COP Full Report - Student Managed Fund

advertisement

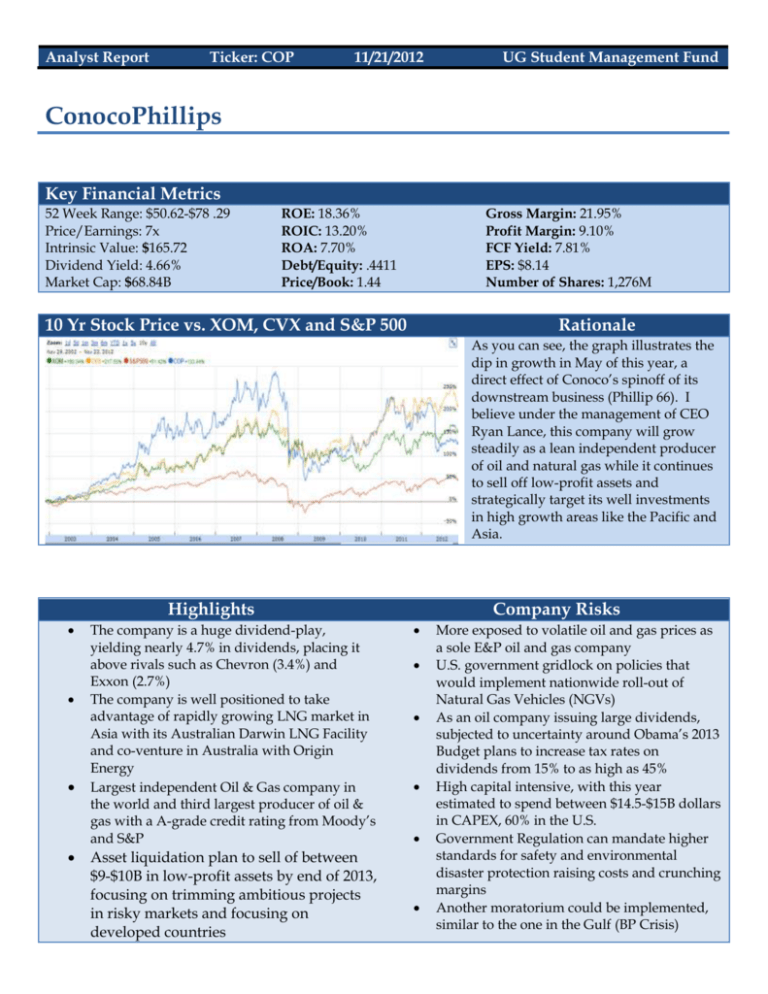

Analyst Report Ticker: COP 11/21/2012 UG Student Management Fund ConocoPhillips Key Financial Metrics 52 Week Range: $50.62-$78 .29 Price/Earnings: 7x Intrinsic Value: $165.72 Dividend Yield: 4.66% Market Cap: $68.84B ROE: 18.36% ROIC: 13.20% ROA: 7.70% Debt/Equity: .4411 Price/Book: 1.44 Gross Margin: 21.95% Profit Margin: 9.10% FCF Yield: 7.81% EPS: $8.14 Number of Shares: 1,276M 10 Yr Stock Price vs. XOM, CVX and S&P 500 Rationale As you can see, the graph illustrates the dip in growth in May of this year, a direct effect of Conoco’s spinoff of its downstream business (Phillip 66). I believe under the management of CEO Ryan Lance, this company will grow steadily as a lean independent producer of oil and natural gas while it continues to sell off low-profit assets and strategically target its well investments in high growth areas like the Pacific and Asia. Highlights The company is a huge dividend-play, yielding nearly 4.7% in dividends, placing it above rivals such as Chevron (3.4%) and Exxon (2.7%) The company is well positioned to take advantage of rapidly growing LNG market in Asia with its Australian Darwin LNG Facility and co-venture in Australia with Origin Energy Largest independent Oil & Gas company in the world and third largest producer of oil & gas with a A-grade credit rating from Moody’s and S&P Asset liquidation plan to sell of between $9-$10B in low-profit assets by end of 2013, focusing on trimming ambitious projects in risky markets and focusing on developed countries Company Risks More exposed to volatile oil and gas prices as a sole E&P oil and gas company U.S. government gridlock on policies that would implement nationwide roll-out of Natural Gas Vehicles (NGVs) As an oil company issuing large dividends, subjected to uncertainty around Obama’s 2013 Budget plans to increase tax rates on dividends from 15% to as high as 45% High capital intensive, with this year estimated to spend between $14.5-$15B dollars in CAPEX, 60% in the U.S. Government Regulation can mandate higher standards for safety and environmental disaster protection raising costs and crunching margins Another moratorium could be implemented, similar to the one in the Gulf (BP Crisis) Current Events On October 25, 2012, in its first full quarter as a pure oil & gas producer, ConocoPhillips reported third quarter 2012 adjusted earnings of $1.44 per share, surpassing the street Estimate of $1.19.the company and beat last year’s results by almost 2.9% even as a spun off company Revenues in the reported quarter decreased to $15,089.0 million, beating the street projections of $11,115 million It also outpaced expectations in crude oil production levels in its projects in the Eagle Ford Basin and Bakken Fields ConocoPhillips has sold its “fruitless” seven yearlong stake in the Russian oil company, LUKOIL (LKOH), anticipating a $400 million gain It has generated $2.1 billion in proceeds from asset sales for the first nine months of 2012, where proceeds are allocated for portfolio optimization, debt reduction and increasing shareholder distribution. the company s earnings per share fell 23.6%year over year during its three-month period ending September 30, but were mainly attributable to lower revenue and production as a standalone E&P company Since 2010, the company has purchased $20.1B worth of shares, ending its commitment to the repurchase program; share repurchases will be made opportunistically, contingent upon commodity prices and proceeds from asset dispositions Business Summary ConocoPhillips, a Houston-based company, is the largest independent Oil & Gas company in the world based on proved reserves & production of liquids & natural gas and third largest producer of oil & gas included integrated. ConocoPhillips was created through the merger of Conoco Inc. and the Phillips Petroleum Company on August 30, 2002 and was the fifth largest integrated oil company until spinning off its midstream and downstream assets to a new separate company, Phillips 66. At December 31, 2011, E&P operations were producing in the United States, Norway, the United Kingdom, Canada, Australia, offshore Timor-Leste in the Timor