Creating Pro Forma Statements

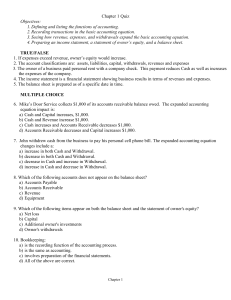

advertisement

Creating Pro Forma Documents William L. Dougan Irvin L.Young Professor of Entrepreneurship Professor of Management UW-Whitewater Six pieces Revenue Model Profit and Loss (P&L) Cash Flow Balance Sheet Startup Capital Notes Order of Importance Cash Flow Revenue Model Notes Startup Capital Profit and Loss (P&L) Balance Sheet Order of Construction Revenue Model Startup Capital Cash Flow Profit and Loss (P&L) Balance Sheet Notes Business Plan Software Placed in a spreadsheet or a Business Plan model ◦ Business Plan Pro ◦ Business Mentor ◦ PitchThenPlan http://www.pitchthenplan.com/homepage.htm ◦ Kauffman Template http://www.bizstartsmilwaukee.com/BizFiles/Templa tesForms/FastTrac_MyFinancialPlanV6.xls Revenue Model Your story about how you will sell your products/services Based on monthly quantities Depends on Units or Dollars or both ◦ Boat Manufacturer Units ◦ Retail store Units are a problem ◦ Multiple Products Add effects of each product Additive Linear Model Additive Linear Model Month 1 2 3 4 5 6 7 8 9 10 11 12 Prod 1 Units Price 0 0 10 15 21 25 35 45 60 90 100 150 0 0 1000 1000 1000 1000 1000 1000 1500 1500 1500 1500 TOTAL 0 0 10000 15000 21000 25000 35000 45000 90000 135000 150000 225000 Month 1 Prod 2 Units Price 2 3 4 5 6 7 8 9 10 11 12 0 0 50 75 90 100 120 140 180 220 300 450 0 0 100 100 100 100 100 90 90 90 90 80 TOTAL 0 0 5000 7500 Month 1 TOTAL 2 3 4 5 0 9000 10000 12000 12600 16200 19800 27000 36000 6 7 8 9 10 11 12 0 15000 22500 30000 35000 47000 57600 106200 154800 177000 261000 Revenue Model Factors Discrete, linear decomposition of a multiple, interacting components ◦ Separate effects of multiple products/services ◦ Startup delay ◦ Production/Sales Ramp-up Diffusion Learning ◦ Seasonality Sales on Account Not all Sales are cash sales ◦ Large Durable Goods like boats and Heating Systems ◦ Most Corporate Sales are on Account SO…….. we need a model for how Sales are Made and Paid Total Sales – Cash Sales (as %) = Sales on Account = Accounts Receivable for first month Accounts Receivable for first month - % paid first month = Accounts Receivable for second month Accounts Receivable for second month - % paid in second month = Accounts Receivable for Third month (OR Bad Debt Expense) Startup Costs List and numerical equivalent of “stuff” you need to start business ◦ Land/building ◦ Equipment Operational Office Vehicle Furniture ◦ Professional Fees Accountant Lawyer Consultants ◦ Raw Materials/Supplies ◦ Insurance Liability Building Bonding Life/Key person Health ◦ Membership Fees ◦ Advertising/promotions Reserve for Wages/Salaries ◦ Banking Line of Credit Account Initiation Loan Initiation Cash Flow Checkbook/Cigar box model Sources/Dispersements and Balance of Cash by Month Documents Inflows and Outflows Big rule CASH BALANCE CAN’T BE NEGATIVE Cash Items SOURCES: Cash Sales ◦ (Different than Sales on account) Collections from AR Loan Proceeds Equity contributions ◦ Cash ◦ Capital Goods Interest Grants Prizes Paid–in Taxes Cash Items DISPERSEMENTS OPERATING EXPENSES Cost of Materials Wages Salaries Income Tax FICA Benefits Sales Taxes Insurance Utilities Advertising Bank Charges Dues and Subscriptions Licenses and fees Marketing/Promotions Meals and Entertainment Office Expenses Professional Fees Property Taxes Rent Maintenance Shipping/Delivery Utilities Telephone Training Travel Vehicle CAPITAL COSTS ◦ Capital Purchases ◦ Estimated Tax Payments ◦ Reduction of Principal ◦ Interest Payments ◦ Owners Draw Opening Cash Balance Month 1 + Cash In from Sources - Cash Out for Dispersements = Ending Cash Balance Which Becomes (for next month) Opening Cash Balance Month 2 + Cash In from Sources - Cash Out for Dispersements = Ending Cash Balance Which Becomes (for next month General Form Cash Flow Profit and Loss Uses much of the same information as Cash Flow Major exceptions ◦ ◦ ◦ ◦ Depreciation Inventory Receivables Payables Profit and Loss Net Sales - COGS Gross Profit - Operating Expenses (See List from Cash Flow) Operating Profit (EBITDA) -Depreciation - Debt Amortization EBIT - Interest EBT - Income Taxes + Interest Income + Royalties - NET INCOME Balance Sheet Metaphor of Balance Balance Sheet Balance Sheet Issues Balance Sheet is Snapshot, Cash Flow and Income Statement are Time Exposure Assets – Liabilities = Equity (plug Figure) CAN’T HAVE NEGATIVE EQUITY ◦ Can have negative retained earnings, but need paid-in capital to balance it ◦ If Equity is Negative, you need more capital or lowered liabilities CAN’T ADD ASSET BALANCES FROM MONTH TO MONTH Notes These provide the justification for values on the other sheets Act as a source of information about the assumptions used in creation of the other documents Don’t have to be elaborate, just have to show a short justification for why each number is the way it is Resources Real Estate Cost ◦ www.wisconsinhomes.com ◦ http://www2.bizjournals.com/bizspace/milwaukee/ Salaries www.salary.com Utilities call utility companies Mortgage Calculator All over internet Insurance call agent Industry RMA Statement Studies + Value Line + Associations Unlimited (for Industry info)+ Dunn and Bradstreet General http://library.uww.edu/