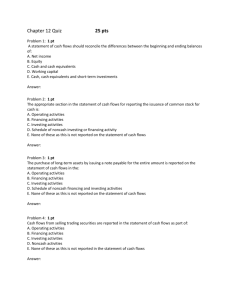

Document

advertisement

©2009 The McGraw-Hill Companies, Inc. Chapter 11 Statement of Cash Flows ©2009 The McGraw-Hill Companies, Inc. Part A Formatting the Statement of Cash Flows 11-3 Statement of Cash Flows Provides a summary of cash inflows and cash outflows during the reporting period E-Games, Inc. Statement of Cash Flows For the Year Ended December 31, 2010 Cash Flows from Operating Activities Net income $42,000 Adjustments for noncash effects: Depreciation expense 9,000 Loss on sale of land 4,000 Increase in accounts receivable (7,000) Decrease in inventory 10,000 Increase in prepaid rent (2,000) Decrease in accounts payable (5,000) Increase in interest payable Decrease in income tax payable Net cash flows from operating activities 1,000 (2,000) $50,000 11-4 Statement of Cash Flows (continued) Cash Flows from Investing Activities Purchase of investment Sale of land (35,000) 6,000 Net cash flows from investing activities (29,000) Cash Flows from Financing Activities Issuance of common stock 5,000 Payment of cash dividends (12,000) Net cash flows from financing activities (7,000) Net increase (decrease) in cash 14,000 Cash at the beginning of the period 48,000 Cash at the end of the period $62,000 Note: Noncash Activities Purchased equipment by issuing a note payable $20,000 11-5 LO1 Classification of Cash Flows Categories of Cash Flows Operating activities Investing activities Financing activities Include cash receipts and cash payments for transactions relating to revenue and expense activities Include cash transactions involving the purchase and sale of long-term assets and current investments Inflows and outflows of cash resulting from the external financing of a business 11-6 Classification of Cash Flows Cash Flows from Operating Activities Cash Inflows: Sale of goods or services. Receipt of interest and dividends. Cash Outflows: Purchase of inventory. For operating expenses. For interest. For income taxes. Cash Flows from Investing Activities Cash Inflows: Sale of investments. Sale of PPE or intangibles. Collection of notes receivable. Cash Outflows: Purchase of investments. Purchase of PPE or intangibles. Acceptance of notes receivable. Cash Flows from Financing Activities Cash Inflows: Issuance of bonds or notes payable. Issuance of stock. Cash Outflows: Repayment of bonds or notes payable. Reacquisition of stock (treasury stock). Payment of dividends. 11-7 Sources of Information Sources Explanation 1. Income statement The income statement provides important information in the determination of cash flows from operating activities. 2. Balance sheets We look at the change in asset, liability, and stockholders’ equity accounts from the end of last period to the end of this period to find cash flows from operating, investing, and financing activities. 3. Additional information Sometimes we need additional information from the accounting records to determine specific cash inflows or cash outflows for the period. 11-8 Relationship between Financial Statements 11-9 Reporting Noncash Activities Transactions that don’t increase or decrease cash Excluded from the statement of cash flows Reported in a separate note to the financial statements as noncash activities Examples: Purchase of long-term assets by issuing debt Purchase of long-term assets by issuing stock Conversion of bonds payable into common stock. Exchange of long-term assets 11-10 Operating Activities – Indirect and Direct Methods Differ only in the presentation format for operating activities. We report investing, financing, and noncash activities identically under both methods. Indirect Method Begin with net income and then list adjustments to net income in order to arrive at operating cash flows. More popular method. Easier and less costly. Direct Method Adjust the items on the income statement to directly show the cash inflows and outflows from operations. Conceptually better method. More difficult and more costly. ©2009 The McGraw-Hill Companies, Inc. Part B Preparing the Statement of Cash Flows 11-12 Steps in Preparing the Statement of Cash Flows 1. Calculate net cash flows from operating activities using information from the income statement and changes in current assets (other than cash) and current liabilities from the comparative balance sheets. 