Sea, Indonesia, China, Vietnam, Libya, Nigeria, Algeria, Qatar and Russia After the spin-off of its midstream and downstream businesses, ConocoPhillips has become a pure-play exploration & production company. The company conducts exploration activities in almost 30 countries and supplements its income with equity stakes in other oil & gas and chemical companies. About 55% of its production consists of liquids and about 45% consists of natural gas. Of the 55% in liquids, 30% is tied to Brent or international prices, which tend to be higher than North American crude markers (WTI). Of the 45% in natural gas, 20% is tied to natural gas. Margins between international natural gas prices and domestic prices are huge, with average disparities at $9.76/btu (British Thermal Unit). This stems from the fact many countries, specifically ones in Asia, index natural gas prices to crude oil prices and not the U.S. Henry Hub Index. The company’s Crude Oil and Natural Gas Liquids production and sales is the most valuable segment. It has significant production capacity with the ability to sell well in excess of 200 million barrels of crude oil and natural gas liquids over the next few years. Coupled with high crude prices, this will translate into substantial cash flows for the company. The company is cash into the lower 48 states with almost $3.9B in CAPEX, but is also making a statement about its confidence in Asia Pacific and Middle East opportunities with a cumulative $2.05B in CAPEX coupled with $2.09B in Europe and the North Sea. As of December of 2011, the company had 3.462B barrels of crude oil and natural gas liquids, 3.486B barrels of oil equivalent in natural gas, 1.439B barrels of oil equivalent in Bitumen. Valuation I valued ConocoPhillips very conservatively, as future predictions are difficult given we as analysts have only been able to observe one full quarter of the company’s performance as a standalone Oil and Gas E&P company. So because previous growth rates of the company would not make sense, I took Conoco’s new projected industry average growth of 7.5%. I calculated the current projected earnings yield for 2012 (about 1 month left) to be 15.189%. I grew that out for 5 years using the projected industry growth to get 21.806%. My objective was to get a target range for a 5 year period using the price earnings multiples of 8x and 9x, which brought me to $93.49 and $105.1742. To earn a 10% return over that 5 year period, using 8x earnings, you would want to buy in around $58.05, where we bought in at $57.25. Current Price Current Price w/o Cash EPS 2012 EPS 2013 (projected) Cash Per share Discount Factor 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% $56.67 $53.59 $8.14 $8.75 $3.08 8x 73.2504 69.8598 66.6558 63.6265 60.7609 58.0488 55.4807 53.0477 50.7416 48.5548 46.4801 Earnings Yield for 2012 Average Growth Rate Expected Yield over 5 years 5-year price at 8x earnings 5-year price at 9x earnings 9x 82.4067 78.5923 74.9878 71.5798 68.356 65.3049 62.4158 59.6787 57.0843 54.6242 52.2902 15.189% 7.500% 21.806% 93.48818 105.1742 Industry Overview The Oil Drilling and Gas Extraction industry has been busy over the last 5 years, with an annualized growth of 3.1% to $345.9B at year end. The industry is highly sensitive to oil prices, which are in turn highly vulnerable to economic conditions, as depicted in the large industry wide dip in 2009 during the major economic slowdown. Although, this dip would be mitigated by a surge in demand form emerging economies causing crude oil prices to rise and is currently continuing. Tensions in the Middle East and speculation of threatened oil supply from large exporters has also aided in driving up oil prices. Even with a brief downtrend in prices earlier his year, prices are expected to remain at historic highs throughout the year with an estimated revenue growth of 4.9%. The natural gas segment also shows promise for growth. Discoveries of vast gas reserves in the Appalachian Basin have spurred industry wide excitement, with estimates of over 750 trillion cubic feet. Growth in demand from electricity producers as some began to transition from coal and other fossil fuels to gas as a source to generate power. Both oil and gas prices are projected to increase over the