MBA Module 4 PPTs

advertisement

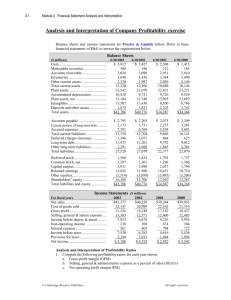

Module 3 Analyzing and Interpreting Financial Statements Common Questions that F/S Analysis Can Help To Answer Creditor Investor Manager Can the company pay the interest and principal on its debt? Does the company reply too much on nonowner financing? Does the company earn an acceptable return on invested capital? Is the gross profit margin growing or shrinking? Does the company effectively use nonowner financing? Are costs under control? Are the company’s markets growing or shrinking? Do observed changes reflect opportunities or threats? Is the allocation of investment across different assets too high or too low? Ratio Analysis Examining various income statement and balance sheet components in relation to one another facilitates financial statement analysis. This type of examination is called ratio analysis. This module focuses on the disaggregation of Return Measures into 1. 2. 3. 4. Level I – RNOA and LEV Level II – Profit Margins and Turnover Level III – GPM, SGA, ART, INVT, PAT, APT, WCT As well as Liquidity and Solvency Measures Profitability Analysis Return on Assets (ROA): ROA = Net Income / Average Assets For example, if we invest $100 in a savings account yielding $3 at year-end, the return on assets is 3%. Disaggregating Return on Assets Profit Margin, Asset Turnover, and Return on Assets for Selected Industries Operating vs. Nonoperating Operating expenses are the usual and customary costs that a company incurs to support its main business activities Nonoperating expenses relate to the company’s financing and investing activities Transitory vs. Core Transitory items are one-time events (e.g., not likely to recur) Core items are likely to recur (persist) and are, therefore, more relevant for company valuation Operating/Nonoperating vs. Core/Transitory Analysis Structure Return on Equity Return on equity (ROE) is computed as: ROE = Net Income / Average Equity Key Definitions Level 1 Analysis – RNOA and Leverage Return on Net Operating Assets (RNOA) RNOA = NOPAT / Average NOA where, NOPAT is net operating profit after tax NOA is net operating assets Operating and Nonoperating Assets/Liabilities NOPAT Net operating profit includes Operating revenues less Operating expenses (COGS, SG&A, Taxes) Excluded are after-tax earnings from investments returns and interest expenses. Financial Leverage and Risk LEV is the other component of ROE Is Debt a bad thing? Given that increases in financial leverage increase ROE, why are all companies not 100% debt financed? Leverage and Income Variability Level II Analysis – Margin and Turnover Margin vs. Turnover Level 3 Analysis — Disaggregation of Margin and Turnover Gross Profit Margin It allows a focus on average unit mark-ups A high gross profit margin is preferred to a lower one, which also implies that a company has relatively more flexibility in product pricing. Gross Profit Margin Two main factors determine gross profit margins: 1. Competition – as the level of competition intensifies, more substitutes become available, which limits a company’s ability to raise prices and pass along price increases to customers. 2. Product mix – if the proportion of lower price, higher volume products increases relative to that of higher priced, lower volume products, then gross profit dollars may stay the same, but gross profit margin declines. Operating Expense Margin Operating expense ratios (percents) are used to examine the proportion of sales consumed by each major expense category. Expense ratios are calculated as follows: Operating expense percentage = Expense item/Net sales Turnover Turnover measures relate to the productivity of company assets. Such measures seek to answer the amount of capital required to generate a specific sales volume. As turnover increases, there is greater cash inflow as cash outflow for assets to support the current sales volume is reduced. Accounts Receivable Turnover (ART) Inventory Turnover (INVT) Accounts Payable Turnover (APT) Liquidity and Solvency Measures Liquidity refers to cash: how much we have, how much is expected, and how much can be raised on short notice. Solvency refers to the ability to meet obligations; primarily obligations to creditors, including lessors. Current and Quick Ratio Solvency Ratios Flow Ratios Limitations of Ratio analysis Vertical and Horizontal Analysis Vertical and Horizontal Analysis