2. Determine the net cash flows from investing activities by analyzing changes in long-term asset accounts from the comparative balance sheets. 3. Determine the net cash flows from financing activities by analyzing changes in long-term liabilities and stockholders’ equity accounts from the comparative balance sheets. 4. Combine the operating, investing, and financing activities and make sure the total agrees with the net increase (decrease) in cash. 11-13 Illustration The income statement, balance sheets, and additional information for E-Games, Inc., are provided in the following Illustration. We will use this information in preparing the statement of cash flows following the four basic steps. E-Games, Inc. Income Statement For the Year Ended December 31, 2010 Revenues $ 1,012,000 Expenses: Cost of goods sold Operating expenses (salaries, rent, utilities) $ 650,000 286,000 Depreciation expense 9,000 Loss on sale of land 4,000 Interest expense 5,000 Income tax expense 16,000 Total expenses Net Income 970,000 $ 42,000 11-14 Illustration (continued) E-Games, Inc. Balance Sheets December 31, 2009 and 2010 2010 2009 Increase (I) or Decrease (D) Assets Current Assets: Cash $ 62,000 $ 48,000 $14,000 (I) Accounts receivable 27,000 20,000 7,000 (I) Inventory 35,000 45,000 10,000 (D) 4,000 2,000 2,000 (I) Investment in stock 35,000 0 35,000 (I) Land 70,000 80,000 10,000 (D) Equipment 90,000 70,000 20,000 (I) (23,000) (14,000) 9,000 (I) $ 300,000 $ 251,000 Prepaid rent Long-Term Assets: Accumulated depreciation Total Assets 11-15 Illustration (continued) Liabilities and Stockholders’ Equity Current Liabilities: Accounts payable $ 22,000 $ 27,000 $ 5,000 (D) Interest payable 2,000 1,000 1,000 (I) Income tax payable 5,000 7,000 2,000 (D) 95,000 75,000 20,000 (I) 105,000 100,000 5,000 (I) 71,000 41,000 30,000 (I) $ 300,000 $ 251,000 Long-Term Liabilities: Notes payable Stockholders’ Equity: Common stock Retained earnings Total Liabilities and Equity Additional Information for 2010: 1. Purchased stock in Intendo Corporation for $35,000. 2. Sold land originally costing $10,000 for $6,000, resulting in a $4,000 loss on sale of land. 3. Purchased $20,000 in equipment by issuing a $20,000 note payable due in three years. No cash was exchanged in the transaction. 4. Issued common stock for $5,000 cash. 5. Declared and paid a cash dividend of $12,000. 11-16 Basic Format E-Games, Inc. Statement of Cash Flows For the Year Ended December 31, 2010 Cash Flows from Operating Activities: Cash Flows from Investing Activities: Cash Flows from Financing Activities: Net increase (decrease) in cash 14,000 Cash at the beginning of the period 48,000 Cash at the end of the period Note: Noncash Activities List of noncash transactions $62,000 11-17 LO2 Operating Activities – Indirect Method Both net income and cash flows from operating activities represent the same operating activities. The income statement reports net income on an accrual basis. On the other hand, the statement of cash flows reports the very same activities on a cash basis. We remove the noncash components from net income so that what’s left is cash flows from operating activities. We can classify the noncash components as: (a) revenues and expenses that don’t affect cash at all (adjustments for noncash components of net income). (b) revenues and expenses that do affect cash, but not by the amount reported as the revenue or expense (adjustments for changes in current assets and current liabilities). 11-18 Adjustments for noncash components of net income Depreciation Expense and Loss on Sale of Land Cash 6,000 Loss on Sale of Land 4,000 Land Add back Depreciation Expense and Loss on Sale of Land which was earlier subtracted from the net income. 