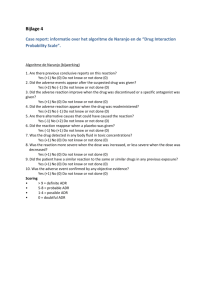

ADRC including difficulties

advertisement

1 PRESENTATION BY MR. MUMTAZ AHMAD MEMBER LEGAL FEDERAL BOARD OF REVENUE 2 OVERALL FUNCTIONS OF THE LEGAL WING COORDINATION WITH OTHER FBR WINGS Dealing with the appeal matters at the Tribunal, High Court and Supreme Court level. Monitoring and overseeing work of 06 Collectors (Appeals and 08 Commissioners (Appeals) Vetting of contracts, rendering of opinion and advice to the line Members in disputes resolution. Federal Services Tribunal and Supreme Court matters (service matters assistance). FTO matters. Complaints responses. Representation to the President. Alternative Dispute Resolution matters. Support to the reforms process. 3 Contd… Assistant on Legal Issues; Assistance to all Wings of FBR on Legal Matters. Transition from the CBR to the FBR. Main statute, IJP rules, uniform and accommodation regulations, Employees Foundation matter etc. Liaison with the Officers of Courts, Ministries, Law Division and managing work of over 100 advocates on Panel approved by the Law Division. Comments: The FBR’s Tax Administration Reforms Program has enabled the Legal Wing of FBR to introduce reforms in the matter of reduction in litigation and creating better environment for taxpayers to discharge their obligation to the state. . 4 Remedy available to the Taxpayers. (A) Appeals hierarchy – (i) (II) (iii) (iv) within the department, Collector/Commissioner, Tribunals, High Court, Supreme Court. (B) Writ and Civil Jurisdiction 5 Contd…. (C) (D) Federal Tax Ombudsman - Indirectly controls the mal-administration of the department’s officers and grants relief to the taxpayers where instances of the mal-administration are pointed out. - Representation against the decision of FTO lies with the President of Pakistan (through Law & Justice Ministry). Representation to the Chairman, FBR. A taxpayer may submit a representation under section 7 of the FBR Act, 2007 to the Chairman, FBR who may issue appropriate order. (F) For foreign investment/N.R companies: Concept of “advance ruling”. Implementation of the provisions of the agreement for avoidance of double taxation is faithfully done. We have such agreements with 55 countries. 6 IMPACT OF ALTERNATE DISPUTE RESOLUTION ON APPEALS AND LITIGATION Common Complaints of taxpayers within the existing system used to involve lengthy litigations, extending over decades. In order to eliminate such delays in deliverance of justice and redressal of grievances, the system of ADR has been introduced. It is resolving of the tax or duty disputes out of court, between the person and the institution. Parties to the dispute may arrive at a mutually agreed solution of the dispute. The system of ADR aims at providing the aggrieved tax payer a platform to raise his dispute at a forum separate from the conventional forum. In this system, there are no “Losers” or “Winners”. It is about deciding disputes which are set and rest on the method of “win-win situation for all”. In fact, ADR is a “hybrid system” in tax matters. ADR is yet another example of FBR’s commitment to revamp the existing system. 7 Benefits of ADR for FBR and Taxpayer Reduces the number of litigation cases and the burden on the courts Saves the management time of litigants. Saves litigation costs. Controls mal-administration. Avoids diversions of time in bringing cases to the courts. Settles disputes through tax experts and recognized institutions. It directly goes to the root of dispute instead of periphery. Preservation of business relationships. Better case management. Greater satisfaction with instant results/outcomes-more options. Confidentiality. Flexibility of procedures. Quicker resolutions. Lower costs for all parties to the dispute. 8 Referring Disputes for ADR Present rules prescribe the stages at which disputes could be referred for ADR subject to FBR’s agreement to form the Committee.· A matter can be referred for ADR from either of the following stages: o o o o After adjudication or assessment, i.e. during pendency of appeal before the Collector (Appeals) or Commissioner (Appeals) After decision of appeal by the Collector (Appeals) or Commissioner (Appeals), i.e. during pendency of appeal before the Appellate Tribunal; After decision of appeal by the Appellate Tribunal, i.e. during pendency of appeal before a High Court; After decision of appeal by High Court, i.e. during pendency of appeal before the Supreme court. ADR does not involve any fee, charges or costs. There is no time limit for applying for ADR. The application can be submitted any time during the pendency of the matter before any appellate authority, tribunal or court and that it should not be a past and closed transaction. 9 Provisions in Various Tax Laws Pertaining to ADR The Legislature has provided following provisions regarding the ADR in various tax laws through the Finance Bill, 2005: Income Tax Sales Tax Section 134 A of the Income Tax Section 47 of the Sales Tax Act,1990 and Ordinance, 2001 and Rule 231 C of the Chapter X of the Sales Tax Rules,2004. Income Tax Rules,2002. Customs Section 195 C of the Customs Act, 1969 and Chapter XVII of the Customs Rules, 2001. Federal Excise: Section 38 of the Federal Excise Act, 2005 and Rule 53 of the Federal Excise Rules, 2005. 10 AMENDMENTS MADE BY FINANCE ACT,2007 & 2008 INCOME TAX ORDINANCE, 2001 SALES TAX ACT,1990 CUSTOMS ACT,1969 FEDERAL EXCISE ACT, 2005 SECTION 134 A SECTION 47A SECTION 195C SECTION 38 1. Sub-section (4A) inserted by the Finance Act, 2008.. [(4A) Notwithstanding anything contained in sub-section (4), the Chairman may on the application of an aggrieved person, for reasons to be recorded in writing, and on being satisfied that there is an error in order or decision may pass such order may be deemed just and equitable.] 