Compensation Analysis - St. Joseph School District / Homepage

advertisement

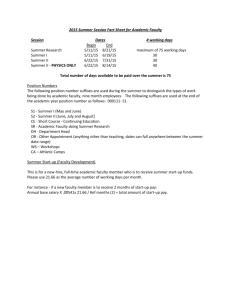

Compensation Study Preliminary Results Presented by: CBIZ Human Capital Services January 11, 2016 Introduction CBIZ Human Capital Services ● Priya Kapila, CCP, SPHR Senior Manager, Compensation Consulting 2 Introduction What we want to accomplish today: • Review the compensation study methodology • Discuss the preliminary project results • Present recommendations and next steps • Answer your questions 3 Introduction The District has asked CBIZ to review current practices and recommend improvements related to: • • • • Job classifications and descriptions Current compensation compared to market Internal equity assessments Compensation policies and procedures 4 Methodology 5 Project Steps 1. 2. 3. 4. 5. 6. Planning Meetings Job Evaluation Compensation Analysis Salary Schedule Development Benefits Cost Analysis Policy Review and Recommendations 6 Job Evaluation ● Job descriptions and job analysis questionnaires (JAQs) were evaluated to identify: – Essential Functions – Duties and Responsibilities ● Job descriptions, not titles, were used to ensure correct matches to the market. 7 Job Evaluation ● Job Classification and Description Updates – Title consolidation and separation – Title revision to better reflect job roles and create consistency throughout the District – Review organizational hierarchy and clarify career paths – Establish consistency and employment law compliance 8 Compensation Analysis What is market pricing? • Valuation of pay for the District’s jobs in the external labor markets. • Key considerations when determining labor markets: – Location o St. Joseph, Missouri o Region o Nation – Industry o School districts o Broad spectrum of employers – Size o Revenue/Operating budget o Number of employees o Number of students 9 Compensation Analysis Custom Survey – Peer Districts • • • • • • Blue Springs* Center* Independence* Kansas City* Lee’s Summit* Liberty* * Survey participant • • • • • • North Kansas City Park Hill* Platte County* Raymore-Peculiar* Raytown* Smithville* 10 Compensation Analysis Enrollment Students: Administrator Students: Teacher Tax Rate Current Expenditures (Millions) Total Expenditures (Millions) Blue Springs 14,425 223 16 5.13 136.226 178.205 Center 2,613 153 11 5.93 31.863 39.116 Independence 15,067 251 16 4.43 134.441 180.806 Kansas City 15,258 172 13 5.27 208.334 251.505 Lee’s Summit 17,834 241 15 5.26 173.602 250.078 Liberty 12,023 261 15 5.35 108.732 145.167 North Kansas City 19,853 276 14 5.23 189.579 274.445 Park Hill 10,921 223 15 4.95 113.791 154.172 Platte County 3,964 195 14 3.89 36.310 47.583 Raymore-Peculiar 6,033 213 15 3.75 50.900 64.113 Raytown 9,102 184 14 5.15 82.701 110.708 Smithville 2,560 206 16 3.44 21.840 25.733 St. Joseph 11,871 229 13 4.28 103.671 135.710 11 Compensation Analysis ● Market Benchmark – 50th percentile: Also known as the median; this is the middle point of the market. By definition, half of organizations pay more and half pay less. A majority of organizations follow a compensation philosophy that strives to pay employees at the median. – An objective of the project was to align salary range midpoints with the market 50th percentile. This is typically the point at which pay for fully-functioning, satisfactorily-performing employees is targeted. 12 Compensation Analysis ● Definitions – Base Salary: The annual fixed rate that an individual is paid for performing a job. – Employee Benefits: Non-cash compensation provided to an employee. Benefits reviewed include: • Paid leave (e.g., holidays, vacation, sick, etc.) • Medically-related benefits (e.g., health insurance, dental insurance, vision insurance, short- and long-term disability insurance, life insurance, etc.) • Retirement plan benefits • Other common benefits (e.g., education cost reimbursement, specialized training and development, etc.) – Total Compensation: The sum of base salary and benefits. 13 Compensation Analysis ● Definitions – 25th percentile: The point at which 75% of organizations pay more and 25% pay less. – 50th percentile: The point at which half of organizations pay more and half pay less. – 75th percentile: The point at which only 25% of organizations pay more and 75% pay less. – Compa-ratio: An employee’s current salary divided by the midpoint of the salary range. 