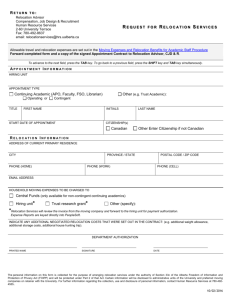

Relocation Agreement

RELOCATION REPAYMENT AGREEMENT

CARE USA has or will spend a sum of money for the purpose of moving or reassigning a qualifying Employee and the Employee’s eligible household members to Employee’s new work location. Please see Chapter 4

(Relocation) of the CARE USA Employee Handbook for complete details regarding this benefit.

The Relocation

Policy sets forth those items which CARE USA will either pay on behalf of the Employee or reimburse as negotiated to the Employee, including but not limited to, temporary living allowance, final move travel, and movement of household goods and automobile(s).

In order to receive this benefit, each qualifying Employee must sign and return this Relocation Repayment

Agreement.

It requires that, if an Employee chooses to terminate his or her employment with CARE USA within 12 months of the Employee’s first day of work in the new location, then that Employee will repay to CARE USA all direct payments and/or reimbursements in accordance with the schedule set forth below:

1 Month

2 Months

3 Months

4 Months

EMPLOYEE RATE OF REPAYMENT

BASED ON LENGTH OF SERVICE FROM START DATE IN NEW LOCATION

(Based on COMPLETED Months of Service)

100% 5 Months

95% 6 Months

90% 7 Months

85% 8 Months

80%

75%

65%

55%

9 Months

10 Months

11 Months

12 Months or More

45%

35%

25%

0%

At CARE USA’s discretion, the repayment may be paid, in whole or in part, by deduction from amounts otherwise owed by CARE USA to the Employee (e.g., final pay, PTO payout), subject to applicable law.

This Agreement should be completed and returned with the Employee's signed offer letter.

11/2011

RELOCATION REPAYMENT AGREEMENT

Name: Click here to enter text.

Department:

Date of Hire:

Click here to enter text.

Click here to enter text.

Region: Choose an item.

Position: Click here to enter text.

Relocating From:

(City/State/Country) Click here to enter text.

I understand that, upon my acceptance of a full-time position with CARE USA, I am eligible to receive relocation and/or one way travel (to assignment) expenses paid for myself and eligible dependants, subject to the terms and conditions set forth in Chapter 4 of the CARE USA Employee Handbook. The benefit is contingent on my execution of this agreement and its submission to my Recruiter prior to any relocation and/or one-way travel (to assignment). I acknowledge that my failure to sign and return this agreement will result in CARE USA not authorizing my relocation and/or one-way travel (to assignment) and my forfeiting this benefit.

I understand and acknowledge that, if I resign (voluntary termination) within twelve (12) months following my first day of work in the new location, I will be responsible for a prorated amount of the gross relocation expenses paid by CARE USA on my behalf

(including any direct payments and/or reimbursements), in accordance with the schedule below:

1 Month

2 Months

3 Months

4 Months

EMPLOYEE RATE OF REPAYMENT

BASED ON LENGTH OF SERVICE FROM START DATE IN NEW LOCATION

(Based on COMPLETED Months of Service)

100% 5 Months

95% 6 Months

90% 7 Months

85% 8 Months

80% 9 Months

75% 10 Months

65% 11 Months

55% 12 Months or More

45%

35%

25%

0%

If there is a leave of absence during this 12-month period, the 12-month service requirement will be extended by the duration of the leave. In the event that I am involuntarily terminated by CARE USA within that period, I would not be required to reimburse the organization.

I understand that any money owed under this agreement will be deducted from any amounts owed by CARE USA to me (ex. my paycheck(s) and/or paid time off account), subject to applicable law, to pay off the balance of any relocation expenses. If any money remains unpaid, I understand that CARE USA will pursue collection of my obligation. In addition, I understand it is my responsibility to contact the HR Service Center to obtain the exact amount due to CARE USA and to make repayment arrangements prior to my last day of work.

I also understand that since the Internal Revenue Service defines this reimbursement plan as non-accountable, the relocation assistance amount is subject to federal, state and FICA taxes.**

I acknowledge that I have READ, FULLY UNDERSTAND, and AGREE TO the above terms and conditions:

Employee Signature Date

Notes to Employee:

**You may use IRS Form 3903 to file with your income tax return to show any allowable moving expenses. For more information regarding non-accountable reimbursement plans see IRS Publication 521.