income redistribution

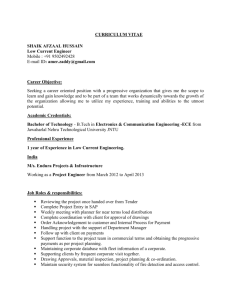

advertisement

Trying to make an unfair world a little bit more fair….. Remember the big 3 economic questions? For whom to produce? So what decides who receives the majority of income and output in a market economy? What are the determining factors? Selling those factors of production Market economy reality As we all know, there is a huge disparity among owners of the factors of production. Some people have special talents and are highly educated, some people do not. Many critics of the market economy use this as an argument against it…. So what if anything is government to do? The Big 4 Government typically chooses from among four policies to try and correct the issue of income redistribution. Can we name them……? #1--Transfer Payments The distribution of income from the haves to the have nots (vulnerable groups). Let’s all shout out without raising our hands some examples of recipients of transfer payments and types of transfer payments…. Transfers Recipients Old folks Sick folks Poor folks Kids of poor folks Unemployed folks Examples Pensions Unemployment benefits Housing benefits Child allowances Maternity benefits and more…. #2—Subsidized provision of merit goods Accepting the reality of unequal income distribution, it would not be surprising to see many of the less fortunate in society unable to receive the benefits of certain merit goods. Merit goods are goods that…….. Merit Goods Merit goods have spillover benefits but often can’t be purchased by poor people. Considered basic human rights nowadays, with unequal distribution of income, too many people would not receive these goods, thus causing significant problems for society as a whole. Government’s role Government must make sure not only to provide education and healthcare but to make them affordable too. Some governments provide free universal healthcare and education, while others have not gone as far…..perhaps they should… Other subsidized merit goods Thank-you government for: Clean Water Sanitation Sewerage Government’s role Subsidize merit goods to ensure that the quantity provided increases #3—Government intervention in markets Government will often intervene in markets to benefit certain groups. Examples include: Minimum wage legislation Price supports for farmers Subsidies to firms #4--Taxation Taxation Tax revenue allows for the provision of transfer payments and the subsiding of merit goods. Tax policies on their own also allow for redistribution of income, but decisions must be made…. Everybody hates taxes! Yet they allow government to do many important things, such as: Provide public transport Provide transfer payments/merit goods Correct negative externalities Pursue fiscal policy when needed And many, many more… Two types of taxes Direct taxes These taxes are paid directly by the consumer to the government. Examples include: Personal income tax Corporate income tax Wealth tax (on property, inheritances) Earmarked taxes (to support programs like unemployment insurance, social security and healthcare) Indirect Taxes These taxes are usually placed on the supplier or seller of a good/service, but the consumer will have to incur some incidence of this tax. There are three main categories we will discuss…… General Expenditure Taxes (Sales taxes) These are taxes on various goods and services paid at the time of purchase. In the U.S.A., many states put a fixed percentage tax on goods purchased. Other countries use a value added tax, which taxes each stage of the production process for the value that is added. Excise taxes (Sin taxes) These are taxes placed on goods that the government wants to discourage consumption of. The level of incidence of the tax for the consumer depends on the elasticity of demand of the consumer for the particular product. Tariffs (Customs duties) These are taxes placed on imported goods. They serve the purpose of protecting domestic industries and at the same time raising revenues. They tend to be much less a part of government policy in MDCs than they are in LDCs The ability to pay principle Most human beings with a heart can come to terms with the idea that the more income you earn the more you should contribute in taxes. Unfortunately, the question is more complicated than should the wealth pay more, but how much more should they pay? Tax Flavours Tax Flavours Taxes are usually defined as being either: Proportional Progressive Regressive This depends on the relationship between income and the fraction of income paid as tax…sound confusing? It’s not really…. Proportional Tax As income increases, the fraction of income paid as taxes remains constant. Joe makes $10,000 a year and his tax rate is 15%. Warren makes $10,000,000,000,000 a year, and his tax rate is 15%. Warren obviously pays more in taxes, but the tax rate is the same. Seem fair? Proportional Tax As income increases, the fraction of income paid as taxes remains increases. Joe makes $10,000 a year and his tax rate is 15%. Joel makes $20,000 a year, and his tax rate is 20%. Joel earns more therefore pays more in taxes. This is a mildly progressive tax, a strongly progressive tax would be higher for Joel. Seem fair? Regressive tax As income increases, the fraction of income paid as taxes decreases. Joe makes $10,000 a year and his tax rate is 15%. Bill makes $20,000 a year and his rate is 10%. Bill still pays a larger dollar amount in this example than Joe, but his % is lower. Seem fair? General Conclusion The more progressive a tax system is, the more equal the after-tax distribution of income will be compared to the pre-tax distribution of income. However, this alone does not remove the controversy surrounding the tax issue Controversy over taxes As you can probably guess, people with high incomes are not happy to see a highly progressive tax system. They argue that they worked hard to achieve what they have, and shouldn’t be forced to pay a higher rate to support the lower income classes. Is this a fair point? Additional questions to ponder Do high taxes reduce the incentives of the rich to work and save? Additional questions to ponder Do taxes worsen the allocation of resources (create allocative efficiency) ? Do high taxes encourage tax evasion? Additional questions to ponder Is there a trade-off between income equality and efficiency? If we create more income equality, will economic growth be sacrificed? Additional questions to ponder Might there be a conflict between using taxes as a fiscal policy tool and as an income redistribution tool? Do transfer payments reduce the incentives of the poor to work and save?