, will require extensive internal analysis and estimates never before

required, all of which will result in the addition of significant liabilities to the statement

of financial position

– debt covenants in debt agreements may be violated or triggered due to material

changes in applicable financial ratios

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

25

Impact of the Proposed New Standards

on Nonprofit Organizations - Continued

• Nonprofit organizations may seek to alter their leasing

strategy to

– Own assets instead of leasing where appropriate, or

– Reduce lease and extension option terms to create the

desired effect on its financial statements

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

26

Actions Nonprofit Organizations Should

Take Now

•

There is still plenty of time before the new standard becomes effective

•

However, since the new standard will apply to virtually all business

assets and all leases in effect as of the effective date, it would be

prudent to start to plan and budget for the affirmative changes to come

•

Suggested actions would be as follows:

– Evaluate the Exposure Draft and the new lease accounting rules, monitor

the comments and review the final standard when issued in 2011

– Measure the likely reporting effect across its leasing platform and the

potential impact on its statement of financial position

– Review the effect of new reporting requirements on existing legal

documentation related to its debt obligations and consider whether any

affirmative action may be required to be taken with its lenders in advance of

the effective date of the new standard

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

27

Actions Nonprofit Organizations Should

Take Now - Continued

Budget for and plan to implement an internal review,

technology and process changes required by the new rules,

including

– Educating the appropriate internal groups responsible for

assessment, measurement and reporting, and

– Determining who will make the difficult judgment calls

regarding certain decisions

– Reassess your leasing program and requirements to

take the appropriate strategic action (e.g., lease v. own,

shorter terms, fewer options, etc.) to minimize the impact

of the new standard

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

28

Summary

• The proposed rule changes related to the new lease

accounting standard could have a significant effect on an

entity’s financial statements

• While the effective date of the new standard is not

immediate, it will take some time for your organization to

understand the implications of the rule changes and to

prepare internally for the new measurement and reporting

obligations

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

29

2010 Patient Protection and Affordable

Care Act / Creating Small Business Jobs

Act of 2010

• Changed Form 1099 reporting rules to pay for health care

changes ($17.1 billion - PPA, $2.5 billion - CSBJA)

• CSBJA increased information return filing penalties ($421

million)

• Current Law – IRC 6041

– Trade or business must provide

• Form 1099 for taxable income payments over $600

• Major exception for corporations (except those providing medical care or

legal services)

• Major exception for purchased goods

• Major exception for “Gross Proceeds”

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

30

2010 Patient Protection and Affordable

Care Act / Creating Small Business Jobs

Act of 2010

• New Law

– Beginning for payments in 2011, rental real estate is now a trade or

business for Form 1099 reporting purposes (2011 Form 1099 filed by

February 2012) – IRC 6041(h)

– Beginning for payments in 2012, all payments over $600 to be reported

(2012 Form 1099 filed by February 2013) – IRC 6041(a)

– IRS provided guidance on credit card charges/payee is credit card company

not vendor

• Repeal is a possibility for IRC 6041(a)

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

31

Other Hot Topics

• ASC 820 – Fair Value Measurement

• ASC 310 – Receivables

• ASC 958-805 – Mergers of Non-Profits and Goodwill

• ASC 740 – Accounting for Income Taxes

• Increased number of IRS Examinations

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

32

Jeff Schragg

Argy, Wiltse & Robinson, P.C.

jschragg@argy.com

703.770.6313

Jeff is a tax partner with Argy, Wiltse & Robinson, PC (“Argy”). Jeff

counsels clients on highly-complex tax and business matters. He

provides his clients a broad and deep knowledge of all areas of

state, federal and international taxation. Jeff has coordinated

services for both individual and business clients, including exempt

organizations, real estate companies and government contractors He brings a resultsdriven approach to closely-held businesses and high net-worth individuals. Jeff advises

clients in all phases of growth from inception to funding growth to exit strategies via sale

or going public. He has extensive mergers and acquisitions experience. As such, Jeff

has brought sophisticated tax planning and advice to Fortune 500 companies, S

corporations, trade associations and charities.

