powerpoint - National Ag Risk Education Library

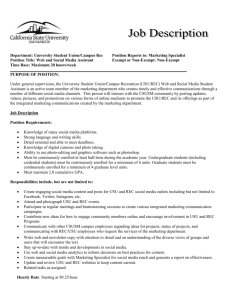

advertisement

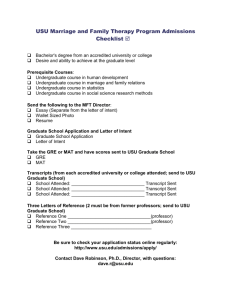

Teaching Tax Issues to Beginning Farmers and Ranchers Dr. Ruby Ward Department of Applied Economics extension.usu.edu Outline • • • • Resources available How to use resources Other topics available Upcoming webinars April 23rd – Details on RuralTax.org website • Future Plans extension.usu.edu Why extension.usu.edu Addition to RuralTax.org extension.usu.edu Chapter 13 Tax Reporting and payment extension.usu.edu extension.usu.edu What does your tax return include and look like? • Material from RuralTax.org being used for the next part. – Sample 1040 form – Sample Schedule F • We are only using the forms here. RuralTax.org also has the explanations. • Both are located under the Sample Tax Returns area extension.usu.edu 1040 Form extension.usu.edu Bottom half front page 1040 extension.usu.edu 2nd Page 1040 extension.usu.edu extension.usu.edu Filling out Schedule F Name, SSN, etc. Income Expenses Net Profit (or loss) extension.usu.edu Income Income from selling livestock (you purchased) less cost (or basis) of livestock (lines 1-3) Cash basis a summary of cash that came to you based on things you sold which you produced (line 4) COOP earnings (line 5) Gov. Program Payments (line 6) Insurance Proceeds (line 8) Custom Hire (line 9) extension.usu.edu Profit and Loss Form extension.usu.edu Expenses Chemicals (line 13) Conservation Expenses (line 14) Custom Hire (line 15) Depreciation (line 16) Feed Purchase (line 18) Fertilizer (line 19) Gas, Fuel and Oil (line 21) Interest (line 23) extension.usu.edu Profit and Loss Form extension.usu.edu Net Profit = Total Income – Total Expenses extension.usu.edu Specific Issues to be aware of • There is a fact sheet available for each of these topics at RuralTax.org • Self-employment tax • Hobby loss rules • 1099 informational returns • New depreciation rules • Cash flow issues with new depreciation rules extension.usu.edu Drought and selling livestock • Breeding Livestock • Market Livestock (calves) extension.usu.edu Breeding Livestock • If sell more breeding livestock than normal because of weather-related issues (drought). • No need for declaration of disaster area, but must show weather caused the sale. extension.usu.edu Breeding Livestock • Can defer gain from the additional head sold – Must replace within two years – If not replaced within two years or replaced for less than the original cattle were sold • then the tax return for the year sold must be amended • any additional tax and interest must be paid extension.usu.edu Example • Trent normally sells 5 cows per year. • This year he sells 20 cows because of drought causing limited forage and feed. • Gains from sale of 15 cows (extra sold) would not be reported as income if Trent plans on replacing them within two years. extension.usu.edu Example if raised livestock sold • The cows are raised so they have $0 basis (no money was spent to purchase them). • They are sold for $500 a head. • The gain on 15 head is $7,500 ($500 * 15), but it is not reported on his tax return. • Trent purchases 15 cows in a year for $600 each. • The new cows have a basis of $100 each, the additional amount per cow to purchase them ($600 $500). extension.usu.edu Example if purchased livestock sold • The cows sold have a $200 basis (the amount purchased for less depreciation already deducted). • They are sold for $500 a head. • The gain on 15 head is $4,500 ($300 * 15), but it is not reported on his tax return. • Trent purchases 15 cows in a year for $600 each. • The new cows have a basis of $300 each, the additional amount per cow to purchase them ($600 $500) plus the original basis ($200). extension.usu.edu How to do it • Must attach a statement to the tax return and include the following: • Name, address and ID number • Evidence of the weather conditions that forced the sale and how it is related to the sale • Number of livestock sold • Number sold under normal conditions (usually the average sold over the previous 3 years). • Amount of income that is postponed. extension.usu.edu Market livestock / calves • The area much be federally declared as eligible to receive federal assistance. • The livestock does not need to be raised in the disaster area, just show that conditions in the disaster area caused the sale. • Only livestock sales in excess of normal qualify. • The animals are not replaced • The gain is put off to the next year. extension.usu.edu Example • Joe sold 150 head of calves in 2011 instead of the usual 75. • He sold the 150 calves for $50,000. • He can defer income from 75 of them (150-75 normally sold). • He can defer $25,000 of income. • The income would not be included on the 2011 tax return • It would be included on the • 2012 tax return. extension.usu.edu How to do it • Similar to what is needed for breeding livestock • Must include that the declaration is under IRS Section 451(e). • Federal disaster designation. • All the other stuff needed for breeding animals. extension.usu.edu Hobby vs. business losses • If you have a hobby, you cannot deduct losses, but must pay taxes on positive income. • If you have a business, you can deduct losses, which lowers the total Adjusted Gross Income and Taxable Income (if you have income from other sources). • If you have positive income in 3 out of the last 5 consecutive years it is a business. • If not, IRS can look at guidelines. extension.usu.edu 9 Factors IRS can look at 1. Is the activity carried on in a businesslike manner? 2. What is the expertise of the farmer/rancher or his advisors? 3. How much time and effort is the farmer/rancher putting in? 4. Are the assets expected to go up in value? 5. Has the farmer/rancher done this before? 6. What’s been happening here? extension.usu.edu 7. Has the producer made any money? 8. Is the producer making money doing something else? 9. Is the producer having fun? extension.usu.edu What can you do? • Have some profit in at least 3 of every 5 years. • Keep written records of everything done – On the Farm/Ranch – Education you receive (Shiprock Ag Days) – Consultations with “experts” (you sought advice to make the business profitable) – Write down what you changed to make the business profitable – Conditions beyond your control – (flood, drought, disease, etc.). extension.usu.edu For more information • • • • RuralTax.org Under Tax Topics Weather Related Sales of Livestock Farm Losses Vs. Hobby Losses extension.usu.edu Tax Webinars • Details will be available on RuralTax.org website. • April 23, 2012 • All time are in Mountain Daylight Savings Time • Noon Introduction to tax issues • 1:00 pm Weather Related Sales of Livestock • 2:00 pm Government Payments: Federal and State extension.usu.edu Future Plans • Summer/Fall of 2012 new materials will be added. • Curriculum modules for tax management • New fact sheets • Case study and sample return for a beginning farmer situation extension.usu.edu