Module 4 Review

advertisement

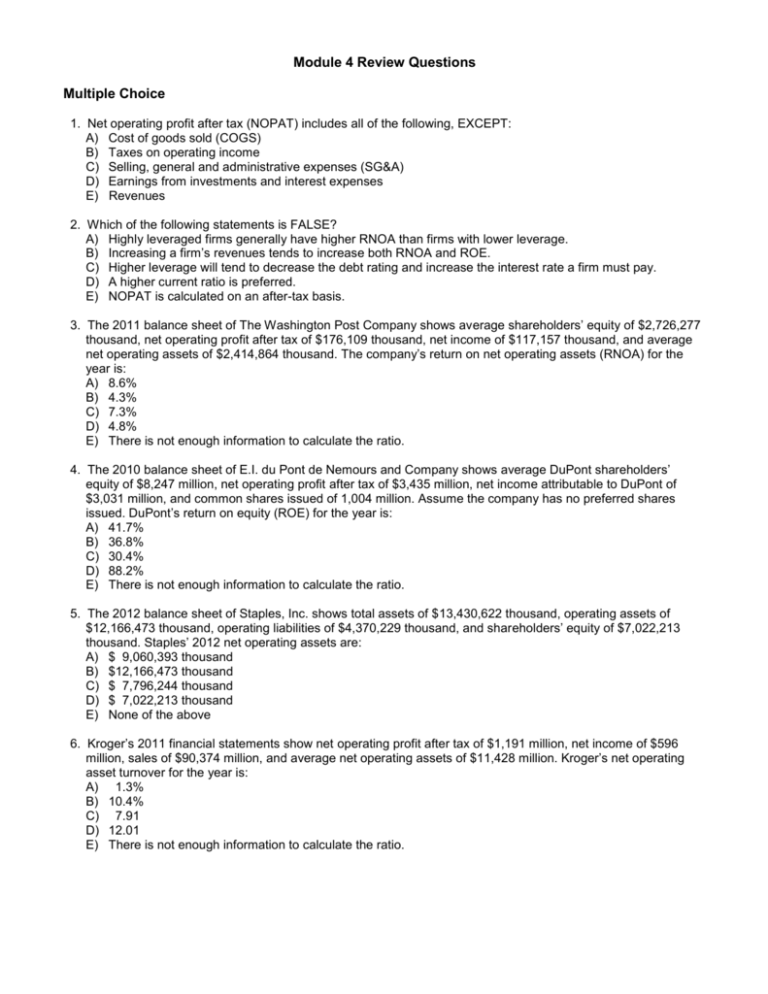

Module 4 Review Questions Multiple Choice 1. Net operating profit after tax (NOPAT) includes all of the following, EXCEPT: A) Cost of goods sold (COGS) B) Taxes on operating income C) Selling, general and administrative expenses (SG&A) D) Earnings from investments and interest expenses E) Revenues 2. Which of the following statements is FALSE? A) Highly leveraged firms generally have higher RNOA than firms with lower leverage. B) Increasing a firm’s revenues tends to increase both RNOA and ROE. C) Higher leverage will tend to decrease the debt rating and increase the interest rate a firm must pay. D) A higher current ratio is preferred. E) NOPAT is calculated on an after-tax basis. 3. The 2011 balance sheet of The Washington Post Company shows average shareholders’ equity of $2,726,277 thousand, net operating profit after tax of $176,109 thousand, net income of $117,157 thousand, and average net operating assets of $2,414,864 thousand. The company’s return on net operating assets (RNOA) for the year is: A) 8.6% B) 4.3% C) 7.3% D) 4.8% E) There is not enough information to calculate the ratio. 4. The 2010 balance sheet of E.I. du Pont de Nemours and Company shows average DuPont shareholders’ equity of $8,247 million, net operating profit after tax of $3,435 million, net income attributable to DuPont of $3,031 million, and common shares issued of 1,004 million. Assume the company has no preferred shares issued. DuPont’s return on equity (ROE) for the year is: A) 41.7% B) 36.8% C) 30.4% D) 88.2% E) There is not enough information to calculate the ratio. 5. The 2012 balance sheet of Staples, Inc. shows total assets of $13,430,622 thousand, operating assets of $12,166,473 thousand, operating liabilities of $4,370,229 thousand, and shareholders’ equity of $7,022,213 thousand. Staples’ 2012 net operating assets are: A) $ 9,060,393 thousand B) $12,166,473 thousand C) $ 7,796,244 thousand D) $ 7,022,213 thousand E) None of the above 6. Kroger’s 2011 financial statements show net operating profit after tax of $1,191 million, net income of $596 million, sales of $90,374 million, and average net operating assets of $11,428 million. Kroger’s net operating asset turnover for the year is: A) 1.3% B) 10.4% C) 7.91 D) 12.01 E) There is not enough information to calculate the ratio. EXERCISES Exercise A Selected balance sheet and income statement data follow for Staples, Inc. (in thousands). 2010 2010 NOPAT 2010 Operating assets 2010 Operating liabilities 2009 Net operating assets Revenues $24,545,113 $1,025,227 $12,450,410 $4,358,723 $8,006,719 Use the data above to calculate: a) return on net operating assets (RNOA) b) net operating profit margin (NOPM) c) net operating asset turnover (NOAT) for fiscal 2010 Exercise B Selected balance sheet income statement data follow for Harley Davidson, Inc for the year ended December 31, 2010 (in thousands). Income Total before Interest Statutory Total shareholders’ provision for expense tax rate liabilities equity income taxes $390,469 $90,357 36.0% $7,223,874 $2,206,866 Use the data to calculate the following rations. Also, indicate for each ratio whether it is high, moderate, or low for an industrial company. a) Times interest earned b) liabilities-to-equity ratio SHORT ANSWER (4 points each) 1. a. Give one example of a long-term operating asset. b. Give one example of a long-term, non-operating liability.