(Dec 4) handout

advertisement

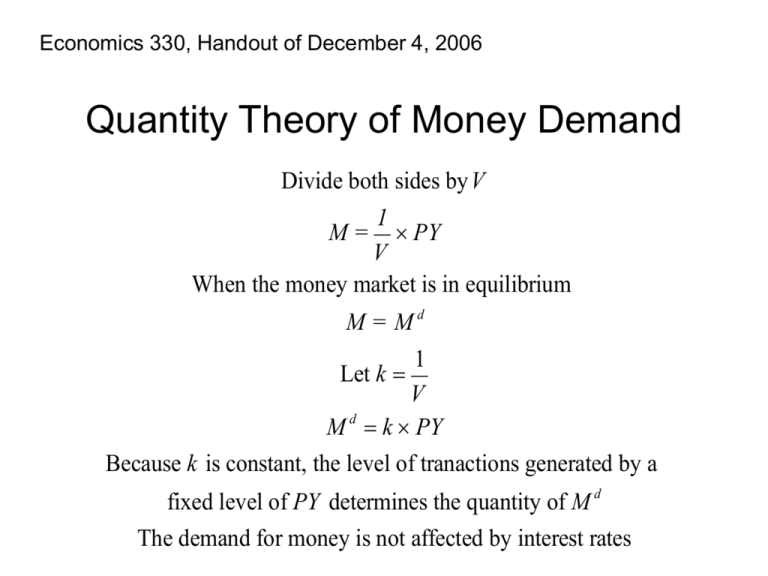

Economics 330, Handout of December 4, 2006 Quantity Theory of Money Demand Divide both sides by V 1 M = PY V When the money market is in equilibrium M = Md 1 Let k V M d k PY Because k is constant, the level of tranactions generated by a fixed level of PY determines the quantity of M d The demand for money is not affected by interest rates Relation of Velocity to Standard Money Demand equation Md f (i,Y ) where the demand for real money balances is P negatively related to the interest rate i, and positively related to real income Y Rewriting P 1 d f (i,Y ) M Multiply both sides by Y and replacing M d with M PY Y V M f (i,Y ) Equilibrium in the Market for Money: The LM Curve • Demand for money called liquidity preference • Md/P depends on income (Y) and interest rates (i) • Positively related to income – Raises the level of transactions – Increases wealth • Negatively related to interest rates Equilibrium in the Market for Money: The LM Curve (cont’d) • Connects points that satisfy the equilibrium condition that MD = MS • For each level of aggregate output, the LM curve tells us what the interest rate must be for equilibrium to occur • The economy tends to move toward points on the LM curve