10,000 (To record loss on sale of land) Cash Flows from Operating Activities Net income $42,000 Adjustments for noncash effects: Depreciation expense 9,000 Loss on sale of land 4,000 11-19 Adjustments for Changes in Current Assets and Current Liabilities Increase in Accounts Receivable (Increase in a current asset) Subtract Cash (to balance) Accounts Receivable ($27,000 – $20,000) 1,005,000 7,000 Revenues (from income statement) 1,012,000 (To record increase in accounts receivable) Cash Flows from Operating Activities Net income $42,000 Adjustments for noncash effects: Depreciation expense 9,000 Loss on sale of land 4,000 Increase in accounts receivable (7,000) 11-20 Adjustments for Changes in Current Assets and Current Liabilities Decrease in Inventory (Decrease in a Current Asset) Add Back Cash Flows from Operating Activities Net income $42,000 Adjustments for noncash effects: Depreciation expense 9,000 Loss on sale of land 4,000 Increase in accounts receivable (7,000) Decrease in inventory 10,000 11-21 Adjustments for Changes in Current Assets and Current Liabilities Decrease in Accounts Payable (Decrease in a Current Liability) Subtract Cash Flows from Operating Activities Net income $42,000 Adjustments for noncash effects: Depreciation expense 9,000 Loss on sale of land 4,000 Increase in accounts receivable (7,000) Decrease in inventory 10,000 Increase in prepaid rent (2,000) Decrease in accounts payable (5,000) 11-22 Adjustments for Changes in Current Assets and Current Liabilities Increase in Interest Payable (Increase in a Current Liability) Add Back Cash Flows from Operating Activities Net income $42,000 Adjustments for noncash effects: Depreciation expense 9,000 Loss on sale of land 4,000 Increase in accounts receivable (7,000) Decrease in inventory 10,000 Increase in prepaid rent (2,000) Decrease in accounts payable (5,000) Increase in interest payable 1,000 11-23 Cash Flows from Operating Activities Cash Flows from Operating Activities Net income $42,000 Adjustments for noncash effects: Depreciation expense 9,000 Loss on sale of land 4,000 Increase in accounts receivable (7,000) Decrease in inventory 10,000 Increase in prepaid rent (2,000) Decrease in accounts payable (5,000) Increase in interest payable Decrease in income tax payable Net cash flows from operating activities 1,000 (2,000) $50,000 11-24 Summary of All Adjustments Cash Flows from Operating Activities Net income Adjustments for noncash effects: For noncash components of income + Depreciation expense + Loss on sale of assets – Gain on sale of assets For changes in current assets and current liabilities – Increase in a current asset + Decrease in a current asset + Increase in a current liability – Decrease in a current liability = Net cash flows from operating activities 11-25 LO3 Investing Activities Cash Flows from Investing Activities Purchase of investment Sale of land Net cash flows from investing activities Cash Outflow (35,000) 6,000 (29,000) Cash Flows from Financing Activities Net cash flows from financing activities Cash Inflow Noncash activity disclosed in the footnote Net increase (decrease) in cash 14,000 Cash at the beginning of the period 48,000 Cash at the end of the period $62,000 Note: Noncash Activities Purchased equipment by issuing a note payable $20,000 11-26 LO3 Financing Activities Cash Flows from Investing Activities Purchase of investment (35,000) Sale of land 6,000 Net cash flows from investing activities Cash Inflow (29,000) Cash Flows from Financing Activities Issuance of common stock 5,000 Payment of cash dividends (12,000) Net cash flows from financing activities (7,000) Net increase (decrease) in cash 14,000 Cash at the beginning of the period 48,000 Cash at the end of the period Cash Outflow $62,000 Note X: Noncash Activities Purchased equipment by issuing a note payable Retained earnings, beg. Balance $41,000 + Net income 42,000 – Dividends (12,000) Retained earnings, ending balance $71,000 $20,000 11-27 LO4 Cash Flow Analysis Analysis based on net cash flows from operating activities (CFFO) ($ in millions) 2006 2005 $19,315 $13,931 Net Income 1,989 1,335 Net Cash Flows from Operations (CFFO) 2,220 2,535 17,205 11,551 $55,908 $49,205 Net Income 3,572 3,043 Net Cash Flows from Operations (CFFO) 4,839 5,310 23,109 23,215 Apple Net Sales