Class PPT

advertisement

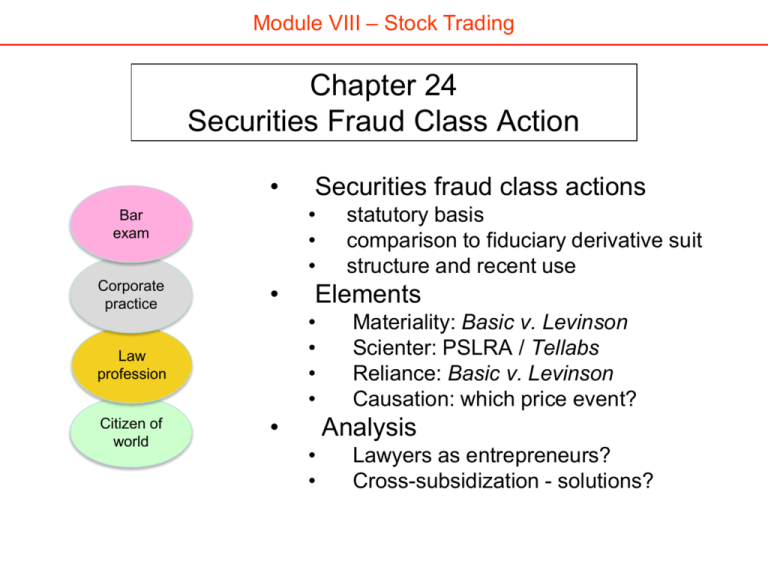

Module VIII – Stock Trading Chapter 24 Securities Fraud Class Action • • • • Bar exam Corporate practice • statutory basis comparison to fiduciary derivative suit structure and recent use Elements • • • • Law profession Citizen of world Securities fraud class actions • Materiality: Basic v. Levinson Scienter: PSLRA / Tellabs Reliance: Basic v. Levinson Causation: which price event? Analysis • • Lawyers as entrepreneurs? Cross-subsidization - solutions? SFCA background … Source: § 10(b) Use of SFCA Securities Exchange Act of 1934 Section 10 -- Manipulative and Deceptive Devices It shall be unlawful for any person, directly or indirectly, by the use of any means or instrumentality of interstate commerce or of the mails, or of any facility of any national securities exchange-(b) To use or employ, in connection with the purchase or sale of any security registered on a national securities exchange or any security not so registered … any manipulative or deceptive device or contrivance in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors. Use of SFCA … “King of Pain” “Loathed because he's so mean, feared because he's so powerful, Bill Lerach is the lawyer everyone in Silicon Valley hates.” Fortune Magazine, Sep. 2000 Formerly, • Milberg Weiss Bershad Hynes & Lerach • Lerach Coughlin Stoia Geller Rudman&Robbins Currently • Coughlin Stoia Geller Rudman & Robbins Securities Fraud Class Actions (“classic”) 250 200 188 150 100 50 0 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 Stanford Class Action Clearinghouse Structure of SFCA (elements) Securities Fraud Action When we deal with private actions under Rule 10b-5, we deal with a judicial oak which has grown from little more than a legislative acorn. Blue Chip Stamps v. Manor Drug Stores (US 1975) William Rehnquist • Parties – Plaintiff – Defendant • Elements 1. Material omission or misrepresentation of fact 2. Scienter (intentional) 3. Reliance 4. Causation • Transactional nexus – “in connection with” – Securities trading • Jurisdictional nexus – Federal court – Statute of limitation 10b-5 action Materiality … 1. • • • • FACTS What was transaction? Who are plaintiffs? Kind of suit? Allegations? Remedy sought? Who are the defendants? 2. ISSUES • Defendant arguments? • Plaintiff responses? 3. HOLDING • Alternatives: “agreement in principle"? "price and structure"? • "probability-magnitude" test? How do stock markets determine value of info? 4. ANALYSIS • Why case-by-case definition of materiality? • Why not bright-line test? • Advantages and disadvantages? 5. CONCLUSION • After this case, how should corporation disclose merger negotiations? • After this case, can corporate executives strategically misinform stock markets? Basic Inc. v. Levinson (US 1988) Shareholders (stock market) Three “white” lies Basic Inc Combustion Engineering merger negotiations Scienter … • Parties – Plaintiff – Defendant • Elements 1. Material omission or misrepresentation of fact 2. Scienter (intentional) 3. Relianc 4. Causation • Transactional nexus – “in connection with” – Securities trading • Jurisdictional nexus – Federal court – Statute of limitation 10b-5 action Plead “scienter” … PSLRA [’34 Act § 21D(b)(1)] In any private action arising under this chapter in which the plaintiff may recover money damages only on proof that the defendant acted with a particular state of mind, the complaint shall, with respect to each act or omission alleged to violate this chapter, state with particularity facts giving rise to a strong inference that the defendant acted with the required state of mind. Required “state of mind”? Compare to Rule 9(b) How get pre-filing “facts”? 1. • • • FACTS What were misstatements? Material – why? Who are plaintiffs? Kind of suit? Tellabs v. Makor Issues & Rights (US 2008) 2. ISSUES • Defendant arguments? • Plaintiff arguments? 