Jeff is the Chair of Synetic Theater’s Board of Directors and a board member of the

Fairfax County Chamber of Commerce.

Jeff received is Juris Doctor from The National Law Center at George Washington

University and a Bachelor of Arts in Economics and Management from Albion College.

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

33

Patty Brickett

Argy, Wiltse & Robinson, P.C.

pbrickett@argy.com

703.752.2782

Patty Brickett, Lead Partner of Argy’s International Services Practice, has over 21

years of experience providing International Tax and human resources consulting

services to multinational corporations and their global executives. Patty works with

clients in all industries and in the not for profit community. Her clients range from

those just beginning to expand globally, to those with mature international operations.

Patty assists clients with Tax planning and compliance using Income Tax Treaty Network to minimize exposure,

International compensation delivery, International payroll management and consulting, Tax equalization/tax

protection policy development, Analysis of Status of Forces Agreements (SOFA’s), Technical Cooperation

Agreements and other bilateral agreements, U.S. tax withholding and reporting requirements on payments to

foreign entities and individuals including assistance to companies under Audit Permanent Establishment

Analysis and Review of foreign tax obligations created by Business Travelers and development of internal

process and procedures to mitigate risk.

Patty is frequently asked to speak on International Tax, payroll and human resources issues. She has spoken

for numerous organizations including the American Society of Payroll Management, ADP, Virginia Society of

CPA’s, the Greater Washington Society of CPA’s Not-For-Profit Organization Symposium, The CanadianAmerican Business Association, Inside NGO’s Annual Conference; Inside NGO’s Taxation of Americans

Overseas Workshop, and the DC Bar Association. Patty is a guest lecturer at the American University Masters

in Tax program and she has been quoted on International Tax and human resource issues in the Washington

Post, Washington Business Journal and the Journal of Financial Planning.

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

34

Leslie Pine

Argy, Wiltse & Robinson, P.C.

lpine@argy.com

703.770.6334

Leslie Pine, Partner in the Virginia office of Argy Wiltse & Robinson, P.C.

(Argy) has over 23 years of experience providing audit and consulting

services to various for profit and non-profit organizations.

As a partner in Argy’s Assurance and Business Advisory Group, Leslie

spends the majority of her time overseeing audits, reviews and compilations

for non-profit organizations and government contractors. Her clients range from start-up entities to

those with mature significant operations. Her expertise also includes non-profit audits under OMB

Circular A-133. In addition, she performs special projects and due diligence reviews for both

acquired and acquiring clients, as well as various types of consulting for government contractors and

non-profit organizations. Leslie is the lead in the assurance and business advisory group with regard

to non-profit clients, and has spoken on several current accounting topics for not-for-profits, such as

Accounting for Uncertainty in Income Taxes and alternative investments. Leslie assists clients with

governmental cost principles, indirect rate structures, disclosure statements, compliance audits for

government contractors and not-for-profits and technical support on auditing and accounting issues

for those clients.

Leslie received both her undergraduate degree and Master’s Degree in Accountancy from the

University of Nevada. She is a member of the AICPA and is licensed in Virginia, the District of

Columbia, and has a Practice Privilege in California.

ARGY, WILTSE & ROBINSON, P.C.

Copyright 2011 Argy, Wiltse & Robinson, P.C., All Rights Reserved

35

All of the materials contained in this course have been created by and belong

solely to Argy, Wiltse & Robinson, P.C.

IRS Circular 230 Disclosure: Tax advice contained herein is not intended or

written to be used and cannot be used for the purpose of avoiding tax-related

penalties that may be imposed on the taxpayer. Argy, Wiltse & Robinson, P.C.

is not rendering legal advice and assumes no liability whatsoever in

connection with its use.

Please Contact Us At

Jeff Schragg

jschragg@argy.com

703.770.6313

Leslie Pine

lpine@argy.com

703.770.6334

Patty Brickett

pbrickett@argy.com

703.752.2782