Chapter 22

Working Capital

Management in the

MNE

Working Capital Management

in the MNE

• Working capital management in a multinational

enterprise requires managing current assets (cash

balances, accounts receivable, and inventory) and

current liabilities (accounts payable and short-term

debt) when faced with political, foreign exchange, tax,

and liquidity constraints.

• The overall goal is to reduce funds tied up in working

capital while simultaneously providing sufficient

funding and liquidity for the conduct of global

business.

• Working capital management should enhance return on

assets and return on equity and should also improve

efficiency ratios and other performance measures.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-2

Working Capital Management

• The operating cycle of a business generates funding

needs, cash inflows and outflows (the cash conversion

cycle) and foreign exchange rate and credit risks.

• The funding needs generated by the operating cycle of

the firm constitute working capital.

• The cash conversion cycle, a subcomponent of the

operating cycle (working capital cycle), is that period

of time extending between cash outflow for purchased

inputs and materials and cash inflow from cash

settlement.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-3

Working Capital Management

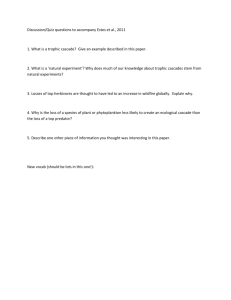

• The operating and cash conversion cycles for Cascade

Mexico is illustrated in the following exhibit.

• This is decomposed into five different periods (each

with business, accounting, and potential cash flow

implications):

– Quotation period

– Input sourcing period

– Inventory period

– Accounts payable period

– Accounts receivable period

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-4

Exhibit 22.1 Operating and Cash Cycles

for Cascade Mexico

Operating Cycle

Accounts

Payable

Period

Input

Sourcing

Period

Quotation

Period

Price

Quote

Cascade

Mexico t

0

Order

Placed

t1

Accounts

Receivable

Period

Inventory

Period

Inputs

Received

t2

Order

Shipped

t3

Payment

Received

t4

t5

Cash

Outflow

Cash

Intflow

Cash

Payment

for Inputs

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

time

Cash

Settlement

Received

Cash

Conversion Cycle

22-5

Working Capital Management

• If Cascade Mexico’s business continues to

expand, it will continually add to inventories

and accounts payable (A/P) in order to fill

increased sales in the form of accounts

receivable (A/R).

• These components make up net working

capital (NWC):

NWC = (A/R + inventory) – (A/P)

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-6

Exhibit 22.2 Cascade Mexico’s Net Working

Capital Requirements

Net Working Capital (NWC) is the net investment required of the firm

to support on-going sales. NWC components typically grow as the

firm buys inputs, produces product, and sells finished goods.

Cascade Mexico’s Balance Sheet

Assets

Liabilities & Net Worth

Cash

Accounts payable (A/P)

Accounts receivable (A/R)

Short-term debt

Inventory

Current assets

Current liabilities

NWC = ( A/R + Inventory ) - A/P

Note that NWC is not the same as Current assets & Current liabilities.

22-7

Working Capital Management

• The previous exhibit illustrates one of the key managerial

decisions for any subsidiary:

– Should A/P be paid off early, taking discounts offered by suppliers?

– The alternate form of financing for NWC balances is short-term debt

• In our example, Cascade Mexico’s CFO must decide which is the

lower cost (short-term Mexican peso borrowings or the effective

annual interest cost of supplier financing – cost of carry).

• Clearly, there are issues such as access to local currency debt, or

various intra-company financing alternatives that complicate the

decision.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-8

Working Capital Management

• A common method of benchmarking financial

management practice is to calculate the NWC of

the firm on a “days sales” basis.

• An analysis of this metric in a global context

shows that US firms have a typical days sales of

29, while the European group has a days sales of

75.

• Clearly, European-based (technology firms in this

example) are carrying a significantly higher level

of net working capital in their financial structures.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-9

Working Capital Management

• The MNE itself poses some unique challenges in the

management of working capital.

• Many multinationals manufacture goods in a few

specific countries and then ship the intermediate

products to other facilities globally for completion and

distribution.

• The payables, receivables, and inventory levels of the

various units are a combination of intra-firm and interfirm.

• The varying business practices observed globally

regarding payment terms – both days and discounts –

create severe mismatches in some cases.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-10

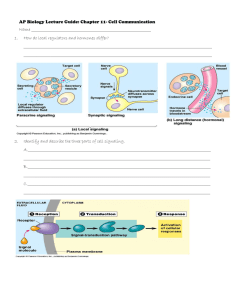

Exhibit 22.4 Cascade’s Multinational Working

Capital Sequence

Cash inflows to Cascade Mexico arise from local market sales.

These cash flows are used to repay both intra-firm payables

(to Cascade USA) and local suppliers.

Cascade Mexico

Balance Sheet

60 days

A/R

Inventory

Cascade USA

Balance Sheet

Intra-firm:

30 days

30 days

A/P

A/P

A/R

Inventory

A/P

Local-sourcing: 60 days

Mexican Business Practices

United States Business Practices

Payment terms in Mexico are longer than

those typical of the United States. Cascade

Mexico must offer 60-day terms to local

customers to be competitive with other firms

in the local market.

Payment terms used by Cascade USA are

typical of the United States, 30 days. Cascade

USA’s local customers will expect to be paid in

30 days. Cascade USA may consider extending

longer terms to Mexico to reduce the squeeze.

Result: Cascade Mexico is squeezed in terms of cash flow. It receives inflows

in 60 days but must pay Cascade USA in 30 days.