3. HOLDING • Congress intended to “strengthen pleading standard” • Must be “cogent and compelling” / compare inferences: plaintiff wins tie 4. ANALYSIS • Why should plaintiff win tie? Wasn’t PSLRA anti-plaintiff? • Why not same burden as at trial – preponderance of inferences? 5. CONCLUSION • After this case, what “facts” will survive motion to dismiss? • After this case, are internal reports of company difficulties enough? Shareholders (stock market) Misstatements about product / “channel stuffing” Tellabs (Notebaert) … PSLRA strong inference of state of mind (scienter) means … “a reasonable person would deem the inference of scienter cogent and at least as compelling as any opposing inference.” … allegations must also be considered “holistically” [isolated insider sales not enough, must have unusual, broad sales] Ruth Bader Ginsburg (civil rights lawyer) … omissions and ambiguities [in the plaintiffs’ allegations] count against inferring scienter” [discount confidential witnesses] Reliance and causation … 1. FACTS • Who are plaintiffs? Kind of suit? • Were individual suits be viable? Basic Inc. v. Levinson (US 1988) 2. ISSUES • Reliance in fraud action? 3. HOLDING • Presumption necessary for class actions to proceed • Market performs valuation process: absorbs publicly-available information into price • Rebuttable presumption – unless market knew or did not react OR individual plaintiffs would have traded anyway 4. ANALYSIS • Is ECMH part of law? • Do investors really trust market price – see White dissent? • Shouldn’t Congress make policy decisions? Shareholders (stock market) Three “white” lies Basic Inc 5. CONCLUSION • SFCA have life – compare to Delaware? • Presumption rebutted in small companies with few analysts? Combustion Engineering merger negotiations “… in open and developed securities market .. Misleading statement defraud purchasers of stock even if the purchasers do not directly rely on the misstatements.” “… reliance is an element of a Rule 10b-5 cause of action. “Presumptions typically serve to assist courts in managing circumstances in which direct proof for one reason or another is rendered difficult.” Justice Harry Blackmun [MN lawyer] How can presumption be overcome? “… I fear that the Court’s decision may have many adverse, unintended effects as it is applied and interpreted in the years to come.” “… Court assumes buyers and sellers rely on the “integrity of the market price … which most mystifies me.” Justice Byron White [former football player] Class action counsel (business model) Investigate corporate disclosures … … identify corporate “fiction” … … followed by “surprise” … … resulting in price drop … … identify “scienter” … … file complaint … (e.g. Bay Networks, Inc) … which must tell “fraud story” … … to avoid “motion to dismiss” Who pays? Average settlement: $80 MM Average attorney fees: 20% 2006 data 2004 data 2003 data Atty fees overview Cross -subsidization … Settlement Selling shareholders (windfall winners!) Buying shareholders (plaintiffs) Holding shareholders (losers!) Payment Insiders (insider trading gains) Corporate execs (D&O insurance) Corporation The end Class Counsel – Business Model • Get started – identify material corporate misrepresentations – find appropriate shareholders to act as class representatives – file a complaint in a court of class counsel’s choosing • Take care of legalities – defend the complaint against motion to dismiss (on legal grounds) – urge the judge to grant class action status to the litigation – send notice to class members, giving them an option to withdraw from the lawsuit – undertake discovery of information from the company and other sources • Close the deal – – – – enter into settlement negotiations with company officials champion any settlement before the judge administer settlement funds appeal any adverse decisions by the trial court judge Stanford Class Action Clearinghouse