next five years, with gas at a slower rate. Industry revenue as whole is expected to climb at an annual average rate of 7.5% over the next 5 years. The basic principles of supply & demand determine US dollar price for oil & gas. Crude oil is a naturally occurring mixture of hydrocarbons that is found in geological formations and can be refined into many consumer products including gasoline, diesel, and plastics. Oil price has a history of high volatility, with any increase positively affecting the industry Same goes for Natural gas, but large discoveries coupled with oversupply in the U.S. has suppressed prices Natural gas is a naturally occurring gas that primarily consists of methane. Natural gas is typically found along with crude oil and other fossil fuel Government Regulation: The Oil Drilling and Gas Extraction industry is highly regulated, with the federal and state governments being involved in all stages of production. State governments determine which areas are open to oil exploration and extraction, issue exploration and production leases, and enforces environmental legislation. Under the Obama administration, the average annual production per day has been 675,000 barrels, which is actually higher than Bush’s 609,000 barrels per day. Although the number of new leases and drilling permits has decreased by 42.4% and 37.4%, a large amount of that decrease can be seen attributable to the BP Horizon disaster and the moratorium Obama imposed following it. On the other hand, while natural gas has increased on private lands by over 16.4B cubic feet since 2005 (encompassing some of Bush’s term as well), federal lands production has decreased from 35% to 21%. Obama’s administration and Congress have both been painfully slow in implementing policies to adapt liquefied natural gas (LNG) as a cleaner alternative fuel nationwide contrary to our economic rival China, who is number six globally in total natural gas vehicles (NGVs) at 6.58% (1,000,000), while US is at number 17 with less than 1% of vehicles (100,00). China has also put in policies to support a serious increase. This is truly unacceptable as the United States' #1 economic advantage against all other countries on Earth is its abundant natural gas reserves combined with its 1 million-plus mile natural gas pipeline distribution system. No other country has the combination of high natural gas production, low natural gas prices, and the ability to economically deliver natural gas to every major metropolitan city as well as to tens of millions of homes and businesses. It is an advantage the country cannot afford to squander. If our country’s government can realize this and began to cooperate in a taking advantage of our own resources, there is serious unrecognized potential upside to the natural gas market. Below are two diagrams that provide some color on market segmentation and import/export segmentation. Competitors Chevron Corporation Chevron Corporation, originally known as ChevronTexaco, was formed in October 2001, when Texaco Inc. and Chevron Corporation merged. The company's headquarters are in San Francisco and has operations in North America, South America, Europe, Africa, the Middle East, Asia and Australia. In May 2005, the company announced that it had changed its name to Chevron Corporation, though in the United States, Chevron markets under the Texaco brand as well. In 2010, Chevron acquired Atlas Energy, a midstream natural gas processor, for $3.2 billion. Chevron's upstream activities in the United States are concentrated in the Gulf of Mexico, California, Louisiana, Texas, New Mexico and the Rocky Mountains. In the Gulf area, the company has interests in onshore Louisiana, as well as in shelf and major deep water fields like Genesis, Petronius and Typhoon. In California, production is concentrated in the San Joaquin Valley. Combined, interests in the Gulf and California account for about 70.0% of the company's US oil production and about half of its natural gas production. Chevron has substantial acreage in the Gulf of Mexico, which represents one of the key hydrocarbon development areas close to the U.S. The surrounding coast and shallow waters have been a center for oil production for decades, but the deep water prospects