1. Sub-section (4A) inserted by the Finance Act,2008.. [(4A) Notwithstanding anything contained in sub-section (4), the Chairman may on the application of an aggrieved person, for reasons to be recorded in writing, and on being satisfied that there is an error in order or decision may pass such order may be deemed just and equitable.] 1. Sub-section (4A) inserted by the Finance Act,2008.. [(4A) Notwithstanding anything contained in sub-section (4), the Chairman may on the application of an aggrieved person, for reasons to be recorded in writing, and on being satisfied that there is an error in order or decision may pass such order may be deemed just and equitable.] (3). The committee constituted under sub-section (2) shall examine the issue and may, if it deems necessary, conduct inquiry, seek expert opinion, direct any of customs or any other person to conduct an audit and make recommendations [, within 1. Sub-section (4A) inserted by the Finance Act,2008.. [(4A) Notwithstanding anything contained in sub-section (4), the Chairman, FBR, and a Member nominated by him, may, on the application of an aggrieved person, for reasons to be recorded in writing, and on being satisfied that there is an error in order or decision may pass such order may be deemed just and equitable.] 11 AMENDMENTS MADE BY FINANCE ACT,2007 & 2008 INCOME TAX RULES, 2001 SALES TAX RULES, 2006 CUSTOMS RULES,2001 FEDERAL EXCISE RULES, 2005 RULE 231 CHAPTER X CHAPTER XVII RULE 53 1. “within ninety days of receipt of such recommendations” inserted by S.R.O.771(I)/2008 dated 21.07.2008 to sub-rule 15 (15). The Board, after examining the recommendations of the Committee shall finally decide the dispute or hardship and make such orders as it may deem fit for for the resolution of the dispute or hardship [ within ninety days of receipt of such recommendations] under intimation to the application, Chairman of the Committee and the concerned Commissioner 12 Contd… Finance Act 2006 has made ADRC available where appeal has been filed. Supreme Court in its recent judgment decided that where criminal proceedings have been initiated, the ADR process would not be available. Amendment made by FBR Act, 2007. By the Finance Act 2005, Wealth Tax disputes of the erstwhile Wealth Tax Laws have also been made a subject matter of ADR. Insertion of these related provisions in various tax laws will provide another venue to the taxpayers to have easy “access to justice” and to resolve disputes at private/public institutions, with no costs and delays. Pakistan is Pioneer and fore-runner in introducing the Alternate Dispute Resolution mechanism in the tax laws. The ADR coupled with reduction in the litigations (150,000 appeals were finalized at the Commissioners and Collectors level, within span of three years), and special bench of Supreme court deciding appeals, will have impact on the litigation at High court and Tribunal level and will provide easy access to justice. 13 Conted… This strategy is a part of the Reforms Program which is on the right track. FBR has now been declared as 98% responsive in the direct tax matters (American Business Council Survey). The Alternate Dispute Resolution mechanism supplements traditional mode of dispensation of justice. The recommendations/decisions of the ADRC are nonbinding on Parties or FBR. 14 Contd…. FBR may, in case of accepting the recommendations, pass a formal order/judgment and on payment of tax, all the proceedings abate, and the orders/judgments made are taken as modified to that extent. In case when the matter is subjudice before the Court the recommendations and order/agreement are to be placed before the Court/Authority, which can then, pass an appropriate order. The number of applications for the ADRC is growing. Once the awareness level is raised, small taxpayers will also prefer this mode, henceforth the number of appeals at the High Court and Tribunal level will decline. 15 Contd…. The ADR works on the method of “discovery”; hence “knowing” the weaknesses and strengths of both the parties to the dispute; through mediation and/or negotiation, and settlement, as compared with adversarial litigation under the traditional system. The ADR has been termed by some taxpayers as a breath of fresh air; a paradigm shift, and a window of opportunity to have easy access to justice. Through the ADR and the consequent reduction in the litigation; the taxpayer is facilitated to pay his tax dues with certainty, accuracy and in accordance with the law. The ADR will go a long way to resolve the disputes and reduce litigation. The credibility, impartiality and integrity of the ADRCs will provide impetus to the working of the ADR System. 16 TAX WISE PROGRESS ADRC Total App. Received App. No. in Rejected/ which Withdrawn comm. Formed No. in which Recom. Received Recom. Not accepted Recom. Impleme nted Cases Pending with ADR Comm. Custom (JudADRC) 276 60 187 141 29 83 46 Sales Tax (Jud/ ADRC) 1008 111 897 490 99 391 409 Income Tax Jud/ ADRC) 286 107 178 134 89 401 40 TOTAL 1570 218 1262 765 217 515 495 90 App. Pending Recomm Received Action Taken Bal. Order to be Passed 765 732 33 Approx 40% 17 DIFFICULTIES. Generally old and complicated applications/cases are received which are difficult to dispose off. The non-departmental members i.e Retd. Judges, Chartered Accountant, advocates and businessman are reluctant to join committees. Chairman/Members of ADRC already on panel do not take keen interest in disposing the cases as no remuneration is paid. Tax payers are not well informed about the ADR mechanism. Applicants do not file applicants properly. No time limit is observed either by the committee or the department. ADRC appeals are accepted if covered under the prescribed rules and laws, except those which do not cover under the law. 18