22-11

Working Capital Management

• A firm’s operating cash inflow is derived primarily

from the collection of accounts receivable.

• Multinational accounts receivable are created by two

separate types of transactions:

– Sales to related subsidiaries

– Sales to independent or unrelated buyers

• Management of accounts receivable form independent

customers requires two types of decisions:

– What currency should the transaction be denominated?

– What should be the terms of payment?

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-12

Working Capital Management

• Operations in inflationary, devaluation-prone

economies sometimes force management to modify its

normal approach to inventory management.

• In some cases, management may choose to maintain

inventory and reorder levels far in excess of what

would be called for in an economic order-quantity

model.

• It is important to anticipate:

– Devaluation

– Price freezes

– The implications of various forms of free-trade zones

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-13

International Cash Management

• International cash management is the set of

activities determining the levels of cash

balances held throughout the MNE (cash

management) and the facilitation of its

movement cross-border (settlements and

processing).

• These activities are typically handled by the

international treasury of the MNE.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-14

International Cash Management

• The level of cash maintained by an individual

subsidiary is determined independent of the working

capital management decisions we have discussed.

• Cash balances, including marketable securities, are

held partly to enable normal day-to-day cash

disbursements and partly to protect against

unanticipated variations from budgeted cash flows.

• These two motives are called the transaction motive

and the precautionary motive.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-15

International Cash Management

• Cash disbursed for operations is replenished

from two sources:

– Internal working capital turnover

– External sourcing, traditionally short-term

borrowing

• Efficient cash management aims to reduce cash

tied up unnecessarily in the system, without

diminishing profit or increasing risk, so as to

increase the rate of return on invested assets.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-16

International Cash Management

• All firms, both domestic and international,

engage in some form of the following

fundamental steps:

– Planning

– Collection

– Repositioning

– Disbursement

– Covering cash shortages

– Investing surplus cash

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-17

International Cash Management

• Multinational business increases the complexity of

making payments and settling cash flows between

related and unrelated firms.

• Over time a number of techniques and services have

evolved that simplify and reduce the costs of making

these cross-border payments.

• Four such techniques include:

–

–

–

–

Wire transfers (exhibit 22.5)

Cash pooling

Payment netting (exhibit 22.7)

Electronic fund transfers

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-18

Exhibit 22.5 Average Daily Dollar Amount Handled

by CHIPS (billions of US dollars)

1600

1400

1200

1000

800

600

400

200

0

70

72

74

76

78

80

82

84

86

88

90

92

94

Source: Clearing House Interbank Payment System, http://www.chips.org (April 2002).

96

98

2000

22-19

Exhibit 22.7 Multilateral Matrix Before Netting

(thousands of US dollars)

The Four European Affiliates of Quad Corporation

$4,000

Quad

United Kingdom

Quad de

France

$3,000

$3,000

$5,000

$5,000

$5,000

$6,000

$4,000

$3,000

$2,000

$2,000

Quad

Belgium

$1,000

Deutscheland

Quad

Prior to netting, the four sister affiliates of Quad Corporation have numerous

intra-firm payments between them. Each payment results in transfer charges.

22-20

Financing Working Capital

• All firms need to finance working capital.

• The normal sources of funds for financing short-term working

capital are accounts payable to suppliers and loans against bank

credit lines.

• In some countries, such as the United States, borrowing is done by

the firm issuing notes payable to banks and other creditors.

• In many other countries, short term borrowing is done on an

“overdraft” basis.

• In all cases, permanent working capital requirements, as opposed

to seasonal needs, are at least partially financed with long-term

debt and equity.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-21

Exhibit 22.9 Multilateral Matrix After Netting

(thousands of US dollars)

The Four European Subsidiaries of Quad Corporation

Quad

United Kingdom

Pays $1,000

Quad

Belgium

Quad de

France

Pays $3,000

Pays $1,000

Deutscheland

Quad

After netting, the four sister subsidiaries of Quad Corporation have only three

net payments to make among themselves to settle all intra-firm obligations

22-22

Financing Working Capital

• Some MNEs have found that their financial resources

and needs are either too large or too sophisticated for

the financial services available in may locations where

they operate.

• One solution to this has been the establishment of an

in-house or internal bank within the firm.

• Such an in-house bank is not a separate corporation;

rather, it is a set of functions performed by the existing

treasury department.

• The following exhibit, illustrates how the in-house

bank of Cascade Pharmaceuticals, Inc., could work.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-23

Financing Working Capital

• Cascade Mexico sells all its receivables to the in-house

bank as they arise, reducing some of the domestic working

capital needs.

• Additional working capital needs are supplied by the inhouse bank directly to Cascade Mexico.

• Because the in-house bank is part of the same company,

the interest rates it charges may be significantly lower than

what Cascade Mexico could obtain on its own.

• In addition to providing financing benefits, in-house banks

allow for more effective currency risk management.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-24

Exhibit 22.10 Cascade’s In-House Bank

Cascade Europe deposits excess cash balances

with the in-house bank.

Cash flow

Cascade’s

In-House

Bank

Cascade Europe

Cascade’s in-house bank

reallocates cash and capital

within the MNE network.

Cascade Mexico

Cash flow

Cascade Mexico sells its receivables to the in-house bank,

receiving cash and receiving working capital financing.

22-25

Financing Working Capital

• MNEs depend on their commercial banks to

handle most of the trade financing needs, such

as letters of credit, and to provide advice on

government support, country risk assessment,

introductions to foreign firms and banks, and

general financing availability.

• The main points of bank contacts are

correspondent banks, representative offices,

branch banks, subsidiaries, and affiliates.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

22-26