in the Gulf have become accessible through recent advances in technology. These advances have included improvements in deep water and horizontal drilling techniques and floating and subsea production systems needed for ultra-deep water developments. Chevron's revenue from oil-drilling operations is expected to have grown an annualized rate of 4.5% to about $37.9 billion in revenue by the end of this year. As with many other major players, Chevron's financial performance took a hit during 2009 with the market crash. As the economy entered the recession, industrial production and consumer demand for energy fell severely. As a result, energy prices plummeted in response to fall in demand. Because the majority of Chevron's recent upstream investments have been outside the United States, the company was able to focus on emerging markets when domestic production dropped. The company, like ConocoPhillips, provides an attractive dividend yielding about 3.5% to Conoco’s 4.66%. It also has accumulated an impressive $21B in cash with only $12.3B in debt. It’s market cap is at $200B, more than triple Conoco’s. Although, it should be noted, an Argentine court has just seized Chevron's assets in the nation in a push to collect $19 billion that Ecuadorean plaintiffs against the company, based on pollution charges, had won in a local court. Exxon Corporation Exxon Mobil was incorporated in New Jersey in 1882 and is one of the largest oil and gas producers and reserve holders in the United States. The company geographically diverse; it has significant positions in all major producing regions, including Alaska, onshore Gulf Coast, shelf and deep water areas of the Gulf of Mexico, onshore and offshore California and the mid-continent. Exxon Mobil's US properties contribute 16.0% of the company's oil production and about 14.0% of its gas production. Exxon operates three distinct segments: upstream (the most relevant to this industry), downstream and chemicals. Exxon Mobil's global upstream and chemical companies, as well as its coal and minerals company, are headquartered in Houston. Exxon Mobil acquired XTO Energy for $24.6 billion in June 2010. Exxon Mobil is expected to grow at an annualized rate of 3.3% to roughly $10.0 billion in revenue by the end of the year. Over the past five years, the company has actively pursued oil and gas wells abroad, especially in the Middle East and Africa. Exxon has invested heavily in specialized technology to drill oil and gas from deposits that are normally difficult to drill. For example, the company invested in arctic technology to explore for oil and gas in cold regions. Recent merger activity and new projects have indicated that the company is interested in natural gas assets in the United States. Exxon Mobil's acquisition of XTO Energy is expected to add significant natural gas capacity to the company's portfolio. XTO Energy had reserves of 14.8 trillion cubic feet of natural gas at the time of the acquisition. The acquisition is a strategic move for Exxon, which is seeking to produce more natural gas in the United States. Most of the company's upstream assets are abroad; the merger represents a move toward the US market. The company yields the least attractive dividend of the two at only 2.7% to Chevrons 3.5% and Conoco’s 4.66%, but has a market cap nearly 6x that of Conoco at $394B. The company has $13B in cash and $8.93 in debt. On March 24, 1989, Exxon Valdez oil spill in Alaska. More than 10 million gallons of oil was spilled polluting waters, beaches, habitat, and killing wildlife. Conclusion: Given the upside potential and dependence on this industry, I believe investing into ConocoPhillips is worth the risk of the volatility of oil and gas prices, which are predicted to rise by most industry experts. Although Exxon and Chevron are much bigger companies with bigger balance sheets, I believe COP’s spinoff gives it a competitive edge as the largest global independent Oil and Gas Exploration Company with a more focused business plan as a leaner company. It’s positioning to benefit off growing demand and support for the use of natural gas and LNGs in the Asia Pacific and its cheap price relative to competitors make it the most attractive investment in this industry.