14 Salary Range Development • New salary schedules and ranges were developed in order to best reflect: – Market-competitive pay levels for District jobs – Job classifications and functions – Organizational hierarchy • Two salary schedule approaches are presented for the District’s consideration: – Blended open range and step schedules for teaching-related staff only – Comprehensive step schedules 15 Salary Range Development Example Title: Job XYZ Market Median: $35,450 Grade Minimum Midpoint Maximum 1 $24,778 $30,972 $37,166 2 $27,398 $35,618 $43,837 3 $31,508 $40,960 $50,413 16 Benefits Cost Analysis ● The cost of the District’s employee benefits package will be compared to market-competitive data. – For medical and medically-related benefits, it is most accurate to utilize a fixed cost per employee to estimate the cost incurred – For other benefits, including paid time off and retirement, a percent of the incumbent’s base salary is the most appropriate metric ● Total compensation will also compared to the market. 17 Preliminary Results 18 Results – Salary Actual Annual Base Salary Compared to Market 50th Percentile Base Salary St. Joseph School District Actual Annual Base Salary 125,000 100,000 St. Joseph Base Salary Market Base Salary Linear (St. Joseph Base Salary) 75,000 Linear (Market Base Salary) St. Joseph School District Salary Trendline Equation and R-Square: 50,000 y = 1.00x - 1,979.97 R² = 0.90 25,000 19 0 0 25,000 50,000 75,000 Market Base Salary 100,000 125,000 Results – Salary ● Comparative Salary Analysis – – Many employees fall within the proposed salary ranges for their jobs. The average overall compa-ratio is approximately 92%, indicating that employees, in general, receive salaries below the market 50th percentile. Blended Schedule Below Salary Approach Range Minimum Adjustments Step Schedule Approach Adjustments Number of Employees 451 522 997 Total Amount ($) 2,117,784 1,032,495 3,761,899 Total Amount as a % of Payroll 3.3% 1.6% 5.8% 20 Results – Benefits Market-Competitive Benefits Data Actual Benefits Costs Average Annual Dollars/ Employee Percent of Payroll Average Annual Dollars/ Employee Percent of Payroll Medical and Medically-Related Payments $6,878 12.7% $7,717 19.5% Retirement and Savings $7,510 12.0% $4,519 11.4% $840 1.6% $0 0.0% Benefit Categories Miscellaneous Benefit Pay 21 Results – Stipends and Extra Duty Pay Administrator Stipend* Travel Longevity Doctorate Head Coach Assistant Coach Sponsor (Club-Related) Sponsor (Music-Related) Peer Districts Average $5,487 $2,806 $6,060 $3,500 $5,449 $3,799 $2,313 $3,206 * The Administrator stipend reported reflects a greater number of the custom school district participants, and peer district employees, than the underlying unique stipends. As a result, the sum of the unique Administrator stipends is not equal to the total average stipend. Among the peer districts, Administrator stipends are provided to Director and Assistant Director and comparable positions. 22 Results – Total Compensation ● Comparative Total Compensation Analysis – – On average, employee salaries are slightly below the market median, while benefits are well aligned with market. As a result, the competitiveness of total compensation falls between that of salaries and benefits. The average comparatio is approximately 94%. 23 Recommendations and Next Steps 24 Recommendations ● ● ● ● ● Review and adopt the proposed market-based salary schedules. Implementation of the compensation plan should occur uniformly across all positions. While different implementation scenarios may recognize budget constraints, partial or sporadic implementation can result in pay equity issues. Update schedules annually. Perform a comprehensive market review every 3 to 5 years to ensure that the salary ranges remain marketcompetitive. Periodically assess benefits offerings to ensure that the employer cost is market-competitive and fiscally sound and that the benefits provided by the District are of value to the employees. 25 Next Steps 1. Review the compensation results, determine the preferred salary schedule approach and identify any final revisions due to internal equity and unique District considerations. 2. Finalize project deliverables. 26 Questions?