Total Assets Dell Net Sales Total Assets 11-28 Cash Return on Assets Return on Assets Net Income ÷ Average Total Assets = Return on Assets Apple 1,989 ÷ (17,205 + 11,551)/2 = 13.8% Dell 3,572 ÷ (23,109 + 23,215)/2 = 15.4% ($ in millions) Cash Return on Assets is higher than the Return on Assets Cash Return on Assets ($ in millions) CFFO ÷ Average Total Assets = Cash Return on Assets Apple 2,220 ÷ (17,205 + 11,551)/2 = 15.4% Dell 4,839 ÷ (23,109 + 23,215)/2 = 20.9% 11-29 Components of Cash Return on Assets Cash Return on Assets = Cash Flow to Sales CFFO Average Total Assets Asset Turnover x CFFO Net Sales = x Net Sales Average Total Assets ($ in millions) CFFO ÷ Net Sales = Cash Flow to Sales Apple 2,220 ÷ 19,315 = 11.5% Dell 4,839 ÷ 55,908 = 8.7% Net Sales ÷ Average Total Assets = Asset Turnover Apple 19,315 ÷ (17,205 + 11,551)/2 = 1.3 times Dell 55,908 ÷ (23,109 + 23,215)/2 = 2.4 times ©2009 The McGraw-Hill Companies, Inc. Appendix Operating Activities-Direct Method 11-31 LO5 Operating Activities-Direct Method We report the cash inflows and cash outflows directly on the statement of cash flows. For instance, we report cash received from customers as the cash effect of sales activities, and cash paid to suppliers as the cash effect of cost of goods sold. Income statement items that have no cash effect—such as depreciation expense or gains and losses on the sale of assets—are simply not reported under the direct method. 11-32 Operating Activities-Direct Method Cash Flows from Operating Activities Cash Inflows: Cash received from customers Cash received from interest Cash received from dividends Less Cash Outflows: Cash paid to suppliers Cash paid for operating expenses Cash paid for interest Cash paid for income taxes Net cash flows from operating activities $ xxx 11-33 Operating Activities-Direct Method Cash Received from Customers Revenues $1,012,000 – Increase in accounts receivable (7,000) Cash received from customers $1,005,000 Cash (to balance) Accounts Receivable ($27,000 - $20,000) Revenues (from income statement) (To record increase in accounts receivable) 1,005,000 7,000 1,012,000 11-34 Operating Activities-Direct Method Cash Paid to Suppliers Inventory Beginning balance 45,000 Cost of goods purchased (increases inventory) ? Ending balance 650,000 Cost of goods sold (decreases inventory) 35,000 Accounts Payable Cash paid to suppliers (decreases A/P) ? 27,000 Beginning balance 640,000 Cost of goods purchased (increases A/P) 22,000 Ending balance Cost of Goods Sold (from income statement) Accounts Payable ($27,000 – 22,000) Inventory ($45,000 – 35,000) Cash (to balance) (Merchandise purchases and sales) 650,000 5,000 10,000 645,000 11-35 Operating Activities-Direct Method Cash Paid to Suppliers Cost of goods sold $650,000 – Decrease in inventory (10,000) = Purchases 640,000 + Decrease in accounts payable = Cash paid to suppliers 5,000 $645,000 11-36 Operating Activities-Direct Method Depreciation Expense and Loss on Sale of Land Not reported on the statement of cash flows Cash (selling price: given) 6,000 Loss on Sale of Land (difference) 4,000 Land (cost: given) (Sale of land) 10,000 11-37 Operating Activities-Direct Method Cash Paid for Interest Interest expense $5,000 – Increase in interest payable (1,000) = Cash paid for interest $4,000 Interest Expense (from the income statement) 5,000 Interest Payable ($2,000 – 1,000) 1,000 Cash (to balance) 4,000 (Payment for interest expense) 11-38 Operating Activities-Direct Method Cash Paid for Income Taxes Income tax expense + Decrease in income tax payable = Cash paid for income taxes $16,000 2,000 $18,000 Income Tax Expense (from the income statement) 16,000 Income Tax Payable ($7,000 – 5,000) 2,000 Cash (to balance) (Payment for income taxes) 18,000 11-39 Operating Activities-Direct Method Cash Flows from Operating Activities Cash received from customers $1,005,000 Cash paid to suppliers (645,000) Cash paid for operating expenses (288,000) Cash paid for interest Cash paid for income taxes Net cash flows from operating activities (4,000) (18,000) $50,000 ©2009 The McGraw-Hill Companies, Inc. End of chapter 11